How often have you been disappointed with contact centers? As it happens, they called to inquire about the minimum credit card payment or find out how to unblock access to the Internet bank. But it was not possible to immediately resolve the issue. Confused in the jungle of the voice menu. We realized that any button will still lead

How often have you been disappointed with contact centers? As it happens, they called to inquire about the minimum credit card payment or find out how to unblock access to the Internet bank. But it was not possible to immediately resolve the issue. Confused in the jungle of the voice menu. We realized that any button will still lead

Have you ever wondered why people use voice communication in the age of instant messengers? According toNational Association of Contact Centers (NACC), in Russia during the pandemic, 25% of contact centers did not record a decrease in the number of calls, and 27% noted an increase in the volume of calls by 25%. It is clear that because of COVID-19, everyone has more reasons for concern: "When will my order be delivered?", "What's with my vouchers?", "Will I get my money back?" Companies invest hundreds of thousands of rubles in contact center automation and employee training, but something goes wrong.

Perhaps the problem is in the approach. Automation decisions are made intuitively, based on observations, or "scientific typing." Meanwhile, there are many non-obvious patterns in the work of the contact center, which are useful to observe not in manual mode, but with the use of technologies for intelligent analysis of business processes.(Process Intelligence). A lot of useful data is collected in the information systems of contact centers - clients' wandering through IVR (Interactive Voice Response), telephone call logs (time and duration, from which number they called), etc.

Today we will analyze, using the example of a bank contact center, how using the platform for analyzing business processes ABBYY Timeline, turn data to good and help people not hang on the line, an intelligent assistant helps, not harm, and operators quickly solve user problems and receive bonuses for this.

Some statistics

According to the NACC , the effectiveness of communication between contact center employees and customers in a pandemic is most influenced by:

- knowledge bases that are outdated or difficult to use,

- lack of operators to service all incoming calls,

- insufficient training of employees.

As stated in the research of the analytical agency iKS-Consulting, customers still prefer to communicate with the company by phone. However, the number of calls to contact centers is not growing. But messages via e-mail, chats and instant messengers are growing by 2% annually: their share of the total number of requests is 20%. Robots help customers not to hang on the line for a long time, and employees - to avoid monotonous processing of simple requests. But, despite the introduction of artificial intelligence technologies and robotization, so far mostly people work in contact centers. Only they can help clients solve a difficult issue or sort out an atypical situation. Moreover, in the age of artificial intelligence (as well as the need to stay at home), empathy and live communication are becoming even more valuable.

For example, before the pandemic, Sberbank receivedabout 17 million calls per month and about 3 million chats. Half of the clients received help from bots - voice on number 900 and text - in chats. Since April 2020, the bank receives up to 23 million calls every month (+ 30%), and already 60% of all issues are resolved in IVR.

But is everything so great in the work of contact centers in banks? According to the analytical center of the National Agency for Financial Research (NAFI) , Russians' loyalty to banks has been declining for the fifth year in a row. According to the latest poll, 35.4% of the country's residents are not satisfied with their bank. They will not recommend it to their friends and may soon find an alternative.

According to NAFI estimates, clients pay the most attention to the value of accounts, deposits, loans and the quality of service. It is important for them to receive services quickly and to feel that they are being cared for. According to NAFI, in the minds of customers, banks are increasingly becoming impersonal IT services and applications. And any service today should be fast, clear and pleasant to use.

How do you achieve this? The work of both people and technology must be controlled. In particular, collect and analyze data on successes and failures, so that with their help then quickly answer questions about loans and be a lifesaver for the client in any non-standard situations.

Vicious circle IVR

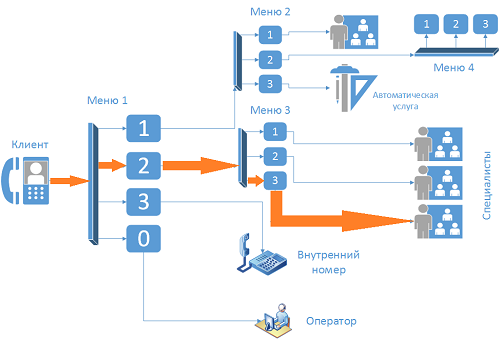

IVR (Interactive Voice Response), or interactive voice menu, solves seemingly noble tasks:

IVR (Interactive Voice Response), or interactive voice menu, solves seemingly noble tasks:

- transfers customers to self-service to the maximum in order to reduce the load on the contact center,

- distributes calls to the required operators.

