Here are the average annual IT investments of several of the largest European banks:

BNP Paribas - $ 7.1 billion

HSBC - $ 6.0 billion

Societe Generale - $ 4.7 billion

Deutsche Bank - $ 4.5 billion

UBS - $ 3.5 billion

Barclays - $ 3.5 billion

RBS - $ 2.9 billion

Credit Suisse - $ 2.9 billion

Commerzbank - $ 1.4 billion

This is the cost of both its own IT departments and the acquisition of third-party products. The top four collectively overtake Google (Alphabet Inc.) with its $ 21.4 billion. The

digitalization trend is constantly ringing in the news. For example, about internal restructuringDeutsche Bank, as a result of which 975 people lost their usual jobs as traders and bankers. At the same time, half of the bank's employees are employed in IT. Or Britain's TSB Bank has partnered with IBM Services to deploy cloud technology and transform the former into a truly digital business. The budget for the project is estimated at £ 120 million.

I don’t know about you, but for me it’s not just £ 120 million, but “£ 120 million, Karl!”.

This article is about what European banks want in IT. This is good news for you and me (IT Schnick). I am sharing information about what is happening in Europe now. More precisely, what we managed to dig up. There will be many links to sources.

I hope someone will be interested in my view of the changing banking market. Well, if not, then the list of the companies mentioned will come in handy to send there a commercial proposal or resume. You can also find out from the article which areas of fintech are most in demand now.

When investing in IT technologies, the largest European banks choose the following fintech companies: source - CB Insights The fintech logos in which a particular bank invests are listed in the center of the table. For clarity, they are divided by industry (columns):

- blockchain

- data analysis

- personal finance

- capital Management

- stock markets

- lending

- electronic payments

- regulatory technologies

According to the investment profile, it can be seen that the goals of investments are compliance with the requirements of regulators, digitalization of existing services and the proposal of new products.

Based on the table, R3 (blockchain) and AcadiaSoft (regulatory technology) are doing very well.

So, banks are acquiring fintech, stimulating demand for it. He became especially active this year. Let's see what this is connected with and what it managed to lead to.

The reasons for the fintech boom

1. COVID-19

I'll start with him. I hope that the pie of popular interest in the virus has not yet cooled down completely.

The forced transition to remote service has changed both the business processes of banks and the behavior of customers. 53% of all banks in the world reported the launch of new digital solutions due to the pandemic. First of all, the novelties touched upon document flow (including digital signature), online applications and platforms (who do not know, it can be considered banking super-CMS), as well as blockchain technologies.

Over the next six months, most Europeans will use e-wallets more often than during the period of self-isolation. According to Deutsche Bank,by 2025, this payment method will become the second most popular after bank cards. With the move away from cash payments, 80% of the world's central banks are developing their own digital currency. 40% have MVPs ready, and 10% are already playing with pilot projects.

2. GAFA

The Big Four - Google, Apple, Facebook and Amazon - are also entering the European financial services market. 2019 brought such news from almost every brand. Google has announced the launch of personal bank accounts for users. The project is codenamed Cache and is being developed in collaboration with Citigroup.

Apple is issuing its own credit cards , which will soon be available in Europe. Facebook is developing cryptocurrency . Amazon is acquiring fintechs to build its financial ecosystem .

Given their huge audiences, access to vast data and their processing capabilities, these giants are just as dangerous for traditional banks as they are attractive to the average user, as Catherine II would say.

3. Neobanks

Another formidable rival that sets a high bar for service is neobanks, which exist only online. At the end of 2019, their audience in Europe amounted to 15.3 million people. By 2025, its size is estimated at 50–85 million people, or 20% of the population over 14 years old.

The rate of attracting clients by neobanks is clearly demonstrated by the startup Zelf . Existing without an application, it works through instant messengers and allows you to issue a card only using your voice. In the first month, the number of pre-ordered cards exceeded 260,000.

4. Messengers and social networks

The ability to grind with your bank in the chat is really in demand. Online correspondence through third-party platforms is becoming a full-fledged channel for interaction with customers for banks.

43% of the entire Internet audience uses social networks for work, while 63% find communication in messengers more convenient and private compared to other types of communication.

48% of users contact organizations through various online chat rooms, rather than by phone. At the same time, 47% of the paying audience will be happy to make a secure payment in the messenger.

5. Regulatory requirements

The PSD2 Directive , introduced by the European Commission in 2018–2019, obliges banks to provide payment services with free and secure access to customer accounts. Formally, it does not require an open API - but it is easiest to do it in this form. This is the basis for Open Banking - an open ecosystem where, in addition to the bank, a number of paid service providers operate.

At the same time, according to the Basel III standards (banking regulation standard), investments in IT are deducted from the capital of banks as intangible assets. In human terms, the bank will not be able to cover its debts with the money spent on IT. This forces banks to prudently choose the direction of technological development.

