The UK is a popular immigration destination for IT professionals. This is an entrance to the world market, a well-developed infrastructure, English, which is close to many, and much more. The United Kingdom is annually among the top countries for relocation. Is it worth moving to the UK and looking for investments here, how to get tax breaks and settle down?

Personal experience

My name is Anna Kachurets. In 2019, I sold my stake in the logistics marketplace GroozGo in Moscow and decided to fulfill my dream: to move to London. I fell in love with this city during my graduate studies, I liked everything here: stupid rain every hour, English humor and friendliness, so royally contrasting with snobbery.

I moved to the UK in 2019 with the Graduate Entrepreneur Visa (now called the Startup Visa), receiving approval from the university where I studied. Endorsement can be obtained within 5 years after graduation.

After moving, I started helping fintech projects with Russian roots enter the English market - I was engaged in business development. A year later, she switched from a startup visa to a 5-year Global Tech talent and took up her own business ProperQuid - I help technology companies start a business in the UK.

Why Great Britain?

Facebook, Google and 500 other multinational corporations have chosen the UK as their European hub for a reason. By opening a company in the UK, businessmen take their business to a completely different level. Here are some reasons why:

- In Great Britain, English law prevails in all international relations. This greatly simplifies the document flow: any contract can be written both on a napkin and in an email - there is no need for a stack of documents in the original and handwritten statements.

- , . . , : 24 .

- , , - Transferwise Revolut. , .

- . UK , : .

- ( Brexit), , . .

- , , . -, .

- , — . , 7,5% ( , — 30%, — 20%), .

- : 30% — . UK .

- — , .

?

Firstly, IT people - here many technology companies have European hubs. If a person has a job offer in the UK, then he will be given a work visa with a probability of 99% (if he did not violate the laws of the UK), in the USA, in a similar case, only one in five will approve a visa, and with Trump's current policy, even less often.

Secondly, technology entrepreneurs - there are three visa options for them: Innovator, Startup and Global Tech Talent. They even removed the quota for the latter, no limits - England is open to all specialists from the technology sector.

Thirdly, bankers and financiers, because London is the economic center of the world. And finally, the researchers: leading English universities hunt all over the world.

UK in numbers

Almost 4 million expats live in the country, which is 6% of the population. At the same time, the population of London is 31% people who were not born in the UK.

In the HSBC Ranking, England is only 27th due to political instability after Brexit, but England is thirteenth in the ranking of the happiest countries, higher than the United States and Germany. Great Britain ranks 19th in terms of quality of life, for comparison, Russia is 70th, Belarus is not on the list.

Russians in Great Britain

There are many immigrants from Russia here: according to unofficial data - more than 300,000, and after 2014, this number has increased. Ex-Russians fondly call London Londongrad or Moscow-on-Thames.

There are a lot of Russian communities in London, there are several groups in the telegram, for example, Tech in UK, "Own in London", as well as business clubs InCircle, ERSN, London Business Club.

A startup paradise

London is the third largest innovation ecosystem after Silicon Valley and New York. 5,000 startups were born in this country, the valuation of which exceeds £ 34 billion in aggregate. The city became the progenitor of 186 accelerators. Every year in the capital of England, 3.5 thousand different technological meetups with a total of 1.6 million people gather. Venture capital investments reached $ 13.2 billion in 2019, surpassing all European countries.

Many venture capital funds (including many Russian ones), including Sequoia capital, INDX and SoftBank, have offices in the UK. There are also business angel associations, Business Angels Association and Angel Investment Network. There are attractive investment schemes in Britain where a business angel can help reduce taxes by investing in a technology product (EIS / SEIS). You can meet investors in places where startups are concentrated or at investor meetings, for example, Labs from WeWork or at demo days, one of which is held in the fintech coworking Level39.

Investment size

Incubators give startups £ 40-50k in return for a 5-7% stake.

Accelerators, in turn, are ready to invest £ 50-120k in the project for 7-10% after the idea is validated and the prototype is launched. The most popular are Founders Factory, Entrepreneurs First, Wayra, Rise Barclays & Techstars, Startupbootcamp, The Bakery and IdeaLondon.

How to stay in the UK?

Technology entrepreneurs:

- Startup Visa is one of the easiest to get. Until 2019, it was called Graduate Entrepreneur. To receive, you do not need to show investments, but you need a letter of support, the so-called Endorsement letter from an accelerator, or a university, or the Ministry of Commerce. The validity period is 1 year, after which it can be extended for the same period, but again you have to show sponsorship. Visa cost £ 893

- Innovator Visa , Startup Visa, , £50,000, . Endorsement letter. , . 3 4 . : £2500.

- Tech Talent Visa — ( , ). “Endorsing Body”, , Tech Nation. , , . , (, , -, ) . 1 5 . : £618 + (IHS) £400 .

