Self-driving technologies rely heavily on vehicle connectivity, and managing this interaction is becoming more important than ever.

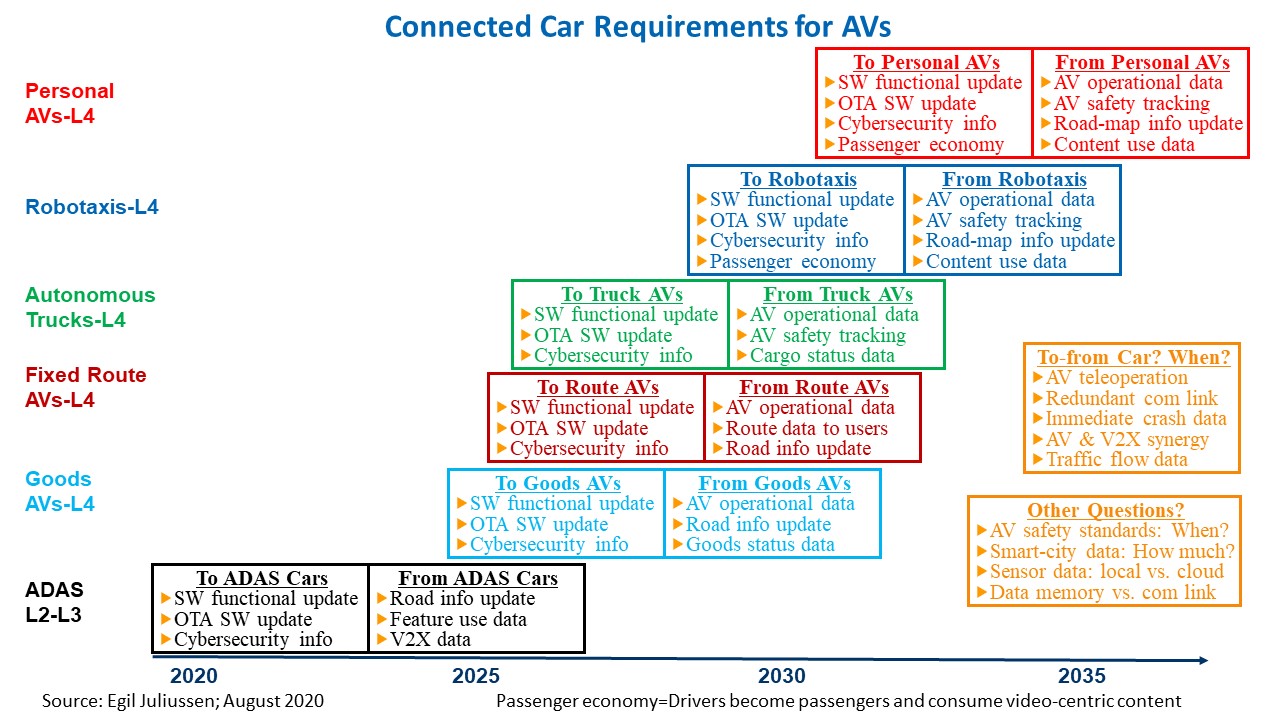

Self-driving technology is expected to have a significant impact on the internet of cars, as driverless cars will generate a significant amount of traffic (and cars will receive more input data). The graph below is my prediction of how autonomous vehicles will affect the data flow in networked vehicles. This forecast is an overview of the car internet industry and highlights the major market segments. The timeline presented also covers only the main use cases for autonomous vehicles (even though the timeframe for the deployment of these vehicles is rather blurry). The timeline below is, in my opinion, rather optimistic.

The graph uses color codes to indicate scenarios for using unmanned vehicles. ADAS systems (including Tier 2 and 3 systems) are marked in black. Unmanned vehicles for transporting goods are marked in light blue, robotic taxis in dark blue. Unmanned trucks are marked in green. Fixed route unmanned vehicles and personal unmanned vehicles are marked in red. Finally, some questions related to use cases for autonomous vehicles are highlighted in yellow on the right side of the graph.

Each category contains two blocks - with data entering the vehicle and data transmitted from the vehicle. These blocks represent many types of data, all of which will be discussed in detail below. As expected, the different use cases for autonomous vehicles will be equally important for the entire industry as they use similar technologies.

Cars with ADAS

The functions of the ADAS systems at the bottom of the graph are already beginning to influence the state of affairs in the industry. For cars with ADAS systems and functionality of 2 and 3 levels of autonomy, the cybersecurity factor is especially important, which increases the capacity of the car Internet market. For vehicles with ADAS systems, software updates over the air are also becoming increasingly important, as the reports from the American Automobile Association require significant improvements to these systems. Various functional updates are currently being released for ADAS systems, and over time this direction will only develop. This development in the industry indicates the following trend: ADAS systems will be updated more frequently than electronic control units.

It is also expected that the amount of data generated by vehicles with ADAS systems will grow. Level 2 and 3 vehicles require traffic and navigation information. Mobileye's Road Experience Management and Roadbook systems are becoming increasingly important.

Because there is a great deal of uncertainty about how drivers are using ADAS capabilities, it is important to collect and analyze ADAS capability use patterns. This factor can also affect the frequency of software updates.

