Hello, Habr! A couple of years ago, I started publishing review articles on gaming cloud services, both Russian and foreign. Cloud gaming is gaining momentum, so the names of the main market players are already on everyone's lips - there is no point in reviewing again.

Instead, I suggest looking at how these players are doing. As it turned out, not everyone is doing well. To be honest, I was prompted to write this article by the news of the bankruptcy of the Shadow service, which has been included in my reviews more than once. Let's see what happened to him and how other companies, both domestic and foreign, are feeling.

What's up with Shadow?

This cloud service was launched back in 2018. Moreover, the scheme of work was initially non-standard - instead of providing the player with a list of games, Shadow preferred to provide virtual gaming PCs on which games are installed.

Game data is processed in the cloud, and visual information is streamed to systems with Windows, Mac, Linux, Android, iOS. The idea is great - the players were mostly happy. But, as it turns out, the problem isn't with the users.

It turned out that the scheme of working with virtual gaming PCs turned out to be problematic - after all, significant resources are needed to maintain the operation of powerful systems, albeit virtual ones. They were just not enough, so the company had to file for bankruptcy. Together with her filed for bankruptcyand the main business unit of which Shadow is a subsidiary. We are talking about the Blade streaming service - he had to defend himself against creditors in the United States and France.

In order to attract more users, Shadow has reduced the cost of the "admission ticket" to $ 12 per month. Unfortunately, we managed to attract additional funds, but not to the extent that the company needs. Shadow's partner, provider 2CRSi, announced $ 35.92 million in debt from the gaming service.

In general, a difficult situation. The company may be able to get out of it, but the bankruptcy process, as far as we know, continues.

Stadia has a lot of problems too

Yes, Google's cloud gaming service, Stadia, also started having problems, and quite significant ones. Experts have been talking about possible difficulties for a long time, but this came to the surface a couple of months ago.

Then Google announced that Stadia Games and Entertainment studios would soon be closed . And this is just about a year and a half after the start. Interestingly, at the very beginning of the launch of this division, its head announced a four-year development period, after which gamers will receive exclusive content.

Apparently, it seemed to someone from the management that 4 years was too long. At the moment, Stadia Games and Entertainment studios do not have exclusive games that could attract users to Stadia, and these games are unlikely to appear anymore. Thus, the story repeats itself with Amazon - one of the richest companies in the world, which, however, also failed to develop anything more or less intelligible to be called a "popular exclusive".

The main service has solid issues that are not related to the lack of Google exclusives. The fact is that Stadia has a serious shortage of players. The discrepancy between what was planned and predicted, and what is actually "hundreds of thousands" of players, as reported by journalists Bloomberg. There are relatively few sets of gaming systems sold, and less than the estimated number of active users.

At the same time, the service spends, or rather, spent, a lot of money to attract publishers like Take-Two and Ubisoft. It took "several tens of millions of US dollars" to complete this task, but Stadia is not very exclusive.

As far as can be understood, the prospects of the service are now in question. Stadia itself does not say anything about its problems, but market players have no doubt that the cloud service is struggling.