But why are customers often unhappy with the voice menu? Let's give an example of a simple case with IVR:

, SMS- . , . IVR : « . 1. 2. - 0». , – . « ». : , , . , , « , ». - : - , .

According to IT distributor ICE Partners, people are most annoyed by long and complex voice menus. The IVR structure may seem convenient and well thought out to the bank, but the client may think otherwise.

In practice, many have to hang up the phone, call back the contact center and listen to the same information again. And even then, the client may not always understand what to do next.

Psychologist George Miller, who worked at Bell Laboratories, in 1956, established that the person is able to hold in the short-term memory 5 to 9 elements. Modern psychologists have reduced the estimate of the volume of short-term memory to 4.By the way, all this is extra traffic of 8-800, and in the volume of a large company - tens of thousands of dollars in losses per month. In addition, if, after a long and complex IVR, the client does not get to the right specialist, then most likely he will hang up and never return to this bank. Therefore, it is better to analyze the effectiveness of IVR in advance so as not to annoy people. How to do it?

- One of the easiest options is to call your company. It can be educational. So, you can listen to IVR many times, in particular, check if there is an exit to a live operator at the end. Then remove all unnecessary, remove loops and dead-end menu branches.

- : , , ..

- . IVR (post-call ), 5-10 . , , , ..

Unfortunately, any of the paths will take a long time. And not every client is ready to answer questions about workload or quality of service. In all these cases, the manager runs the risk of not seeing the full picture of the process, for example, the number of subscribers who received comprehensive answers to their questions in the IVR system; the percentage of customers who left the menu without reaching information blocks or transitions to the operator, etc. To find out these and other details about the effectiveness of IVR, you can use another way - tools for a comprehensive analysis of business processes.

So, in ABBYY Timeline you can download the logs of systems that contact center employees have worked with for a certain period, for example, logs of IVR systems, call tracking, knowledge base, CRM, and then analyze various indicators of business processes.

Logs are files that contain all user actions performed in the system.Based on these logs, the system can both automatically build a high-level diagram of the process,

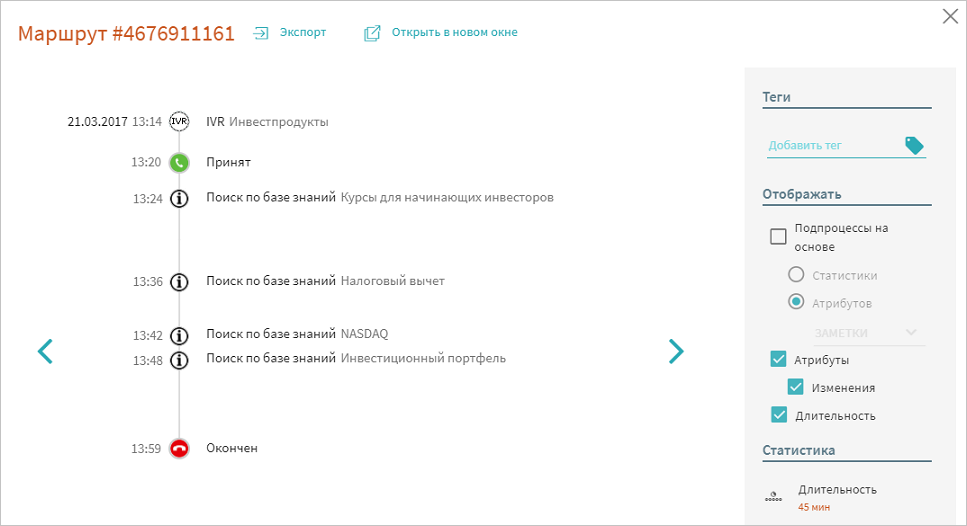

and show the details for each specific case:

Let's say it can be the client's path along the branches of the voice menu, as well as recordings of a conversation with an operator and information about what issue they tried to solve.

ABBYY Timeline helps to combine log data obtained from several systems and analyze all components of the process in a single space. All events that occurred in various IT systems, but related to one specific call, are combined by the platform into a chain called a route .

