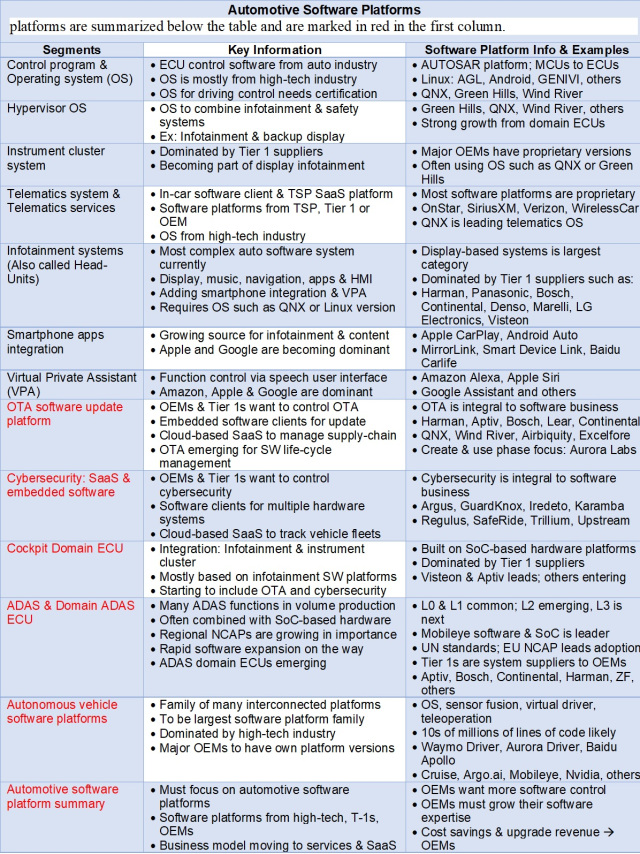

The first seven entries in this table were covered in a previous article . The rest of the software platforms are summarized, they are marked in red in the first column.

Note: AUTOSAR = AUTomotive Open System ARchitecture; AGL = Automotive Grade Linux; CS = Cybersecurity; ECU = Electronic control unit; NCAP = European New Car Assessment Program; SoC = Systems on a Chip; SW = SW; TSP = Telematic Service Provider; UN = UN.

Automakers need smart software strategies. The growing amount of software functionality in new car models will require manufacturers to improve their skills in this area, and yet there is something missing in the automotive industry.

Software expertise and experience are becoming key competencies that are lacking in the automotive industry. The growing amount of software functionality in new car models will require OEMs, Tier-1 vendors and software developers to upgrade their skills. Software platform development is a necessary strategy to keep pace with the software boom driven by the increased demand for connected vehicles, multi-application infotainment systems and multiple ADAS features.

In this article, I'll summarize my overview of the challenges and opportunities in the automotive industry. To do this, we will consider software platforms for automotive, market conditions and technology trends. This is the third part in a series of articles published over the course of a month, all of which focused on software platforms.

First of all, let me summarize the current state of the market for current software platforms in the automotive industry - for this, the table above is presented.

Over the air software platforms

Over the air software update (OTA) technology has come from the high-tech industry, and such systems are becoming an integral part of the automotive software market. It is especially important for the automotive industry to work with key platforms that can be upgraded over the air - and Tier-1 suppliers must be in the lead in this market.

Harman (in conjunction with the 2015 acquisitions of Red Bend and Symphony-Teleca) is the leading provider of over-the-air systems. Also, after the purchase of Movimento in 2017, Aptiv entered this market segment. There are also a number of other Tier-1 vendors providing OTA solutions through acquisitions or partnerships with high-tech vendors. This lineup includes GM, Ford, BMW and Tesla, and other OEMs may be joining in the future. Tesla's software updates are based on solutions from Harman. Tesla is leading the way in the OTA space - the company currently releases about 10 major updates to its ECUs every year (not counting numerous updates to the autopilot system).

Some automakers develop their own OTA platforms, usually combining their own know-how and available technologies from existing solutions. Harman's Redbend OTA software platform is considered the leader in remote software updates for the automotive industry.

There is also a new over-the-air upgrade technology emerging now, and it is positioning OTA as lifecycle management software with a focus on development and use phases. Thus, OTA functionality will be integrated with software development platforms as part of their maintenance tools. An example of a company taking this approach is Aurora Labs. The strategy is to use the OTA platform as a software forecasting tool to help identify and fix software bugs. This trend is also pushing OTA platforms into the service market.