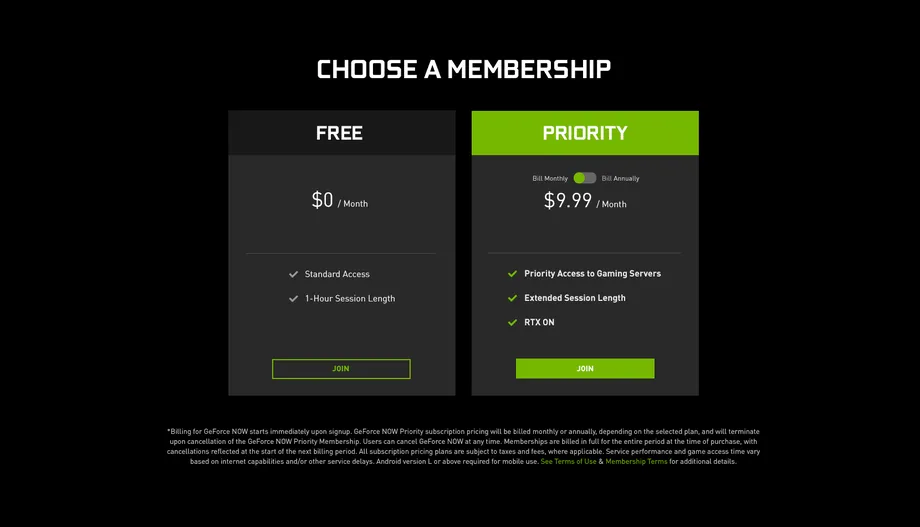

GFN raises prices

The GeForce Now service seems to be doing well, there are no such complex problems as Shadow and Stadia. Still, GFN had to take unpopular measures to increase profitability. In mid-March, management announced that it was changing the subscription plan for the service for new users.

Priority will replace Founders. There are no special perks, everything remains in approximately the same form as before. But the price rises from $ 4.99 for a subscription to $ 9.99. In addition, the company also offers an annual subscription for $ 99.99.

Good news for those users who signed up before mid-March 2021 - for them the company's pricing policy remains the same.

In general, the company is clearly not afraid to lose some of its users. After the start, GFN quickly gained a base of 10 million people, so now it can already move to a new stage of development, with the attraction of significant funds from subscribers. In general, Nvidia can afford to experiment with GFN - everything is fine with the business, investments continue to pour into the cloud gaming service. Something can be tried and changed.

The company is expanding its infrastructure and adding more and more games to the catalog. Now the speed of adding new products is planned to be increased from 10 per week to 15. True, the company is going to reach the estimated volume of added games not earlier than by the end of 2021.

MY.GAMES Cloud is doing well

I wrote about this service relatively recently. So far, it continues to gain momentum. Unfortunately, nothing is known about the financial side yet, but MY.GAMES Cloud is evolving. So, a couple of days ago, the service released a major update for its cloud gaming service. It allows gamers to play at 4K resolution and 120 frames per second.

The company also announced new tariffs. All active users of the platform will be transferred to a Medium subscription for 599 rubles per month. If desired, users will be able to upgrade to the Ultra plan (with 4K resolution and 120 fps) with a monthly payment of 1199 rubles. Both options are completely unlimited. In addition to the monthly subscription, you can buy hour passes and annual subscriptions in the service.

Better yet, Playkey

One of the veterans of Russian cloud gaming, Playkey recently announced that there are even more users than the service can handle. This is especially true for long vacations, holidays, etc.

The number of gamers and their activity has tripled since the beginning of the pandemic. The company was not even ready for such an influx, so it introduced decentralization technology, which gives users the opportunity to rent out their computer, increasing the available capacity.

The lifting of strict quarantine measures led to a drop in demand to the average seasonal values, but the trend still remained upward. There are significantly more users, but they play a little less often than during the self-isolation mode. Since 2020, the service has become profitable, and since then it has remained in operating profit.