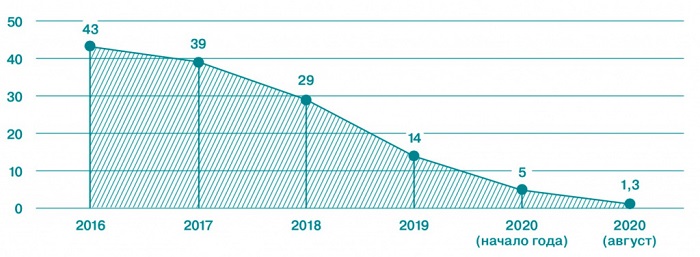

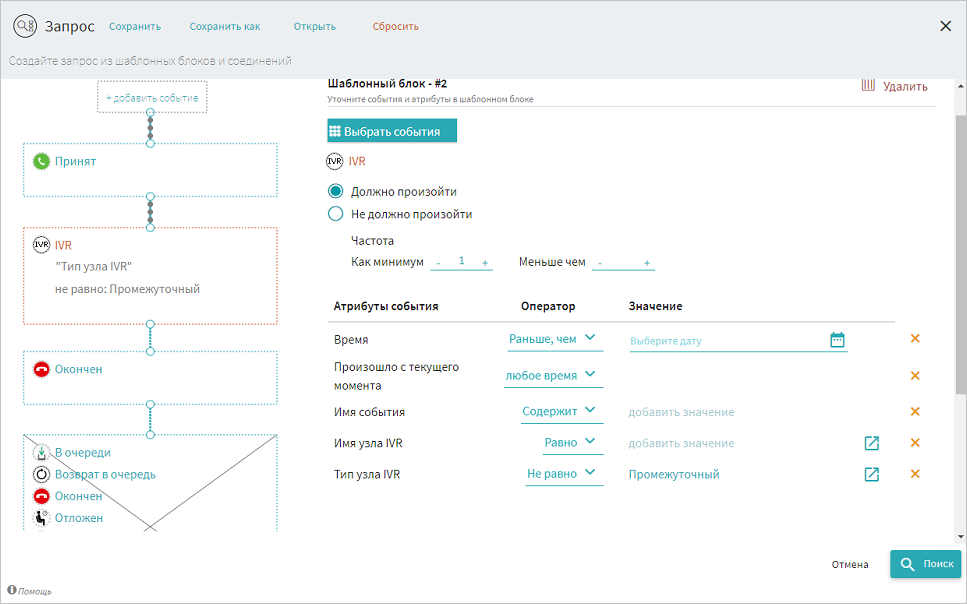

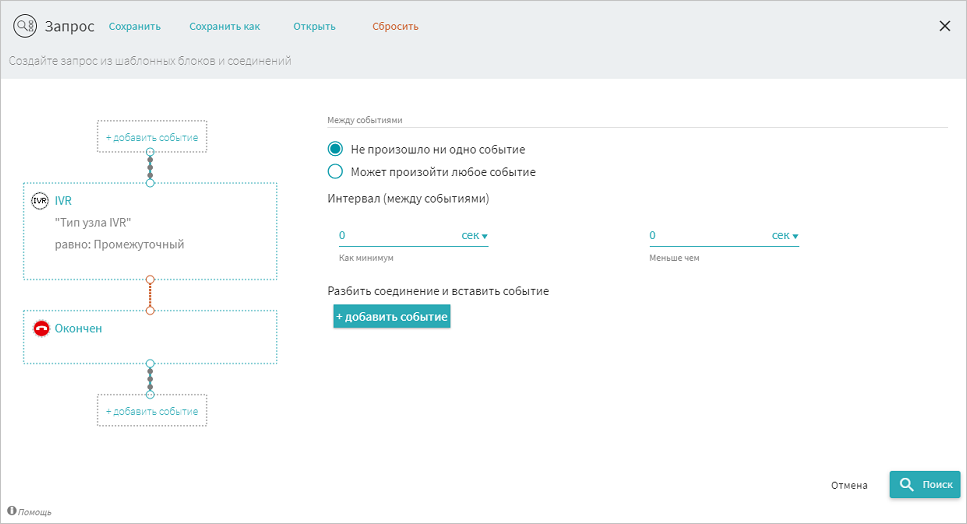

Each route can be unique, but ABBYY Timeline can easily find patterns in them or test various hypotheses. For example, you can see how long it takes a client to resolve his issue in IVR. First, let's use the "Request" tool to select those calls in which the client reached a voice menu node that is not intermediate, and then the call ended.

