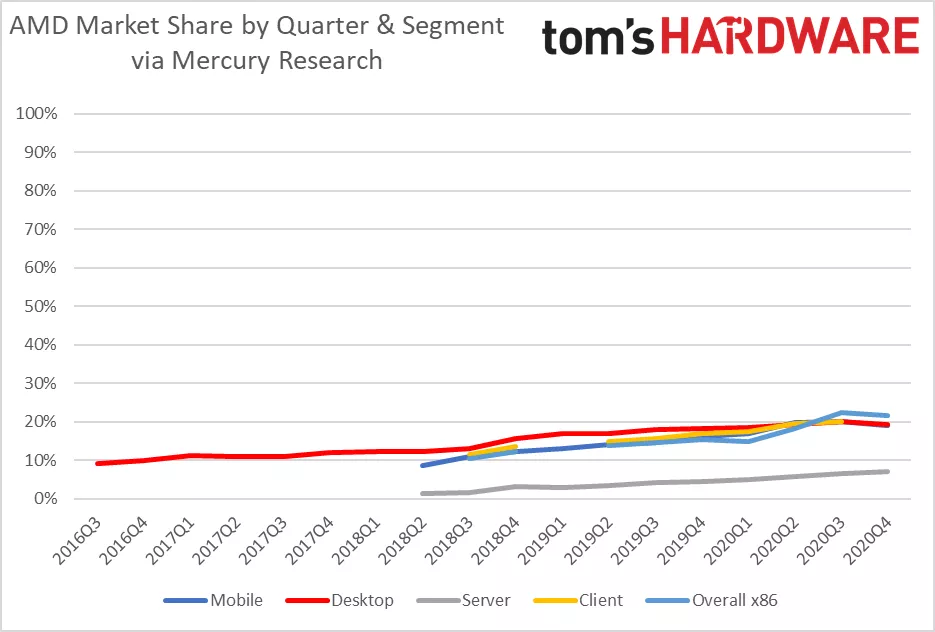

Analytical agency Mercury Research recently published interesting statistics that show that Intel was able to take a share of the market from AMD. We are talking about the desktop market and the mobile sector. Intel managed to increase the share of this market at the expense of AMD for the first time since 2018.

True, the figures are not very high - only about 0.8%. So, earlier AMD occupied 20.1% of the desktop segment of chips, but now it is 19.3%. Among the reasons why Intel is increasing its market share. Mercury Research cites AMD's marketing policy to prioritize more expensive processor models. They are sold less compared to budget chips.

In the mobile segment, AMD also had to give way to Intel, whose share increased immediately by 1.2%. In November, AMD occupied 20.2% of the mobile market, but at the end of the fourth quarter, this figure dropped to 19%. If we talk about monetary terms, AMD's losses are stronger here, since it is mobile chips that form about 60% of the company's revenue in the consumer segment.

One of the reasons is the lack of processors from AMD. Intel has managed to ramp up production, judging by the company's own data. The production of chips in the lower price segment is developing especially actively. So, Intel supplies chips for chromebooks that remain popular. Therefore, Intel's market share is growing. Last year, Chromebooks owned 14.8% of the laptop market; in 2021, experts predict an increase in the share of such devices to 18.5%.

| 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 1Q18 | 4Q17 | 3Q17 | 2Q17 | 1Q17 | 4Q16 | 3Q16 | |

| AMD Desktop Unit Share | 19.3% | 20.1% | 19.2% | 18.6% | 18.3% | 18% | 17.1% | 17.1% | 15.8% | 13% | 12.3% | 12.2% | 12.0% | 10.9% | 11.1% | 11.4% | 9.9% | 9.1% |

| Quarter over Quarter / Year over Year (pp) | -0.8 / +1.0 | +0.9 / +2.1 | +0.6 / +2.1 | +0.3 / +1.5 | +0.3 / +2.4 | +0.9 / +5 | Flat / +4.8 | +1.3 / +4.9 | +2.8 / +3.8 | +0.7 / +2.1 | +0.1 / +1.2 | +0.2 / +0.8 | +1.1 / +2.1 | -0.2 / +1.8 | -0.3 / - | +1.5 / - | +0.8 / - | - |

Shares of AMD and Intel based on Q4 2020 results

Another potentially likely reason for Intel's strong growth is the agreement between this company and NVIDIA.

The third reason is that Intel has managed to establish tight control over the chip supply chain and manufacturing facilities. This made it possible to cope with negative external factors, including the pandemic.

| 4Q20 | 3Q20 | 2Q20 | 1Q20 | Q419 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | |

| AMD Mobile Unit Share | 19% | 20.2% | 19.9% | 17.1% | 16.2% | 14.7% | 14.1% | 13.1% | 12.2% | 10.9% | 8.8% |

| Quarter over Quarter / Year over Year (pp) | -1.2 / +2.8 | +0.3 / +5.5 | +2.9 / +5.8 | +0.9 / +3.2 | +1.5 / +4.0 | +0.7 / +3.8 | +1.0 / +5.3 | +0.9 / ? |

Share of AMD and Intel in the market of mbble chips based on Q4 2020 results.

However, 2020 and 2021 cannot be considered bad for AMD. The company manages to increase its capacity without stopping in development. Now the confrontation between the two companies is intensifying. So, more recently, sales of new laptops with AMD Ryzen 5000H and Ryzen 5000U hybrid processors began. 3rd Gen EPYC server chips (Milan) based on the latest Zen 3 architecture and AMD Ryzen 5000G desktop APUs are coming soon. Intel also does not work carelessly - in March the company is going to bring to the market the 11th generation Intel Core (Rocket Lake-S) for the LGA1200 platform. Also, IBM will introduce a 3rd generation 10nm Xeon (Ice Lake-SP) with Sunny Cove architecture for servers.

However, AMD and Intel are not the only competitors in these markets. Experts from another analytical agency, this time TrendForce, believe that in 2021, the transition to its own processors will strengthen Apple's position. Despite the fact that at the end of 2020 Apple's share in the market of processors for mobile PCs was only 0.8%, this year the company's market share may grow immediately to 7%.