An article for IT entrepreneurs: we will tell you what benefits you can get from the state; what taxation system is better to choose; how to work correctly in order to stay on benefits and avoid risks from the state.

Taxation system for an IT company

An IT company can choose 3 tax systems:

Simplified income tax system (STS 6%)

Simplified taxation system income minus expenses (simplified taxation system 15%)

General taxation system (OSN)

An individual entrepreneur can choose 4 taxation systems:

Simplified income tax system (STS 6%)

Simplified taxation system income minus expenses (simplified taxation system 15%)

General taxation system (OSN)

Patent

The choice of the taxation system determines the tax burden by 80%. Therefore, this is an important stage in the creation of a company.

STS and OSN

Let's briefly talk about the simplified tax system and the basic tax system. If you want more, you can read our article " What kind of tax system to choose for an IT company ."

The most burdensome tax is considered to be VAT, therefore, the companies on the DOS have the largest tax burden. Especially for IT companies, where the main expense is the salaries of employees, because they do not give input VAT. You can read more about VAT in our article .

The simplified tax system is considered more economical in terms of the tax burden. If the share of the company's expenses is more than 60% of the proceeds, it is more profitable to use the simplified taxation system of 15%, if less, then the simplified taxation system is 6%.

However, to apply the simplified tax system, you need to comply with the limits on employees and revenue:

200 . 2021 .

130 2021 .

- , . , (.. 1 . 5 173 ). , .

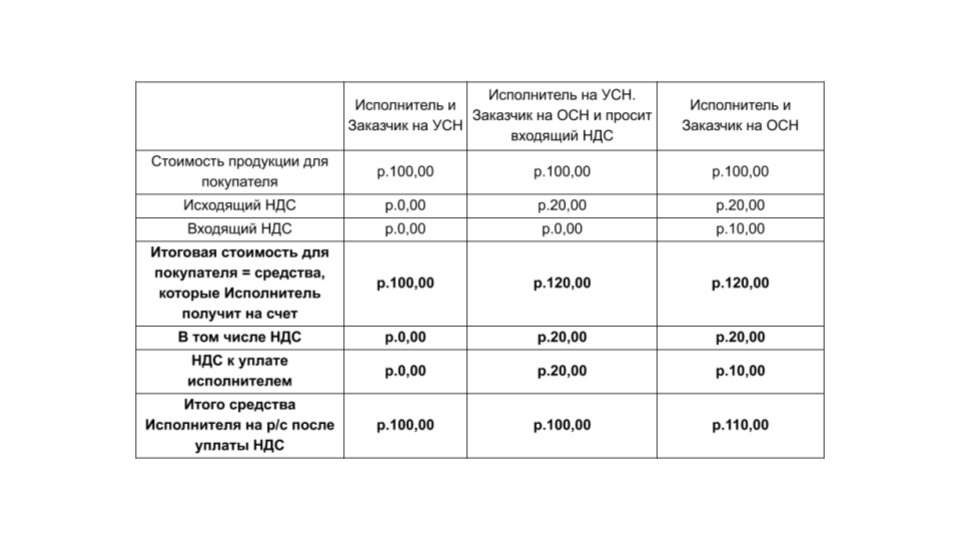

, — . 100 , 120 20 — 100 . .

. , (. 1 146 ), 2019 (.3 .2 .171 ).

.. 100 . . 30 . , 5 . . 5 . .

. , .

IT

IT (.. 62, .2, 346.43 ).

. , .

.

. , IT 2021 300 000 .

:

.

15 (.5 346.43 ).

60 . (..1, .6, 346.45 ).

, . , IT , .

, IT . 2021 30 . , 25 . , 10 .

:

300 000 .

1 800 000 6%.

750 000 15%.

, .

, :

50 . — .

10 . — .

20 . — = + .

15 . — .

3 . — .

.

, . .

, :

. 75 000 .

. 30 000 .

. 200 000 .

, . .

, 1 .

.

, IT- .