Intermediate IVR nodes are those where some choice is expected from the client and are not “targeted” to the client.

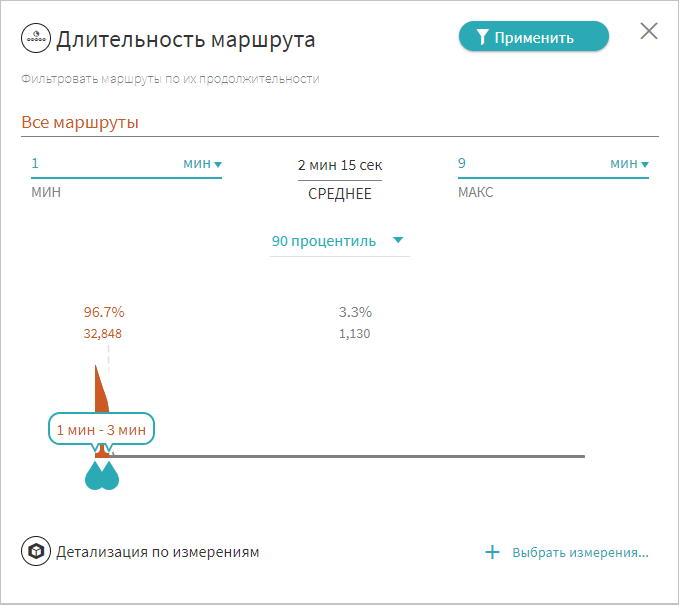

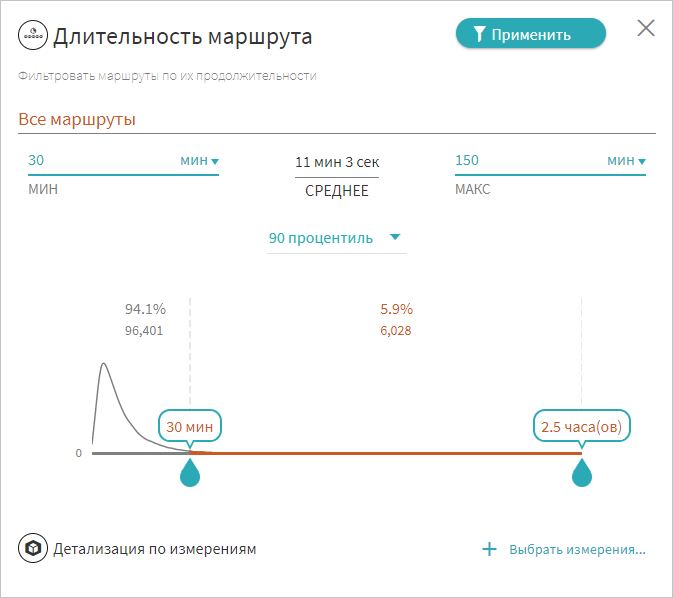

Now let's see the "Route duration" statistics for the selected calls:

This metric will help determine how easy and convenient navigation in the menu is for the client. If the task is solved through IVR in 10 minutes, and through the operator - in a minute, then it is better to switch such a call to the operator. An automated information service should not take the client more than 6 minutes.

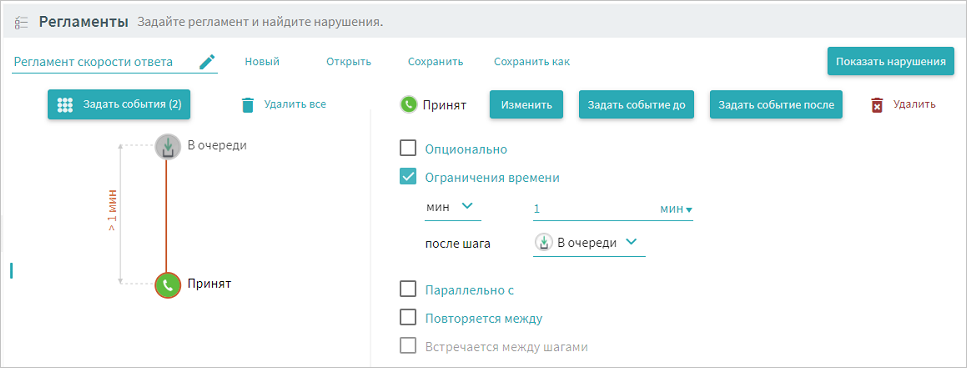

You can find out how much time customers spend waiting for an operator's response. Let's say a person should not hang in line for more than a minute, but this rule is often violated. Let's create a new process regulation... You can create regulations that take into account many parameters, but we will limit ourselves only to the maximum interval between two events: the call got into the queue and the operator accepted it:

