Forbes Global 2000 2019 China Construction Bank ( 2020- — ) , .

IT- China Construction Bank (Niu Wenchao), , , Huawei , . , « » « -», , .

It would seem much further, but financial services around the world continue to digitalize, and very intensively. Today they are dominated by mobile (for example, they are adding to the popularity of supers), flexible ICT infrastructure is increasingly important, and high-frequency transactions have become the norm. These changes did not appear yesterday, and in their light, since 2011, China Construction Bank has been implementing a strategy called TOP + for short.

The T in the acronym stands for “technology,” because technology and data are the driving forces behind the digital transformation we are going through. O - Opening up the bank's potential: CCB wants to make its cutting-edge developments widely available in traditional banking areas such as lending, insurance and finance. P is a platform for an ecosystem that makes all mentioned innovations work consistently.

A conventional financial platform for making money transfers and conducting transactions with deposit and credit accounts is not able to meet the needs of end customers in 2021, especially given the fact that these requests are rapidly changing. As a result, we need to embed financial services in a variety of, often sophisticated scenarios. And our solution not only serves as the foundation for CCB's own financial platform: it can be used as a common basis for us and our partners.

Finally, the TOP + plus sign refers to a culture of learning and innovation focused on sustainable development: in the coming years, the bank will use artificial intelligence technologies, blockchain, cloud computing, big data and IoT to strengthen its fintech capabilities.

In accordance with our fintech strategy for a period of five years, we are building a highly effective system of technological innovation management and adapting R&D to the changed realities in order to create new demanded services. Thanks to the chosen development path, the bank managed to become more productive in general and was able to provide a number of contactless digital services during the pandemic throughout 2020. During these months, we had to expose our network channels to an unprecedented load in order to provide digital services 24/7. In addition to meeting the daily needs of our customers, we have launched over ten services, such as super-fast online lending, to meet the financial needs of our customers and, moreover, to anticipate the emergence of their needs.

When the pandemic was just flaring up, in early February 2020, on our telemedicine platform, we launched a section with integrated services, including mobile and WeChat banking. By aggregating in real time big data on the situation around the coronavirus, we have provided the opportunity for free online consultations, monitoring information on the spread of infection, tracking close contacts between people, transferring clinical data on the course of the disease, as well as processing requests for deferred loan payments for private borrowers. as well as the accounting of donations. According to transaction statistics on our backend, OTC trading experienced a dramatic decline after the first outbreak of COVID-19, but online transactions of individuals even showed a slight increase. Here's just one example of how digital transformation brings flexibility,which allows us to deal with emergencies.

The coronavirus and the fight against it have forced many of us to move work and study online. The new circumstances have seriously affected all industries and changed the attitudes of the mass of people, which is also definitely accelerating the digital transformation. And, in fact, the whole of China is gradually mastering a new approach to creating an IT infrastructure, including 5G developments, IoT, industrial digital solutions and large-scale data centers, in order to create a solid foundation for digital transformation in all sectors of the economy, including financial.

