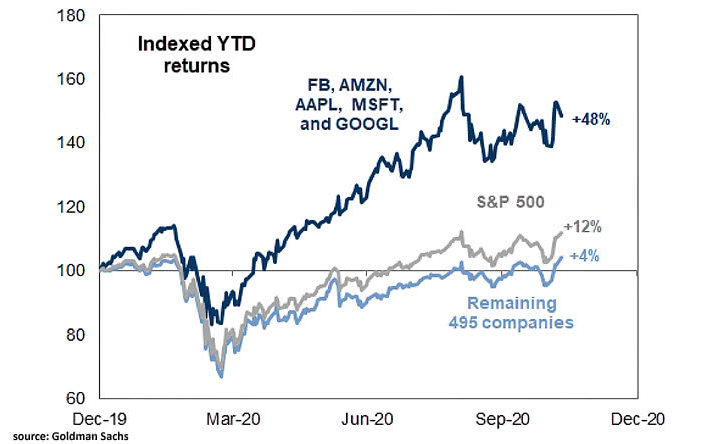

The last year has been characterized by unprecedented growth in all markets. So, for the year from December 2019 to December 2020, the shares of the largest companies in the technology sector, the so-called FAAMG (Facebook, Amazon, Apple, Microsoft, Google), grew by 48%. The shares of the other 500 largest companies in the US market rose 12% over the same period. Not many large companies have reduced their capitalization. One such example is AT&T, the world's largest telecommunications company, founded by the inventor of the telephone, Alexander Bel. What is going on with the former monopolist and does she have any prospects?

Failures of recent years

, . 4 30% , S&P 500, AT&T 60%. ,

, AT&T - ( 53% ) - . .

- . - Cord-cutting ( « »).

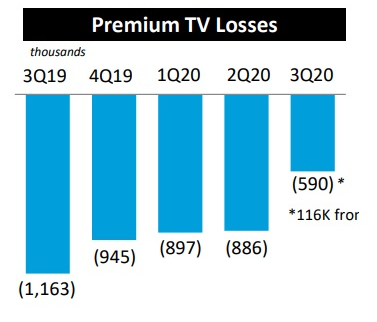

, 2020 AT&T, 886 000 . 2 6 . . , . 2015 AT&T Direct TV $49 ., 2017 . .

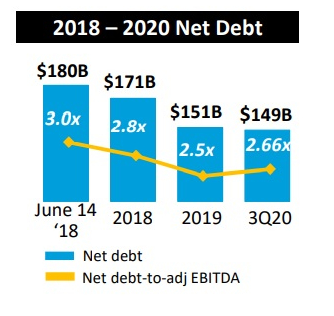

Time Warner (WarnerMedia) - , 30 . , . Time Warner 2018 $85 ., $180. , .

2020 , , , .

. , - Direct TV, , .

2020 HBO Max, . , :: Netflix, Disney+, Apple TV, Peacock, HBO - $14,99 .

-

, . , .

, AT&T . .

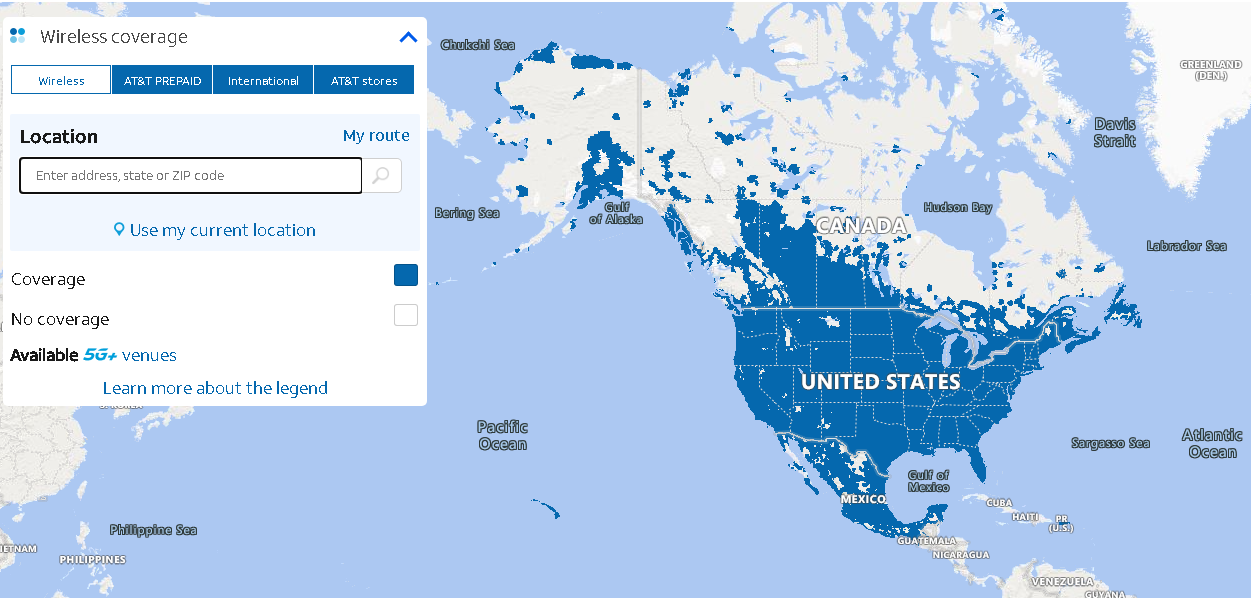

AT&T 5G . T-Mobile Verizon , , , . Huawei.

, . , Net debt/EBITDA 3,17. , 3. 3,17 , . , 2020 4,3% 4,1%

, AT&T . Direct TV ( 15%), CNN, Warner, Xandr - - WarnerMedia. , , -, , -, AT&T , , .

, AT&T “ ”. , 5 5,6%, - 7,22%. , - 2%. , . P/FCF = 7,6, .

. EV/EBITDA 6,7. , 2020 , . .

. . , “” , .

AT&T is a company with a stable core business. Its problems have been known for a long time and are already included in the share price. At the same time, it is clearly underestimated and even lags behind the market, which means that, most likely, with a possible correction, the share price will not suffer. At the same time, any positive shift (sale of non-core and loss-generating assets and debt reduction; development of the 5G segment; development of the HBO Max service, and even the success of the Warner Bros movie, which, for example, will repeat the box office of the Joker) is likely to cause an increase in the share price. All this, combined with high dividends, makes buying shares of the company a potentially very good investment.