This is the story of a bitcoin transaction - the largest transaction in my life. I was led to this deal by a deep but insane exploration of the crypto ecosystem. And this is the story of what is actually happening in the crypt - and what to do about it.

If you have significant amounts of cryptocurrency or are thinking about buying it, then I wrote this for you. Please read to the end.

Prologue: Tether and Company

There are a few things you need to know before starting this story.

There are tokens on the market called Tether . To simplify things a bit, they are issued by a crypto company called Tether Ltd. In other words, if Tether Ltd. says that you have a Tether token, then you have it.

Tether Ltd. also says that one Tether is worth exactly one US dollar. How can they provide this? Well, they say they can because they hold $ 1 worth of assets for each Tether . But are these assets real dollars? No, it’s not . What if assets fall in value? Don't worry won't fall... Okay, but can you at least see these assets? No, you can't .

Who in their right mind would use something like Tether? Well, the short answer is that a lot of people use them to buy bitcoins and other cryptocurrencies. The long answer, however, is striking - more on that later.

Since Tether sounds like a currency scam, you would hardly be surprised that Tether Ltd. currently under investigation by the Attorney General's Office for the Southern District of New York. The investigation was announced on April 25, 2019.

Deal

Now fast forward one year. In March 2020, I bought a lot of bitcoins. At that time, I saw the market move and saw the likelihood of significant dollar inflation due to the possible reaction of the US government to the unfolding pandemic.

I suspected that bitcoin would be inflation resistant due to the forced scarcity. Knowing about the investigation into Tether, I assumed that everything is clear with Tether and now the tokens will probably be removed from the markets, so I did not take this factor into account when buying.

This was a huge mistake.

HODLE

Until the end of 2020, my inflationary thesis looked correct. The unrest in the US, coupled with predictable high lending and consumer spending following the pandemic, is likely to fuel substantial dollar inflation in real terms through the end of 2021. During the same period, the market is experiencing a growing shortage of bitcoins due to demand from the masses .

It seems that the market also agreed with this thesis. My position in bitcoin doubled in value, then doubled again. By the end of the year, I was sitting at 600% profit and had become a decent fortune in nominal dollars.

I intended to hold bitcoins for a very long time - it never even occurred to me to sell them, despite the daily fluctuations in the rate.

And then at the beginning of January I came across a post on the forum.

Shock

On January 8th, I saw this post on Hacker News about how Tether manipulates the price of bitcoin. This shocked me: I assumed that Tether was removed from the crypto markets, but this turned out to be not the case. But how many of these tokens can actually be on the market? Not much, of course.

And yet I looked. The answer turned out to be surprising: there are really a lot of them.

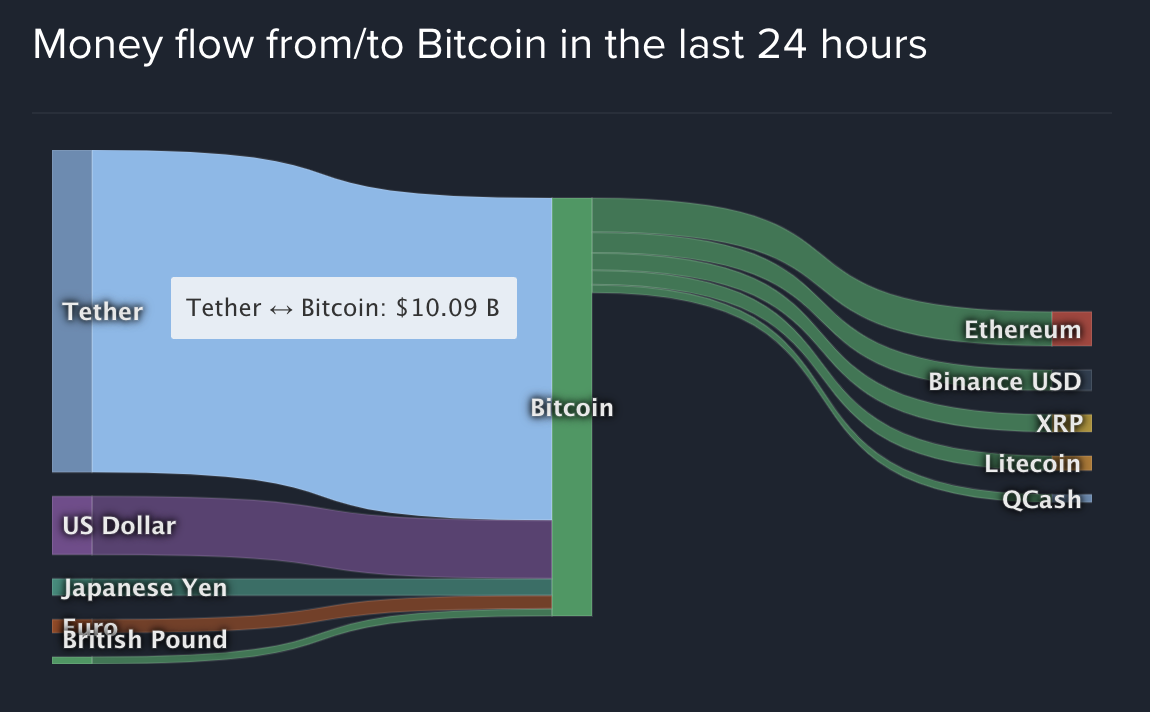

Source: Coinlib BTC The

left side of the graph shows which currencies are used to buy bitcoin on all crypto exchanges. The right side shows which currencies flow out of bitcoin (i.e. what bitcoin is used to buy what). The graph shows typical figures for early January 2021.

Bottom line: More than two-thirds of all $ 10 billion worth of bitcoins in the previous 24 hours were purchased using Tether.

