Developers have talked about the benefits of blockchain technology over the years. They argued this with faded "use cases" coupled with vague definitions of how the technology works, what it is for, and how the platforms that use it differ from each other. Unsurprisingly, this has caused confusion and distrust in blockchain technology.

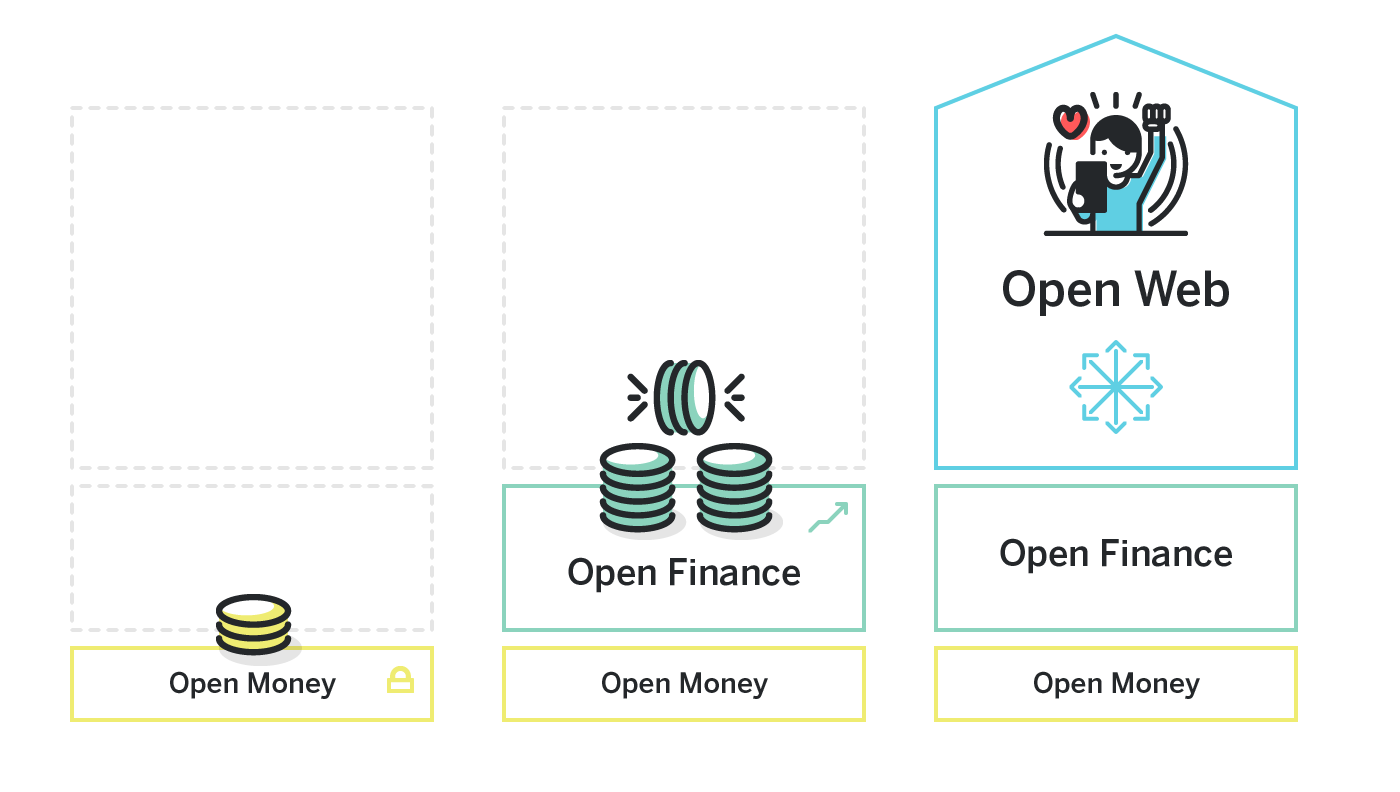

In this article, I want to describe a set of mental models that will help you understand how potential use cases lead to technical trade-offs that each platform has to make. These mental models are built on the progress that blockchain technology has made over the past 10 years, going through 3 generations in its development: open money, open finance and, finally, the open Internet.

My goal is to help you form a clear idea of what blockchain is, understand why different platforms are needed and imagine the future of the open Internet.

