On Privacy.com, hiding your online shopping habits is simple: you enter your debit or bank account information and the website generates a virtual debit card. This so-called "burner card" hides the buyer behind a "proxy", not allowing him to find out his name and address. Then you just need to enter the number, card, its expiration date and CVV code in any online store, make a purchase, and Privacy will take care of the rest. The service will make a payment using the user's real card, add these funds to the burner and use this new card to purchase.

It looks attractive. The card can be configured so that merchants cannot charge any additional payments from it, for example, automatic payment for a subscription. If the seller's site is hacked, then you just get rid of the “burned out” card and start another one. And if any of the parties to the transaction tries to sell your data, then it will only have information that the purchase was made through Privacy.

It is not the only service that offers a transaction hiding service. Last August, Apple introduced the Apple Card, a non-numbered credit card issued by Goldman Sachs that does not track purchases. Privacy and other emerging software companies like FigLeaf and Abineare working on creating burner cards and other technologies (password managers, browser extensions) to mask web browsing. Offline, consumers have always had the opportunity to make purchases anonymously, paying for them in cash. But online is a whole different story. “We want to empower consumers to say, I love working with you and shopping online, I just want to do it on my own terms,” says Abine co-founder Rob Shavell.

We have grown accustomed to the sad fact that almost every major ad distributor, website, and personal device manufacturer collects and tracks user data in some way. Some do it for their own purposes. Others do this to the advantage of various algorithmic spy network owners like Facebook or Google, which analyze vast amounts of personal information, from social media likes to GPS location, to display relevant ads. (The Fast Company site , which hosts the original article, like many other media, tracks reader data for advertising purposes.)

But credit card details are needed to fully understand shopper behavior. Over the past decade, consumer shopping has gradually become the most coveted and promising dataset, used by people on Wall Street and Madison Avenue to determine consumer tastes, budgets, and plans. "Transaction data is the holy grail for marketers today," says Michael Moreau, co-founder of Boston-based startup Habu; his company helps advertisers organize their data.

These transactions have fueled the rise in popularity of a sophisticated data selling ecosystem. At its foundation are credit card payment processing networks, including Visa, American Express and Mastercard; the latter made $ 4.1 billion in 2019 (a quarter of its annual revenue) by leveraging its array of transaction data in services that provide marketing analytics, bonus programs and fraud detection features. And then there are banks, retailers, payment processors, and software companies that provide online transactions. Few of them disclose their methods, and some actively hide their work; but they all declare that personal data is anonymized and grouped, and therefore safe.

However, in reality, everything is much more complicated. On the one hand, cardholders are protected more than ever from identity theft. On the other hand, they all now shop at freak show, and companies track and analyze their actions in near real time. It has never been more difficult for us to find out who is tracking and selling this data, let alone who is buying it.

Companies started looking at transaction data to sell us more products back in the 1990s. Credit card giants like American Express were analyzing purchases to provide special offers to cardholders. Meanwhile, marketers with more limited information were pulling data from their own cash registers to better understand their customers.

The situation changed significantly after a decade, with the emergence of fintech startups. Banks were initially wary of sharing and manipulating data, mainly due to the 1999 Gramm-Rich-Bliley Act, which penalized financial institutions that put customer data at risk, including names, dates of birth, addresses and other personal information. ... To solve this problem, startups have implemented a sophisticated system that removes identity details and replaces them with randomly generated aliases used as ID codes: they are incomprehensible by themselves, but can be associated with files of individual customers.

This replacement system (also known as “tokenization”) has become the standard today. Chip cards, contactless payment systems like Apple Pay, online payment solutions, and other Internet banking technologies use it to communicate with each other. They even form chains: if an e-commerce app needs to accept credit cards, it uses a payment system like Stripe. If a financial services application such as Acorns needs to contact a user's bank accounts, it can use Plaid's API to automate logins. If the budget application needs to show users information about their credit cards, savings, and investment accounts, it can use Yodlee software.

Today, almost without exception, the data of any American who buys something online is transferred to the company that issued his card, as well as to startups that create middleware. And some of these middlemen make money by selling information to marketers, hedge funds and other parties.

“In essence, tokenization has created a loophole in the law,” says Yves-Alexandre de Mongeuil, head of privacy in computer systems at Imperial College London and advising the European Commission on privacy issues. After getting rid of the names and other details, companies can declare: "This is not personal, but anonymized data."