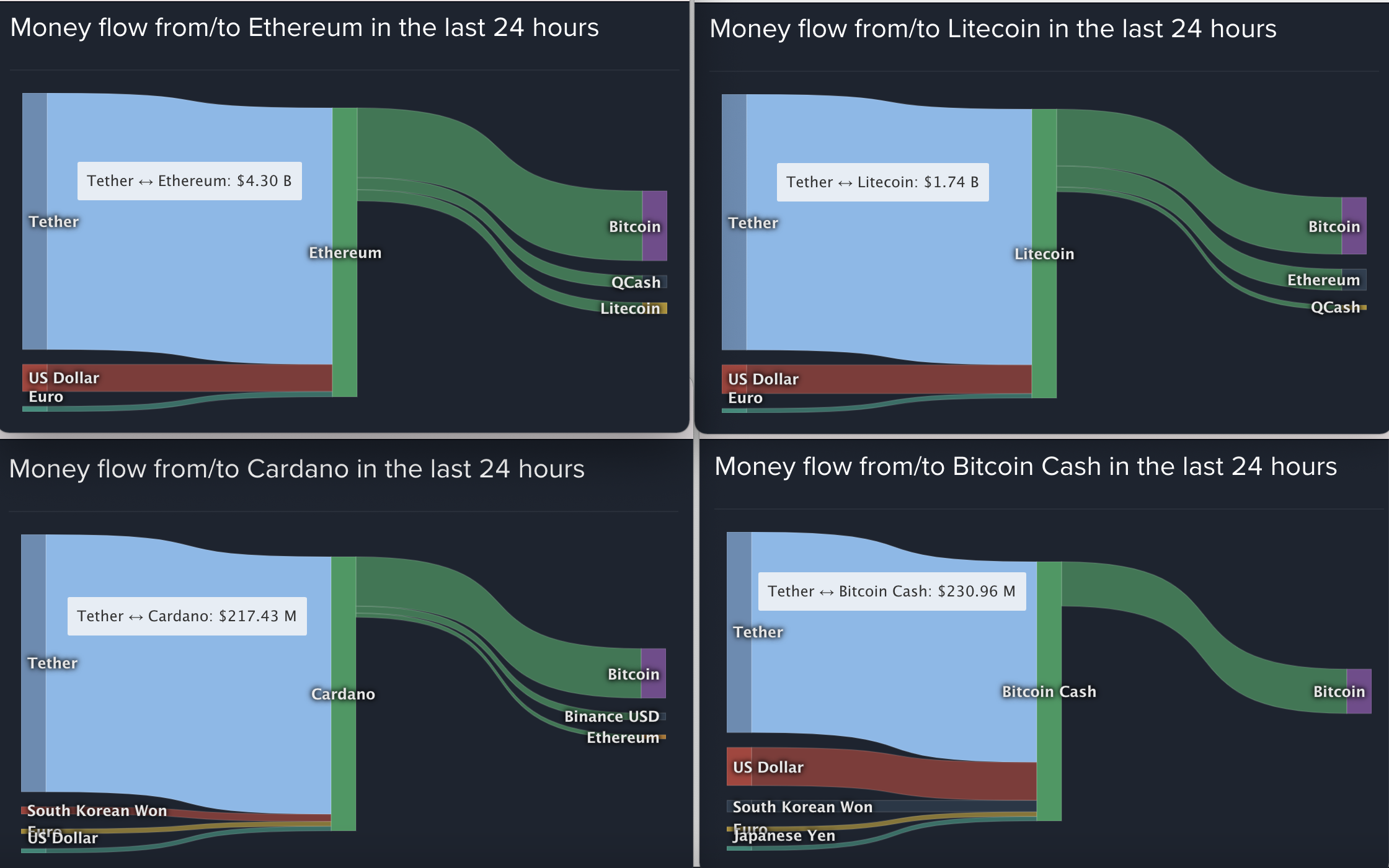

Moreover, this pattern is not unique to Bitcoin. Ditto for all other popular cryptocurrencies:

Source: Coinlib ETH , LTC , ADA and BCH

Looks like I was wrong. Tether tokens didn't just stay in the market - they were the market.

Panic

This worried me. Most of my fortune was bitcoins, and bitcoins seemed to be thought of as Tether. And the issuing company Tether is under investigation. I urgently needed to find out how real the risk was.

I got rid of my current affairs and started digging. It immediately became apparent that if Tether flows were partially or completely fraudulent, it would have a significant impact on the market price of bitcoin (although the $ 10 billion from Tether is only 1.4% of the nominal $ 700 billion bitcoin market capitalization, in fact, the share of daily of BTC turnover, and here Tether accounts for about 70%).

How to find out the truth about Tether, is there an element of fraud? One of the indirect signs may be on which exchanges it is traded. I knew that some exchanges, like Coinbase , have strict anti-money laundering rules, while many other exchanges are not so strict. Is there a pattern that some exchanges support Tether while others don't?

