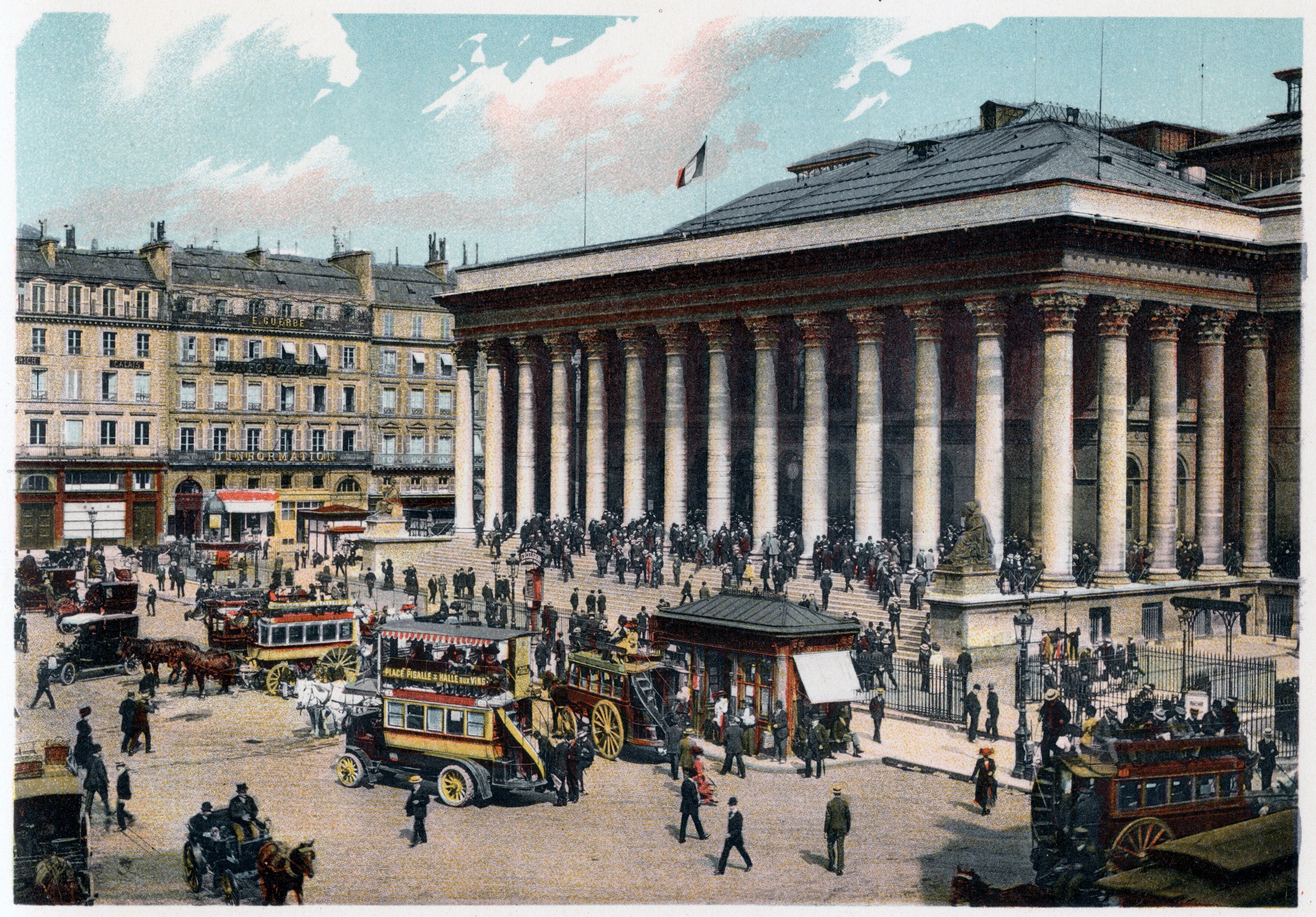

Colored postcard overlooking the facade of the Paris Stock Exchange, circa 1900

In the midst of the international crisis, hedge funds thrive. According to Bloomberg , the top 15 hedge fund managers earned an estimated $ 23.2 billion last year. The leader is the forty-five-year-old founder of Tiger Global Management, Chase Coleman, who has independently earned more than three billion. The Financial Times put the phenomenon more broadly, saying that twenty "the world's best hedge fund managers" provided investors with $ 63 billion amid coronavirus market chaos, "making this the best year in a decade."

Given the dominance of hedge funds, the recent boom and crash in GameStop's value seems both enjoyable and terrifying at the same time, driven by petty speculators. Several hedge funds have lost huge amounts of funds (many billions of dollars) in financial derivatives called options. Of course, in the world of the financial elite, “loss” is a relative term. Due to the GameStop turmoil, hedge fund Melvin Capital has lost more than half of its assets, but its founder raised an estimated $ 850 million last year.

