There are many accounting systems for small businesses, in addition to the 1C products that hold a monopoly position on the Russian market. There are, for example, specialized cloud solutions and online banking services, which can be accessed along with settlement and cash services. For all popular products, you have to regularly pay a fairly decent amount of money, which is quite justified in the presence of hired employees and rather complex business processes. If an individual entrepreneur works himself and applies a simplified taxation system, there is no point in paying 5-10 thousand rubles a year just for the right to keep accounting records and form a tax return. In a short article, we will try to figure out how microbusiness can save some micro money by using alternative programs.

What are the challenges?

Suppliers of expensive accounting systems scare entrepreneurs by constantly changing reporting forms: they say, only we keep pace with the initiatives of legislators and regulators, and therefore there is a risk of getting a fine due to untimely introduction of changes to the program of third-party developers. For fairly large enterprises with different types of activities, employees and complex reporting, this is quite true, since even a qualified accountant is not easy to keep track of a crazy printer.

Let's try to understand how the problem is relevant for a solo microentrepreneur who uses the simplified tax system, possibly combining this special regime with patents. Let's break down the tasks related to accounting and reporting that may arise at least theoretically:

- (, ..);

- ( );

- , , ;

- , / ( ) ;

- ;

- ;

- ;

- ( );

- ( ).

At first glance, our spherical IP in a vacuum has many problems. In fact, this is not the case. Outwardly, he usually issues taxes and contributions to the state for himself, as well as one single document - a tax return of the approved format. This is where the tax reporting ends, and from our accounting IP we only need a book of income and expenses (KUDiR). To conduct business, an entrepreneur needs to work with primary accounting, financial accounting and integration with banks. The need to accept payments from individuals, keep records of goods in a warehouse, or, say, combine a simplified taxation with a patent may complicate matters somewhat, but the difference is not fundamental.

Rosstat periodically requests some kind of reporting, but in practice this rarely happens: once every five years with continuous observation, the rest of the time the department is not interested in any small things. To avoid getting fines, just check on the websitethe need to submit the appropriate forms (paper notices may not be received), download the forms, fill them in Excel and send them to the authorities - this process does not require automation. As for the KUDiR, it can be kept electronically in any accounting system and printed only if the tax office requires paper for verification. Practice shows that the probability of this event tends to zero, because the tax authorities are not particularly interested in small entrepreneurs as long as they give the state their due share of the profits and do not perform dubious transactions.

What solutions does the market offer?

There are really a lot of various tools for automating the difficult life of a small individual entrepreneur, and therefore they need to be classified with a listing of the main advantages and disadvantages:

- Boxed version of 1C: Enterprise for small business ("Simplified" configuration and that's all). At first glance, the product is inexpensive, but buying and forgetting is not about 1C, because at a low start there is already a franchisee with a milking machine in the form of an ITS agreement. A lone individual entrepreneur does not seem to need it, but otherwise you will not receive updates through the portal. You will have to pay for the local version of 1C regularly, put up with it;

- 1: — «» . , () , . , ;

- -. , . - , . , . , ( ), ;

- 1: RuVDS. . VDS , . , . , -, . , - — ;

- 1: iOS/iPadOS Android. , . . ( ) , 1 ( «»);

- ERP. . - , . .

- - Windows. 1: , , . , .

?

1C: Enterprise has quite a few competitors. There are various ERP systems for large companies as well as simple solutions for small businesses. The latter are most often shareware: you will have to buy additional features and / or support. It is especially pleasing that these programs can not only be downloaded and installed, but also updated for free. Here is a far from complete list of 1C alternatives: FE USN 2 , Info-Enterprise , Business Pack and Svoya Tekhnologiya... In terms of functionality, they are inferior to the solutions of the market leader, but it is easier for people without an accounting education to work with alternative programs. For the test, we chose the first two options for the optimal combination of the features of the free version, usability, frequency of updates and the cost of commercial licenses.

How to deploy?

