Everything goes to the fact that automotive electronics will be determined by software.

Since the introduction of various electromechanical and electronic components, cars have become the most complex series production products in the last 50 years. During this time, electronic systems have supplemented (and replaced) various units and systems, and there is still much to be done.

All this means that sooner or later, automotive systems will become the most complex products to manufacture in the electronics market (they may already be significantly different from all other products). Yes, it is possible that aircraft components are more complex in terms of parts, and supercomputers have more complex electronics, but they are not produced in the tens of millions every year.

Thanks to electronic systems, a lot more software is used in cars - the amount of use depends on the car. There are many articles claiming that there are over 100 million lines of code used in modern cars. I have not seen a detailed breakdown that would explain what is included in these 100 million - if such exists, its data can be very useful. Of course, the further ADAS systems, the Internet of cars, networking technologies, cybersecurity and self-driving systems develop, the more software components will be used in cars.

I have not seen any discussion of automotive software in the context of strategic decisions, software market segments, key technologies, or other important issues. In this text, we will look at all these issues, as well as explore the prospects for the automotive software market. There are significant differences between hardware and software in automobiles, and it is these differences that influence the success of the automotive software market.

Automotive software has come a long way over the past two decades. In the 1990s, automotive software was only used to control embedded electronics in driving systems and simple entertainment devices. The complexity of these systems increased significantly over time, but only a few (if any) embedded systems used a million lines of code. Automakers and their suppliers have handled the development of embedded systems in-house.

That all changed in the 1990s, when infotainment and navigation systems gained a multitude of features and capabilities that required a complete operating system to handle the complexity of software. Operating systems have pushed high-tech companies into the automotive market (such companies include QNX, Green Hills, Wind River, Microsoft, and many others). In recent years, the importance of open source software (such as Linux) has grown significantly in the automotive industry.

Development-Build-Marketing-Use Concept

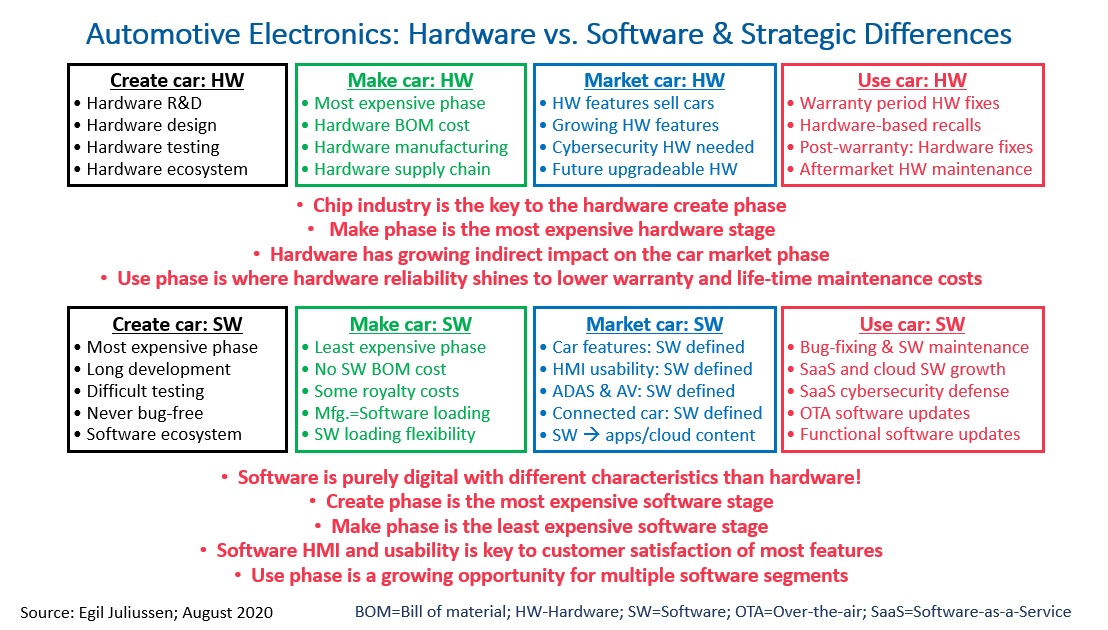

The image below shows all the differences between hardware and software in cars. However, the structure of this comparison requires some explanation. The picture shows the 4 phases that all products and industries go through. The development phase is the process of researching and working on creating a product. The assembly phase involves the production of the product - including the cost of all parts, the cost of manufacturing facilities and the supply chain. The third phase is marketing. This phase includes aspects such as advertising, sales and working with distribution channels - all the operations required to deliver a product to a direct customer. The fourth phase - use - in the automotive industry is quite lengthy.

I was introduced to the design-build-marketing concept at Texas Instruments and it was very popular in the 70's and 80's. When I was working at IHS Markit I added a use phase. I used different insights from these phases in reports and presentations as a tool to analyze different segments of the automotive market (including software, batteries in electric vehicles, 3D printing, and many others).

The diagram below highlights the individual importance of each of the four steps to hardware and software. It also provides comments on how these components affect the market success of a vehicle at each stage.