Modern ADAS systems are likely to have support for V2X (vehicle networking) - even though the battle is between V2X-DSRC and C-V2X, two competing vehicle networking technologies. The deployment timing and pace of these systems are unclear, but V2X is likely to expand the range of use cases for the Internet of cars.

Unmanned vehicles for transporting goods

One of the consequences of the Covid-19 pandemic has become the fact that the transportation of goods using unmanned vehicles is becoming one of the main segments of the unmanned vehicle market. There are two types of unmanned vehicles for transporting goods: devices that move along sidewalks and vehicles that drive onto public roads. Since these vehicles have no passengers, many of the usual networked transport functions are no longer required. However, electronic control units will require extensive networking functionality (especially self-driving control units).

All this means that OTA updates (as well as functionality updates) will be especially important. Self-driving vehicles for the transport of goods can be used by fleet operators, whose vehicles can regularly return to base (usually this need arises several times a day). In this use case, security updates can be installed at the home maintenance station. Wireless technologies will remain the backbone of networking, although a cable connection may also be used for some functions.

Cybersecurity issues will also be very important for operator companies.

The operational data of such vehicles is likely to be of greatest importance. It is this data that can be the key to improving the software and hardware of self-driving cars (through comprehensive analysis).

Self-driving vehicles will use map and road data navigation systems to transport goods, and this data needs to be updated regularly. Thus, updates to road data will be collected by unmanned courier devices, and these updates will be distributed throughout the fleet as needed.

For customers of such services, data on which goods are loaded into the car and when they will be delivered will be crucial.

Unmanned vehicles with fixed routes

The Covid-19 pandemic has negatively impacted unmanned vehicles with fixed (and variable) routes, as the sharing of such vehicles has become undesirable. The list of possible scenarios for the use of unmanned vehicles with fixed routes includes travel in closed areas and various bus routes. The prospects for the use of such cars should bounce back (perhaps the understanding of this norm will change) within a year or two.

The key functionality of fixed-route vehicles overlaps with the functionality of delivery devices. Electronic control units will rely on a stable network connection and the frequency of functional updates will increase markedly.

Also, for each of the passengers of such a car, the issue of cybersecurity will become acute - significant software updates will be required to improve the reliability of various security systems (including the on-board software will need to carefully monitor any suspicious activity).

Operational data from vehicles with fixed routes will have the highest priority - they will be used to improve the safety and functionality of the software and hardware of these vehicles.

Users of unmanned route vehicles will be asked to access data on the availability and time of arrival of such vehicles in real time. The accuracy of this data will determine user satisfaction and frequency of service use.

Changes to road data will also be collected and recorded, but in this market segment they are not so important due to the fact that travel will be on a limited number of routes.

Unmanned trucks

As a result of the Covid-19 pandemic, there is a great demand for services for the transportation of various goods. The current market situation stimulates investment in the field of self-driving trucks. The unmanned cargo transportation industry is divided into different directions: transportation between transport hubs, trucks for closed areas and transportation along fixed routes.

Connectivity is critical for self-driving trucks. These trucks' ECUs will require a stable wireless connection, and over-the-air and feature updates will be released frequently.

Cybersecurity at various levels is important for all self-driving vehicles - especially for trucks, given the damage that can be caused by malicious hacker attacks. The majority of self-driving trucks will be cybersecurity fleets ranging from a wide range of onboard workflow tracking software to cloud-based operations centers.

For self-driving trucks, the operational data of other self-driving vehicles will be very important - they can be the key to ensuring the safety and functionality of software and hardware.

Tracking safety trends over the years will require additional data and analysis on the operation of autonomous truck fleets. This approach is required in all autonomous vehicle scenarios, but its implementation is especially important in the case of devices designed to replace human-driven vehicles. All this data is necessary in order to prove the safety of unmanned vehicles in comparison with those driven by a person - the data will allow you to evaluate various numerical metrics, analyze driving conditions and other similar data.

Cargo and truck health data is important today, but it will be critical in the future supply chain (powered by self-driving vehicles). In the future, the requirements for both the details of this data and the frequency of their updating will increase.

Robotaxi

Most of the robotic taxi tests were carried out at the very beginning of the Covid-19 pandemic, later there were delays and cancellations of tests. Almost all tests of the robotic taxi were attended by a human driver who monitored the safety of the system. About 5% of Waymo's Phoenix test drives were driverless. California law allows test driving without a driver, but requires remote control. Chinese authorities are also starting to allow driverless self-driving vehicles in some regions of the country.

Robotaxi puts forward much more weighty requirements for the operation of a wireless connection, compared to unmanned vehicles, which were discussed earlier. As in other areas of the industry, vehicle control electronics require high-speed wireless connectivity for frequent software updates and enhanced functionality.

Also, robotic taxis need extensive cybersecurity capabilities. Most of the robotaxis will be part of fleets that sell rides, and these vehicles will have built-in hardware and software protections. Cloud operations centers will track, analyze and compare network communication operations to find unusual patterns so that they can investigate and take action when necessary.