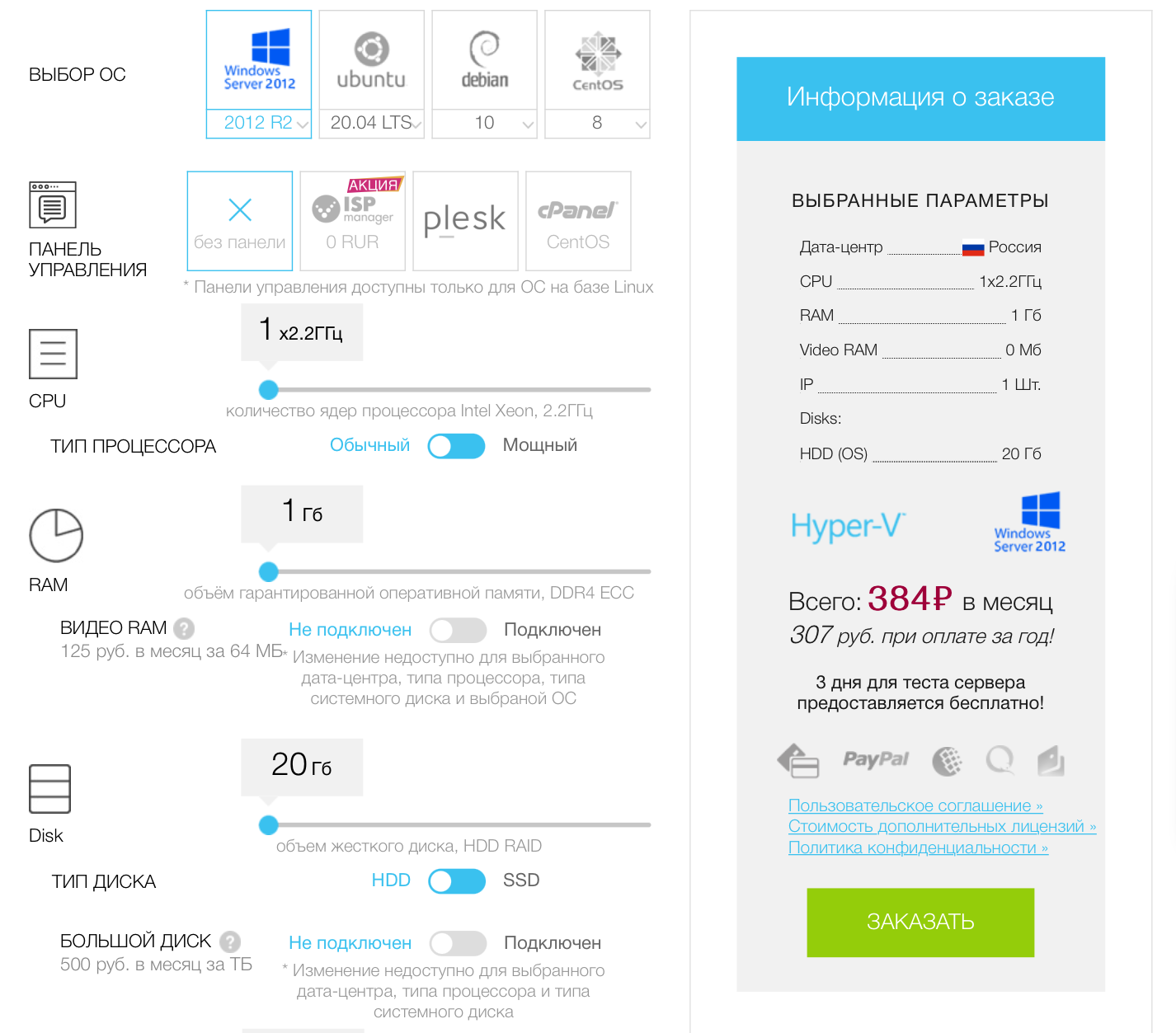

Shareware accounting programs are not particularly demanding on resources and work even on Windows XP. You can deploy them on your local computer or on an inexpensive virtual server. The advantages of the second option are that there is no need to purchase and maintain equipment and the ability to access the system from anywhere in the world where there is Internet. Using VDS, it is not difficult to organize multi-user remote work, should such a need arise. Expensive rates are not required for this: we ran all tests on a machine with a minimal configuration and Windows Server 2012.

Next, you need to download the selected distribution kit and install it on the virtual server.

