When it comes to investing in new hardware and software, there are often disputes over which infrastructure model to use: on-premise, cloud platform solutions, or hybrid? Many people choose the first option because it is “cheaper” and “everything is at hand”. The calculation is very simple: the prices for "own" equipment and the cost of services of cloud providers are compared, after which conclusions are drawn.

And this approach is wrong. Cloud4Y explains why.

To correctly answer the question "how much does your equipment or the cloud cost", you need to estimate all costs: capital and operating. It is for this purpose that TCO - Total Cost of Ownership - was invented. TCO includes all costs that are directly or indirectly related to the acquisition, implementation and operation of information systems or the company's software and hardware complex.

It is important to understand that TCO is not just a fixed amount. This is the amount of funds that a company invests from the moment it becomes the owner of the equipment until it gets rid of it.

How TCO was invented

The term TCO (Total cost of ownership) was officially introduced into circulation by the consulting company Gartner Group in the 80s. Initially she used it in her research to calculate the financial cost of owning Wintel computers, and in 1987 she finally formulated the concept of total cost of ownership, which was used in business. It turns out that the model for analyzing the financial side of the use of IT equipment was created in the last century!

The following formula for calculating TCO is considered in

general use : TCO = Capital Cost ( CAPEX ) + Operating Cost ( OPEX )

Capital costs (or one-time, fixed) imply only the cost of purchasing and implementing IT systems. They are called capital, since they are required once, at the initial stages of creating information systems. They also carry with them subsequent recurrent costs:

- Project development and implementation cost;

- Cost of services of external consultants;

- First purchase of basic software required;

- First purchase of additional software;

- First hardware purchase.

Operating costs arise directly from the operation of IT systems. They include:

- The cost of maintaining and modernizing the system (staff salaries, external consultants, outsourcing, training programs, obtaining certificates, etc.);

- Costs for complex system management;

- The costs associated with the active operation of information systems by users.

It is not by chance that the new method of calculating costs has become in demand by the business. In addition to direct costs (the cost of equipment and salaries of maintenance personnel), there are also indirect costs. These include the salaries of managers who are not directly involved in the work with the equipment (CIO, accountant), advertising costs, rent payments, entertainment expenses. There are also non-operating expenses. They are understood as payments of interest on loans and securities of an organization, financial losses due to instability of currencies, penalties in the form of payments to counterparties, etc. This data must also be included in the formula for calculating the total cost of ownership.

Calculation example

To make it clearer, let's list all the variables in our TCO formula. Let's start with the capital expenditures for hardware and software. We include in the total cost:

- Server equipment

- Storage

- Virtualization platform

- Information security equipment (crypto gateways, firewall, etc.)

- network hardware

- Backup system

- Internet (IP)

- Software licenses (antivirus software, Microsoft licenses, 1C, etc.)

- Disaster recovery (duplication for 2 data centers, if necessary)

- Accommodation in the data center / rent extra. squares

Of the associated costs, you must take into account:

- IT infrastructure design (hiring a specialist)

- Equipment installation and commissioning

- Infrastructure maintenance costs (staff salaries and supplies)

- Lost profit

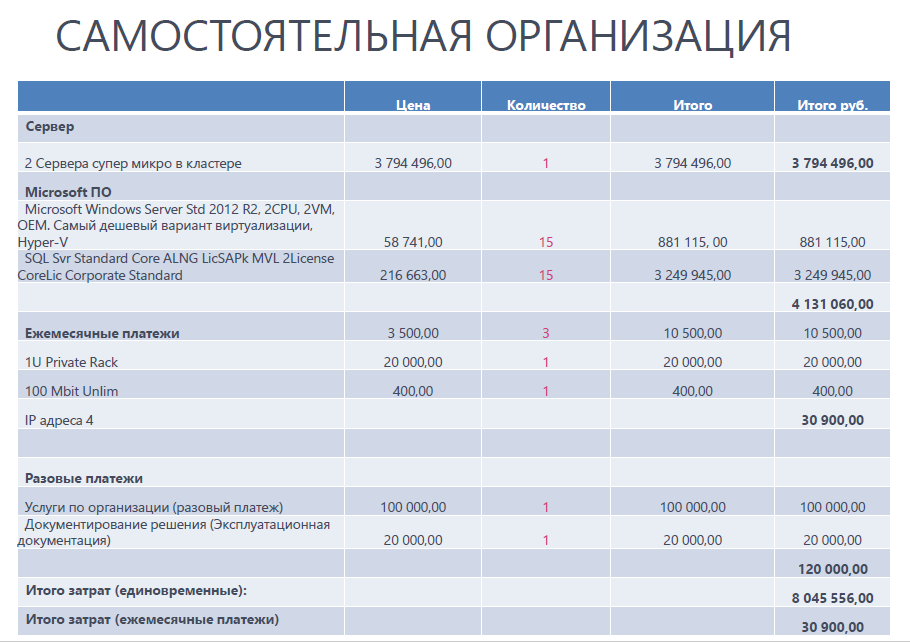

Let's make a calculation for one company:

As you can see from this example, cloud solutions are not only comparable in price to on-premise, but even cheaper. Yes, in order to obtain objective figures, you need to calculate everything yourself, and this is more difficult than the usual saying that “your own hardware is cheaper”. However, in the long run, a scrupulous approach is always more effective than a superficial one. Effective management of operating costs can significantly reduce the total cost of ownership of the IT infrastructure and save part of the budget that can be spent on new projects.

In addition, there are other arguments for clouds. The company saves money by eliminating one-time purchases of equipment, optimizes the tax base, gains instant scalability and reduces the risks associated with owning and managing information assets.

What else is interesting in the Cloud4Y blog

→ AI again defeated the F-16 pilot in air combat

→ “Do it yourself”, or a computer from Yugoslavia

→ The US State Department will create its great firewall

→ Artificial intelligence sings about the revolution

→ Easter eggs on topographic maps of Switzerland

Subscribe to our Telegram-channel so as not to miss another article. We write no more than twice a week and only on business.