Compulsive spending is buying "emotionally", which in certain cases can lead to serious financial difficulties. A survey of more than 5,000 people with mental disorders showed that 93% of them spend more during periods of exacerbation of the disease. For example, people with bipolar disorder tend to spend significantly more during the manic phase, which results in huge debt accumulation. How banking apps can help vulnerable customers avoid these situations.

Study

I spoke with three people with bipolar disorder about how they dealt with their manic spending. Their experience indicated that the easier it was to make a purchase, the more difficult it was for them to stop and consider their financial decisions.

Adding positive friction

Based on the research, I put forward a hypothesis: before withdrawing money from the account, the bank may ask the user to cancel or confirm the purchase the next day.

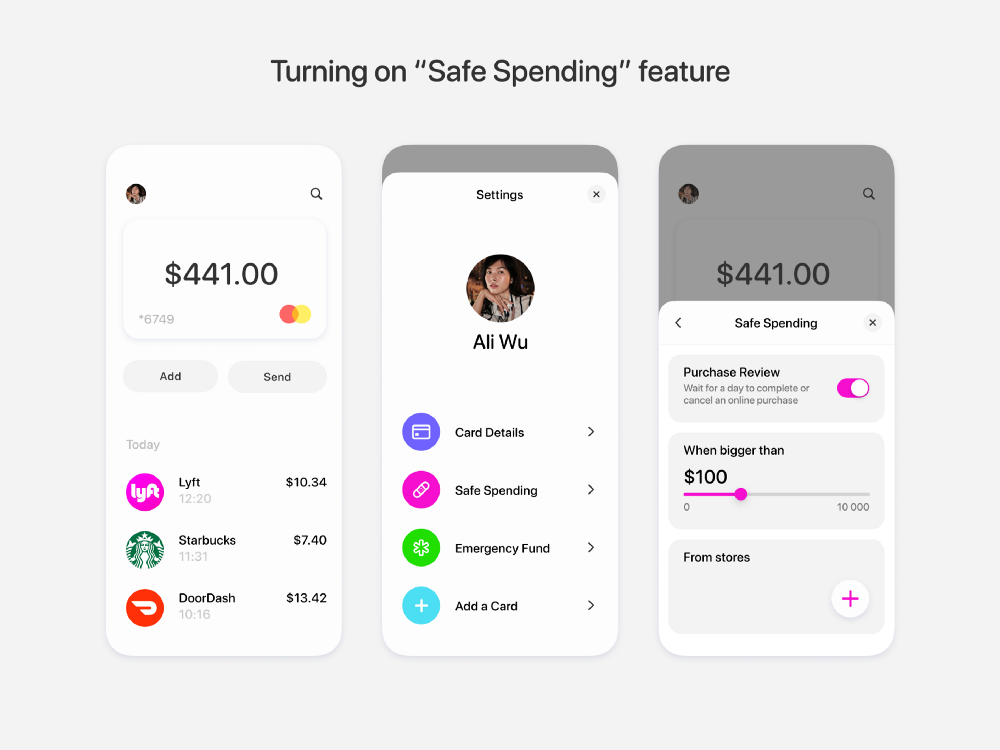

First, the user turns on the function in the settings and sets the limit.