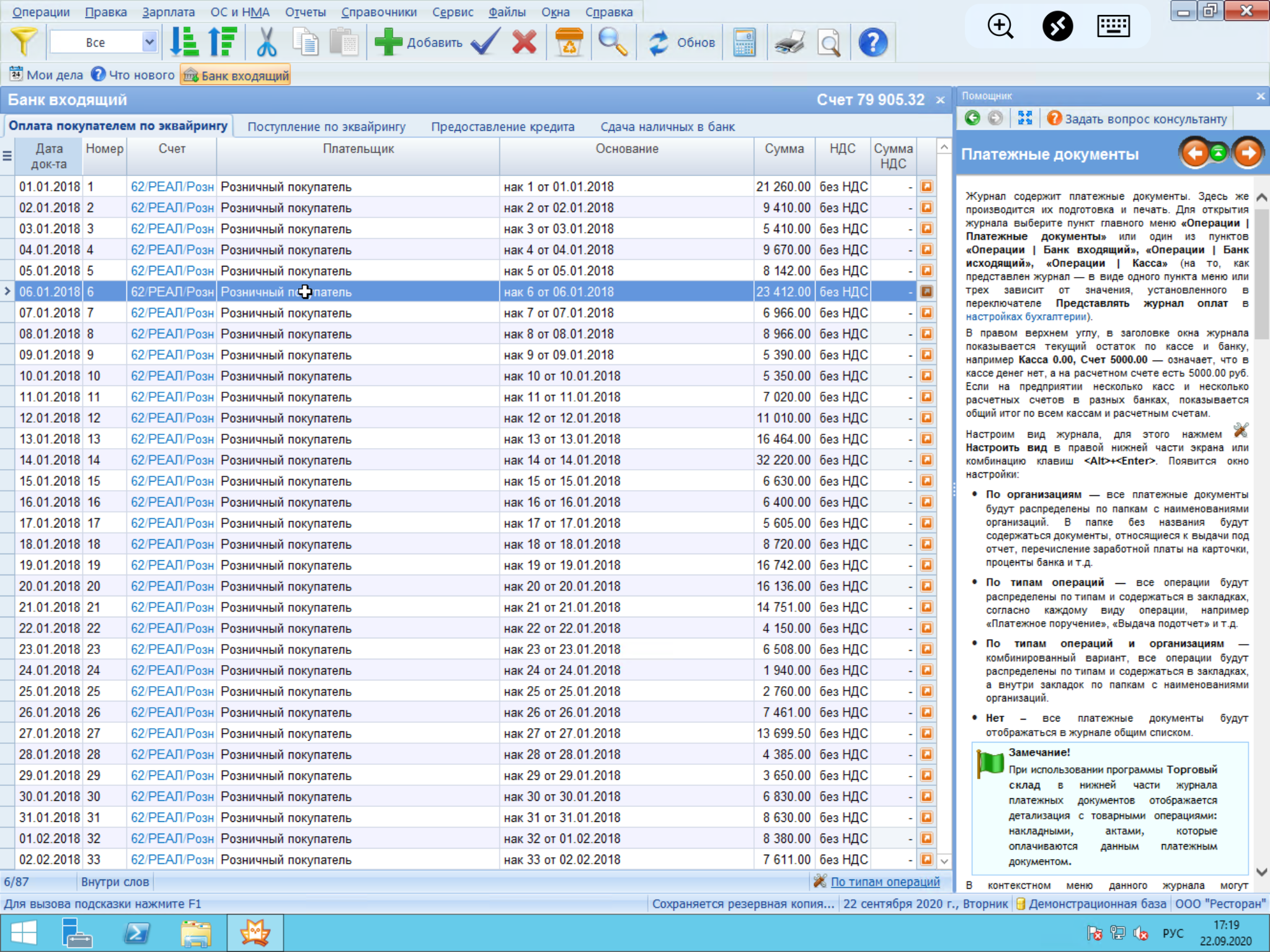

Let's start with SP USN 2 . The program also requires .NET Framework 2.0 or higher to work. With an annual turnover of up to 1 million rubles, it can be used free of charge, and with a higher turnover, the license costs 1000 rubles a year. The user has access to financial accounting functions (banking and cash transactions), working with primary documents, automatic calculation of taxes and contributions, preparation of tax reports and other features, including integration with EDM systems and a client bank, a contract designer and a variety of reference books. Only the 6% simplified tax system is supported without employees. Once launched, the program regularly checks for updates on the developer's website.

The accounting capabilities of Info-Enterprise are much wider , in addition, the developer offers other products, and the free delivery includes tax accounting for different taxation regimes (ORN, USN, USN based on a patent, Unified agricultural tax, UTII), work with primary documents, financial accounting , interaction with banks and cash desk. Also available free of charge module "Salary", personnel records, internal reports and multidimensional analytics. The free version lacks multi-user capabilities, embedded programming, as well as some additional functions and integration with other developer products for complex enterprise automation. A detailed comparison of versions is available on the website .

We looked at one simple program for individual entrepreneurs on the STS 6% without employees and one advanced development, suitable for a larger business. The conclusion is simple: Russia has up-to-date accounting systems that can be used for free. They are done well, but in order to make the right choice, entrepreneurs are better off deploying the programs themselves. We recommend using our virtual server for tests )

If the topic interests the blog readers, we will study it in more detail. A lot of interesting things remained behind the scenes: integration of the accounting application launched on VDS with legally significant EDM systems, remote reporting, work with cash register machines, etc.