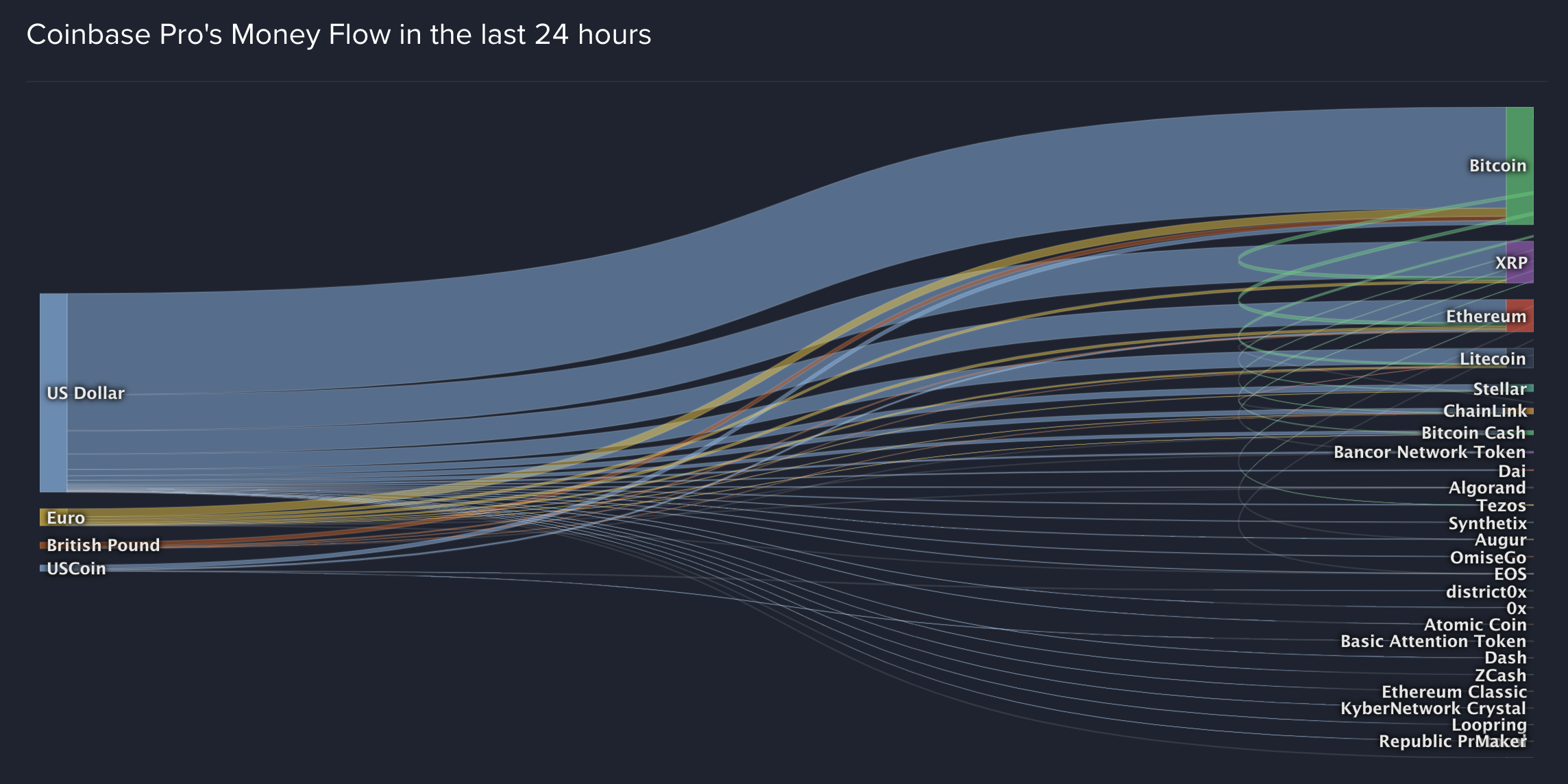

He is there. Here is the volume of transactions on Coinbase Pro in a typical 24-hour period:

Source: Coinlib data from Coinbase Pro

Note that cryptocurrencies are mainly in dollars, euros and British pounds - currencies strictly controlled by the authorities in their respective countries.