Cybersecurity platforms

Cybersecurity software must protect the various systems present in the vehicle. In vehicles with network functionality, the components that are responsible for the networking are extremely important. To protect them, you need special software (and built-in hardware components) that are responsible for ensuring cybersecurity. In addition, the network devices can be equipped with software to protect the data processed by various vehicle systems. The most critical ECUs also have built-in data protection software. There are many cybersecurity companies that focus on the automotive industry (and many of them were just startups). Examples of such companies are Argus (acquired by Continental), GuardKnox, Karamba, Iredeto, Regulus Cyber, SafeRide Technologies and Trillium Secure.

Argus is regarded as the market leader in automotive cybersecurity. Regulus Cyber solutions include protection against GPS spoofing (which is an increasingly serious problem). SafeRide solutions protect automotive Ethernet networks.

It is also necessary to note the importance of cybersecurity solutions, which are cloud SaaS platforms - they are usually called cybersecurity operations centers (SOCs - Security Operation Center). Cloud SaaS platforms can be used without automotive cybersecurity clients for fleets. Upstream Security is one of the leading providers of similar services to the automotive industry. Some companies offering cybersecurity software to customers also offer SaaS platforms that interact with their automotive software clients and / or hardware.

ECU platforms used in the cabin

Cabin ECUs combine cockpit display and infotainment functions into a single system. Systems with these control units can include multiple displays - such as instrument displays, center and HUD displays. Infotainment systems include several subsystems: car audio, a variety of user interfaces (knobs, touchscreens, speech recognition) and smartphone app integration. Telematics systems are likely to be implemented in top-end versions.

This integration requires more powerful software platforms and is built on high-performance hardware platforms with systems on chips. The benefit of this integration is the elimination of multiple ECUs and subsystems, resulting in savings in hardware costs, fewer parts and suppliers, and savings in weight and space.

For the most part, software platforms for cabin ECUs are based on platforms for infotainment systems (such as operating systems, OTA systems, cybersecurity solutions, voice assistants, smartphone application integration systems, and others). By definition, an OS must serve security-critical systems - this is required by ISO 26262 certification. If Linux is used, then a hypervisor and an additional certified OS will be required.

The ECU cabin industry is still developing as large-scale production only started in 2017. The growth potential of software platforms and SoC chips is significant (tens of millions of such devices may be produced after 2025).

One of the first leaders in the salon control unit market was Visteon (along with Aptiv, the first to enter the market). Also, many Tier-1 suppliers are ready for serial production of their products in this area: Bosch, Continental, Harman, Marelli and Panasonic.

Software platforms for ADAS

ADAS systems include many functions to assist drivers while driving. ADAS systems take into account SAE levels of autonomy: from 0 to 3. There is no automation at level zero, it only implies warning functions (for example, parking assistance, blind spot, lane departure and collision warnings, and driver monitoring) ... Zero-level features are available in almost all vehicles sold in most countries.

Level 1 functions provide driver assistance and limited vehicle control. The three main features of this level are adaptive cruise control, lane centering and semi-automatic parking. The second level implies partial automation, but the driver is still required to constantly monitor the car. The second-level features include traffic jam assistance and partial autopilot. The third layer is predominantly composed of advanced autopilot systems for various driving conditions (such as highways, low-speed urban areas and automatic parking). The driver can be distracted from the driving process, but he must be ready to take control within a few seconds if the third level system requires it.

All functions of ADAS systems are determined by software that receives data from cameras, radars and ultrasonic sensors. For systems of levels 2 and 3, budget lidars are being developed.

Regulations are a very important factor in talking about the growth of the ADAS market as the UN has adopted comprehensive safety standards. These standards are being implemented by many regional NCAP organizations. European New Car Evaluation Organizations are on a very aggressive schedule.

Initially, the market created control units for ADAS systems with an eye to integrating level 0 and 1 functionality. The main focus in the work on such ECUs is made on functions of levels 2 and 3, for which various systems on chips and large software platforms are used.

If you are looking for detailed information on ADAS implementation, IHS Markit has historical and predictive OEM and device model data in the context of all ADAS functionality (including sensor, application and vendor information).

Self-driving car software platforms

Self-driving vehicle software platforms will be multifunctional and complex. Virtual driver software is likely to need the most complex platforms with a huge codebase. Many companies are developing software platforms for unmanned vehicles. In order to get an idea of the many players in this market, this article provides a picture of the key companies and the connections between them. This picture was collected in early May 2020 and a lot has already changed. The diagram will be updated this fall.

