I also run the Investorka telegram, where I talk about triathlon and wine, and at the same time about buying shares on the OTC market. In 2019, I entered 20 IPOs, in 2020 - 21 IPOs, and another 10 pre-IPOs this year and last. If these acronyms aren't very familiar, here are the more familiar names Zoom, Beyond Meat and Impossible Foods, SpaceX and Coursera.

All these companies were privately owned at the time of the purchase. Some of them are already traded on the exchange, some are not yet. I will tell you how investing in companies from Silicon Valley works for an ordinary investor with $ 100 for me.

How it all began

I've never done investment before. It seemed to me that it was difficult and not for me. Yes, there was a feeling that you could do something smarter with your money, but you had to figure it out. And it's always difficult to understand. So if it hadn't been for a new job, I wouldn't have thought about investing for another 10 years, and I certainly wouldn't have started a Telegram channel about it.

Two years ago I came to United Traders. We created media about investments, sawed landing pages and launched mailings. It was difficult for me to write about investments without my own experience, so I decided to give it a try.

IPO and pre-IPO

United Traders specializes in IPO and pre-IPO investments. I decided to start with them.

An IPO is a company going public. Before the public offering (IPO), the company's shares are not traded on the stock exchange, they belong to a limited circle of people - founders, employees, early investors. After the IPO, shares are traded on the stock exchange and available to everyone. There is always a demand for shares of cool companies, but before the IPO, access to them is limited, after the IPO there are no restrictions. So after the IPO, the share price usually rises, and this is what investors earn.

There are two key points here:

- Choose exactly the company whose shares will grow in value.

- Be able to get these shares.

For investment in an IPO, the scenario is as follows:

- The IPO is designed to be successful for all parties. The company wants to raise more money. Early investors want to make more money. The underwriters (the banks that arrange the placement) want to maintain their reputation. Nevertheless, there are companies whose shares fall after the placement. And it can be very unpleasant to go to such a particularly large amount. Here you can partially rely on the choice of a broker / investment company - they make a preliminary selection. I invest through United Traders, but anyone can use the services.

- Then you need to get these shares. This is the most difficult moment for an IPO. There are a lot of people who want to make money on an IPO, there are a limited number of shares. Investors apply for one amount of the amount, but receives shares only for the amount less, the remainder is returned. This is called allocation. If at the beginning of 2019 it was possible to receive 80-90% of the application, then at the end of 2019 - 40-50%, and in 2020 - 5-20%.

Another scenario works for investments in pre-IPO:

- There is no problem here to get 100% of the shares, but you will have to wait longer. United Traders (again investing through them) chooses companies that are to conduct an IPO in 1-3 years, but no one knows exactly when the company will go public.

- It is more difficult to choose a company for investment in the case of a pre-IPO. Companies are not public, many indicators are not disclosed. So it is very important to diversify - buy many different pre-IPOs with the expectation that some of them will shoot, some will not.

IPO in 2019: shares of Levi`s, Lyft, Zoom and Beyond Meat

From theory to practice. Last year, I applied for $ 100 for every (well, almost) IPO that appeared on the United Traders platform. In total, I invested about $ 750 in 20 IPOs and earned about $ 1050 (+ 40%).

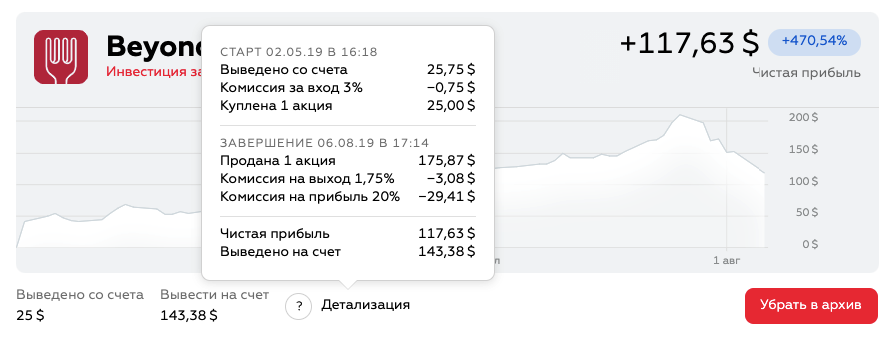

Success of the Year - Beyond Meat, Artificial Meat, + 470%. The moment when you realize that $ 25 suddenly became $ 143. Epicfail

IPO

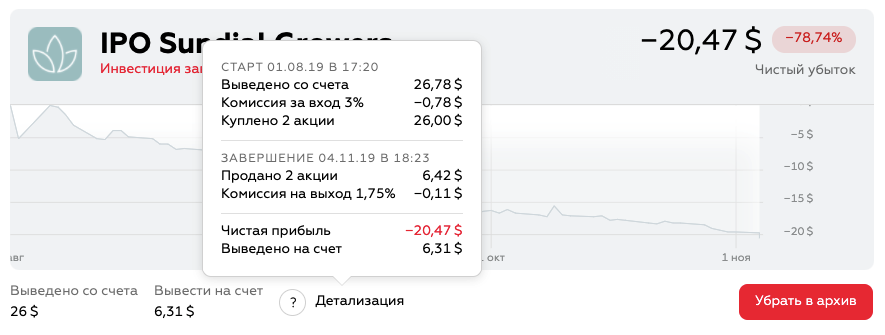

Calendar of the Year - Sundial Growers, Cannabis, -79%. The moment when you realize that $ 26 can turn into dust.