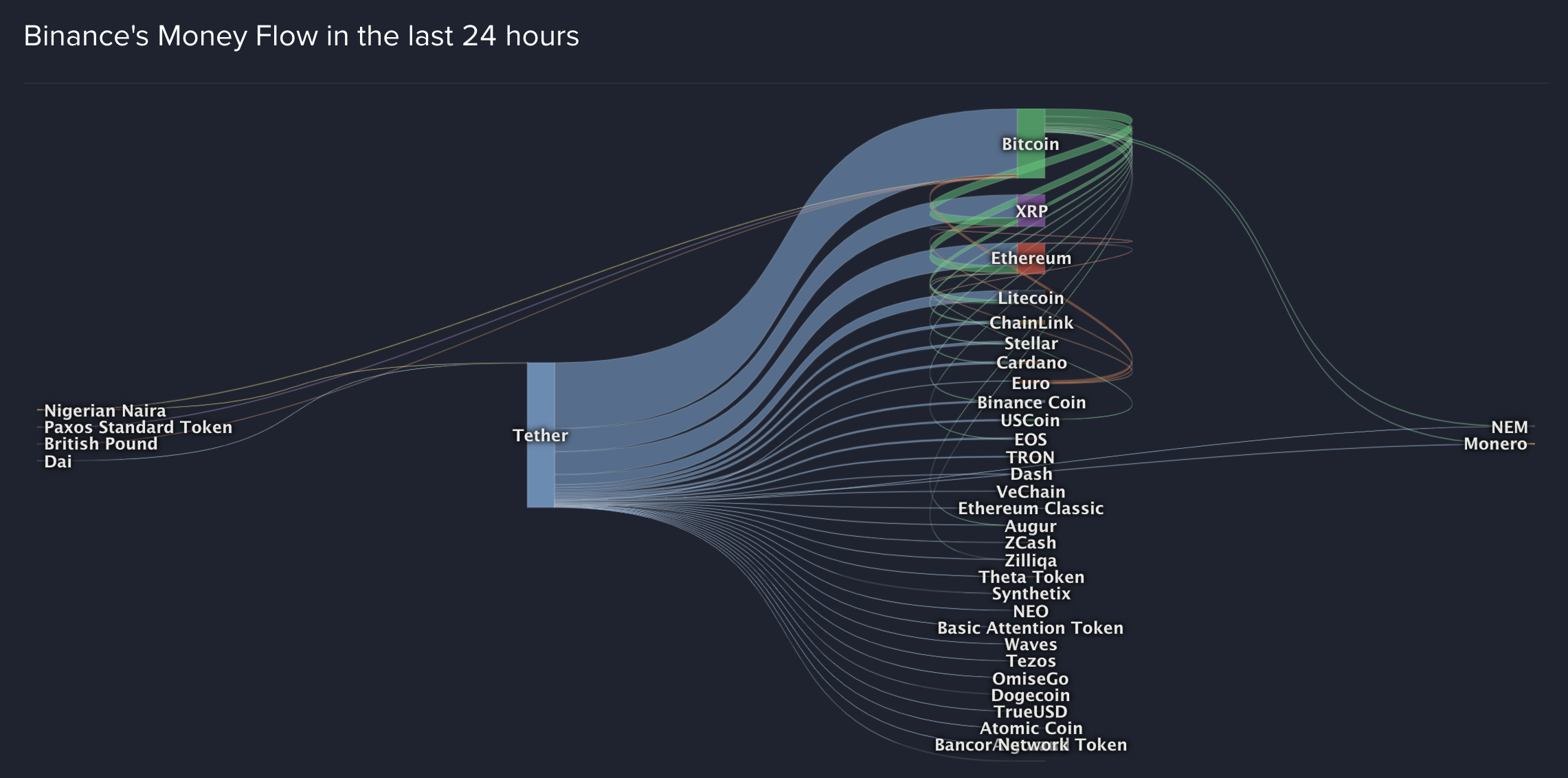

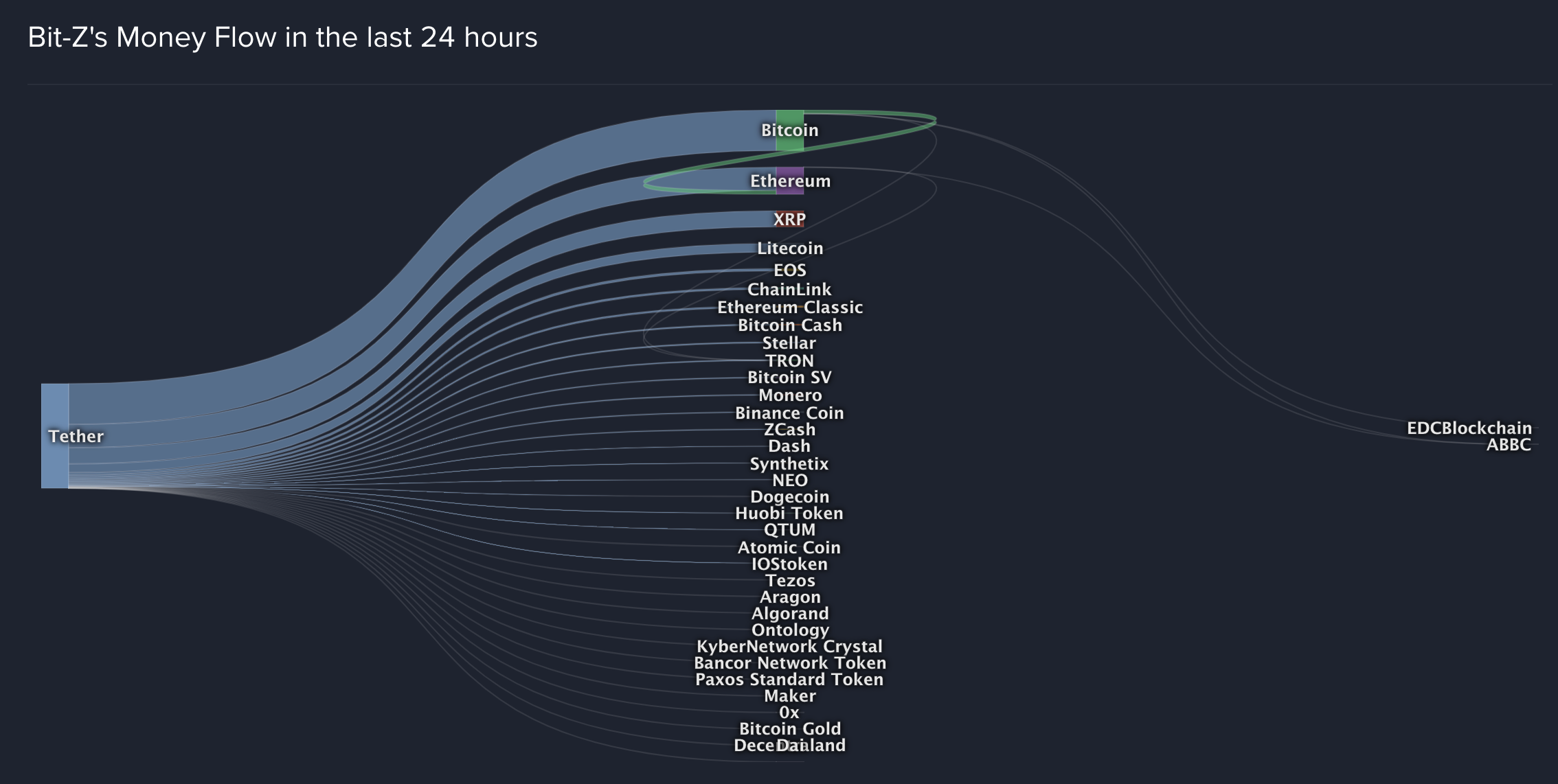

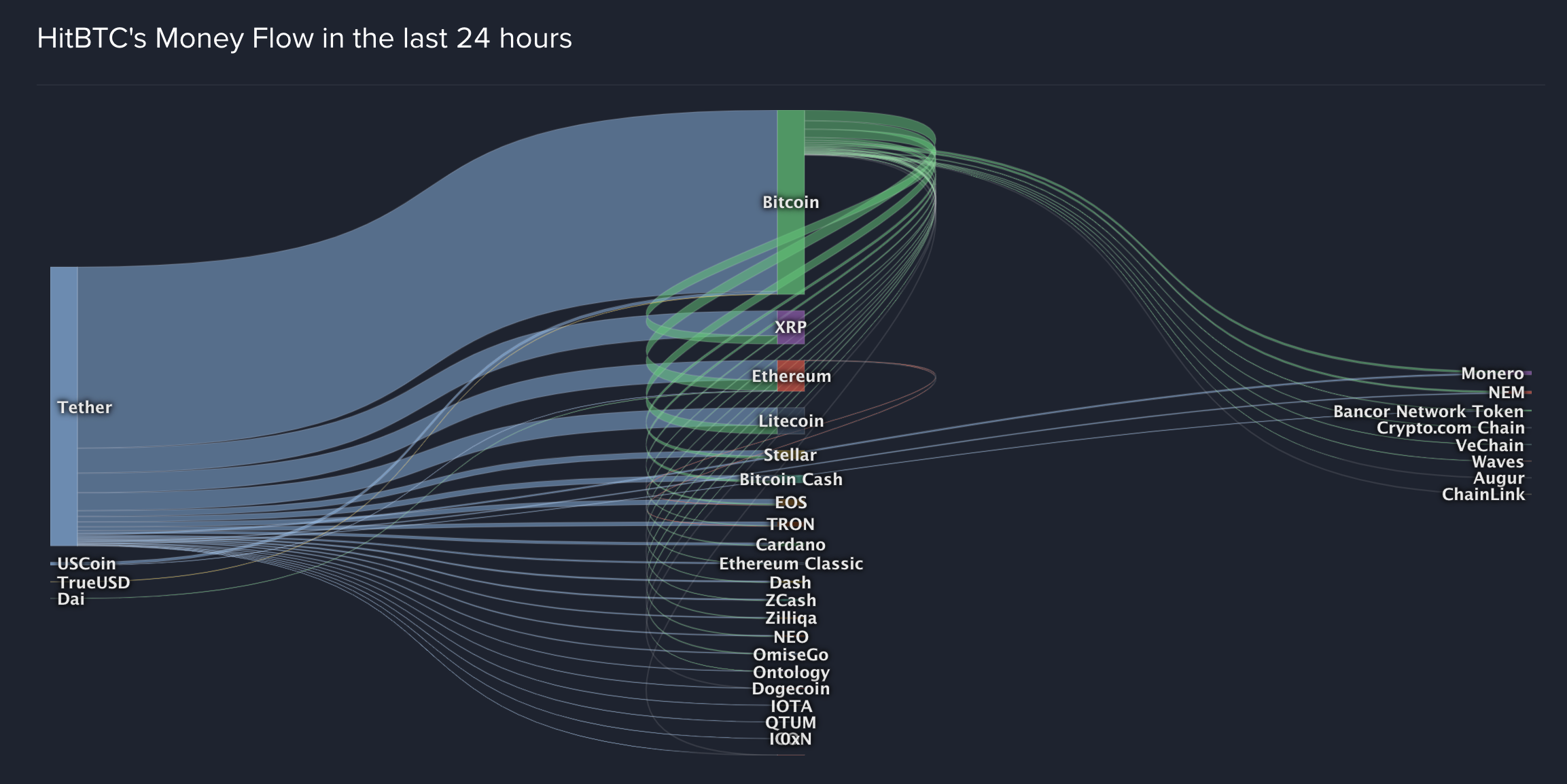

And here is the crypto investment through Binance, Bit-Z and HitBTC are the three largest crypto exchanges in the world by nominal volume:

Source: Coinlib data on Binance (excluding Binance US )

Source: Coinlib data on Bit-Z

Source: Coinlib data on HitBTC

The pattern is obvious. Almost all cryptocurrency on these three exchanges is bought with Tether. Dollars are not used at all.

