Essay in three parts:

Essay in three parts:

- Bitcoins don't have a single “price” and the market is terribly inefficient.

- Understand the laws related to customer identification and money laundering.

- Bitcoin is not a Ponzi scheme! It just works the same way.

The articles were written in 2017 as a warning for enthusiasts little knowledgeable about the world of finance, who decided to make "easy money" from crypto trading. They were written by David Gerard, author of The Attack of the 50-Foot Blockchain: Bitcoin, Blockchain, Ethereum and Smart Contracts.

Part 1: bitcoins don't have a single “price” and the market is terribly inefficient

The following assumptions are commonly accepted in public discussions about Bitcoin:

- Bitcoins have a price and are expected to be bought and sold.

- Buying bitcoins is like buying stocks or a commodity like gold - the market works the same way.

- Bitcoins are liquid - it is relatively easy to exchange money for bitcoins, and bitcoins for money in a bank account.

And this is not true.

How much is bitcoin worth?

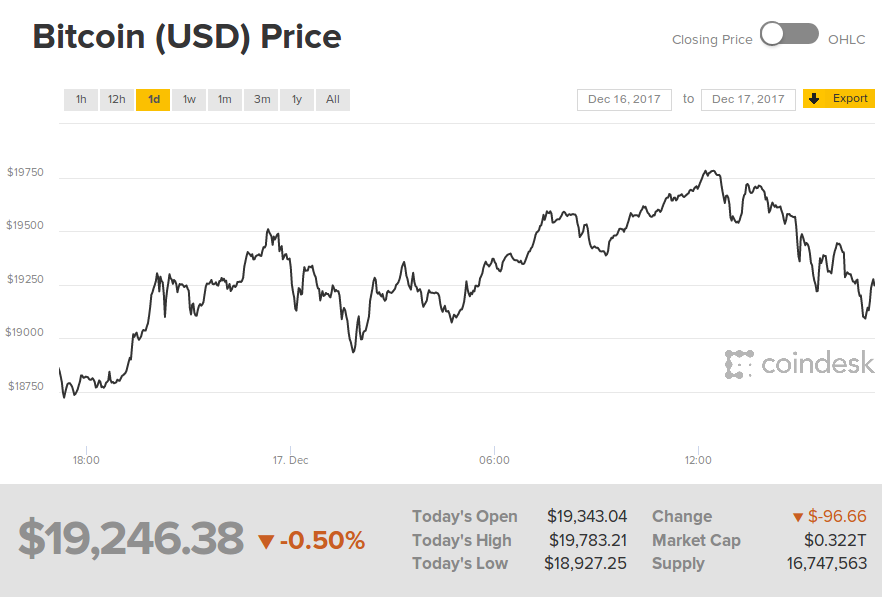

Here I am looking at the Bitcoin Price Index on CoinDesk . At the time of this writing, it costs $ 19,699.46. Oh, already $ 19,691.76! And now here's $ 19,690.70! Etc.

This number is an advertisement for bitcoins. It should create the impression that bitcoins are real objects, tradable, with a market structure, that their price can be meaningfully written down to the nearest cent, that all this is wonderful and makes sense. But all this is just an illusion.

There is no "price" for bitcoin - this is an invented number. You can't expect to be able to exchange Bitcoin for that amount - it's just averagethe value taken from the last several trades. The CoinDesk Index uses Coinbase, Bitstamp, itBit, and Bitfinex. The latter name will surely surprise cryptocurrency lovers.

If you look at the spread between exchanges - the different cost of one bitcoin - you will see a difference of hundreds of dollars, and in times of high volatility it can reach thousands of dollars.

Saying aloud a number like "$ 19,699.46" with seven significant digits, when there is a 5% variation in your data, should give you a slap on the head from your high school physics teacher, whose shadow should live in your head. This is a very misleading number. It's like saying "$ 19,700 plus / minus $ 500, depending on." The above graph should actually be drawn with a thick line.

Market capitalization is even worse. This is literally the last price multiplied by the number of tokens in existence. This is a fictional, unrelated number. This is not money invested in crypto, this is not the selling value, like the capitalization of a company, it does not affect prices. It’s just a pretty simple calculated number that graces the title. In any cryptocurrency, even in bitcoins, trading is so weak that even a small fraction of this number cannot be realized. This is pure marketing.