The GameStop hype has drawn the kind of attention they've tried to avoid for hedge fund executives over the past decade. Maxine Waters, chair of the US House of Representatives Financial Services Committee, called for an immediate hearing on such "abuses." "This recent market volatility has drawn the nation's attention to established practices among Wall Street firms," the congresswoman said during her first committee hearing, after which she added that "market participants, we observe, are trying to hide the evidence." Indeed, hedge fund managers work diligently to hide who they are and what they do behind an impenetrable wall. The secrecy also reflects the name of their profession, because "hedge" is the "wall".Written mentions of the word "hedge" first appear in Old English in 785, around the time the Vikings began sacking northern England. At that time, the word "hedge" was used to refer to the boundary set by man. It was the simplest demarcation of property and possession, a line dividing yours and mine.

Since then, the definition of the word "hedge" has expanded, but public knowledge of hedge funds is still limited. Rather, on the contrary, the wall separating the rest of the people from those who buy and sell billions every day is becoming more and more fortified, and for good reason. By the time the word migrated into the lexicon of modern English, the line between “mine” and “not mine” had acquired a militaristic flavor, and arsenals of physical protection were included in the definition of the word “hedge”, for example, “hedge of archers” - “chain archers ". At this point in linguistic history, one person's hedge became another's great bad luck.

Half a millennium passed, and hedging merged with gambling. In 1672, the phrase “to hedge a bet” first appeared, implying questionable moral qualities. The hedged rate was intended for cheaters, and Shakespeare's English was enriched with the concepts of "hedge wench", "hedge cavalier", hedge doctor, hedge lawyer ), hedge writer, hedge priest, and hedge wine. Some of the earliest examples of investor hedging emerged decades later in the coffee shops of London's Exchange Alley, where caffeinated forerunners of brokers bet on share price changes in the Bank of England, the South Sea Company and the British East India Company.Equity investors could have partially covered the potential for future losses by hedging, for example, by betting a fall in advance - a strategy recently repeated by hedge funds unlucky enough to “go short,” that is, bet against the price of GameStop's stock.

Hedging, which was originally a method of defense, can also be an aggressive maneuver - a bet that the object you are betting on will lose. This controversial approach to speculation was reflected in the ever-increasing interest in betting strategies in the eighteenth century, embodied in the Venetian casino Ridotto, the world's first gambling establishment to receive government approval.

In 1754, the infamous schemer, diary writer and heartthrob Giacomo Girolamo Casanova wrote that a certain type of high-risk betting had become fashionable in Ridotto. This bet was called "martingale", and in it we would immediately recognize a simple coin toss. In a matter of seconds, martingale could bring dizzying winnings, or, with equal probability, bankruptcy. In terms of duration, it was the equivalent of modern high-speed trading. The only noteworthy fact about the otherwise simple martingale is that everyone knew an unmistakable winning strategy: if a player bets on the same result indefinitely every time, then the laws of probability theory say that he will not only win back everything he lost earlier, but and will double your money. The only trick wasthat he needs to double the bet every time, and this strategy can be followed only as long as the player remains creditworthy. Many times Martingales left Casanova bankrupt.

In modern finance, tossing a coin has come to mean much more than just heads or tails. The Martingale concept is a defensive wall of what economists call the Efficient Market Hypothesis, which can be understood from the often repeated Wall Street adage that for every person who thinks that the bid will rise (the buyer), there is an equal person with the opposite view. that the rate will fall (seller). Even when the markets go crazy, traders keep repeating this mantra: for every buyer there is a seller. But the coveted goal of the hedge fund, like the dreams of a coin tossor on the brink of bankruptcy, was to dodge the strict fifty-fifty martingale probabilities. The dream was like this: heads - I won, tails - you lost.

The foresight of how such hedged bets might be arranged appeared in print around the time that gambling at Ridotto's casinos was at its peak: in the eighteenth century, finance author Nicholas Magens published his Essay on Insurance. Magens first defined the word "option" as a condition of the contract: "The amount transferred is called a contribution, and the right that the contributor has to fulfill or not fulfill the contract is called an option ..." The concept of an option was introduced as protection against financial losses, and over time it became an integral instrument of hedge funds.

By the middle of the next century, large-scale bets on stocks and bonds were already actively being placed on the Paris Stock Exchange. The exchange, located under a roof supported by many Corinthian columns, together with its unofficial accessory market called Coulisse, carried out cashless payments for more than a hundred billion francs, changing the volume, speed and direction of movement. One of the most popular financial instruments for trading on the Exchange was a debt instrument known as rente , which usually guaranteed an annual return of three percent. As the dates of the offers and the interest rates on these annuities changed, their prices fluctuated relative to each other.

