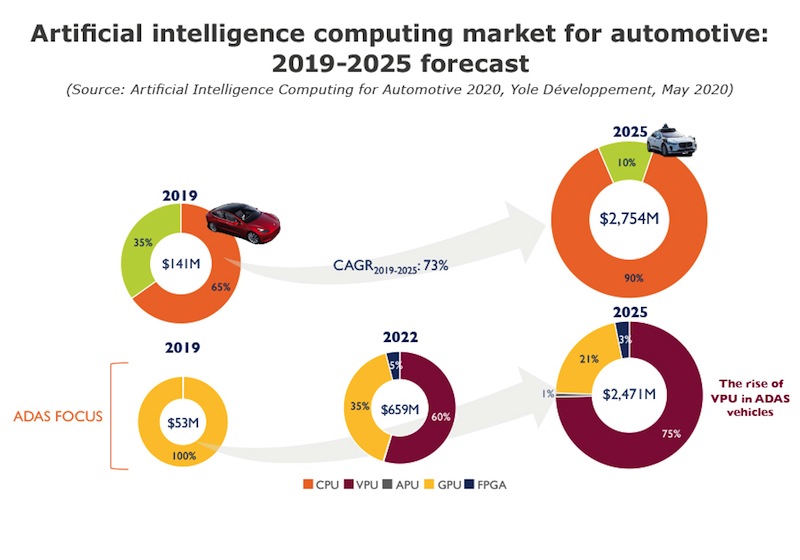

The AI market (including ADAS systems and robotic cars) is expected to be valued at $ 2.75 billion in 2025, of which $ 2.5 billion will come from ADAS alone.Artificial

intelligence is gradually invading our lives through smartphones, smart speakers and cameras video surveillance. The hype around AI has led some market players to view it as a relatively difficult secondary target rather than a primary tool for building unmanned vehicles. Who won and who lost in this race for autonomy?

AI is paving the way for unmanned vehicles

“AI is slowly invading our lives, and this is especially true in the automotive world,” says Johann Chudi, technology, market, computing and software analyst at Yole Développement (abbreviated as Yole). “AI can become the main tool for creating self-driving systems, although many companies fear the hype and do not rely on intelligent systems as part of their strategies for creating self-driving systems.”

Companies that have grasped this aspect of the technology battle are already pushing ahead. The impact of COVID-19 is still unclear, but analysts at Yole are now claiming that the pandemic will have serious consequences. Most likely, research in the field of unmanned vehicles will be slowed down this year and next due to lack of funds.

Are AI systems ready for automotive applications? Which companies are in this race? What relationships exist within this ecosystem? Who will win the "battle for autonomy"? Which vendors are key and what technologies do they deal with? Yole presents his view on the achievements of the AI industry and their application in the automotive industry.

Who wins the race for autonomy

Let's take a look at Tesla, a company that has built its self-driving technology stack (including software and hardware) and is the sole owner of many solutions. For Tesla, the promotion strategy in small steps will be beneficial, since it does not imply any "side research", it rather allows you to integrate individual projects into a common system (this is how the company works with electric vehicles). Most likely, the recent crisis will highlight Tesla's leadership in the market (which, according to some estimates, has been going on for several years). In the second row, analysts singled out OEMs developing their own software stack based on hardware supplied by other players in the market.

The lack of funds can slow down work on some platforms, although development on some projects takes several years and will probably not be interrupted. Even with delays, self-driving systems are an integral part of OEMs' medium-term strategies (this also applies to Tesla). As for wait-and-see companies that do not prioritize autonomy, their research programs (if any) will most likely be suspended until the crisis is resolved. These companies will be left behind in the race for autonomy and will have to rely on products from other companies to provide complete solutions / functional systems for autonomous driving.

The main motive of the race is the union of AI and electronics

The development of various functionalities and increasing their complexity requires the creation of special software solutions. First, it is increasingly difficult to ignore the neural network aspect. Despite the fact that their “black box” factor is not widely discussed, it can become an obstacle to the implementation of systems on the principle of “safety first”.