And the volumes are colossal. Coinbase Pro is responsible for approximately $ 4 billion in daily turnover, but only on Binance accounts for more than $ 50 billion in turnover, and each of the other two exchanges is larger than Coinbase. On these three exchanges, most of the crypto is traded for Tether.

Binance, Bit-Z, and HitBTC are "off-bank" exchanges. This means they do not have direct access to the US financial system - most likely because no US institution wants to serve as their correspondent bank domestically ( Binance US , Binance's partner, does allow purchases in dollars. But its daily volume is only 10% of Coinbase's volume - and less than 1% of its offshore counterpart - so the impact on crypto markets is negligible).

It is difficult for crypto exchanges to connect with banks, but Coinbase, Bitstamp and several other high-quality exchanges have succeeded thanks to their strict know-your-customer (KYC) policies and anti-money laundering (AML) policies.

But my biggest concern was that neither of the two most established exchanges with dollar banks - Coinbase and Bitstamp - support Tether trading at all . If Tether was okay, there would be no reason for them to waive commission on this trading pair. Unless their security teams found this token too risky to work with.

Deep dive

By this time, I was worried that my position in bitcoin might be too risky. But I needed more proof before deciding on such a large sale.

I should have gotten more information about Tether - information as free as possible from marketing bias. I found what I was looking for in documents related to the ongoing investigation by the New York prosecutor's office against Tether Ltd. (note that “iFinex Inc., et al” and not “Tether Ltd.” are listed as the defendant for reasons that we will not go into).

I'll skip most of the content - I highly recommend going through the docs on your own - and just list the three main takeaways I've made:

- 26 2019 — — Tether Ltd. . — , , Tether, .

- 25 2019 9 2020 — 15 (!) — Tether Ltd. , , , .

- 9 2020 - Tether Ltd., Tether Ltd. . , . Tether Ltd. ( ), , Tether Ltd. . , .

It’s bad. Then I thought: Is there any other significant event with Tether on July 9, 2020 or so?

I looked and found something.

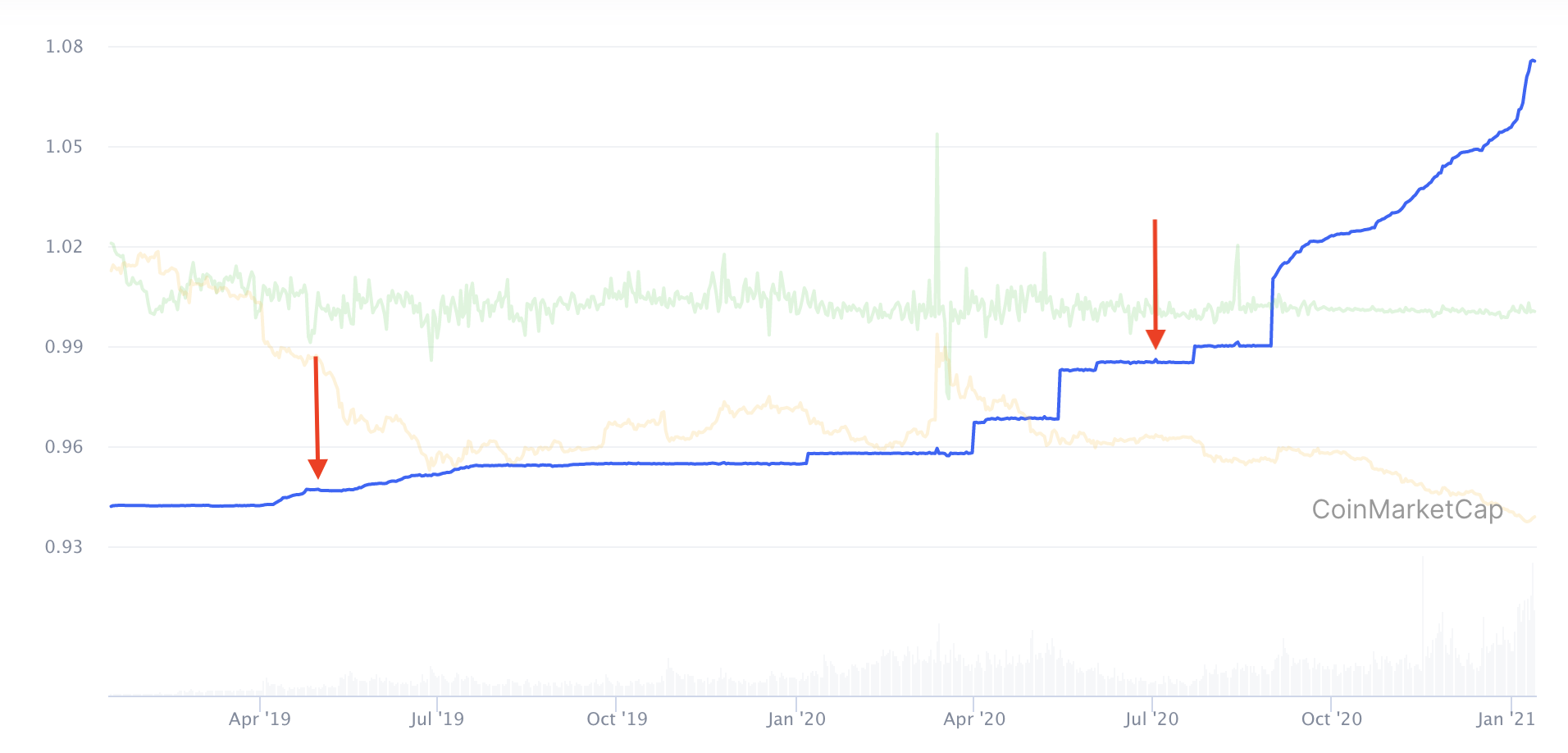

Source: Coinmarketcap USDT

The chart shows the market cap of all Tether tokens between January 13, 2019 and January 13, 2021 (blue curve). Since Tether is nominally equal to a dollar, the total dollar market cap of Tether is always equal to the total Tether quantity (the numbers on the vertical axis do not correspond to market cap, but for scale, the high point of the blue curve is roughly $ 25 billion).

