Against the background of the latest news about the revision of agreements on avoidance of double taxation between Russia and transit and / or offshore countries and the introduction of a preferential tax regime for IT companies in Russia, I will tell you about the main factors in choosing a jurisdiction.

The main purposes of registering a company outside of Russia:

- Minimizing the tax burden

- Easier introduction of your product to the international market

- Legal risks associated with the imperfection of Russian legislation

Tax

When creating a company, an entrepreneur usually wants to receive as much profit as possible and continue to invest it in the development of the company, or to take it for himself in the form of dividends or entertainment expenses.

Taxes that reduce profits: VAT and personal income tax. After them, you must pay income tax at the end of the reporting year. If you made a profit this year, and you plan to spend it on business development only next year, you still have to pay income tax, and you can only invest a reduced amount.

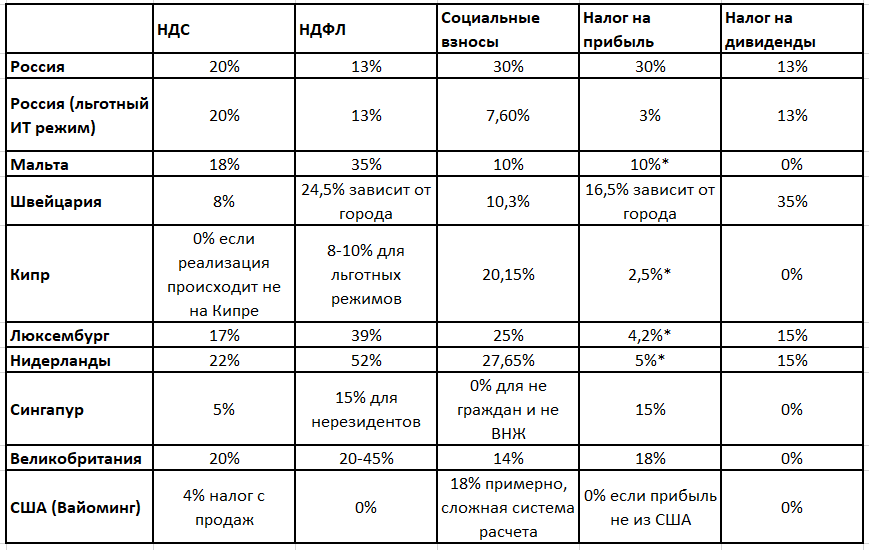

Below are the tax rates for the most popular jurisdictions. Taxes marked with "*" are concessional taxes applicable to IT companies.

Let's assume a simplified business model with the following articles:

- Revenue - 100

- Salary - 40

- Other costs - 15

Where the only income is sales revenue. Payroll costs account for 40% of revenue, other costs 15%. In a completely tax-free world, an entrepreneur would have 45 units of profit left.

Having recalculated the main taxes, we get the following distribution of countries according to the money remaining with the entrepreneur for reinvestment and withdrawal as dividends.

As you can see, Russia, even with a preferential regime, is not becoming the most attractive option due to the absence of VAT, personal income tax and dividend tax benefits. Nevertheless, the tax burden has more than halved, and the lag behind the leaders is no longer so critical. You should also take into account that Wyoming offers 0% income tax only if the proceeds are received from a company outside the United States. Otherwise the tax is 21%.

Luxembourg, the Netherlands, Malta in this situation look unattractive, because the example assumes the use of labor in the country where the company is located. In fact, large holdings outsource employees from countries with low income taxes and social contributions.

international market

The easiest way to interact with counterparties is when you are in the same jurisdiction or in the same legal field (EU zone, Anglo-Saxon system). Payments pass between you faster, in case of disputes there is no cross-border and language barrier and both parties have more confidence in the reliability, solvency and legality of each other. In addition, a number of states have their own black lists of countries with which it is better not to make payments or to carry out only if there is a large number of supporting documents.

Unfortunately, Russia is currently under sanctions. There are rumors about the risks of disconnecting from the SWIFT system. In such an environment, the registration of a company in Russia calls into question the possibility of comfortable interaction with foreign partners.

See where most of your competitors and counterparties are registered. Most likely, this country is optimal.

Legal risks

This can also include the problems of political instability that caused companies to leave Belarus.

Below is the ranking of countries in the world for the protection of intellectual property for 2019 . Russia is in 86th place out of 129 countries.

The choice of jurisdiction depends on many factors. Do not forget about the higher costs of maintaining an office and nominee directors in another country. At the same time, minimizing the tax burden is often the only way not to go broke. And the lack of confidence in the protection of property rights and the possibility of full participation in the global market is demotivating to create something.