A brief introduction to blockchain

A few basics. Blockchain is essentially just a database that is managed by a group of different operators, instead of a single enterprise (like Amazon, Microsoft or Google). An important difference between blockchain and the cloud is that you don't need to trust the "owner" of the database (or its operational security) in order to store valuable data. When a blockchain is public (and all the largest blockchains are public), anyone can use it for anything.

For such a system to work on a large number of anonymous devices around the world, it must have a digital token that will be used as a means of payment. The users of the chain will pay with these tokens to the system operators. At the same time, the token provides a security guarantee, which is determined by the game theory embedded in it. And although the idea was largely compromised by the boom of fraudulent ICOs in 2017, the very idea of tokens and tokenization in general, which is that an individual digital asset can be uniquely identified and sent, has incredible potential.

It is also important to separate the part of the database that stores the data from the part that changes the data (virtual machine).

Various chain characteristics can be optimized. For example, security (in bitcoin), speed, price, or scalability. In addition, the modification logic can also be optimized in different ways: it can be a simple calculator for addition and subtraction (as in Bitcoin), or it can be a Turing-complete virtual machine (as in Ethereum and NEAR).

So two blockchain platforms can "configure" their blockchain and virtual machine to perform completely different functions, and they may never compete with each other in the market. For example, bitcoin is a completely different world compared to Ethereum or NEAR, and Ethereum and NEAR, in turn, have nothing to do with Ripple and Stellar - despite the fact that they all work on "blockchain technology".

Three generations of blockchain

Technological advances and specific solutions in the design of the system have made it possible to expand the functionality of the blockchain during 3 generations of its development over the past 10 years. These generations can be divided as follows:

- Open money: Give everyone access to digital money.

- Open finance: making digital money programmable and expanding the boundaries of its use.

- Open Internet: Expand open finance to include valuable information of any kind and become available for the masses.

Let's start with open money.

First generation: open money

Money is the foundation of capitalism. The first phase allowed anyone, anywhere, to access money.

One of the most important data that can be stored in a database is money itself. This is the innovation of bitcoin: having a simple distributed ledger that allows everyone to agree that Joe has 30 bitcoins and just sent Jill 1.5 bitcoins. Bitcoin is tuned to prioritize security over all other parameters. Bitcoin consensus is incredibly expensive, time consuming, and works like a bottleneck, and in terms of modification, it is essentially a conventional addition and subtraction calculator that allows transactions and some other very limited operations.

Bitcoin is a good example showing the main advantages of storing data on the blockchain: it does not depend on any intermediaries and is available to everyone. That is, everyone who has bitcoins can make a p2p transfer without resorting to anyone's help.

Because of the simplicity and power of what bitcoin promised, “money” became one of the earliest and most successful use cases for blockchain. But the “too slow, too expensive and too secure” bitcoin system works well for storing assets - similar to gold, but does not work for day-to-day use for services such as internet payments or international transfers.

Setting up open money

For these use cases, other nets were created with different settings:

- : , , - , . . Ripple Stellar — , .

- : , , , , , . , . — « » , , , , «» . — Lightning Network. — , , , Libra.

- Private Transactions: In order to maintain complete confidentiality during a transaction, you need to add a layer of anonymization. This decreases performance and increases price, this is how Zcash and Monero work.

Since this kind of money is a fully digital asset tokens, it can also be programmed at the basic level of the system. For example, the total amount of Bitcoin that will be produced over time is programmed into the underlying Bitcoin system. By building a good computing system on top of a basic level, it can be taken to a whole new level.

This is where open finance comes into play.

Second generation: open finance

With open finance, money is no longer just a store of value or a tool for transactions - it can now be capitalized on, which increases its potential.

The properties that allow people to make bitcoin transfers publicly also allow developers to write programs that do the same. Based on this, suppose that digital money has its own independent API, which does not require obtaining an API key or user agreement from any company to use it.

This is what "open finance", also known as "decentralized finance" (DeFi), promises.

ETHEREUM

As mentioned earlier, the bitcoin API is quite simple and unproductive. It is enough to deploy scripts on the bitcoin network that allow it to work. In order to do something more interesting, you need to transfer bitcoin itself to another blockchain platform, which is not an easy task.

Other platforms have worked to combine the high level of security required to handle digital money with a more sophisticated level of modification. Ethereum was the first to launch this. Instead of a Bitcoin "calculator" that does addition and subtraction, Ethereum created an entire virtual machine on top of a storage layer that allowed developers to write complete programs and run them right on the chain.