:

- Sole Representative. , UK. — 3 , : £1810

- Investor Visa. ( ) £2 . — 3 4 , : £2823

Employed workers:

Tier 2 (Work visa). A rather complicated visa in registration. In order for it to be approved, you need an offer-offer from a company that will sponsor your stay in the country. It must be on the list of firms eligible to issue such sponsorship. In addition, the firm will need to prove that it has not found a suitable candidate in England. On a work visa, you must live in the country for 5 years, then 305 days for a residence permit (ILR), after which you can apply for citizenship.

How easy is it to get a residence permit?

There is an Exceptional Talent visa that is given to tech talents. To obtain citizenship on this visa, you must live for 3 years instead of five.

The second option is to marry a Briton)

Move alone?

With almost all visas, you can relocate with your family. However, be aware of the high cost of living, especially in London.

Things that are usually thought of last

England is one of the most expensive countries in Europe. At the same time, there is a lot of free things here, for example, medicine or museums. Flights to Europe cost less than in Russia. On this, perhaps, everything.

London has several zones, from 1 to 6, where the first zone is the center and the sixth is the farthest. An example of expenses in the first and second zones:

- One-way metro ride: £ 2.75

- Renting an apartment: studio £ 800-1500, two-room £ 2500-3500 / month + security deposit twice the monthly fee. The landlord may ask to pay six months in advance.

- Beer bottle: £ 3.50

- Breakfast at the cafe: £ 13

- A dozen eggs: £ 1.99

- Liter of gas: £ 1.24

- Big Mac: £ 4.29

- London-Moscow ticket: £ 60-120 (pre-pandemic)

- Fitness subscription: budget option £ 30-50, higher level - £ 100-180 per month. Yoga or Pilates lesson - £ 15-20.

Salaries in England

- Financiers take home £ 112,666 a year on average

- Top companies and sales managers have an income of £ 109,278

- Developers - £ 108,623. For example, one of the highest salaries for an IT developer on Facebook - an average of £ 85,000 per year before taxes - just over 8 million rubles per year

- Medical workers and doctors are also getting good money. The average salary for an orthodontist is £ 99,000, although government agencies pay several times less - £ 40,036 per year.

You can see the average salary level on Glassdoor.

Jobs in England are looked for on LinkedIn, local portals, Totaljobs or Indeed, positions in startups can be viewed on Angellist.

UK taxes

1. Personal income tax (Income tax). In England, it is calculated on a progressive scale. By earning up to £ 12,500, you are exempt from paying income tax. If your salary is £ 50,000-150,000, you will have to pay 40% of that, over 45%. The average salary in London is £ 27,000-35,000.

2. Social contributions (NIC, National Insurance Contribution). This tax is paid together with income tax. To avoid NIC charges, your salary must be no higher than £ 8,632 per year. If you get more than this figure and up to £ 50,000, you will have to pay 12% of the amount, more than £ 50,000 - 2%.

For example, you earn £ 30,000 a year, personal income tax will be 20% or £ 3,500, NIC another 12% or £ 2,564. That leaves £ 23,936 per year (£ 1,995 / month) at your disposal.

3. VAT (VAT). VAT is 20%.

Companies with a turnover of up to £ 85,000 are exempt from VAT. The obligation to pay VAT occurs when the company's income has exceeded this limit, you yourself must report this to HRMC.

4. Income tax. In the UK, it is 19%.

Tax services

There are many websites for calculating personal taxes, for example, www.tax.service.gov.uk/estimate-paye-take-home-pay/your-pay . Self-employed can use the portal www.stepchange.org/debt-info/self-employed-income-calculator.aspx .

It is much more difficult to calculate the taxes of legal entities, there are many variables, so the services are unlikely to help here.

Tax incentives

1. R&D tax credit

Under this program, a legal entity registered in the UK that spends funds on research can receive a cashback from the state in the amount of 33%. In this case, you can get your money back, even if the development was not done by a company, but by contractors from any country. This scheme allows you to reduce income tax.

2. SEIS / EIS

These investment schemes increase the company's attractiveness for venture capital financing. If the project has received permission to use SEIS or EIS, any investor entering the startup can apply for a tax deduction on capital income, while he is exempted from taxes on any profit received from the sale of startup shares after 3 years.

Benefits apply only to UK tax residents.

Example:

Greg sold a house for £ 250,000, receiving £ 50,000 and invested in a technology company. Under the investment scheme, the tax was reduced by £ 14,000. The rest of £ 200,000 Greg can use whatever he wants. In addition, the EIS income tax deduction will be £ 50,000 X 30% = £ 15,000. For example, Greg had a £ 200,000 home construction cost, the income tax would then be (£ 250,000 - £ 200,0000) * 45% (income over 150,000 is taxed 45%) = £ 22,500, which is reduced by £ 15,000. he will only have to pay £ 7,500.