Among the traders was a young man named Louis Bachelier. He was born into a wealthy family - his father was a wine merchant and his maternal grandfather was a banker, but his parents died when he was a teenager, so he had to postpone all his scientific ambitions until he came of age. Although no one knew exactly where he worked, everyone recognized that Bachelier had mastered the internal mechanisms of the Exchange well. From his subsequent research work, it can be assumed that he drew attention to the desire of the best traders to buy a range of diverse and even conflicting positions. You might think that so many bets in so many different directions with so many different settlement dates would guarantee chaos, but these traders did so to reduce their risk.After completing compulsory military service, Bachelier at the age of twenty-two was able to enter the Sorbonne. In 1900, he submitted his doctoral dissertation on a topic that few had previously explored: the mathematical analysis of options trading on rent .

Bachelier's dissertation, The Theory of Speculations, is considered the first to use mathematical analysis to analyze under-roof trading. It began with a statement: "For several years I knew that it would be possible ... to imagine transactions in which one of the parties makes a profit at any price." The best traders on the Exchange knew how to select a complex set of positions designed to protect them, regardless of where and how fast the market was moving. The process described by Bachelier consists in separating each element in a set of rates at different prices and in creating equations for them. The commission that accepted the dissertation under the leadership of the famous mathematician and theoretical physicist Henri Poincaré was impressed, but the work itself turned out to be unusual. “The theme chosen by Monsieur Bachelier is rather far from thosewhat our candidates usually choose, ”the report said. For work that will allow billions of dollars to be poured into the pooled capital of future hedge funds, Bachelier was rated honorable instead of très honorable . It was the "four".

Needless to say, Bachelier's views on the application of mathematics to finance were ahead of their time. The insights from his work were not appreciated and certainly not used by Wall Street until the 1970s, when his dissertation was not found by Nobel laureate Paul Samuelson, the author of one of the world's most popular textbooks on economics, who got it translated into English. Two economists, Fisher Black and Myron Scholes, read this work and published one of the most famous articles in the history of financial mathematics in the 1973 issue of the Journal of Political Economy .

Based on Bachelier's dissertation, economists developed the Black-Scholes model for option pricing. They found that the price of an option could be set by a clear mathematical equation, which allowed the new Chicago Board Options Exchange to expand its business into a new universe of financial derivatives. Within one year,

more than twenty thousand option contracts were transferred from hand to hand every day. Four years later, BCH introduced the "put option", thus introducing a bet that the object you are betting on will lose. "Profit at any price" has become common in both the theory and practice of economics.

In 1994, Scholes partnered with Long-Term Capital Management, a hedge fund based in Greenwich, Connecticut. At the peak of its financial activity, this fund had more than a hundred billion dollars in assets. Applying the theory of financial mathematics in practice, LTCM brought in 20% of the profit in 1994, and 40% in 1995 and 1996.

Unfortunately, Scholes' equation was not completely reliable. Like the best traders on the Paris Stock Exchange, Scholes realized that sudden price changes depend on human feelings, such as fear and greed, that can increase or decrease the speed of buying or selling assets. Option pricing is based on an ingenious calculation of sensitivity to such volatility, known in the world of financial mathematics under the pseudo-Greek name "Vega". But there have been volatilities in human history that even MIT professors and Louis Bachelier could not predict. The 1998 financial crises in Asia and Russia were not part of the Black-Scholes equation, and Long-Term Capital Management lost more than $ 4 billion in less than four months.However, the setback didn't stop new generations of mathematically-minded future billionaires from working around the clock to create a next-generation formula that is profitable at all prices, transforming Vega into even more bizarre derivatives and creating a whole new alphabet of financial Greek (including Vomma and Zomma).

Much has changed in the world since the eighteenth century Parisian traders bet on canal, rail, and rents prices , but the dream that we can create a completely invulnerable barrier against financial risk remains unchanged. For a while, it seemed that hedge funds, faced with a year-long international crisis, could achieve a new level of protection against unpredictable volatility. But then it was a few days in February 2021 when a horde of barbarians on Reddit blew a hole in the wall, and it became apparent that hedge fund managers, for all their intelligence and hype, were still not far from throwing a Casanova coin at Ridotto.

A hedge fund designed to protect property and mitigate risks, designed to eliminate the shortcomings of binary buying or selling, and dedicated to making a profit at any price, has once again proven its vulnerability. We were fascinated by this story, and then life in Washington and Wall Street returned to its usual course. Tiger Global Management is looking forward to another record-breaking year, and Maxine Waters, determined to "get to the bottom" of the "dark funds" of the secret capital, promises to hold new hearings.