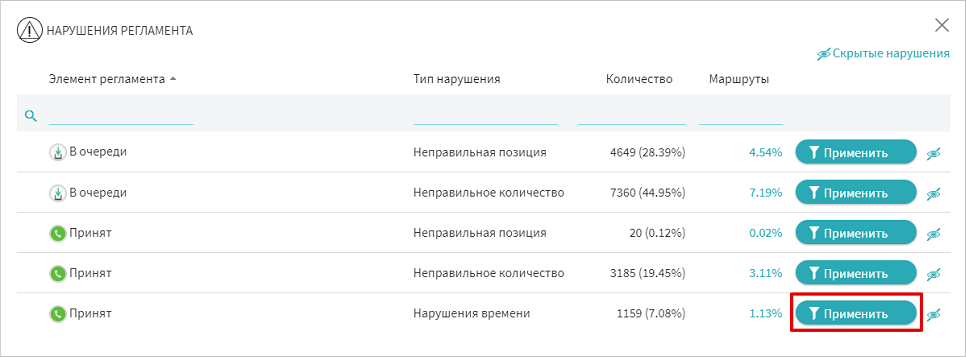

Now let's see the violations of this regulation:

You can not only select calls that violate the time of execution of the regulations, but also set up automatic notifications for such violations. When new calls appear that do not meet the processing timeline, ABBYY Timeline will send an email with direct links to the routes of such calls.

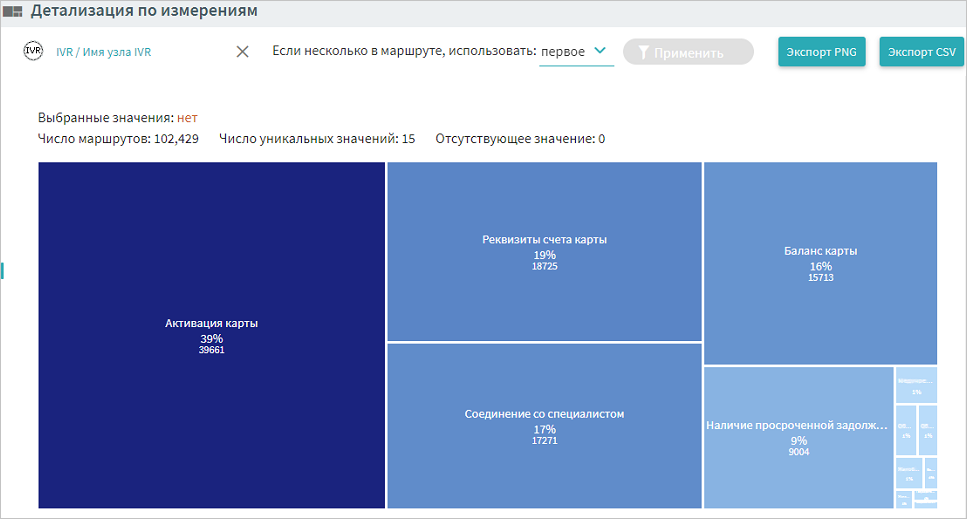

You can find the most frequently used branches of the voice menu, and then move them forward:

We selected all calls that ended up in the target (not intermediate) IVR menu node and displayed the distribution of calls by IVR node name.

ABBYY Timeline allows you to measure the statistics of abandoned pipes: on which IVR branches and how many clients abandoned the pipe before reaching the end. This is one of the important indicators of problems with IVR: The

request is easy to select calls, where no event occurred between the event of the intermediate IVR menu item and the event of an abandoned handset.

We now see the IVR menu items where customers most often decided to hang up rather than go deeper.

The contact center can work not only with historical data, but also test hypotheses. Forecasting tools in ABBYY Timeline allow you to simulate a situation when a future client calls you and walks through the IVR maze. If you "drive" all possible options for action, then you will find where the main "plug" will be, and figure out how to fix it.

"There are many of you, but I am alone"

Correctly distributing the workload on employees is another "headache" of the bank. There are generalists who will answer questions even about loans, even about debit cards, but also just listen to you and even tell you the address of the nearest ATM, clinic or flower shop at midnight.