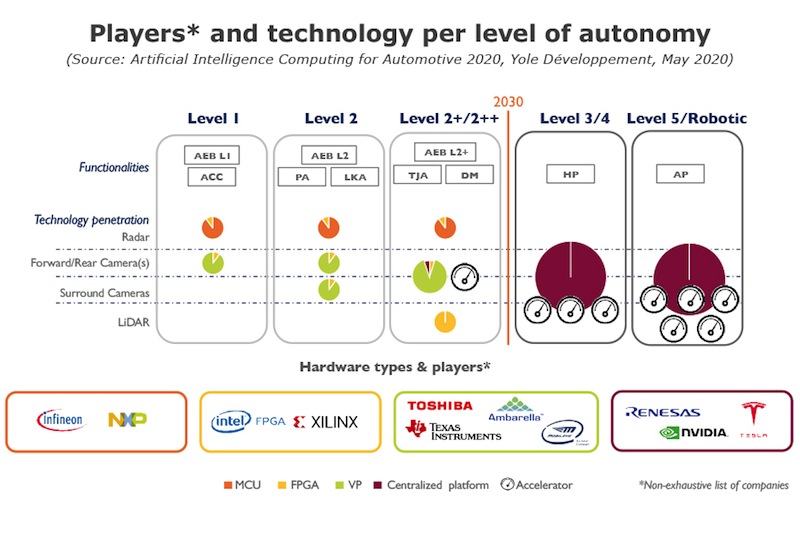

Yole focuses on integrating accelerators (neural engines / neural processors - all different marketing names for the same architecture) into ADAS systems. These modules, which began to appear in mobile phone processors, are designed to process deep learning algorithms - the most famous of these algorithms is used in intelligent systems to recognize objects in images. Last year, Tesla integrated these accelerators and AI into its Full Self-Driving (FSD) chip.

Most OEMs will implement this solution by 2021 - 2022, as these devices are currently integrated into all existing (and will be integrated in the future) ADAS chipsets from Mobileye, Xilinx, TI, Toshiba, Ambarella and Renesas. This trend towards the integration of more and more intelligent systems and therefore neural processors linearly follows the development of autonomous driving technologies. Other trends, such as centralization, will gradually transform the future of computing.

The market is divided between common platforms and computer vision processors

In his report, "Artificial Intelligence Computing for Automotive 2020," Yole concludes that the automotive intelligence market is divided between single platforms and computer vision processors.

Pierrick Boulet, a technology and market analyst for solid-state lighting at Yole, made the following statement: “We assume there are two platform architectures. The first is a single chip computer from Nvidia or a self-driving system taken from top-end robotic cars (ie, the "brain" of a vehicle). The second is the multitude of computer vision processors with integrated accelerators - this architecture is already used by many OEMs. "

Competition will arise between these two technologies, and it is this competition that will determine the distribution of profits in the market. The market research and strategic consulting company writes in its New Technologies and Market Report that “in 2025, the AI market (including ADAS systems and robotic vehicles) will be valued at $ 2.75 billion, of which $ 2.5 billion will be only on ADAS ".

Yole has partnered with System Plus Consulting to research all the breakthrough technologies associated with ADAS systems applications. System Plus recently interviewed EE Times' Junko Yoshida about innovation in the new Audi A8 . Part of this interview focuses on Nvidia's accomplishments.

Romain Fro, CEO of System Plus Consulting, explains: “… The platform includes NVIDIA Tegra K1 processors used for traffic sensing, pedestrian detection, collision avoidance, light detection and lane detection. The Tegra K1 eight-layer PCB contains 192 cores Cuda is the same as NVIDIA integrates into a single SMX module in Kepler GPUs. These CPUs are currently on the market and have DirectX 11 and OpenGL 4.4 support. "

“This is just the beginning, and the challenges of AI and its impact on the automotive industry are already visible,” comments Yole’s Johann Chudi. Some companies have a distinct advantage and will be difficult to catch up - especially without the integration of AI systems and technologies. related to them.