6. Superappas

An Asian trend well illustrating the future of open banking. WeChat, Grab, AliPay, Zalo, etc. - applications that allow you to perform many operations from one screen. For example, chat with friends, book a hotel, call a taxi, buy a plane ticket, transfer money, order food, etc. Each superapp is capable of becoming the only app for life.

Brands in the European Union have not yet launched full-fledged analogues. Steps in this direction in the West are being made, for example, by Google Maps. Through them, you can already book tables in restaurants, order a taxi and purchase tickets for American trains. There are positive trends in Russia (see Yandex, Tinkoff applications).

The likely strategic choice of banks in the near future is to create their own superapp or join a developing one.

The growing use of technology is illustrated by the statistics of banking vacancies. Thus, the demand for IT specialists continued to increase even during the pandemic. True, only American statistics were found here. But I will assume that this trend has also manifested itself in Europe.

For example, in Goldman Sachs 44% of open positions are for IT. source - eFinancialCareers

IT specialists at the beginning of their careers and when changing specialization should seriously think about the financial sphere. Probably, banking will soon be as fun as it is in game development.

And what comes out?

These factors have created a new level of user expectations. 60-85% of bank customers of all ages prefer to use mobile and internet banking for everyday transactions, and 10-25% - even for complex transactions.

However, having a banking application alone is no longer enough. Users expect a flawless experience with it. So, 40% of the audience abandons a digital product if the registration and / or getting started process seems too complicated for them (which means that there will be work for interface designers as well).

Bank customers are ready to try the services of other brands in search of the best service. This explains the huge influx of audience into neobanks. For example, to the British Monzo55,000 people connect weekly, Revolut estimates an inflow of 600,000 per month, German N26 has covered 25 countries and reached a total customer base of 5 million people. Since not all users close their accounts in their old banks at the same time, the dramatic turnover is easy to underestimate.

New user priorities also include :

- the ability to shop completely online

- understanding and sharing brand values

- confidence in the security of personal data

- using data as currency (for example, in exchange for bonuses)

- round-the-clock access to services.

At the same time, according to Deloitte, the banks' current applications do not meet the "digital" needs of customers. The process of entering the application is poorly implemented (people are dissatisfied in 41% of cases), integration with external services (33%), and in general, people want more functionality from banking applications.

It is noteworthy that the list of the most used banking applications does not coincide with the list of the largest European banks: source - Statista

- Barclays Mobile Banking (UK) - 7 million people per month

- CaixaBank (Spain) - 6 million people per month

- MaBanque (Crédit Agricole) (France) - 5 million people per month

- Sparkasse (Germany) - 2 million people per month

- Intesa Sanpaolo Mobile (Spain) - 2 million people per month

Modest traffic versus tech startups. Everything indicates that the leaders of traditional banking have not yet mastered the new reality.