But why does Bitcoin work like that? Why isn't its price a reasonable and useful number?

Isolated islands pretending to be a continent

In ordinary securities trading, if a stock is listed on multiple exchanges, orders are often placed through smart routing so that a particular buy or sell order is in the context of all the order books for that stock. This helps to avoid fragmentation of liquidity , in which order books from different exchanges are isolated from each other, which makes trading more volatile and difficult. This is easy to do, because it is not necessary to store capital on ordinary exchanges to organize trading.

This will not work with bitcoins - on each specific exchange, trading is isolated from others, and bitcoins are stored directly there. This is just a recipe for high volatility and wide price range.

Moreover, in conventional securities trading, spreads between exchanges are quickly equalized through arbitrage - buying on one exchange to sell on another. As a result, the price rises on one exchange and falls on the other.

The structure of the bitcoin market does not allow such a scheme to work. If you want to capitalize on price spreads, you need to:

- buy bitcoins on one exchange;

- withdraw them from the exchange (let's say you send them directly to the bitcoin address of the second exchange), confirm the transaction in the blockchain (with a delay of at least 10 minutes), pay a commission of at least $ 25 if you want the transfer to be confirmed in one or two blocks ... Double the numbers for reliability;

- sell them on a second exchange.

Delays from 10 minutes to an hour, as well as significant commissions, create a spread between exchanges that will persist even if everyone starts using trading bots.

Therefore, each exchange operates like an island. "Price" does not apply to any of the islands.

What is it like to live on one of these islands?

What the lack of regulation means in practice

When you buy common stock or commodities, you are assuming that this trading is governed by reasonable rules and that the exchanges ensure that the rules are in compliance with the laws - in short, that they will not deceive you.

In crypto trading, such assumptions cannot be made. This is what it means to be "unregulated."

Trade rates are important because each of them came about after someone robbed a bunch of people in this way. These regulations ensure the integrity of the market. Therefore, even those investors who understand the full power of risk (and what we mean by high volatility and lack of real value behind cryptocurrencies) do not always realize how much the environment on the exchanges contributes to these risks.

One of the striking examples was the collapse of the Australian iGot exchange in 2016, hitting many small sellers. "I assumed that in Australia there must be some kind of insurance or regulation or something, in connection with which he would be responsible for his actions."

It is not in vain that all dubious schemes are prohibited on real exchanges, which, however, are almost the standard in crypto trading:

- Wash trades - trading with yourself in order to fill or drop the price, or create the illusion of trading volumes. More recently, this could be done on the Bitfinex trading engine.

- – , , . Bitfinex Coinbase/GDAX.

- (painting the tape) – . , Willybot Mt. Gox - 2013 .

- (front-running) – , . Yobit , .

- Insider access to the trading base of your own exchange. Bitfinex members themselves traded on their exchange. They claim to have avoided conflicts of interest, but there was no oversight or transparency.

The US Commodity Futures Trading Commission has listed many of these points as common problems that are far worse on bitcoin exchanges than on conventional markets:

In addition to the practical and speculative functions of these emerging markets, there were also several negative aspects that harm retail customers and warrant the attention of the Commission. Among them, among others: rapid price drops (flash crashes), pending transactions, spoofing messages, hacks, messages about internal theft and manipulation, vulnerabilities in smart contract code, speculative trading and other conflicts of interest. Such actions by attackers can suppress innovations aimed at improving the market, violate its integrity and delay development.And since the Wild West is taking place inside these exchanges, the links between them and the world of regulated finance are zealously regulated. Because of this, incredible difficulties arise with the withdrawal of real money from these exchanges.

2:

The Know Your Customer series of rules adopted to combat money laundering are a constant source of problems for the bitcoin trader.

The rule "know your customer" in the United States appeared under the so-called. the " patriotic act " adopted in 2001 based on the 9/11 terrorist attack. Their idea was to make it easier to catch terrorists and money launderers.

For you as a customer, this rule is unpleasant because it makes your bank consider you a threat. And bitcoins are extremely popular with criminals and drug dealers, which is why they receive special attention from bank officials responsible for compliance with rules and regulations.