Hardware phases

At the top of the diagram are the key characteristics of each of the four phases of building a vehicle's hardware. The development phase defines a set of characteristics and properties of electronic systems, and its importance continues to grow to this day. Most of the hardware components are sourced from companies in the chip industry, and this industry will only grow. The ecosystem of hardware platforms used in automotive electronics is also gaining in importance. The cost of the first phase of hardware development is estimated at millions (or tens of millions) of dollars, but since the production volume is hundreds of thousands of units, the cost per vehicle is not high.

The build phase is the most expensive in this chain. This is due to the cost of all hardware components (or bill of materials). It is also necessary to consider the cost of supply chain management, the cost of human labor and many other aspects. In general, hardware costs represent a small fraction of the total cost of a vehicle, but this amount increases even when the cost of individual components decreases. The average cost of all components of electronic systems is from 3 to 8 thousand dollars (the upper limit applies to luxury cars).

The marketing phase for hardware varies depending on the components and type of system. In most cases, this phase is handled by a Tier-1 vendor, resulting in the product becoming a complete automotive electronics system.

The characteristics and capabilities of hardware components also have a very large impact on vehicle sales (and this impact continues to grow). This influence arises from the functionality provided by the components of electronic systems. Opportunities that are currently being worked on (as well as opportunities that will emerge in the future) relate to ADAS systems, cybersecurity hardware, enhanceable platforms and self-driving technologies.

The use phase of automotive products lasts on average 10 to 15 years, sometimes a little longer. This long lifespan requires high reliability of the equipment in order to reduce manufacturers' warranty and recall campaign costs. During the use phase, the aftermarket market has the greatest opportunity - especially after the components are out of the factory warranty. The significant number of accidents also creates business opportunities for these companies, as the damaged vehicles require new hardware components.

Phases of software development

At the bottom of the diagram are the key characteristics of the four phases of an automotive software development. The software exists exclusively in digital form, and therefore its characteristics differ from those of the hardware. However, software is, of course, entirely dependent on the associated hardware components.

The development phase is the longest and, as a rule, the most expensive stage of creating a software product. Large software projects require a long development time, which, among other things, is spent on complex testing procedures to fix as many errors as possible (which is absolutely justified from an economic point of view). No major software platform is ever bug-free, and new bugs are discovered throughout the life of the software. Cybersecurity requirements have created a new class of software bugs - vulnerabilities that can be exploited by attackers for various purposes. Since most programmers in the automotive industry are not cybersecurity experts, they don't always know how to write code in a way thatso that it is completely immune to hacker attacks.

The assembly phase of automotive software puts forward significant demands on the ecosystem - we are talking about the need to write new programs and test the resulting software products. The automotive industry is doing well in this area (some also use open source development tools).

The build phase is also usually the cheapest - it is simply the launch of finished software on the existing hardware platform. Sometimes manufacturers are faced with the need to pay royalties, but usually this is only a small fraction of the cost of hardware components. The build phase is essentially the loading of programs into the vehicle's electronic systems. There is also some flexibility in terms of when and how software is loaded into electronic systems.

The marketing phase in the case of software varies by segment of use and type of software product. In most cases, the marketing phase is handled by a Tier-1 supplier, presenting the software product as part of the vehicle's electronic systems.

Software functionality has a significant impact on vehicle sales. Much of this impact is based on usability or how the software implements the Human Machine Interface (HMI). Ease of use affects all areas of functionality - car internet features, over-the-air updates, feature updates, ADAS systems, and future self-driving features. A low level of software usability will lead to negative reviews, which will negatively affect the potential of a particular model. These negative trends are a problem for today's infotainment systems and one of the reasons for the recent success of Apple and Google in integrating infotainment systems with smartphones.

The use phase of automotive products lasts 10 to 15 years, longer in some countries. With such a long life cycle, automobiles require numerous software bug fixes. The reduction in bug fix costs resulting from over-the-air upgradeability is necessary to save on warranty service and recall campaigns.

The use phase is a stage in which the software market can develop significantly and has great prospects for growth in the SaaS (Software as a Service) and cloud software segments. SaaS-based cybersecurity is a very promising opportunity. Over the air bug fixes and feature updates are already seen as core capabilities in the product usage phase. It's worth noting that the SaaS-based infotainment market is booming. Also, new opportunities may arise due to accidents occurring, since new hardware systems will need to install new software.

Conclusion

The four stages of software development show that the development stage is the most expensive. This concept suggests that the solution is to use software platforms to reduce development costs and reduce errors in large software products. The automotive industry is starting to implement a software platform strategy, and the hi-tech market is helping it, but this is not enough.

Subscribe to the channels:

@TeslaHackers - a community of Russian Tesla hackers, rental and drift training on Tesla

@AutomotiveRu - auto industry news, hardware and driving psychology

About ITELMA

- automotive . 2500 , 650 .

, , . ( 30, ), -, -, - (DSP-) .

, . , , , . , automotive. , , .

, , . ( 30, ), -, -, - (DSP-) .

, . , , , . , automotive. , , .

Read more helpful articles:

- Free Online Courses in Automotive, Aerospace, Robotics and Engineering (50+)

- [] (, , )

- DEF CON 2018-2019

- [] Motornet —

- 16 , 8

- open source

- McKinsey: automotive

- …