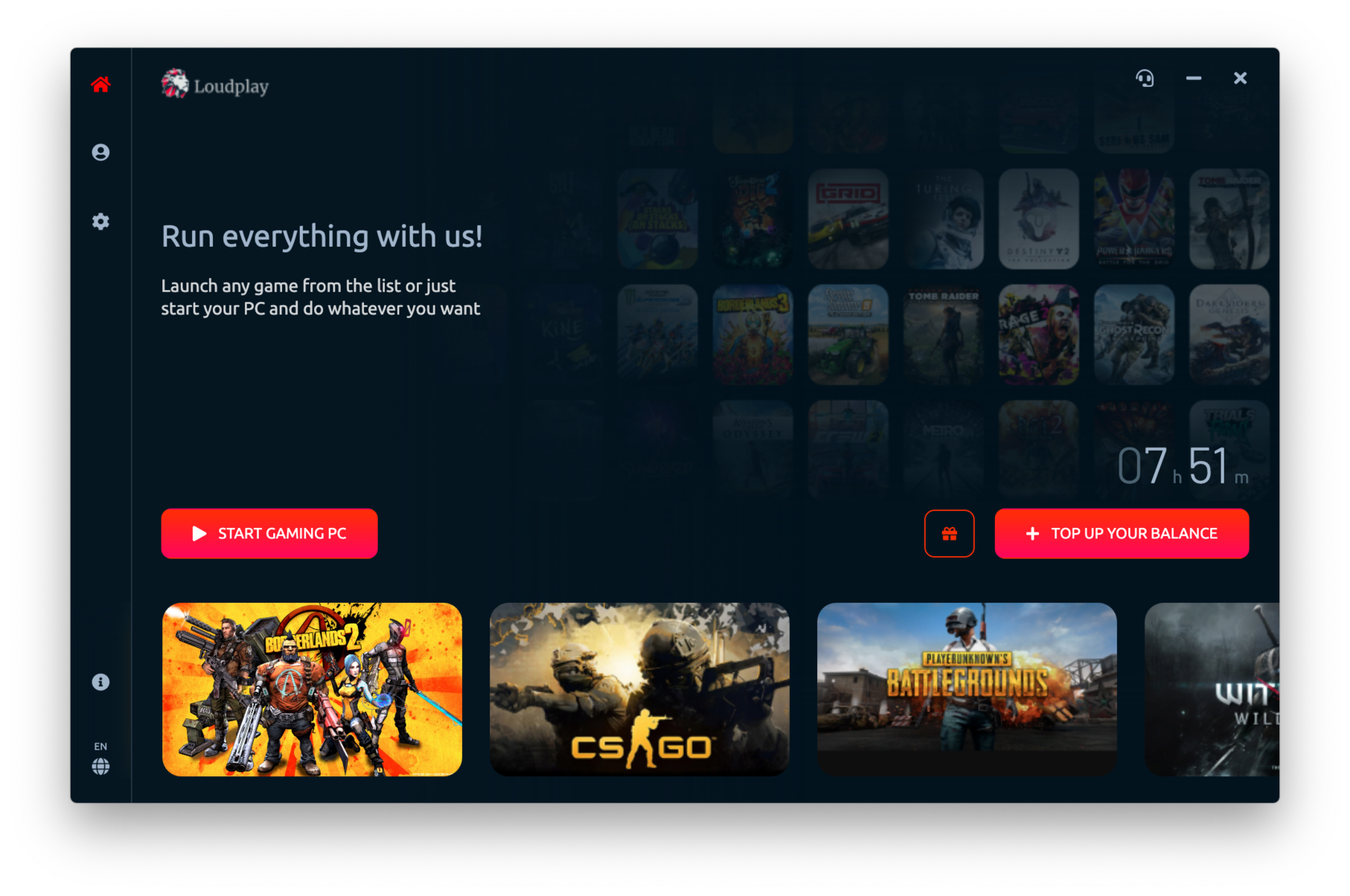

Loudplay is doing well too

The company also recently announced that business is doing well. The service also reached operating profit and this trend continues. By the way, the management of the service believes that the Russian cloud gaming market at the moment is probably one of the most advanced in the world, judging by the level of competition and the number of users.

In general, both the global and the Russian cloud gaming market is still undergoing a stage of formation, which is noticeable in the dynamics of the development of services. A mature market is just emerging; several companies are already represented on it, which have successfully moved from the startup stage to the stage of sustainable and profitable business. Some players, including GFN, Playkey, Loudplay, have the resources necessary to develop technology and business. They are also able to invest in attracting new users and expanding the base of games, which they successfully do. It remains to wait quite a bit - and the cloud gaming market will finally take shape.