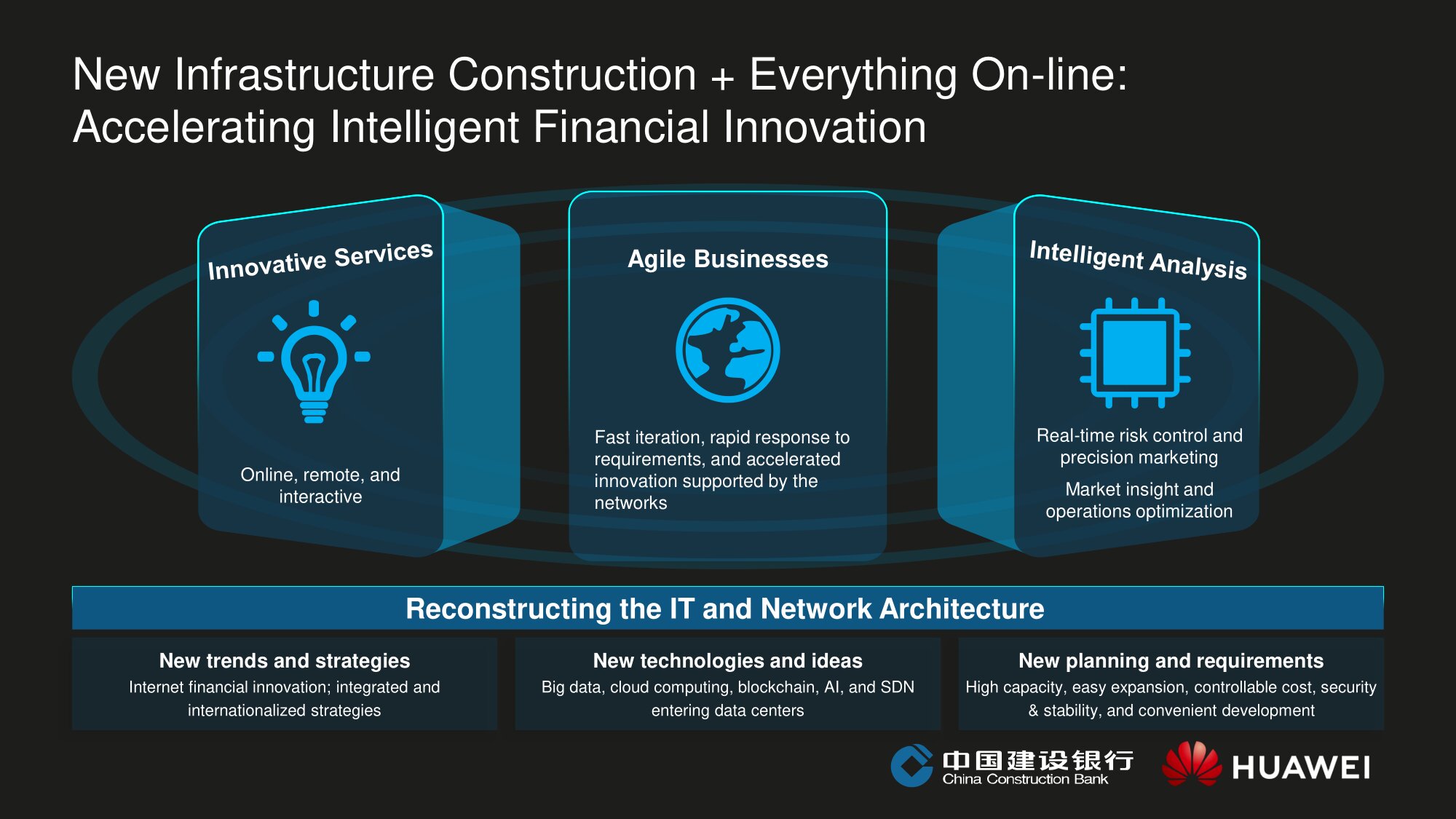

In our data center, for our part, we maintain the critical infrastructure for financial innovation. We need to meet new challenges and new trends with dignity and master new technologies in order to meaningfully “re-invent” IT in general and network infrastructure in particular.

With the growing trend towards smart finance in mind, we found that the traditional “financial-type” data center was no longer responding to changing customer demands. A truly smart data center must be geared towards new technologies such as 5G, big data, and AI from the outset to improve the delivery of omnichannel financial services and make the services themselves more complex, smarter and more personalized.

It is necessary that the data center is capable of rapidly changing services, and also be able to flexibly scale and adapt to the rapid metamorphosis of the outside world. And, of course, its backbone must be extremely reliable, stable and highly automated. Otherwise, new challenges will not be able to cope: with the rapid growth of traffic and the increase in the number of devices, the complexity of the network will grow exponentially.

