Content:

How much is the total number of stablecoins in circulation?

Market leaders and their growth over the last year

Regulation of stablecoins: new trends

How do corporations plan to implement stablecoins?

Stablecoin startups and technical breakthroughs

Disputes over stablecoins

How much is the total number of stablecoins in circulation?

According to CoinMarketCap, in mid-April 2021, there were approximately $ 245 billion worth of stablecoins circulating around the world, while their total capitalization exceeded $ 84 billion.

Market leaders and their growth over the last year

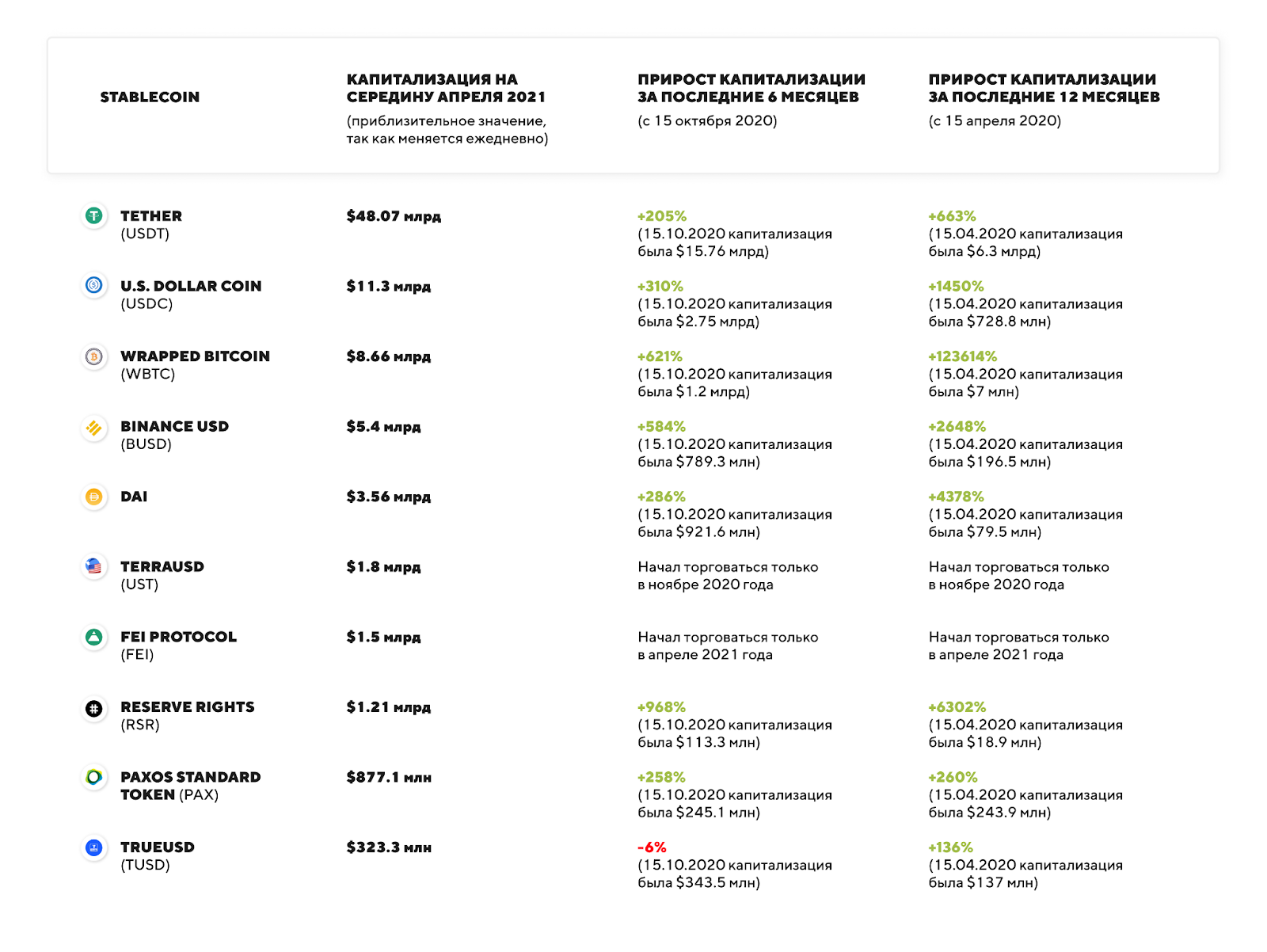

According to CoinMarketCap, the top 10 stablecoins include the following currencies:

Regulation of stablecoins: new trends

, , , . , 2020 , , stablecoins, , .

“REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL on Markets in Crypto-assets”. .

( 2021), . stablecoins 1 . , , stablecoins.

, 2022 .

, . , 2021 . , .

. 2020 (SEC) (OCC) , , .

, . : hosted-, .. . , , .

, . - . , . .

2021 . . (INVN) ( ) .

, , - . 2020 (Sequoia Capital) « ».

:

, (, , )

-

(People’s Bank of China)

-

, , 2019 . .

, . - “ ”, . $3 . - JD.com , .

. 2020 (Multilateral Trading Facility). , , --.

, . - (FATF), 2019 . , . .

stablecoins?

: ( ) . :

2020 Visa Circle ( USDC), Circle USDC , Visa.

2020 J.P.Morgan - JPM Coin. ( ). 2020 . - , Onyx.

:

Mitsubishi MUFG. 2020 , . .

IBM BlockchainWorldWire (BWW) b2b-. . RCBC (), Banco Bradesco () ( ) .

- , . -.

GMO Internet () , . - 2020.

Libra Facebook - SEC, Diem. 2021 .

Terra -, , . Luna. . 2021 Terra 2 , 70 -.

TerraUSD (UST), , $1.8 . , Binance Labs, OKEx, Huobi Capital Upbit. $30 .

Multis b2b-. , , . .

Frick ( ) , “ ” (SCaaS). , . .

.

PegNet - - 1/10 . (, ..) .

Circle Dapper Labs ( CryptoKitties), USDC Flow Dapper Labs. , .

ZeFi 7% . .

Basis. 2018 Basis $133 . , SEC . , .

- USDT. 2021 - (NYAG) Tether, Bitfinex iFinex. , USDT 74%.

The defendants had to agree to several demands:

No Trade With Any Individuals or Entities in New York

Payment of a fine of $ 18.5 million

Regular reporting to NYAG (stablecoin stocks, funds transfers, operating and customer accounts, etc.)

Publishing categories of assets that support Tether. In this case, it is necessary to indicate the percentage of the category, as well as loans / debts.