01.01.2021 7,6% ( 5 () 1 №265- 31.07.2020) ( + ).

100 000 ~11 000 .

.

:

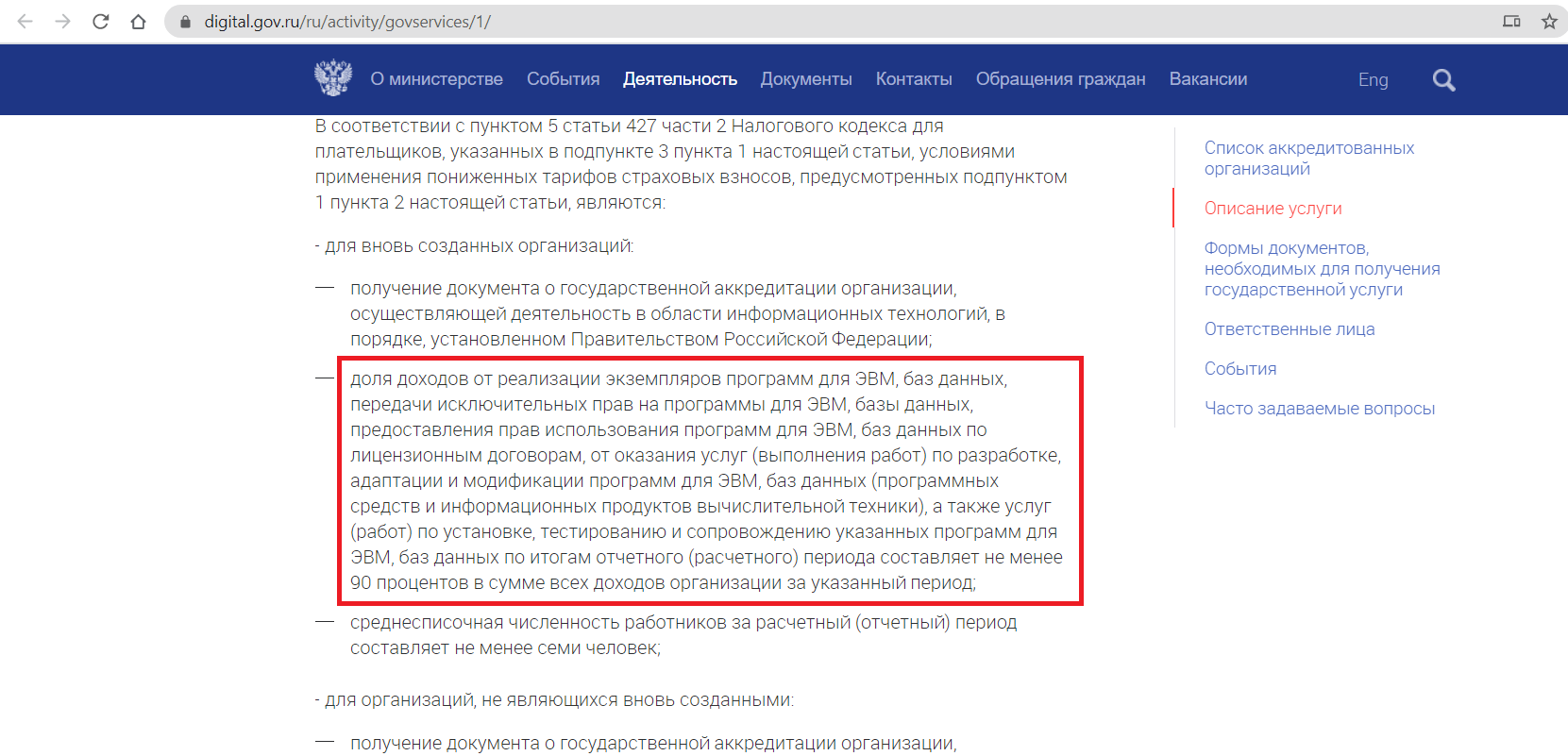

90% . , . , 9 .

7 9 . . .