Sensor suite software is another area of software platform development that is closely related to virtual driver software. These platforms include a variety of AI technologies. Many companies develop, test and improve the functionality of sensor sets, platform components, or underlying algorithms. Most virtual driver software companies are also developing software platforms for sensor kits.

Also, many expect that the market will be very important software platforms for the remote control of unmanned vehicles. Remote Control is mandatory in California in vehicles where there is no human driver to ensure driving safety (and many other regions copy this policy). Remote control technology companies include Phantom Auto, Ottopia, Designated Driver and DriveU.

Self-driving vehicle software will require a modern operating system to manage all software and hardware, including multiple sensors. QNX is well positioned in the UAV market, and Nvidia and many others have chosen it for their solutions.

It's important to remember that most OEMs want to have their own version of the autonomous vehicle software platform. This is the standard approach in the automotive industry and is likely to expand to software platforms for autonomous vehicles. One question remains - will Tier-1 vendors deal with software platforms for OEMs (and if so, how many players will there be in this market?).

The software platform segment for unmanned vehicles is diverse, complex and growing very rapidly. When there is more information, it is worth writing a separate article about this topic.

Prospects for the cost of software in the automotive industry

Estimating the value of automotive software is often an art form and is no easier to do than it is for software in other industries. Let's take a look at the big picture first - how much will it cost to develop all the new software for a car? Let's say the code base of such a project will be 100 million lines. So we need to calculate the cost of writing one line of code. There is a lot of data on various segments of the software development market. I think the most useful data (in the context of automotive software) will be from a post by Phil Koopman published in October 2010.

This post states that the cost per line of code for embedded software ranges from $ 15 to $ 40. For $ 40, you get robust, well thought out industrial-grade code that can be applied to the automotive industry. Since this data is almost ten years old, the cost has probably increased, but I'll start with the $ 40 figure. This means that it would cost $ 4 billion to develop a system suitable for use in cars with a 100 million line code base. Obviously, it follows that many people want to reuse and update automotive software platforms as much as possible.

The next aspect of estimating software costs is software royalties per customer included in annual vehicle sales. Typically, these royalties are a few dollars (or less) per unit sold. Royalties for using an OS (such as QNX) will range from $ 10 or less (for telematics systems) to $ 15 (for infotainment systems). This does not include the cost of maintaining and updating the software - they are usually negotiated separately as part of a development project.

The cost of developing automotive software varies depending on the ECU segment. Software development for infotainment systems is common, and is a necessity for most new models. The high-end infotainment system for the new model will cost about $ 20 million for software and the same for hardware. The average development time will be 2-3 years, (including all tests and verification).

What about the cost of driverless vehicle software? There is a lot we do not know yet due to the fact that many aspects are unclear. Be that as it may, venture capital investments in this industry have already exceeded $ 20 billion, although not all of this money has been spent so far.

The autonomous vehicle industry will use several software platforms that will generate sales royalties (as well as service charges for SaaS services until the very end of their lifecycle). The royalties in the autonomous vehicle software market will cost significantly more, ranging from $ 150 to $ 300 per vehicle. However, the bulk of autonomous vehicle software revenue will come from monthly SaaS service fees collected from all autonomous vehicles on the road. Annual fees will roughly equal the original royalties. SaaS service fees can be recalculated based on mileage - then the cost for each individual vehicle will be lower.

Conclusion

OEMs able to leverage and combine software platforms and third-party expertise and expertise with their own solutions will be winners in the long term in the fast-growing software-driven transport market (given the many innovations coming from high-tech software firms.)

OEMs want more control over the software as it defines most of the car's functions (and how users interact with their cars). However, OEMs must rely on modular software platforms and innovations that software vendors create.

The automotive software business model is shifting towards SaaS-based services and relationships. This is good for software vendors, as their revenues are proportional to car revenues (which can be 10 times the annual sales). But OEMs will need to lower overall costs by building more reliable software. OEMs also expect upgraded software functionality to generate more revenue over the life of the software (as Tesla already does).

- Russia's first serial control system for a dual-fuel engine with functional separation of controllers

- There are more lines of code in a modern car than ...

- Free Online Courses in Automotive, Aerospace, Robotics and Engineering (50+)

- McKinsey: rethinking software and electronics architecture in automotive