IPO Calendar

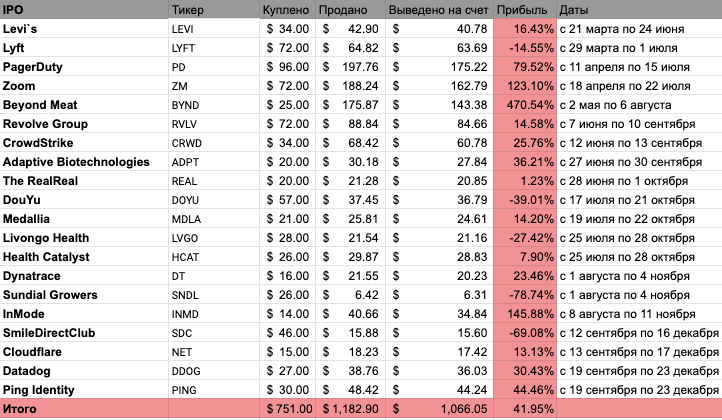

Here is a list of all the companies in which IPO I participated.

IPO calendar

<cat /> Back in the middle of the year, I realized that it works. Toward the end, I decided that it was necessary to enter a large amount, but in 2020 everything did not go according to plan.

IPO in 2020: calendar

I expected that in 2020 everything would be as clear as in 2019: you submit an application, it is executed for some pleasant amount of interest, and you make a profit. I looked at the results in percentages, extrapolated them to large numbers, and I thought I had it all. But it was not there.

At the end of February, markets began to fall. Somewhere in March, it was a good time to buy stocks that had fallen in price from the market (I did so). Everyone forgot about the IPO for a while - the companies postponed the placement until mid-to-late 2020 or even 2021.

I only started investing in IPO again in May. As of mid-October 2020, I have invested in 21 IPOs. I applied for $ 13,000, of which about $ 1,400 went into the IPO, now they cost about $ 2,400. Part of the IPO is still waiting for the end of the lock-up period (usually it lasts 3 months).

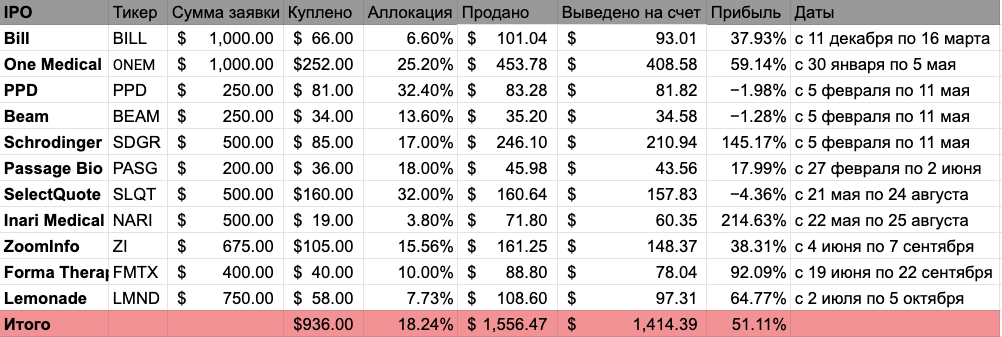

Here is a list of those already completed:

IPO Calendar

Pre-IPO: Coursera and SpaceX shares

A year ago, when it became clear that the popularity of IPO investments was growing and the percentage of order execution was falling, I tried to invest in a pre-IPO. At the pre-IPO stage (one to three years before the IPO), the company is already quite large, but there is still no excitement. Then in October 2019, I went to Postmates, it was supposed to announce an IPO just about, but in the end it postponed the placement. Postmates' IPO is not foreseen yet, but I felt the thrill of investing in pre-IPO and went into several more companies.

Of the coolest:

- + 60% DigitalOcean, an IT company. A year ago, their shares were worth $ 13.8, now they are worth $ 22.

- + 51% Coursera, online learning. At the beginning of 2020, their shares were worth $ 13.8, now they are worth $ 21.

- + 36% SpaceX, satellites, rockets, Elon Musk. In May 2020, their shares were worth $ 250, now they are $ 340.

Results: + 40%, + 50%, + 70% and + 16%

So let's count.

In 2019, by going $ 100 at each IPO, I went to 20 companies for $ 750 and earned $ 1,050. This is + 300 $ (or + 40%).

In 2020, I applied for 25 IPOs for a total of about $ 13,000. Entered 21 IPOs.

There are already 11 IPO results. I went there for $ 935 and earned $ 1415. This is $ 480 (or + 50%).

10 IPOs are still waiting for the completion of the lockup. There is about $ 500, which now costs about $ 800. This is $ 300 (or + 70%).

Now pre-IPO. During the year I invested $ 2,845 in pre-IPO. Now these shares are worth $ 3,300, that is, I am in the black by $ 455 (or + 16%).

I think we need to continue, but let's see what 2021 brings.