Hey guys.

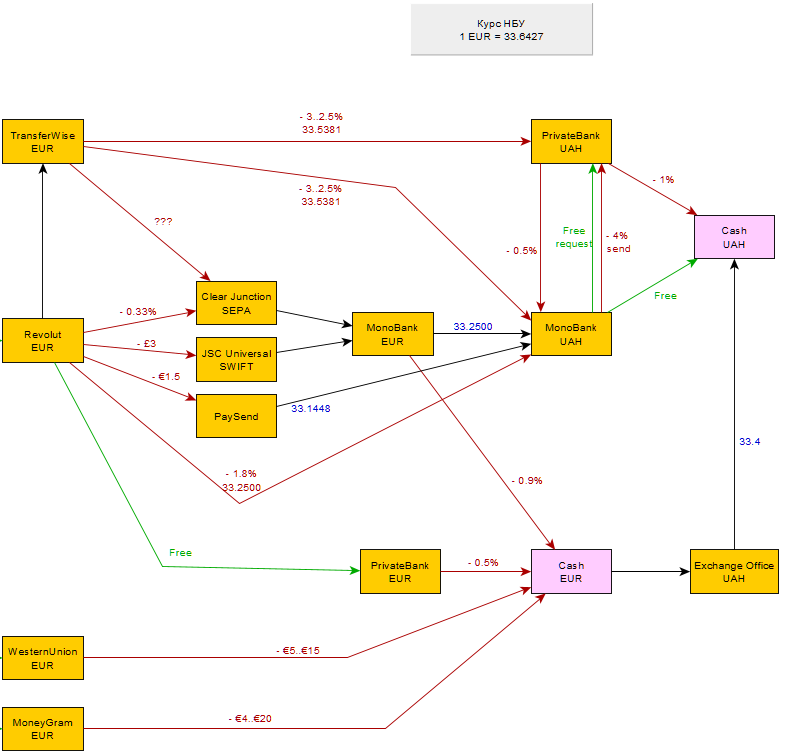

Recently I asked myself which of the ways of transferring money from Europe to Ukraine is the most optimal. Nowadays, there are quite a few banks, both real and virtual, that allow you to transfer small amounts of money with minimal losses. Each of them has its own commissions, its own exchange rate and other nuances. I decided to collect some of those that I use (used) in one picture and, in fact, build a graph where these same banks are the vertices.

The most optimal way in Ukraine is to bring currency and change cash in an exchanger, so I took it as an ideal option with which I compare all other transfer methods.

In short, I got the following conclusions:

When you need it quickly, and on any card, then Paysend . Loss of € 1.5 on transfer and 25 kopecks on each euro on conversion.

When you need cash in euros, Privatbank EUR . Loss of 0.5% when withdrawing cash at a PrivatBank branch.

When you need cash in hryvnia, then through SEPA to Monobank EUR and then transfer with conversion to Monobank UAH . Loss of 0.33% for using SEPA and 15 kopecks for each euro in conversion.

Participants: Foreign bank (in my case Revolut), Monobank EUR (SEPA), Monobank UAH, PrivatBank EUR, Paysend, TransferWise, MoneyGram, Western Union.

To begin with, I built a graph of these participants and the direction of transfers, indicating the commission and / or exchange rate:

, . , — . — — : .

, . Y — , X — (10 - 1000 EUR). , . , .

( ).

For example, Paysend runs within a minute and can be transferred to any card. But there you can only get hryvnia. On the other hand, PrivatBank has the opportunity to open a Euro account and pay 0.5% for currency withdrawals.

Perhaps this information will be useful to someone. Perhaps I made some mistakes and inaccuracies here. Perhaps someone wants to add or fix it.