This is true for both cryptocurrency exchanges and banks. It is a well-known practice of the Coinbase exchange, forcing people to re-upload the documents already provided, and putting them into a limited mode of operation (in which they cannot withdraw money, which, in fact, belongs to you). After that, the exchange requires more identification documents from you before you can take from them the money they demanded from you. All this happens automatically, with little or no support from the support team. However, they don't just hold your money for money - they are legally required to consider you a threat.

Banks hate bitcoin due to the need to obey the rules

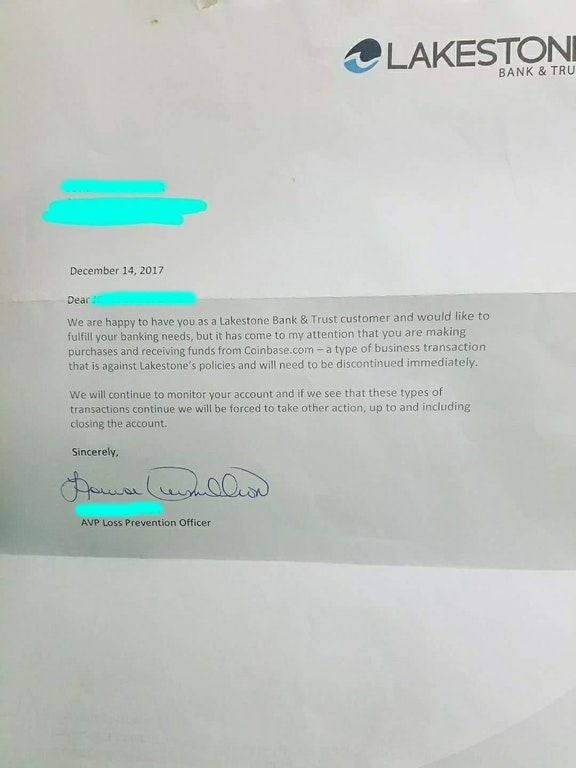

Even when the bitcoin exchange seems like a clean enough deal to send the money received to the bank, the bank may have concerns about any involvement in the bitcoin exchange. For example, here's what the bank wrote to one of the Coinbase users:

We are delighted that you are a client of our bank Lakestone Bank & Trust and would like to meet all your banking needs. However, it dawned on me that you are shopping and receiving money from Coinbase.com. Such business transactions are contrary to bank policy and must be stopped immediately.

We will continue to monitor the activity on your account, and if we still see such transactions, we will be forced to take measures, up to the closure of the account.

The user's colleagues reacted to this as expected - they pounced on the bank's Facebook and Yelp pages like rabid adherents of a cult.

The problem is that bitcoins originally had to resist government control. Their creators were idealistic anarcho-capitalists . They imagined that their creation would be used by free citizens to trade among themselves, without being exposed to the threat of government theft - that is, taxes.

For obvious reasons, bitcoins have attracted criminals with their endless imaginations in search of ways to turn bad money into good enough, and drug dealers. They also attracted other characters for whom the use of normal money was a problem, and who, as a result, were looking for a replacement.

That is, bitcoins were originally developed for tax evasion and money laundering. Technically they are not anonymous - if you really want to, you can do the hard and boring work of tracking bitcoin flows on the blockchain. However, your bank is unlikely to agree to shoulder this burden just so you can cash out some bitcoins.

Another problem is that there are a lot of serial entrepreneurs among Bitcoin users. This often means that they have founded several successful businesses. But more often, this means that they are chronically unemployed, money-haters and prone to falling prey to scammers. Even if they give the bank the entire history of each of their bitcoins, they will still remain high-risk clients.

And then there are bitcoin traders who consider themselves clearly smarter than the bank's compliance officers and claim that Coinbase is a coin collector's site. Trust me, this trick never works.

How does this affect the attempt to withdraw money?

Coinbase says that you can withdraw money with a simple click of a button. Some people succeed, but for many, everything actually turns out to be wrong. Withdrawing money can be slow and frustrating.

Banks have very strict reporting rules. Banks are required to report large amounts arriving in accounts, and sometimes refuse to make a bank transfer if it seems dubious to them.