Correctly distributing the workload on employees is another "headache" of the bank. There are generalists who will answer questions even about loans, even about debit cards, but also just listen to you and even tell you the address of the nearest ATM, clinic or flower shop at midnight.

Some banks divide employees according to thematic areas. But sometimes it is difficult to calculate the load on the line, because yesterday everyone wanted to make a deposit, but today everyone urgently needed investment accounts. What if there are not enough bank restructuring specialists, and 5 people are hanging on the line at the same time with urgent questions? Or it may happen that the client immediately has a loan for an individual entrepreneur, an installment card, a savings account and a slippery question about real estate insurance. And he wants to get information on everything at once. How many operators will you have to switch it to?

The task of specialists who plan the number of employees on the line is to make sure that the client does not wait, and the operators do not sit idle. How to achieve perfect proportions?

You can create familiar chronological or summary reports in the form of tables. For example, watch how the average response rate, talk time, subscriber put on hold and call post-processing change every day. And then - to draw conclusions about the distribution of the workload on employees.

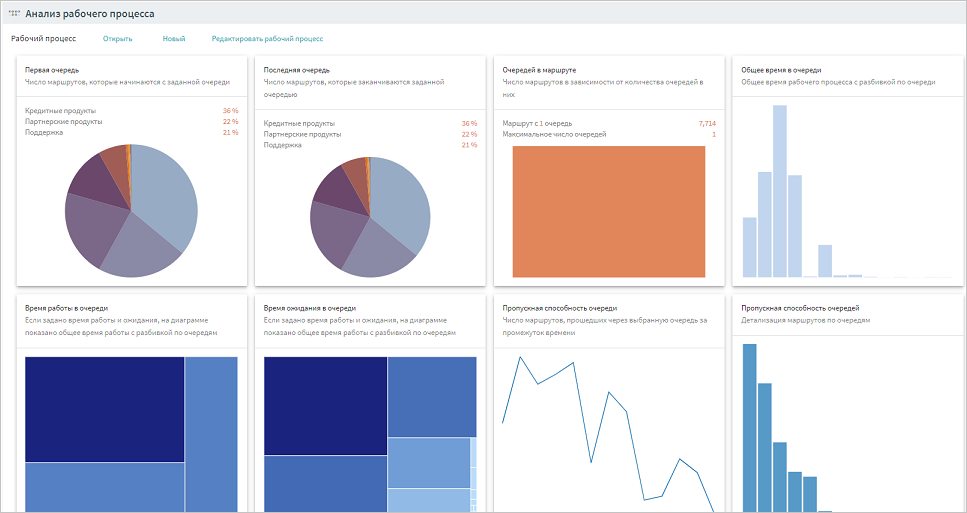

Another option is to analyze how the load on the contact center changes in real time and what bottlenecks there are in this process. For example, you can use the "Queues" tool in ABBYY Timeline and see what is actually happening with the load on the line: ABBYY Timeline allows you to track the distribution of tasks between the request processing commands in real time. The picture is clickable

This tool can also show how the situation changes with the load on the contact center, if the bank, for example, moves from the system of universal employees to the division of specialists in several areas. It is possible to assess the shortage of operators who are versed in a narrow topic, for example, in investment accounts. Alternatively, you can see in which queues clients wait longer for a response: ABBYY Timeline calculates statistics of requests idle in queues. Clickable picture The throughput of the queues allows you to evaluate which teams cope with the largest volume of requests within the selected period. The picture is clickable