The importance lies in the fact that the security of a digital asset (for example, money) that is stored on a chain is the same as the security and reliability of programs that can natively change the state of this chain. Ethereum smart contract programs are essentially serverless scripts that are executed on the chain in exactly the same way as the most common "send Jill 23 tokens" transaction is performed on bitcoin. Ethereum's native token is Ether, or ETH.

Blockchain components as a pipeline

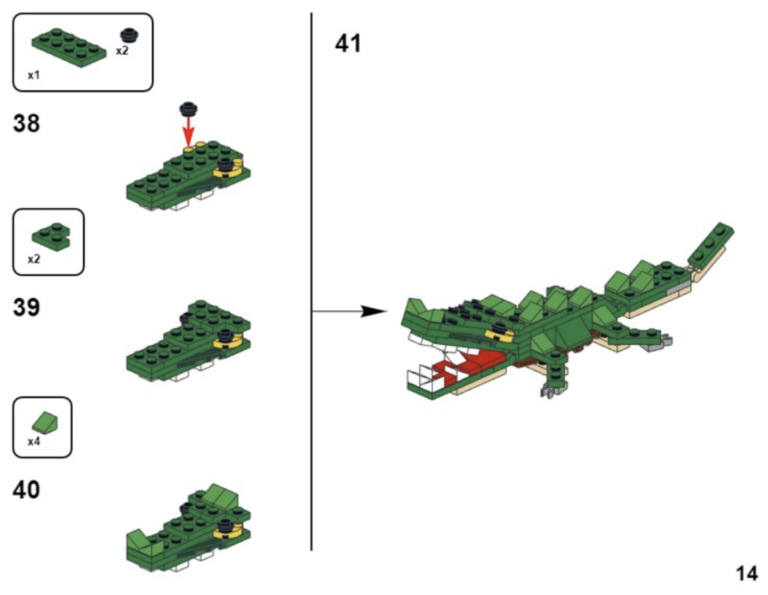

Since the API over ETH is publicly available (like in Bitcoin), but infinitely programmable, it turned out to create a series of building blocks that transmit ether to each other in order to do useful work for the end user.

In the "familiar world", this would require, for example, a large bank that would negotiate the terms of contracts and access to the API with each individual provider. But on blockchain, each of these blocks was independently created by developers and quickly scaled to millions of dollars of bandwidth and over $ 1 billion in storage at the start of 2020.

For example, let's start with Dharma, a wallet that allows users to store digital tokens and receive interest on them. This is a fundamental principle of using the traditional banking system. Dharma developers offer an interest rate to their users by connecting many components that were built on top of Ethereum. For example, user dollars are converted to DAI, an Ethereum-based stablecoin, which is equal to the US dollar. This stablecoin is then piped into Compound, a protocol that lends this money at interest and thus instantly earns interest for users.

Application of open finance

The main conclusion is that the final product that reached the user was created using many components, each of which was created by a separate team, and to use these components, you did not need to obtain permission or a key from the API. Billions of dollars are currently circulating in this system. It's almost like open source software, but if open source software requires you to download a copy of a specific library for each implementation, then open source components are deployed only once, and then each user can send requests to a specific component to access its general state.

Each of the teams that created these components are not responsible for any excessive EC2 bills due to abuse of their API. Reading and charging for the use of these components is essentially automatic within the circuit.

Performance and customization

Ethereum works with the same parameters as Bitcoin, but blocks are transferred to the network about 30 times faster and cheaper - the cost of a transaction is $ 0.1 instead of about $ 0.5 in Bitcoin. This provides an adequate level of security for applications that manage financial assets and do not require high bandwidth.

The Ethereum network, being a first generation technology, did not survive the high volume of requests and suffered from throughput of 15 transactions per second. This productivity gap has left open finance stuck in a proof-of-concept state. The congested network worked like a global financial system in the era of analog devices with paper checks and phone confirmations because Ethereum has less computing power thangraphing calculator 1990.

Ethereum has demonstrated convergence capabilities for financial use models and opened up access to a wider range of uses called the open internet.

Third generation: the open internet

Now everything that has value can become money, connecting the Internet with open finance and thus creating an Internet of value and an open Internet.

As noted earlier, the concept of open money has many uses. It has also been described how the next generation technology, Ethereum, made open money more useful by creating opportunities to combine the components of open finance. Now let's look at how another generation of technology is expanding the possibilities of open finance and unlocking the true potential of blockchain.

