I decided to write this article after I saw fierce disputes about unit economics in a couple of thematic chats in Telegram, and then I also stumbled upon whole consultations and courses on this very unit economics. And for calculators too. In general, I have a strong feeling that for some reason many complicate the whole story of unit economics and argue mainly about terms, although for the vast majority these subtleties and terminological disputes are useless and only complicate understanding.

At the same time, understanding what unit economics is and being able to calculate it is, of course, useful. It just so happened that people talk about it mainly in the startup world, so, I hope, the article will make it easier for Habrovites to understand - this is applicable not only for startups, but also for their own pet-projects and, in general, for understanding - here's what to do now: throw more money into advertising or slow down promotion, refine the product, rethink the business model, etc.

In short:

Unit economics describes how much a business makes or loses on one unit.

A unit is the basic unit that generates income, and each business has its own.

How to calculate unit economics

Define a unit.

Calculate how much profit or loss this unit brought. It is important to consider all the costs and revenues associated with the unit.

That's all , that's enough.

— .

. . .

- , , — , . , :

— , , .

, — . , — . — . / — -. ..

, . , , , . .

, .

— ?

, :

— .

— : .

1. —

- . — / . : ?

2. —

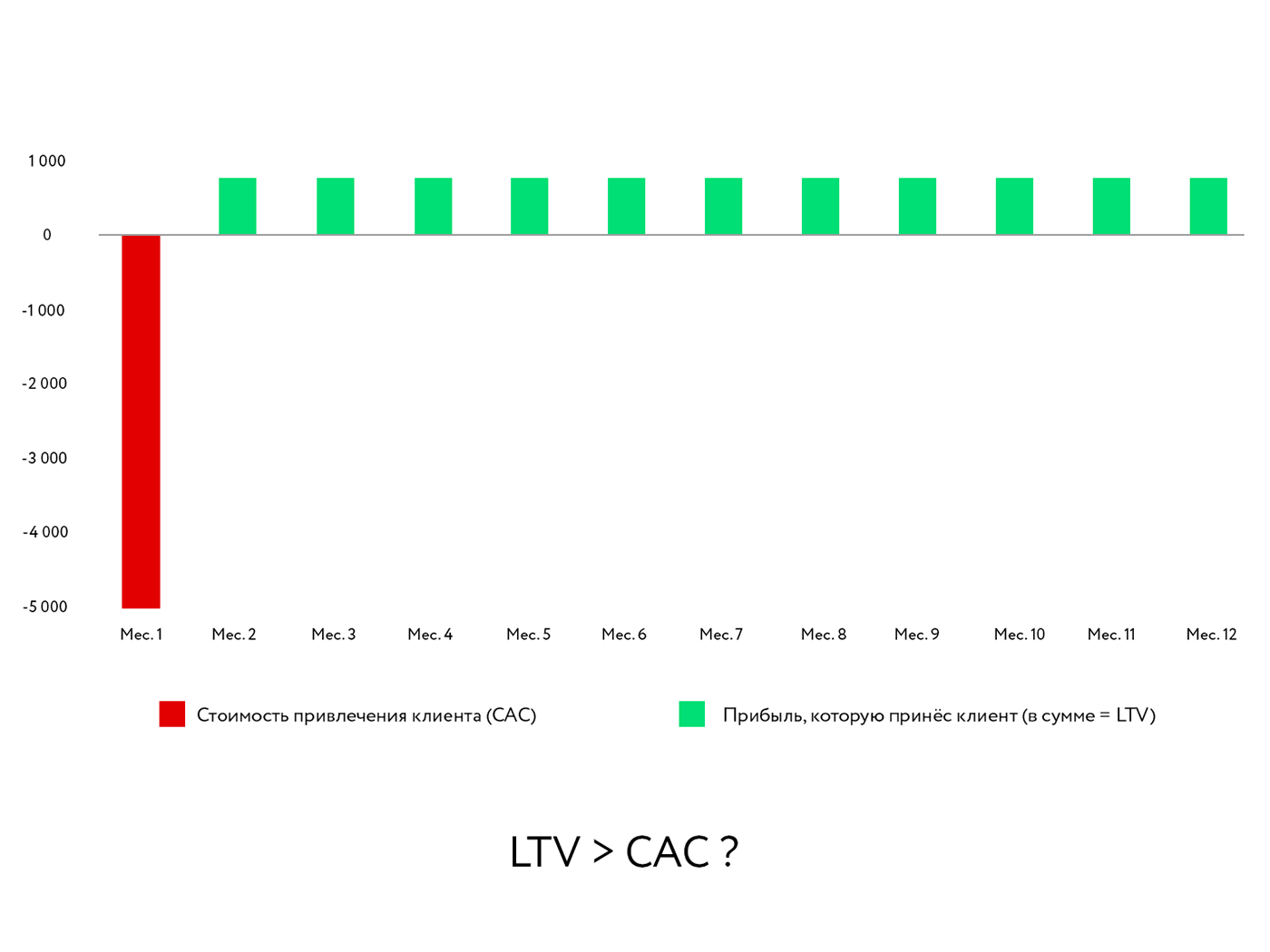

- — , , . LTV (lifetime value, ) CAC (customer acquisition cost, ). : , ?

, : — . , — CAC. , — , . , , «» .

— , . : LTV/CAC.

, , , — , , , .

, . , .

,

, , . — , .

. , , -. , , — . - , : , SEO, . , , .

, , , . , , , , , , , , - . , ..

. , .

: «» , , , «» .

, . -. .

?

, , , .

, : , — .

, , — , .

ARPU, ARPA, MRR, ARR, ACV, AOV, COGS , -?

:) , , / . -, , , , .

, . : COGS ( ) , ..

, . , . , , .

-:

. (, , ), , — . : , — .

. — , . , , — - . — , , . - , - … . — , .

. , . , , .

, . , , , .

, . ( ), , «» , . , , , .

, - , , , , .

— : . , : - , . - , . .

, — — , , — .

, — , , .

If we begin to attribute to the cost of a unit that which is not actually connected with it, we risk mistakenly getting a negative result and concluding that we cannot scale anything, although in fact it is not so.

The opposite is also true: if we do not take into account in the costs of a unit what actually belongs to them, we run the risk of scaling losses.

Total

Keep the goal in mind - to scale the business - and refer to expenses and income per unit only that which actually applies to the unit in accordance with the business model.

Don't worry too much about terms if you're thinking for yourself.

Don't overcomplicate. If we put aside the universal calculators with terminological disputes and just count, it will become clear: unit economics is simple.