The first red arrow on the chart points to April 25, 2019: announcement of the prosecutor's office about the beginning of the investigation Notice how the rate of issue of Tether grows during the investigation: in large single blocks of $ 1 billion every few months.

Second arrow - July 9, 2020 : Date of the New York court ruling forcing Tether Ltd. start the process of transferring documents to the prosecutor's office. Two weeks later, Tether Ltd. releases another large block of tokens with a par value of about $ 800 million. And soon after that - on September 1 - the Tether emission scheme completely changes.

Starting in September, Tether Ltd. begins to produce several large blocks per day. The pace is accelerating, and in the first week of 2021 alone, $ 2.3 billion worth of tokens were issued.

This is consistent with the assumption that, as the various appeals rejected by Tether Ltd. tried to issue tokens faster and faster in order to maximize the amount of value that it could extract from the crypto ecosystem before it was closed. The pace accelerates closer to Tether Ltd.'s final disclosure deadline. - January 15, 2021 .

There was still one last question. Is the issue of Tether really correlated with the price of bitcoin? The charts give a clear affirmative answer:

Source: Coinmarketcap BTC

This chart highlights three main periods of high relative Tether emissions: 1) April 2019 - July 2019; 2) April 2020 - July 2020; and 3) September 2020 - Present. Throughout all three periods, an increase in the price of bitcoin is noticeable (here the red arrows point to the same two dates as in the Tether chart above).

This pattern has yet to prove that the release of Tether is causing the price of bitcoin to rise. It is possible that market demand for bitcoin pushed real dollars into Tether Ltd. through some unknown mechanism, then Tether Ltd. issued tokens in exchange for these dollars and these issued tokens were then used to buy bitcoin. In this scenario, the growth of Tether itselfcaused by the demand for bitcoin, and eventually the tokens can be fully backed by dollars.

However, I considered the risks too high. I was long on BTC, Bitcoin clearly correlated with Tether, and Tether was issued at a breakneck pace, and this issue is highly likely not backed up by anything.

I realized: it's time to go out.

Output

On January 9, 2021, I liquidated my Bitcoin position. In the process, I took in a dollar profit, which, in the interests of full disclosure, I can only describe in this way: this money will change my life.

At that moment, I had not yet seen the whole picture. For example, I still assumed that Tether could be backed by real assets. I thought something like this: “Of the 70% of Tether flows to bitcoin, some are real; some part is illegal (for example, buying drugs); and some of them are pure fiction. I have no idea what the respective shares are, but personally I cannot risk that. "

I was a little worried that I might have miscalculated. Perhaps Tether is pretty much a secured token and if so then I got it wrong.

And then, by pure chance, I had a conversation that blew my brain.

Revelation

I was video chatting with a friend, let's call him Bob. I had just logged out of Bitcoin and was nervously awaiting confirmation from the bank that the transfer from the exchange had been verified and confirmed. I was still thinking about the crypt, so I asked Bob.

The conversation went something like this:

: ? , .

: Bybit. , ?

: . ?

: , . Bybit .

: ? , ?

: Coinbase . Bybit .

: . , , ? Bybit, Coinbase?

: . - , 100, . Coinbase .

: * *

: , , Telegram .

: !@

: ! . , VPN.

: VPN? , ?

: . .

: * *

There is a scene in the Short Game where Mike Baum meets a stripper who has taken out a mortgage on five properties. The stripper sees nothing wrong with this because the mortgage broker told her that she can always refinance her loans when prices rise. And real estate will always rise in price.

Up to this point in the film, Mike's investigation has revolved around bonds, mortgage rates, and CDOs. But a meeting with a stripper shows him the state of the market: for the first time, Mike sees a person who is on the other side of a mortgage deal. And that's what ultimately convinces him to short-cut his real estate papers.

For me, this is exactly what the conversation with Bobby became: for the first time, I saw what it was like to be the victim of a financial disaster.

Smoking gun

The conversation with Bob changed my view of Tether. I saw them now not as a source of excessive risk, but as a very likely fraud.

Part of the reason was this massive distribution of bonuses. The Tether token amounts that Bybit , Binance, and other similar exchanges were giving away to people like Bob seemed inconsistent with the income these exchanges could expect from the average user.

To get an idea of the bonuses, I ran an anonymized Google search for [Binance bonuses]... One of the first results in the search was a page on binance.om: "At the end of the year, a special promotion is being held for which the user will receive a 500 USDT [Tether] savings voucher!"

On the other hand, a similar search for [Coinbase bonuses] yielded nothing. This suggests that offshore exchanges may be more willing to give away Tether than Coinbase is giving away dollars. This implies that offshore exchanges are pricing tokens cheaper than par.

When I knew what to look for, everything fell into place. First, I found this thread on Twitter with information that Tethers are issued in blocks in precise, perfectly round numbers (in the screenshot below, USDT is the ticker for Tether). Source: Travis Kimmel

on Twitter

This is unusual: if the demand for tokens is real, then Tether Ltd. could combine several dollar deposits into one emission block. Such combinations do not have to add up to perfectly round numbers every time. Moreover, the estimated USD investment (for example, 401 431 056 USD top left) gives perfectly round numbers (400 million USDT in the same transaction) in every block - regardless of the exchange rate or whatever.

This in itself is strange. But if we compare it with the emission patterns of USD Coin - Coinbase's own stablecoin, which is backed up by real reserves - the difference is enormous (in the screenshot below, USDC is the USD Coin ticker). Source: Travis Kimmel on Twitter

USD Coin is issued in a completely different way from Tether. USD Coin emission blocks are smaller in size and their size varies more: while Tether blocks range from 150 to 400 million, USD Coin blocks range from about 7 million to about 60 million.

In addition, USD Coin emission blocks are randomly sized (for example, 9,374,133 USDC in the top transaction). This corresponds to the real demand for tokens and dollars received from a group of dissimilar investors who are combined into each emission block.