3. Patent Box

The Patent Box is a piece of legislation designed to help innovative companies lower corporate taxes and encourage them to continue doing business in the UK. While R&D tax credit is aimed at helping growing startups, the Patent box is aimed at companies that have already successfully commercialized their project and turned out to be profitable.

Patents must be registered in specific jurisdictions.

The cost of filing a Patent Box is around £ 10,000, so it is economically viable when you get more of the benefit than you spend on it.

A little about the culture of the British

In the business environment, I noticed several interesting points. The British do not like it when something is directly sold to them. This applies to both B2B and B2C. Effective Facebook ads for them are where you share information, not offer to buy.

Here you also need to establish contacts before any meeting. Build relationships, for example, at social gatherings or over a pint of beer. Don't be surprised if at 17-18 o'clock, passing by the pub, you see a crowd of people with glasses of beer. Deals close here more slowly than in Russia, but with pleasure.

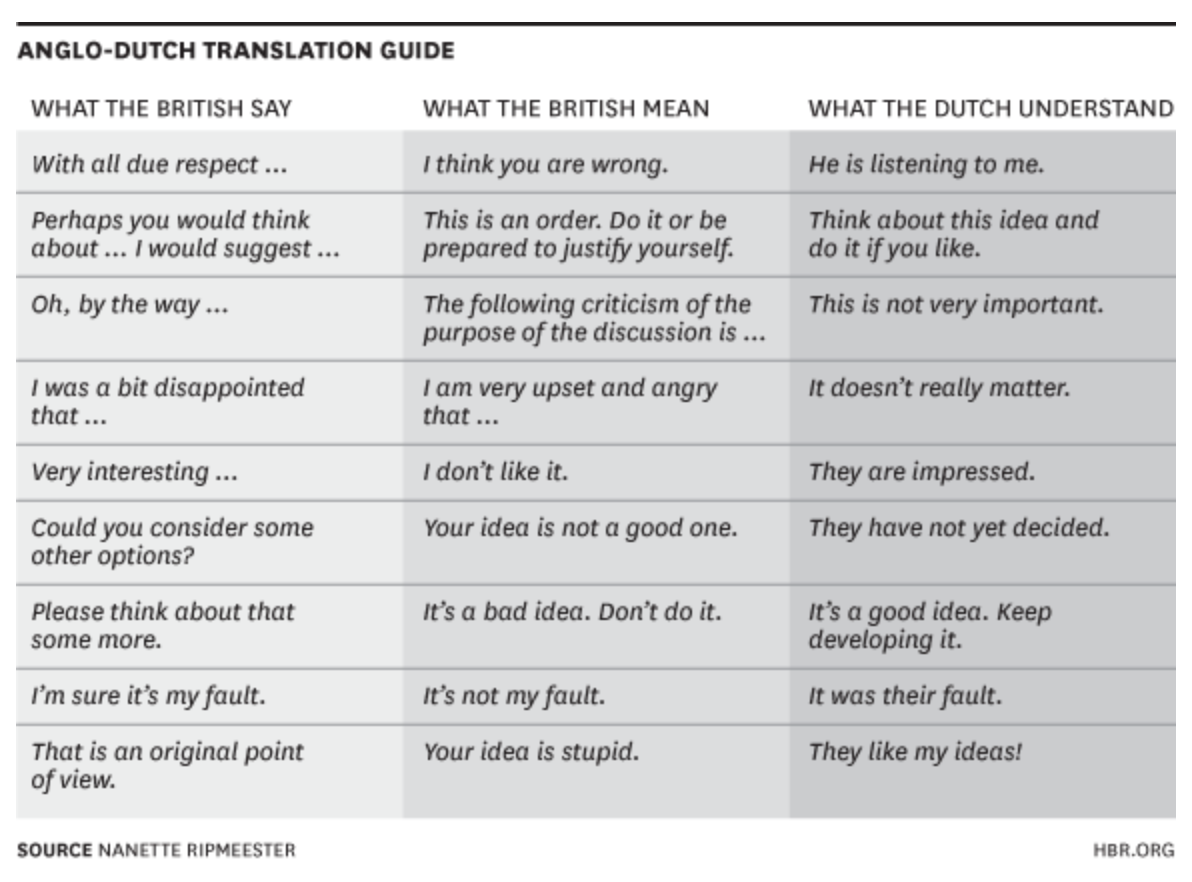

In England, there are strict rules for the tone of voice: here you need not only to understand WHAT a person is saying, but also HOW he says it. For example, if you hear the phrase: “This sounds very interesting”, most likely your interlocutor did not understand anything at all or considers your idea to be stupid and will no longer answer your call.

In the United Kingdom, people find it difficult to give personal feedback and say no to their face, so they prefer to remain silent or not respond. This makes them very different from their business partners from the USA or Germany.

Despite the high salaries and the aristocratic accent, the British are people just like us. They are used to foreigners from the cradle, but sometimes they are wary of Russians.