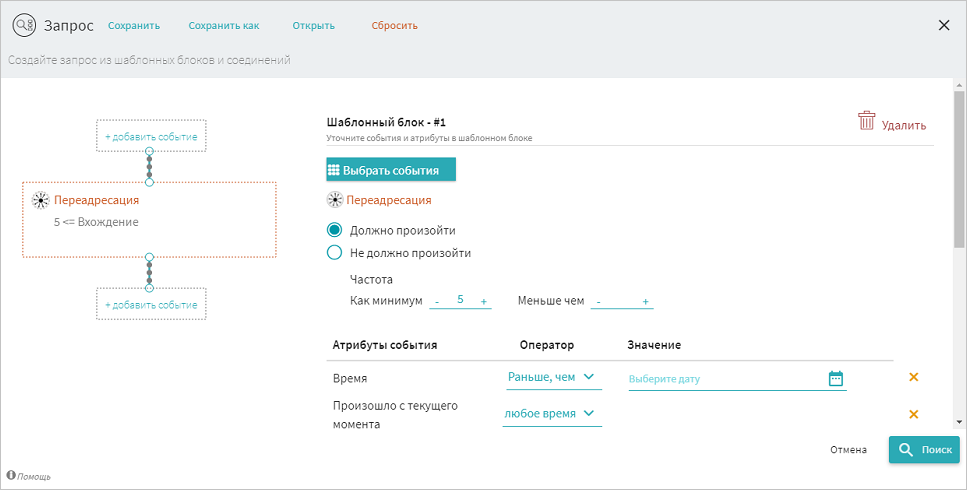

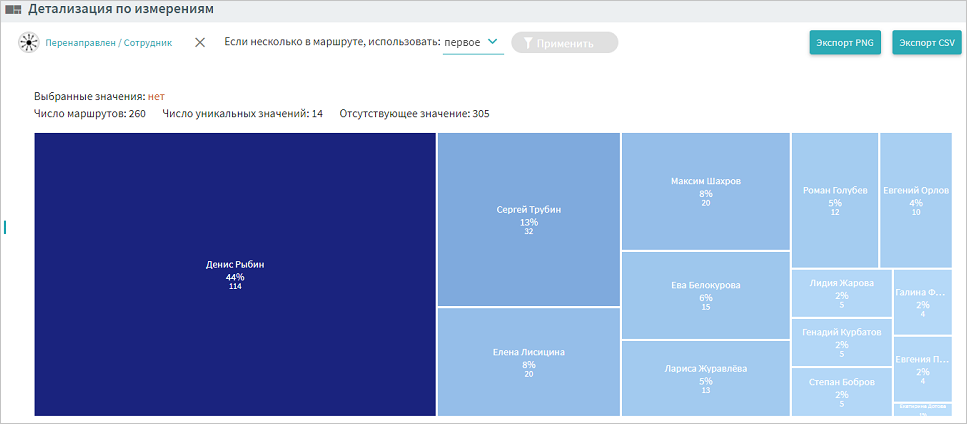

There are indicators that speak specifically about the quality of service. For example, the client should not be switched more than 5 times to another bank manager. Is the subscriber driven back and forth and left unanswered? This situation can be traced:

The "Request" tool is used to find routes with multiple redirects.

The "Request" tool is used to find routes with multiple redirects.

Further, it is interesting to see the distribution of such calls for specific employees in order to talk with them and, possibly, learn something new about your business process: The picture is clickable

Base, base, answer!

A bank contact center can support a conversation on a variety of topics: money transfers, loans, personal data protection, cashbacks, cards for children, insurance, overdrafts, problems with paying for purchases on the Internet. And this is not counting various force majeure and situations where the employee needs to be smart and sometimes act not according to the script. With each call, the operator can "jump" to a new topic. You need to react quickly, answer clearly and informatively, conduct the dialogue politely.

In addition, information on banking products and services is updated frequently. New loans, cards, accounts appear, and there is little time to master new ones. Knowledge bases come to the aid of specialists - huge introsites for collecting, structuring, storing and quickly finding the necessary information. But the path to it can be thorny. Especially when the materials in the database were moved to a new location. Or when the necessary information has simply not yet appeared. By the way, did you know that you cannot answer a customer “Don't know” in a contact center?

What's happening? The largest flow of calls to the contact center happens at the moment when there are massive updates, disruptions, or, for example, when the president announces a credit vacation for small businesses. And the bank covers with a shaft of calls on this topic, and in the knowledge base there is a donut hole!

What's happening? The largest flow of calls to the contact center happens at the moment when there are massive updates, disruptions, or, for example, when the president announces a credit vacation for small businesses. And the bank covers with a shaft of calls on this topic, and in the knowledge base there is a donut hole!

What does the operator do? Places a call on hold and looks for answers to questions. Ask a colleague at the next table, a senior consultant, write to the team in a chat. In the meantime, the number and average hold times are usually tracked and should not exceed, for example, 2 minutes and 2 holds per call. Otherwise, there would be sanctions and the prize would cry. Although in this case there is just a lack of Q&A on the topic.