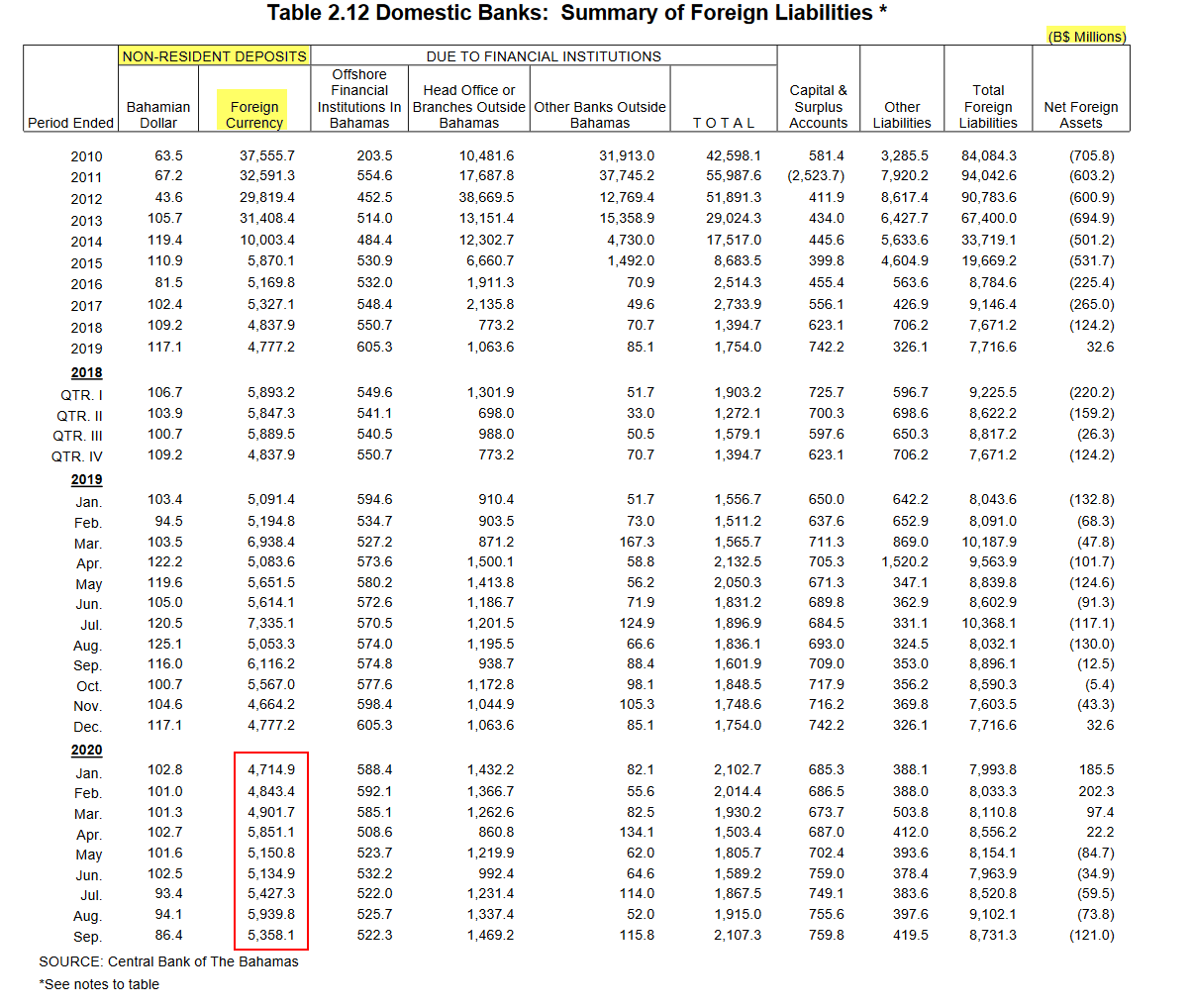

The final nail in the coffin lid was the lack of visible reserves at Tether Ltd. If she really took a dollar for each token issued, then there should be as many dollars in her bank account as there are issued tokens. And it turns out that you can check it! Their bank is Deltec is in the Bahamas, and the Bahamas publishes every month how much foreign currency is in the accounts.

The figures show that, at least at the end of September 2020, this money is not enough: Source: Center for Combating Money Laundering on Twitter From January 2020 to September 2020, the volume of funds in all foreign currencies in all banks of the Bahamas increased by only $ 600 million - from $ 4.7 billion to $ 5.3 billion (the table is in Bahamian dollars, but it is pegged to the US dollar, so 1 BSD = 1 USD).

But over the same period, the total volume of issued Tethers increased by almost $ 5.4 billion - from $ 4.6 billion to $ 10 billion!

This leads to a shocking conclusion: there will not be enough dollars in all banks in the Bahamas to support Tether on the crypto market.

So this is the big crypto shortfall: Tether Ltd. there are simply not enough dollars - worth about $ 25 billion.

The big picture

After the end of my investigation, I anxiously awaited the continuation of events. I got out of bitcoin, but the bank transfer had not yet arrived - the risk of an unreliable counterparty still hung over me. So I couldn't feel at ease until I was completely out of the fraudulent market as it turned out.

In my head, I combined Bob's experience with other evidence to create a mental picture of the underlying mechanism of the fraud. Here's how it can be arranged:

- Crypto Investor Bob transfers real $ 100 to Coinbase.

- Then he buys bitcoins for this amount on Coinbase.

- Bob transfers his bitcoins to an off-bank exchange like Bybit.

- Bob starts trading crypto on Bybit using leverage and receiving promotional gifts - all nominated for Tether.

- Tether Ltd. , - . Tether.

- Tether Ltd. , Coinbase.

- , Tether Ltd. Coinbase .

I assume that Tether Ltd. (through proxy accounts) is responsible for only a small fraction of the demand on these exchanges. But with $ 50 billion in daily turnover on Binance, even a small fraction of that turnover represents a huge amount. And if your business is dealing with the exchange of fake dollars for real dollars, the profit can be quite high.

In the example above, Tether Ltd. bought bitcoins from Bob at par in Tether tokens - but that bitcoin was the price to pay for access to amazing leverage and promotional bonuses from the exchange. And this is the very leverage, and these very shares, they are all denominated in Tether tokens, which, as I suspect, Tether Ltd. transfers to the exchange in huge quantities to subsidize the purchase of users through additional promotions.

This explains how Tether was able to maintain its stable USD 1 rate on non-bank offshore exchanges. For a certain amount of bitcoins, a crypto trader gets effective access to a much larger number of tokens than the exchange rate implies . But exchanges use these additional tokens as "leverage" and "shares". Thus, they maintain the illusion that these "free" tokens are not traded for bitcoins at all - even if they are given to Bob as part of the package for his BTC.

From this point of view, the absence of the dollar on offshore exchanges is not a bug, but a feature: in a transparent market, it is critical to prevent the dollar and Tether tokens from meeting so that the true price of the token remains opaque and no one can dispute its fixed rate of 1 dollar.