Robotaxi is expected to offer its passengers a wide range of content - including video content that previously could not be consumed by regular car drivers. This phenomenon is often referred to as the "passenger economy" - it celebrates the fact that the driver has also become a passenger and is able to consume video content. When using video, bandwidth requirements increase significantly, and work on this issue will begin in the field of robotaxi after the start of the deployment of services.

Mobileye's Roadbook is a lane-lined roadmap (Source: Mobileye)

Operational data will be especially important for the operation of robotic taxis - they can be obtained from various data arrays that arise during the operation of vehicle fleets. Analyzing this data could be the key to ensuring the safety and functionality of the robotaxi hardware and software.

Additional information and analysis of fleet operations will be used to improve robotic taxi security systems for decades. Such data and its analysis will be required in order to prove that robotic taxis will be safer than existing taxi companies with human drivers. It is important to determine the driving conditions most suitable for the robotic taxi operation. If the industry can determine what data is worth tracking and how to use it, it will be possible to formulate industry standards for analyzing and comparing the results (as well as the results themselves that will advance the safety of autonomous vehicles in a global perspective).

Test vehicles are already collecting traffic information and changes in road conditions, and as services continue to roll out, these processes will continue and gain momentum.

The passenger economy, in turn, will increase the need for statistical data on content consumption in robotaxi. The key question is what privacy settings the user can control.

Personal unmanned vehicles

Personal unmanned vehicles of the 4th level will appear very soon, and the prospects for their development and deployment are very blurry. The best scenario is as follows: personal unmanned vehicles will use the software platforms used in robotaxi fleets and will be able to provide similar services for personal use. Thus, personal unmanned vehicles will need the same car internet technologies as robotic taxis.

The passenger economy in personal self-driving cars will be more advanced than in robotic taxis, as passengers will spend more time in such vehicles, which will lead to more extensive content consumption and increased load on wireless communication channels.

Other issues in the unmanned vehicle industry

There are a number of challenges in the autonomous vehicle market, marked in the yellow boxes in the figure. All of these challenges relate to the wireless connectivity capabilities of self-driving vehicles.

Remote control is a technology that can be applied in a number of cases. Its essence is that the vehicle will be remotely controlled by an operator who will see what the vehicle's sensors see. This technology can be used for a short time under certain conditions (or as a fallback in case of any software problems). Remote control requires significant wireless bandwidth to transmit sensor information to the operator.

Wireless connections are critical to all vehicles, which raises a key question. Do some unmanned vehicles need a backup channel to ensure communication at any given time? There is a similar question - does the cybersecurity system need its own wireless connection to increase the level of security? I believe that the second question can be answered in the affirmative. An additional wireless channel, if necessary, can be used as a backup communication channel for data transmission.

Almost all cars sold in the US have a black box that records key information from the ECU in the event of an accident. However, recovering such data is difficult and expensive. I believe that data on accidents involving self-driving cars should be stored in a black box, and also immediately transferred to a neutral party for storage and analysis. Such data can be transmitted over existing wireless connections.

The V2X continues its journey into the automotive industry despite the opposition between the V2X-DSRC and the C-V2X. Self-driving vehicles do not require V2X support, although this technology has very promising integration capabilities and benefits. V2X will become another channel for wireless communication with vehicles (and other facilities) as the technology rolls out over the next 3-5 years.

Also, any vehicle can leverage traffic flow data and benefit from it, all of which will be even more significant with V2X. Is there a possibility (or likelihood) that autonomous vehicles will be able to interact with traffic management systems - at least at the local or regional level? If possible, will such technology be implemented in 10, 15 years or in the future?

Finally, let's take a look at a couple more questions to expand the internet of cars. The first question is when will the standards for unmanned vehicles appear , how many will there be, and what levels will they concern?

Smart cities use data from connected cars, but big data from various self-driving vehicle use cases will be even more useful. They will deliver results that will improve the productivity of all urban transport. How much data is needed for this and when will this interaction be organized?

Self-driving vehicles generate enormous amounts of data - especially from sensors in lidars, radars and cameras. Most of the sensor data is short-lived and never leaves the vehicle. The question arises: what part of the data from the sensors will be sent by the car to the cloud? I believe that it is very small, but the total amount of this data will still be large.

Thus, another question arises. Data storage is often used as a compromise with wireless transmission due to cost concerns. The memory of devices storing data is cleared after connecting to a wired or wireless network. I think that on-board memory in self-driving cars will be used to temporarily store most of the data coming from the sensors.

Subscribe to the channels:

@TeslaHackers - a community of Russian Tesla hackers, rental and drift training on Tesla

@AutomotiveRu - auto industry news, hardware and driving psychology

About ITELMA

- automotive . 2500 , 650 .

, , . ( 30, ), -, -, - (DSP-) .

, . , , , . , automotive. , , .

, , . ( 30, ), -, -, - (DSP-) .

, . , , , . , automotive. , , .

Read more helpful articles:

- Free Online Courses in Automotive, Aerospace, Robotics and Engineering (50+)

- [] (, , )

- DEF CON 2018-2019

- [] Motornet —

- 16 , 8

- open source

- McKinsey: automotive

- …