The situation could be simpler. The employee looks for some obvious information in the corporate database, but does not find it, because it is in a new place or a new wording has appeared. A paradoxical situation: the knowledge base was invented so that the client does not hang on the wire. But it is being updated in such a way that the client is forced to spend time "in limbo". The more often this is repeated, the more complaints in social networks. And the “control shot” can be the phrase: “Unfortunately, we cannot solve your problem, please contact the state organization X”. All of this affects the attitude of customers towards the bank, as well as the motivation, engagement and productivity of operators.

How to be?

- - , . : , -.

- – , Microsoft Excel .

- : / -. , , .

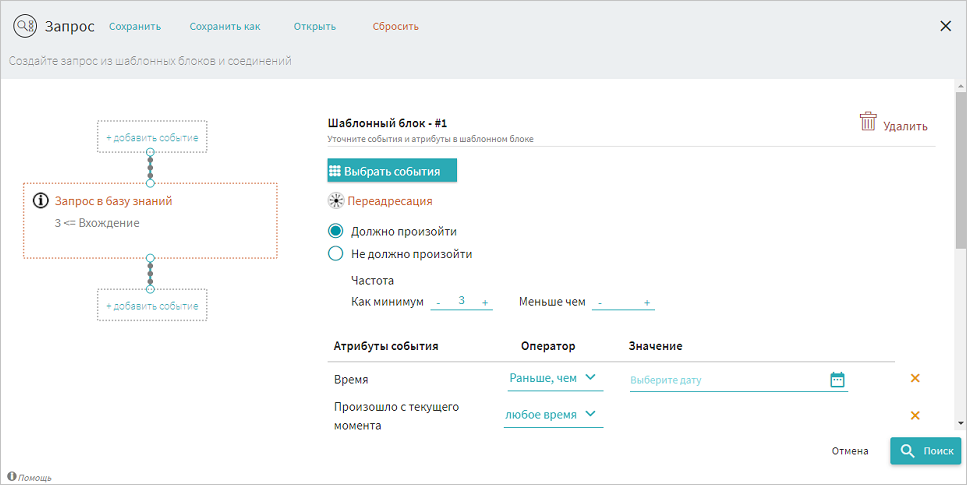

Let's take a look at a list of all search queries that an employee entered when working with some complex and long call. Let's select the longest calls:

Among these calls, we will find those that contained more than 3 searches in the knowledge base:

During calls on a certain type of product or from a certain type of customer, the operator, after placing a call on hold, searches the knowledge base for information on certain tags or topics. In the future, it is possible to refine precisely those articles of the knowledge base that lack up-to-date information:

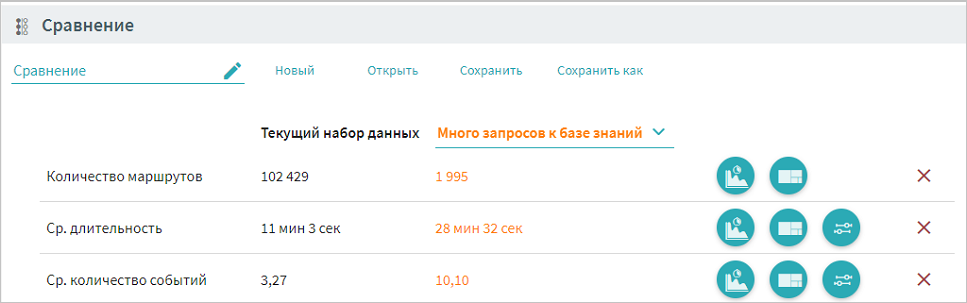

You can track calls during which the operator consulted the knowledge base noticeably more than in other situations, and also compare the indicators for different calls. It can be seen that calls with a large number of queries to the knowledge base are, on average, longer:

Comparison of two queries. One of them contains more calls to the knowledge base.

Comparison of two queries. One of them contains more calls to the knowledge base.

Then you can analyze: what topics people called, when you have to search for an answer for a long time, what is lacking for employees (training or information), and so on.

Instead of a conclusion

The competitive advantage of any contact center is the quality of service. And when the business processes in the company are established and improved in real time, then nothing prevents the operator from responding clearly and clearly to the client, showing participation and care. And when the client is satisfied with the attitude towards himself, he will definitely return to you. And it's not so important what helped him in the end: he quickly found everything through IVR, the operator answered the question, or the client asked the voice assistant. It is important that both the employee and the company were not indifferent to the person and his situation.