Tax monitoring is a new form of tax control. It replaces traditional checks with online interaction based on remote access to taxpayer information systems and its accounting and tax reporting.

I would give an additional definition of tax monitoring - this is the digitalization of desk audits, their transfer from one-time events to the form of constant monitoring of the company's activities. It becomes possible for a taxpayer to manage tax risks through a reasoned opinion of the tax authority, i.e. receive warnings from the Federal Tax Service with the ability to take measures to eliminate tax risk.

If we talk about forecasts, then I would most likely give a forecast that by 2030 all enterprises, medium and larger, will be forced to enter into tax monitoring. The state has already set a vector of movement by changing tax legislation and reducing the threshold for entering tax monitoring: https://sozd.duma.gov.ru/bill/1025470-7

There are 3 forms of interaction with the Federal Tax Service within the framework of tax monitoring:

- FTS access to the accounting system

- Showcase

- TCS

Information from open sources:

As you can see from the slide, the form of interaction with the Federal Tax Service on the basis of a showcase is gaining popularity. There are many suppliers of "boxes" for the showcase, including SAP.

In this article, we will not consider the method of interaction through the TCS, since this method is more likely an opportunity to enter into tax monitoring for organizations that, for some reason, need this regime, but there is not enough expertise / time / resources for a showcase or direct access. But, on the other hand, after the GNIVTs fulfills the plans to create a "cloud tax monitoring system", the TCS method may be reincarnated as an interface between the GNIVTs cloud and the taxpayer's accounting systems.

, SAP, - . , SAP.

, . . , SAP GRC Risk Management and Process Control . – , SAP .

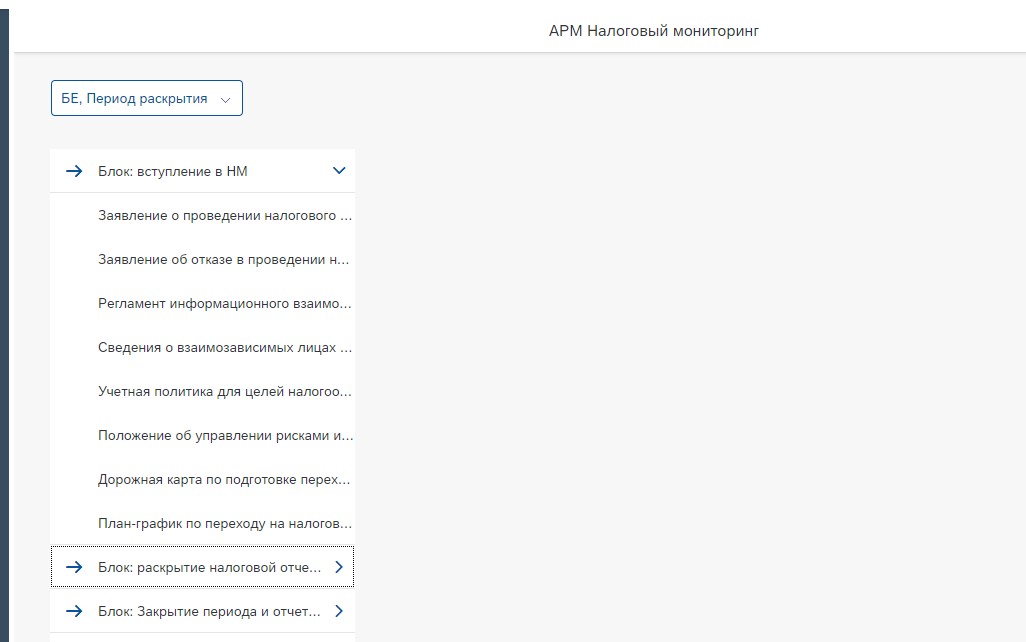

If you look at the showcase from the point of view of the interface, then it is not difficult to create an analogue for direct access in the form of the Tax Monitoring AWS on ABAP (screenshot of the AWS example below).

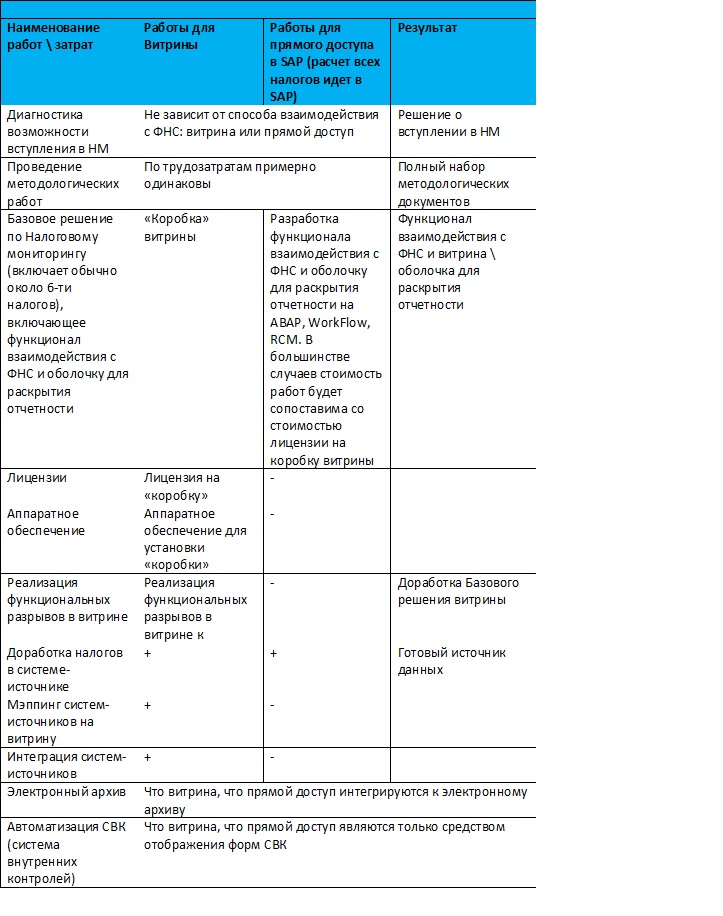

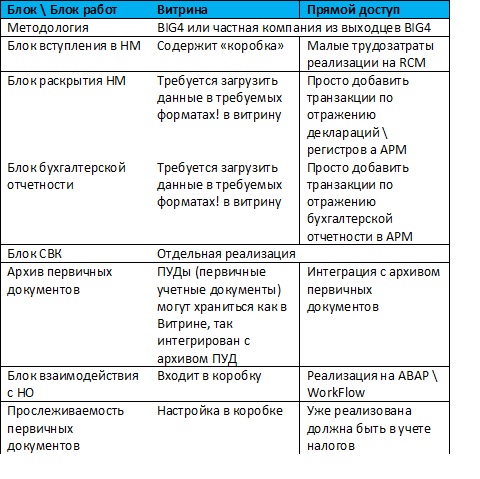

Consider solutions for blocks \ work blocks:

Thus, for a functional customer and an IT customer there is something to think about if taxes are calculated in SAP, especially taking into account that direct access organizes a single work space for tax accountants and the Federal Tax Service, and the showcase makes tax accountants work as in an accounting system, and in a separate showcase with all the ensuing consequences in the form of additional reconciliations.