But they are not very anonymous. In 2015, de Montjoy and colleagues from MIT took a lot of data containing a three-month history of credit card transactions of 1.1 million nameless people, and found that in 90% of cases it is possible to identify a person, knowing the approximate details (date and store) of four purchases of this person. In other words, a combination of multiple receipts, tweets, and photos from a cafe on Instagram allows you to identify your other purchases as well.

All this is happening under the veil of secrecy. Yes, credit card companies admit that they make money from analyzing transactions, but they are very vague about the data they are sharing. Visa, for example, says its data businesses provide transaction history at the zip code grouping level. However, the zip codes used by this company are in the format zip code + 4 numbers, which is enough to determine the address on one side of the street in the block, and often the exact address. (Visa says it shares this data by batch to avoid disclosing personal information.) American Express says it never sells transaction data to third parties. However, the company has partnered with a data broker called Wiland to identify individual consumers,whose buying habits meet the criteria provided by marketers. (According to American Express, this "modeling methodology" protects the privacy of the cardholder.) Targeting specific people based on transaction data is "extremely easy," says Robert Brill. He is the founder of Brill Media, which uses data from Mastercard and other sources to buy digital ads at the request of its customers.using data from Mastercard and other sources to purchase digital advertising at the request of its customers.using data from Mastercard and other sources to purchase digital advertising at the request of its customers.

There are also fintech intermediaries. Plaid, which receives bank account information for more than 2,600 apps, claims it never sells user data. However, in January, the company was acquired by Visa, which sells data through a business called Visa Advertising Solutions. (Visa declined to comment on its plans for Plaid.) The developers of the financial planning app HelloWallet say it does not sell unique user data. But to access user accounts, the app uses Yodlee, a service that sells such information.

The state's ability to regulate such trade is limited. In January, Ohio Senator Sherrod Brown, Oregon Senator Ron Wyden, and California Representative Ann Ash sent a letter to the FTC demanding an investigation into Yodlee's parent company, Envestnet, for selling consumer data without their knowledge. Yodlee, for its part, declares that it complies with all legal regulations. "Congress needs to create clear rules that govern corporations that delve into our privacy," says Brown. For example, a bill introduced by Wyden last October would force companies to go into more detail about how they share consumer data. However, there is no evidence that the Senate will begin considering it any time soon.

With no regulation, apps like Privacy and Abine have emerged to help consumers. But they still have bindings to the data ecosystem. Privacy uses Plaid. Abine uses Stripe, a service that does not disclose the names of its banking partners. (Many banks share transaction data.) Even Apple, which has banned Goldman Sachs from using its card details for marketing purposes, cannot obtain such concessions from its Mastercard payment system.

Of course, these services tend to hide the identity of privacy-conscious shoppers, but they cannot completely free themselves from tracking.

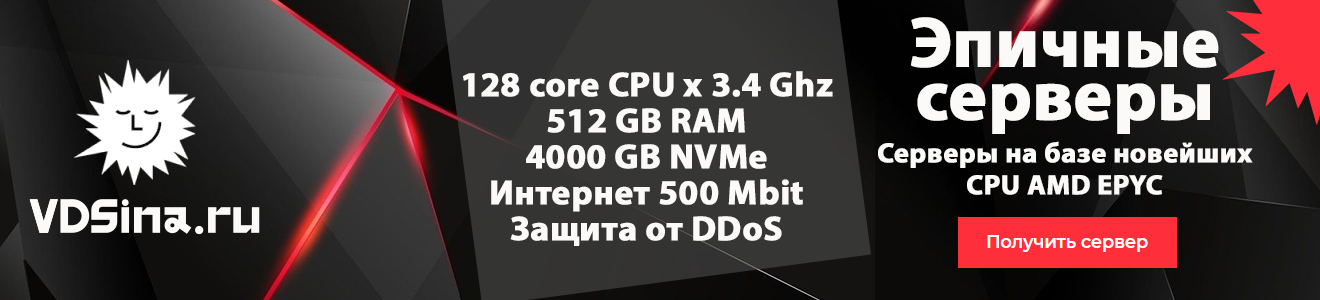

Advertising

VDSina offers servers for rent for any task, one e-mail is enough to order! Huge selection of operating systems for automatic installation, it is possible to install any OS from your own ISO , a convenient proprietary control panel and daily payment.