- Burry, what's going on?

- It's simple. We are witnessing the greatest bubble of all time. In everything.

I don't remember the 2008 crisis. I was a poor student and therefore the gap between me and wealthy people was narrowing, and according to the relativity of the movement, it seemed that I was getting rich.

Then there was the great movie "The game for a fall," with Batman (Christian Bale) in the title role, but Batman was w of mouths and made a short and x. And with drumsticks in hand.

Batman has proven to the world that his calculations about the upcoming 2008 fucker are correct. Michael Burry then worked as a manager of the hedge fund Scion Capital and in 2005 he insured about a billion dollars of his clients through a credit default swap. Three years later, in 2008, when it smelled fried, Batman earned the investors (although they wanted to sue him) $ 700 million (489.34%) of his fund and personally pocketed $ 100 million.

Now Burry was alarmed again. What was “then,” Burry says, is in bloom compared to what is about to happen.

Burry led, stopped, and tweets again.

In May 2021, Michael Burry bet half a billion dollars on the Tesla crash. He revealed that he had put options to sell 800,100 Tesla shares at the end of the first quarter for $ 534 million. In February, he tweeted, "My last short is bigger, much bigger." He also commented on Tesla's rise in market capitalization, saying it won't last long. Burry also said last year that the environmental regulatory credits that Tesla relied on to generate profits will decline as Fiat Chrysler's sales increase. Burrie likened what was happening with Tesla to the collapse of the dot-com.

On April 6, Michael Burry deletedyour Twitter account.

On June 15, Burry returned to Twitter.

“People keep asking me what's going on in the markets. It's simple. Greatest speculative bubble of all time. Two orders of magnitude larger. # FlyingPigs360 ".

On June 17, Michael Burry warned that investors buying stocks of memes and cryptocurrencies are suffering huge losses.

“All the hype / speculation attracts the retail trade before it causes all the crashes,” the investor wrote. "When cryptocurrencies crash by trillions or meme stocks plummet by tens of billions, #MainStreet's losses will be comparable to the size of a country."

Burry added that FOMO (people's fear of missing out) has pushed asset prices to unacceptable levels. "#FOMO Parabolas don't resolve sideways"

"The problem with #Crypto, as with so many other things, is leverage," he tweeted. "If you don't know what leverage a cryptocurrency has, then you don't know anything about cryptocurrency."

PS

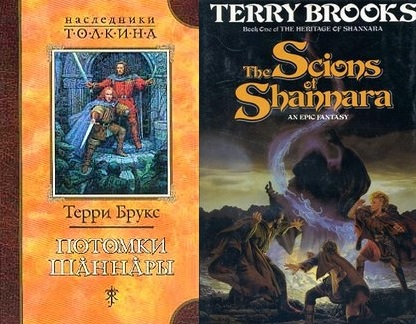

Fun fact, Michael Burry named his hedge fund Scion Capital after the book Descendants of Shannara:

Burrie continues to tweet and delete, and occasionally upload heavy metal songs :

Deathbed perspective ... to be this creative as I die ...

Two torches light up the way

As they beckon from below

To the groves of willows where

The seeds of hate we sow