This is especially true for those people who, having discovered an old stash of bitcoins, want to turn them into money. I know of one such case where a user many years ago sold his car for bitcoins and wanted to cash them out against the background of the current bubble. The best that the exchange could come up with was to withdraw several thousand dollars daily. And slobbering millions of dollars a few thousand at a time will not be just boring - it will look like some kind of scheme with which someone wants to bypass the reporting rules.

Clients of American banks suffer most from these requirements. As far as I know, the residents of Britain and Australia are doing better with this - although there, too, the bank may stop working with a client on a similar basis. Recently reportedthat HSBC bank considered the direct money transfer between individuals for a transaction with bitcoins on the LocalBitcoins website to be fraudulent. The recipient's account was blocked for several days until the situation was sorted out.

First, contact your bank and get ready to provide a comprehensive history of every cryptocurrency transaction you have ever participated in, as well as all the money you bought them with. Prepare to provide your tax office with as much information as possible so that they can reconstruct you from one piece of a clipped nail. And if this is some serious amount, hire a normal accountant.

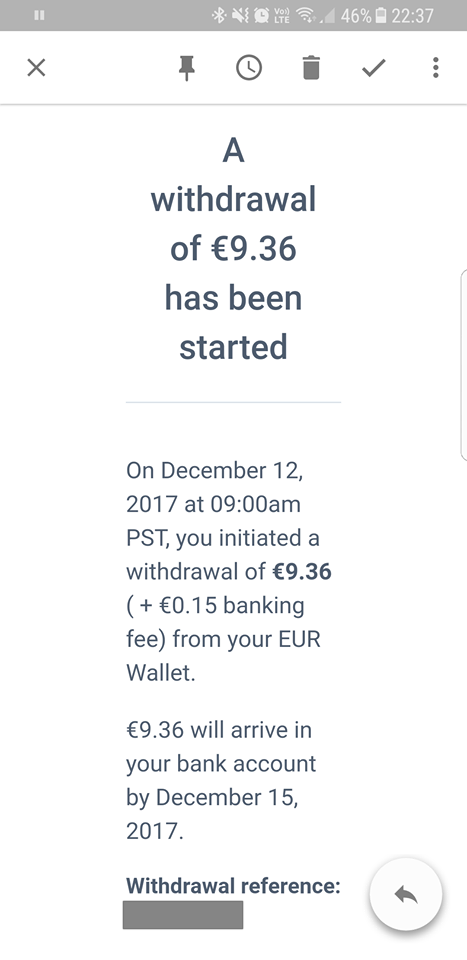

Based on feedback from Coinbase users, if you can successfully withdraw money to your bank account, you should have fewer problems with future transactions. They will not disappear at all, but there will be fewer of them. The following screenshot was taken by a UK user on December 12th. They promised to withdraw this amount by the 15th.

Know Your Customer Law Affects Exchanges

Exchanges take these issues very seriously, as they may be left without banking services at all. There have been such cases.

Bitfinex, the largest by volume of sales, and its related company Tether , lost access to dollar transactions in April 2017 when Wells Fargo, the only intermediary bank between their Taiwanese banks and US customers, refused to process payments going to or from Bitfinex ... Bitfinex filed a lawsuit - a great way to ensure that no other bank does business with you - but to no avail. As wrote Phil Potter of Bitfinex:

We have had problems with banks in the past, but we have always been able to work around them or solve them. We opened new accounts, and the like - changed the legal entity, and did all sorts of tricks.I already wrote in my book that I am almost sure - it is because of this that the cryptocurrency bubble happened in 2017. People could not withdraw dollars from Bitfinex, they started buying bitcoins and other cryptocurrencies in order to cash them out somehow, which caused prices to creep up.

Part 3: Bitcoin is not a Ponzi scheme! They just work the same way

It was such an aquarium without food, into which the fish kept jumping, because they heard that there was a buffet. And for the most daring fish, this was it.Well, you bought yourself a cryptocurrency on the wave of a bubble. It's okay, it's impossible to lose! And if the bubble bursts - just hold the funds longer!

- Sid Midnight

Oh oh. The price has just dropped from $ 19,000 to $ 11,000. Now what to do?