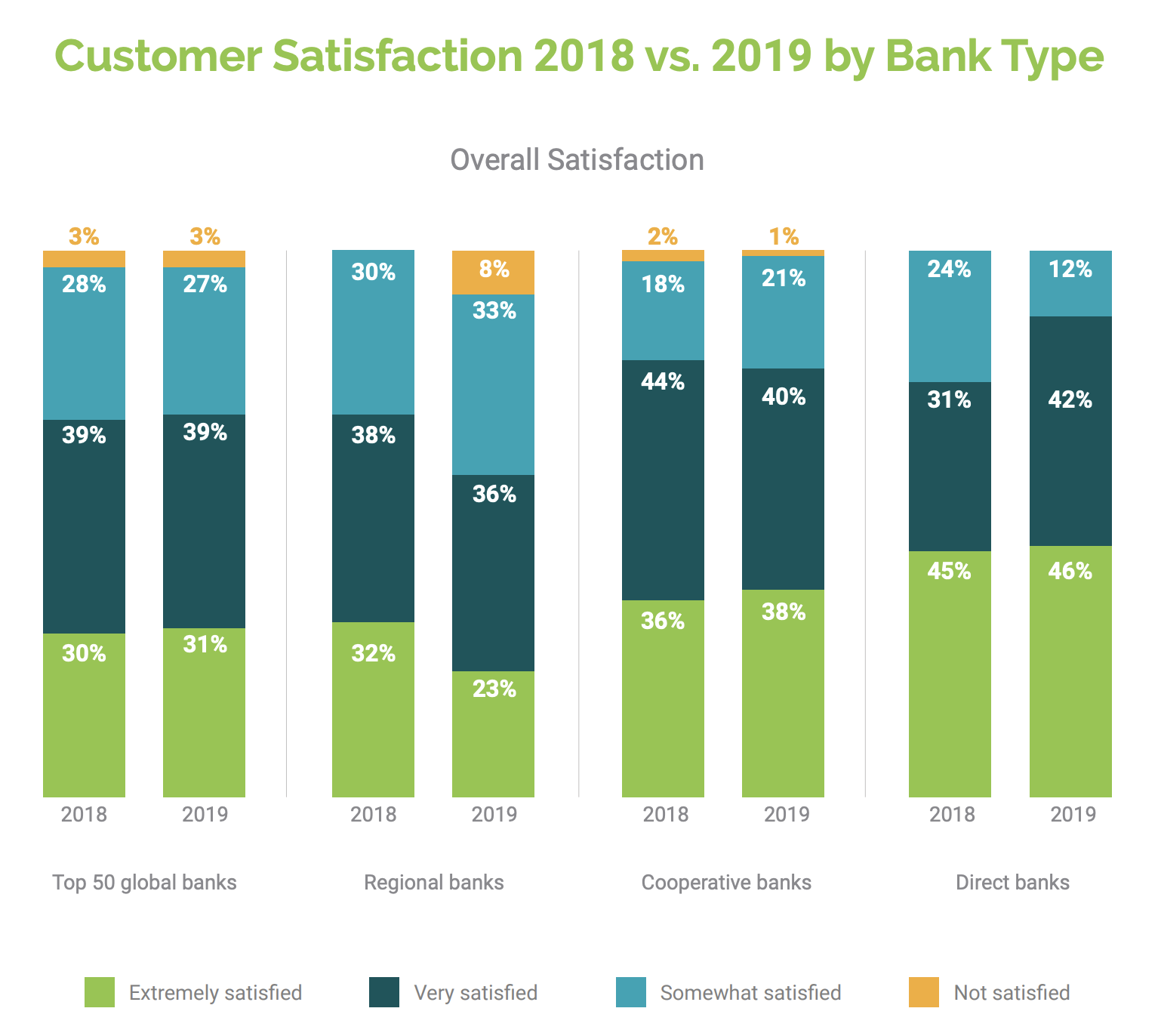

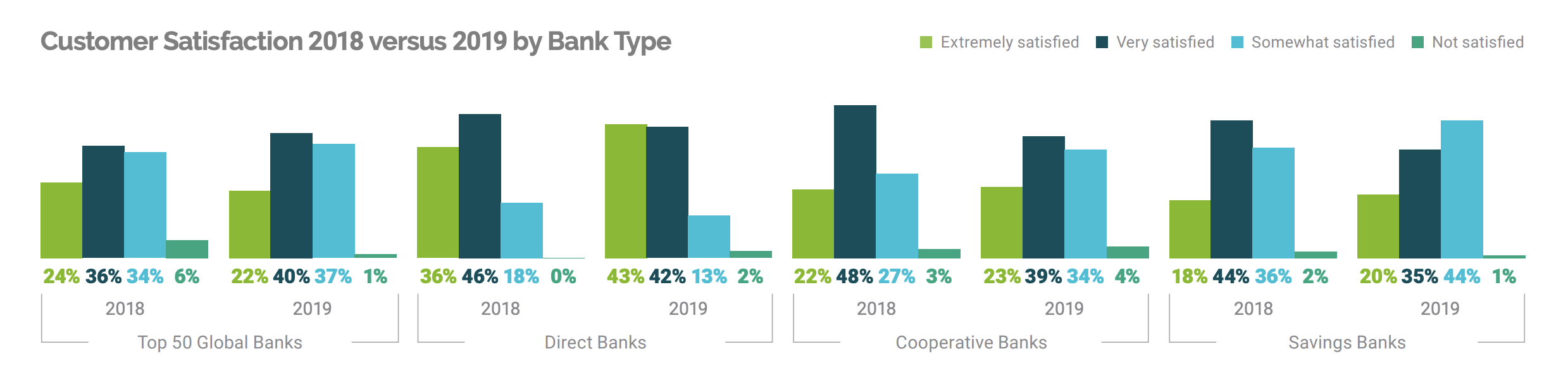

In terms of overall satisfaction with banks, the picture is:

UK: Source - Fidelity National Information Services, Inc. Germany: Source - Fidelity National Information Services, Inc. It is obvious that banks without branches (Direct Banks on the charts), which include fully digital banks, are much more loved by their clients. Traditional banks are unlikely to like this gap. By the way, great news for Russian techies: less than 60%

European vacancies can be filled by residents. Considering the popularity of remote work, which has been growing since spring, our compatriots have every chance to apply for a place in promising neobanks.

But for traditional banks, the news is rather sad: in order to retain and expand their customer base, they will still have to change.

This line marks the end of the article. They

wrote for you: Denis Elianovsky , Stanislav Lushin. Thanks to Stanislav for the great job done in collecting statistics. And also to Elena Efimova for the picture in the header, Tatyana Kitaeva for editing.