Forget about the activity on offshore exchanges for a moment and imagine the simple picture. Imagine standing at a kiosk where Coinbase connects to the US financial system. There are two lines of people in front of you. One queue consists of crypto investors investing dollars, and the other consists of fraudsters withdrawing dollars.

An hour after I finally figured out all this colossal mess, a notification came from the bank. My transfer from the exchange has been confirmed.

I left the market.

Epilogue. In the land of the blind

In everyday life, I am the founder of a fairly successful startup. At work, you need to constantly monitor the posts of other startups and venture capitalists. By and large, these people are friendly, highly intelligent and deeply competent in understanding the markets.

And yet this collection of cryptocurrency tweets is pretty typical of our community:

These are respected members of society. I have personally met some of them, and they have always made a good impression as friendly and discerning people. Moreover, I myself have at times expressed similar feelings about bitcoin in the process of inflating this latest bubble.

What's going on here? How can the community fail to notice fraud of this magnitude?

Part of the answer, I guess, is illiquidity.

Illiquida market is one that you cannot get out of quickly. The startup ecosystem is highly illiquid: it takes founders years, if not decades, to get money out of the business they are building. Startup founders - and the venture capitalists who support them - mostly have experience in illiquid markets.

Scammers don't like illiquid markets. Scammers love to cash out quickly: the longer they stay in one place, the more likely they are to be caught because they are scammers.

Since illiquid markets are not suitable for fraudsters, the illiquid startup ecosystem turns out to be largely (though not entirely!) free of them. This is one of the reasons it is so enjoyable to work here, but it also means that the community has never developed a large collective fraud radar: it just isn't needed.

But the startup community has a fantastic collective radar for things that 1) start small; 2) grow rapidly; 3) challenge the current state of affairs; and 4) misunderstood by the general public. These are the signs of a promising startup! And the community knows how important it is to recognize and appreciate such things.

Unfortunately, these are also signs of fraud. But there are very few scammers in the startup community, so we tend to ignore this possibility - and in crypt, the situation is completely different. Unlike startups, this a highly liquid market is one that attracts scammers, and scammers love to cheat. This means that if something looks like a promising startup in the crypto world, it is most likely a scam.

But this is not the only point: among other things, crypt is indeed a promising technology. Its value is in decentralization and resistance to censorship, in reliable execution of contracts . Schelling point value for scarce asset. The startup community sees this potential value correctly. But without a good fraud radar at the moment, it is impossible to assess how real this value is.

I think the startup community is about to recalibrate its fraud radar. This recalibration - and the exorbitant price the market will charge for it - will become mandatory for any owner of significant amounts of crypto.

So what's the bottom line? There are still a few questions left.

Can we end this scam right now?

Is it possible to end this scam quickly so that as few people as possible suffer from it? I think you can.

Legitimate crypto exchanges like Coinbase and Bitstamp clearly stay away from Tether: none of them support these tokens. And this is mutual! Because if Tether Ltd. launched its tokens into a large liquid dollar market, the fraud would instantly become apparent to everyone when the market price of Tether falls well below $ 1.

Kraken is the largest crypto exchange where Tether tokens are freely traded for dollars. The market there is quite modest - about $ 16 million per day for this pair - and Tether Ltd., of course, should monitor it very closely. Actually, from Tether Ltd. there is no choice but to buy all the tokens that are sold here, otherwise this whole charade will be exposed.

My guess is that maintaining a course on Kraken is a major expense for scammers. If they don’t scrape together enough dollars to keep the Kraken going, game is over, things are going to crash. This is their weak point .

Once again, to be clear, every time you sell Tether on Kraken, you force Tether Ltd. pay you in US dollars. If enough tokens are sold, then Tether Ltd. dollars will run out and this whole machine, which currently powers 70% of all crypto-trading flows, will simply fall apart.

Perhaps it makes sense for hedge fund managers to reread the paragraph above and consider the implications.

How to prevent this in the future?

I have several suggestions.

New York prosecutors are to obtain an injunction blocking any further issuance of Tether . This should be done as soon as possible in a procedural and legal sense. At stake is not only the blood money of countless people. Issuing a pseudo-currency in dollar terms without support and restrictions jeopardizes the country's ability to regulate its own financial system.

For clarity, the authorities should be extremely concerned about this situation . In fact, there is now an unregulated foreign organization printing dollars with impunity. ... There is reason to believe that this represents a direct attack on the US dollar - and the longer it goes on, the more it risks questioning the integrity of the entire US financial system.

The US Treasury is required to require 100% back-up coverage for all USD pegged stablecoins, with mandatory audits . Crypto has a lot of potential - the startup community got this part right! - but this potential is not realized if the industry is teeming with scammers. While over-regulation is a real problem, this long-term and widespread fraud is a clear sign that we need a mechanism to check the reserves of stablecoin issuers.

Healthy regulation increasesrather than diminishing the value of the ecosystem. Bitcoin can be unstable on its own, but if it is bought with fake dollars, then its dollar rate will also be fake. To trust the valuation of bitcoin, we must test the reality of the dollars that are pumping it.

Why did I write this?

Before that conversation with Bob, I thought about the problem in the abstract: there is a riddle that needs to be solved; there is money to be made. But after the conversation, I looked at the situation through the eyes of a real person - someone who took the wrong side in this scheme.

There are millions of beans in the world. Many are head over heels into Tether on non-bank exchanges. Thousands of others buy these tokens every day. And almost all of them will lose money when the pyramid collapses.

This is an unpleasant situation even for normal times. But during a pandemic, it's a disaster. Huge amounts of money for millions of people will be destroyed. Individuals, families, and the most vulnerable of us will be ruined at the worst possible time. This is not a game: human pain will be real and unbearable. And the longer the deception continues, the stronger this pain will be.

I wrote this to end the mess.

Some materials that I used in the investigation:

- An excellent post by Patrick McKenzie gives a clear picture of the situation with Tether until October 2019.

- Matt Levine dedicated one of the Money Stuff issues to Tether .

- Cryptocompare provides useful historical data on the volumes of various currencies that are exchanged for bitcoin.

- -: @coloradotravis, @Bitfinexed [], @DrHOSP1, @BennettTomlin, @patio11 (, Twitter , Tether; , ).

The content of the article is my personal opinion and does not necessarily reflect the position of any person or organization with which I may be associated in the present or past.

I am posting this anonymously, but at some point in the future I may decide to identify myself. Below is the SHA-256 hash of my real name, padded with random characters. To claim authorship, I will post the input string for this hash under an account I control.

35a7b6e1eddac723b0097551f9a6768a8a48009255956bdbae0b2f38d75b13e9

Good luck to everyone,

- Crypto Anonymous