Bitcoin has no economy as such. Therefore, on paper, bitcoins have a lot of "value" that is never realized.

How money flows in bitcoin bubbles from new dreamers to old holders

In 2017, @Buttcoin tweeted an explanation of how the bitcoin market works in practice, and why old investors who cashed their money persuade new ones to hold out longer - or, as they call it, " hodl ":

, : . , . , .

, , , , « ». 40% , , .

$19 000, - . , . , , , , « » .

? «, , , ». 2017 , .

. , , , , .

:

Bitcoins are not the circulatory system of a functional economy. There is no circular income stream . Very little can be bought with bitcoins - even drug sellers refuse them , since the cost of commissions breaks records . Bitcoin has no economy.

A stock of bitcoins is not a useful pile of capital that can be invested in profitable economic activity by increasing your assets. They can only be sold back. From a practical point of view, bitcoins work only within the framework of the regular currency system .

It turns out that bitcoins are a zero-sum investment. The money leaving the system cannot exceed the incoming money. In fact, they are even slightly smaller because miners cash out their rewards for each block mined to pay for electricity. X real money is poured into bitcoins, and exactly X money is immediately returned to another person. This is all that happens.

This is why “market cap” is a deceptive and useless number. If someone bought a piece of bitcoins at $ 19,000 for BTC, that does not make another bitcoin owner a “billionaire”, whose BTC sells for $ 19,000 apiece. The total amount of money that can be drawn from the system has not increased.

Try to sell any significant share of those billions on paper and watch their value collapse. There is no real money for everyone to cash out. At some point, the race for the exit will begin, and most of the physically will not be able to come out with their "profit".

People invest in the hope of making a profit. This means that more money must enter the system - more people must join the scheme. This is obvious to all "contributors" - they must attract newcomers.

In the end, the system runs out of more " big fools ", the bubble bursts, and a lot of people are left at a broken trough.

Old investors get paid by new investors - this is a key feature of the Ponzi scheme. Functionally, it is a pyramid, even though it does not have an operator. As user evilweasel wrote on the Something Awful blog:

The Bitcoin system distributes these tokens to early adopters so that they can advertise the system. This automatic circuit «pump and dump» ( pump and reset ) or type "honest Ponzi scheme."

The main innovation of bitcoin is that it is a "fair Ponzi scheme". It works by giving early adopters a monetary incentive to promote the scheme.

Technically this is certainly not a Ponzi circuit ...

The problem is that bitcoins cannot be called a “Ponzi scheme” or a “pyramid”. At the very top of the Ponzi scheme, there is an attacker making money.

Bitcoin doesn't have it. Bitcoin lovers take advantage of this to avoid calling this scheme a "Ponzi scheme". Apparently, Satoshi Nakamoto deployed it with completely honest intentions.

Even with an extensive description of Nakamoto's political goals for bitcoin - an anarcho-capitalist version of the gold standard with a touch of bank conspiracy - he didn't like how passionately fans jumped at the profit opportunity. He even asked themdo not mine on video cards, because this will ruin the whole idea, according to which everyone should participate in the scheme.

Nakamoto abandoned the project around 2011, and his supply of one million bitcoins has not changed since then. But his followers continue to work.

Preston Byrne describes how bitcoins work in a headless Ponzi scheme, which he called the " Nakamoto scheme ":

– , , , , .

, . , - , , .

– , , , , . , , - .

Bitcoin as a Ponzi platform

Bitcoin is also a popular platform for Ponzi schemes and the like. The book details the history of the Pirateat40 , but “high-return investment programs” were incredibly popular in the early days of the system. Bitcoin has attracted experienced operators of Ponzi schemes, such as Sergei Mavrodi , who organized the MMM pyramid in the 1990s and launched a new scheme based on bitcoins.

Later, cryptocurrencies did not behave better - when Ethereum introduced cryptocurrencies with smart contracts, the earliest of these were letters of fortune, lotteries and automatic Ponzi schemes .

Something about cryptocurrencies attracts not just naive people with burning eyes, but people. who believe that Ponzi schemes, letters of happiness, and other blatantly fraudulent schemes are good ideas.

And where there are naive people with burning eyes, there are scammers who want to cash in on them. This is a new paradigm!