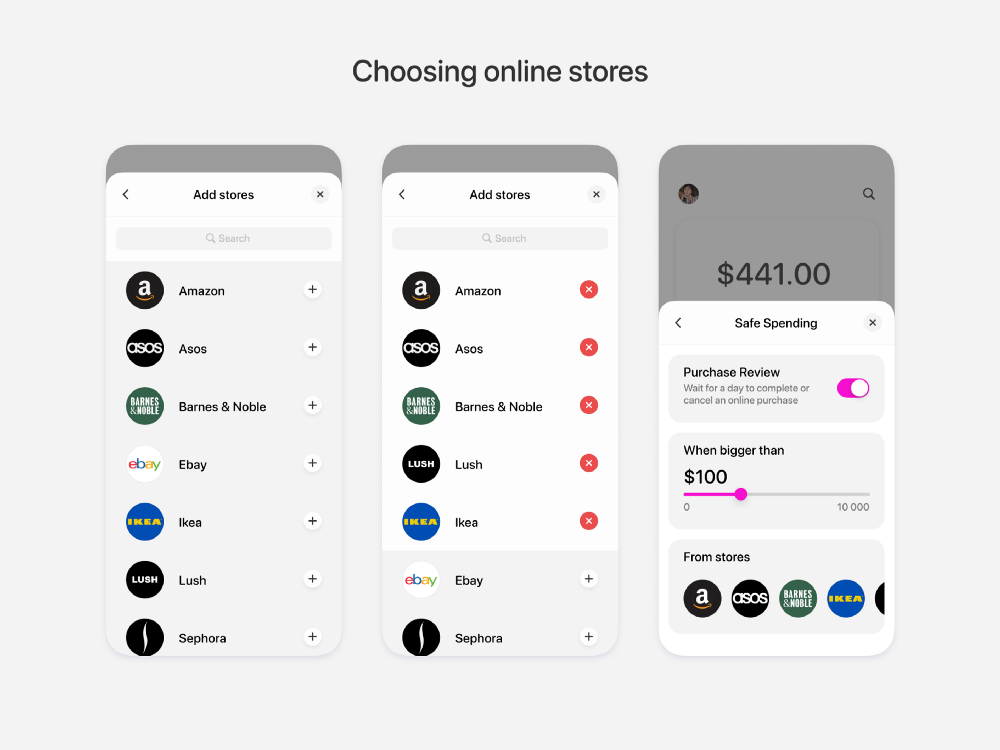

Then he selects stores where he tends to spend too much. I chose stores over categories because on e-comm platforms such as Amazon or eBay, banks cannot determine which category a purchase belongs to.

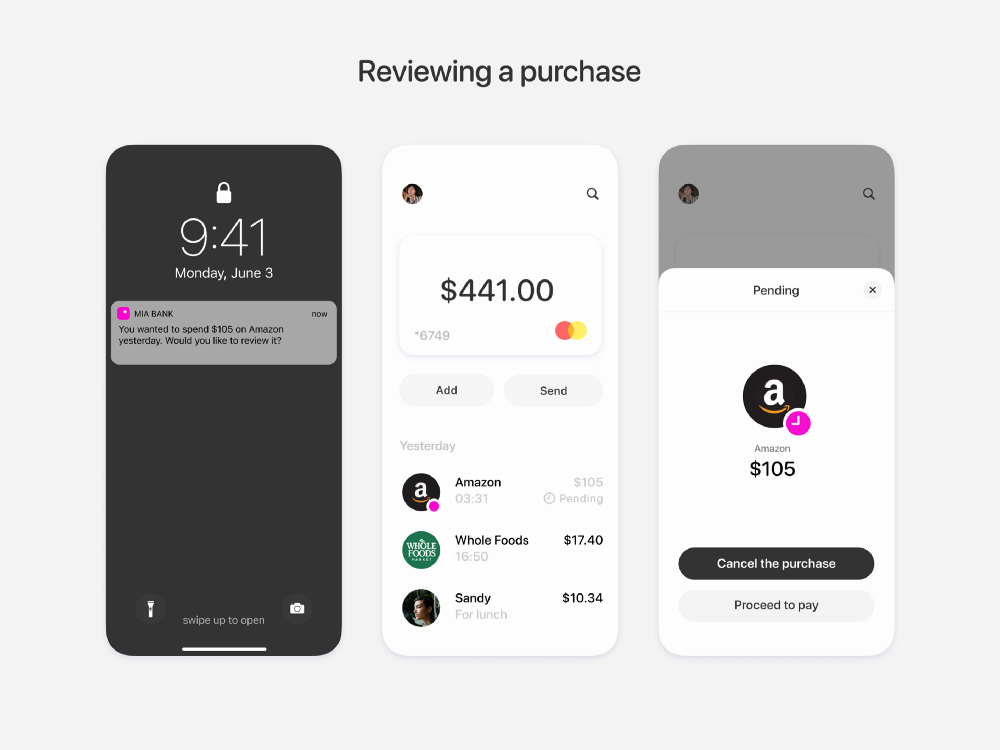

After placing an order, the user receives a notification that the purchase is frozen until tomorrow. The next day, the bank will ask what to do with the unfinished purchase - cancel it or pay. These deterrents will allow the user to make a more informed decision.

conclusions

Of course, this is not the only solution to the problem of compulsive shopping. But this feature could be a small step towards more informed money management and protect vulnerable users during a difficult time.