. , .

.

, , «» 1/5 . .

. . . 30 ( 1 ).

, .. . , , IT-.

, , 2 :

.

.

. .

. «» .

90% 7 , . .

, , , .

2020 , « IT ». rusbase. IT (.. 26 .2 149 ).

- IT-, , :

, . .

IT- 6% 15%. .

IT- , , . , . .

IT- , 20%, . , .

20% 3%.

IT 14% 7,6%.

, .

, . . ( ) 149 , .. .

: .

, . (, , . ) . . 3,5 . 100–200 .

, .

. , :

, 50%.

, : ; /; ; .

. ( 30 (4) ).

.

:

(.1 145.1 ).

(.1 246.1 , .5.1 284 ).

( 381 ).

14% ( 427 .1 .10, .2 .4).

.

. .

, .

(.. 1 . 2 . 170 ). , 120 20 . , :

, 120 — .

, 100 — .

— , , .

, . .

— , . .

rocket science, . , , ERP , , , , .

.

, .

, , . 20 , .

, .

20 .

12 20 , . , 1 2019 31 2020. 20 2020 .

, :

.

road map ( road map ).

— .

, — .

, ( ).

, 300 . , , 1 . .

. :

2019 : 800 . . 500 . . .

2020 : 1,5 . . 130 . . .

2021 : 500 . . 250 . . . 300 . (130 + 250 = 380).

, IT . :

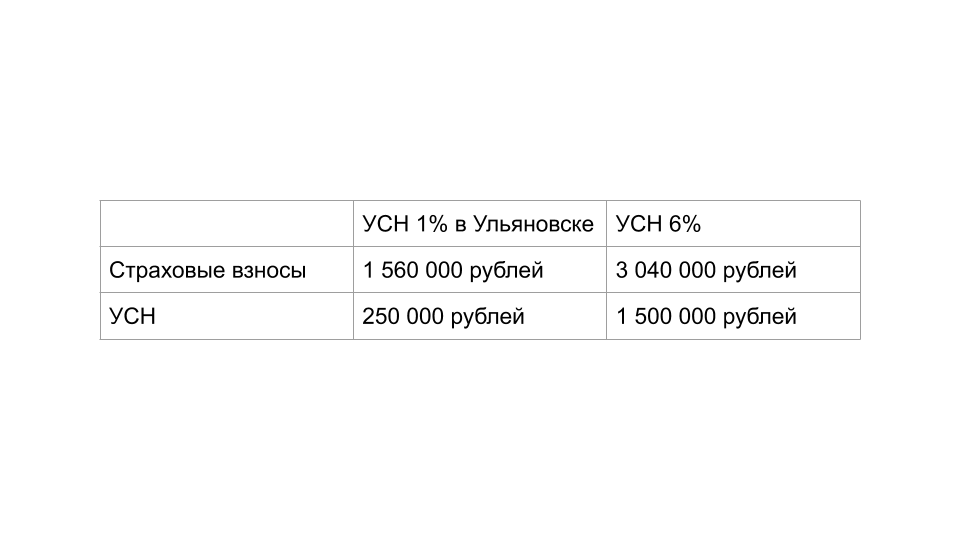

1% IT- ( ).

0% 2 ( 2 ) , IT .

1% IT- ( ).

— , . , , , , . -, .

. : ; , .

90% , 7 .

. « 1%». 1%, .

-, , . « ».

, 100 000 .

— 7,6% 15%, , — 6% .

2.4 . . , .

. .

: , . - .

, .. . , .

:

, : , , .

, 2 .

. , , .

–.

. , .

: 3 25 , .

— . 2019 , . , .

:

= + .

.

( ) + .

+ , . .

, .

, .

Google .

, :

— .

.

-.

IT- 2021: .

IT 2021 , .

How to work with self-employed and individual entrepreneurs .

The material was prepared by S4 Consulting.

Telegram channel , in which we talk about accounting, taxes and management for entrepreneurs in the language of entrepreneurs.