Initially, all the "money" that was mentioned is just the kind of data that is stored on the blockchain with its own open API. But the database can store anything.

Because of its design, blockchain is best suited for data that has meaningful value. The definition of "significant value" is extremely flexible. Any data that potentially has value to humans can be tokenized. Tokenization in this context is the process by which an existing asset (not created from scratch, like Bitcoin) is transferred to the blockchain and receives the same public API as Bitcoin or Ethereum. As with Bitcoin, this creates a deficit (be it 21 million tokens or just one).

Consider the example of Reddit, where users earn online reputation in the form of karma. And let's take a project like Sofi, where many criteria are used to assess the solvency of a particular person. In today's world, if the hackathon team developing the new Sofi wanted to embed a Reddit Karma rating into their loan disbursement algorithm, they would need to enter into a bilateral agreement with the Reddit team to gain certified API access. If "karma" were tokenized, then this team would have all the necessary tools to integrate with "karma" and Reddit would not even know about it. He would simply benefit from the fact that even more users want to improve their karma, because now it is useful not only within Reddit, but around the world.

Going even further, 100 different teams in the next hackathon may come up with new ways to use this and other assets to create a new set of open source reusable components or build new applications for consumers. This is the idea of an open internet.

Ethereum made it easy to "pipe" large amounts through publicly available components, by the same principle, allowing the transfer of any asset that can be tokenized, as well as spend, exchange, give it collateral, modify or interact with it in another way, as laid down in its open API.

Setting up for the open internet

The open Internet is inherently no different from open finance: it's just a superstructure on top of it. Increasing use cases for the open internet requires a significant leap in productivity as well as the ability to attract new users.

To maintain an open internet, the platform needs the following properties:

- More bandwidth, faster speeds, and cheaper transactions. Since the chain is no longer just conveying slow asset management solutions, it needs to scale to support more complex data types and use cases.

- Usability. As use cases will flow into applications for users, it is very important that the components that developers create, or applications developed with them, provide a good experience for the end user. For example, when they create an account or link an existing one to different assets and platforms, while retaining control over the data in the user's hands.

None of the platforms had such characteristics before due to their complexity. It took years of research to get to the point where new consensus mechanisms merge with new runtimes and new ways of scaling - while maintaining performance and security at the level required for monetary assets.

Open internet platform

Dozens of blockchain projects that are entering the market this year have customized their platforms to be applied to a variety of use cases within open money and open finance. Given the limitations of the technology at the current stage, it was beneficial for them to optimize their platform for a specific niche.

NEAR is the only chain that has deliberately refined its technology and tuned its performance characteristics to fully meet the needs of the open internet.

NEAR combines scaling approaches from the world of high performance databases with runtime improvements and years of usability improvements. Like Ethereum, NEAR has a full-fledged virtual machine built on top of the blockchain, but to keep up with demand, the underlying chain balances the throughput of the virtual machine by breaking computations into parallel processes (sharding). And at the same time, it maintains security at the level necessary for reliable data storage.

This means NEAR can implement all possible use cases: fiat-backed coins that give everyone access to a stable currency, open finance mechanisms that scale to complex financial instruments and back before ordinary people use them, and finally open source applications. of the Internet, which incorporate all of this for daily trading and interaction.

Conclusion

The story of the open internet is just beginning because we have just developed the necessary technologies to bring it to its true scale. Now that this big step has been taken, the future will be built on the innovation that can be created from these new technologies, as well as on the technological sophistication of the developers and entrepreneurs who are at the forefront of the new reality.

To understand the potential impact of the open internet, consider the Cambrian Explosion that occurred during the creation of the early internet protocols needed for users to finally be able to spend money online in the late 1990s. For the next 25 years, online commerce grew, generating more than $ 2 trillion in volumes each year.

Likewise, the open internet expands the reach and reach of the financial primitives of open finance and enables them to be incorporated into business and consumer applications in ways that we can guess but certainly not predict.

Let's build an open internet together!

A small list of resources for those who want to dig deeper now:

1. You can see what development looks like for NEAR, and experiment in the online IDE here .

2. Developers wishing to join the ecosystem here .

3. Extensive developer documentation in English is available here .

4. You can follow all the news in Russian in the telegram community, and in the group on VKontakte

5. If you have ideas for community-driven services and want to work on them, come to our entrepreneurship support program .