New injections require a high level of automation and data mining. To achieve what they wanted, Huawei borrowed a concept from the auto industry and created an ADN (autonomous driving networks) solution, see a separate post for details. on Habré) - based on core networks with autonomous control. In the case of ADN, the network infrastructure is built in accordance with the business logic and requests of the service layer, and instead of passive O&M, we are dealing with active O&M. Our bank worked on joint innovations with Huawei in this direction, and we managed to achieve tangible results here.

The ADN concept provides for six levels of network infrastructure autonomy.

- L0 - basic. It assumes mostly manual O&M. Most dynamic tasks have to be done by humans.

- L1 is an O&M that is somewhat lightened by application tooling so that the system is able to perform regularly recurring tasks based on predefined rules to improve operational efficiency.

- L2 . , (, ).

- L3 conditional automation, -, , . , .

- L4 — , , , , , , .

- L5 — , — ADN. , , , . , « ». — , -.

Our technological advances are at different levels of maturity to date, and although there is still a long way to go to L5, taken together they already allow us to implement network solutions in rather complex intelligent scenarios.

As for the practical experience of CCB in the context of digital transformation and development strategy in fintech, I will touch on the challenges in relation to the network infrastructure of the data center. First of all, it should be noted the exponential growth in the number of network nodes and a dramatic increase in its total complexity. We currently have two cloud stacks. The private cloud, which has been operating since 2013, ensures overall stability. For seven years in a row, it has maintained the proper operation of our next generation support systems; we have three data centers in two cities. In turn, the public "cloud" provides flexibility in the deployment and use of innovative services, we commissioned it in 2018, and by mid-2020 we had more than 37 thousand "cloud" servers.

The second challenge is the ever higher demands on the network and its bandwidth. By standard means, the limited staff of network administrators is unable to cope with the ever-growing requirements. It is not surprising, since almost 10 thousand changes are made to our network infrastructure every year, an average of 20-30 per day. Moreover, they are required to be carried out almost always on a day-to-day basis, and modern DevOps procedures required for testing and rolling out new solutions into production require flexible configuration of network resources.

The third challenge is the limited arsenal of O&M. Network problems are unpredictable, and even extraordinary expert skills are not enough to deal with them on the fly. It would also be nice to catch problems before they appear at the level of customer service. It is also important to ensure the stability of services as they move to the clouds.

Of course, in reality there are more challenges than listed. Each industry or business vertical has its own specifics and its own pain points, which means that solutions for them require different ones.

CB is currently working with Huawei to co-innovate on ADN data center networks. With the iMaster NCE autonomous network solution built by Huawei, which is based on SDN architecture, we obtain a high level of autonomy - namely L3 - for network infrastructure design, deployment, management, maintenance and optimization.

On the first day, at the stage of infrastructure design, the system understands the customer's application needs and, using smart algorithms, selects the best network configuration. Thanks to the user-friendly graphical interface, network deployment is three times more efficient than before.

On the second day, allotted for the initialization of network services, with emulation of their work and further verification of their settings, we reduce the number of errors during configuration by 40%.

On the third day, which is devoted to monitoring the infrastructure and debugging O&M, and an additional day dedicated to managing the troubleshooting process, we run the previously drawn configuration at three levels, and we have the opportunity to bring services to a stable state within 20 minutes. Also, the pool of preparatory procedures includes checking the network health and building a knowledge graph using AI in accordance with the O&M 1-3-5 concept: a minute to detect a failure or risk of failure, three minutes to detect its cause, five minutes to make recommendations to eliminate it.

I am sure that as we improve our developments, we will come to the point that our network will be completely autonomous and able to independently cope with internal problems and failures.

***

When a market is undergoing radical change, only those hungry for change will be able to turn the market around themselves and pass the tests of digital transformation with honor. The pandemic has only strengthened the overall trend. China Construction Bank is committed to implementing SDN and ADN technologies to meet the new requirements for online services, data center infrastructure and digitalization and stay in the mainstream of innovation, so in the near future we will be happy to show what we have achieved along the way.