This article is a continuation of this one: Analysis of impersonal transactions in stock trading

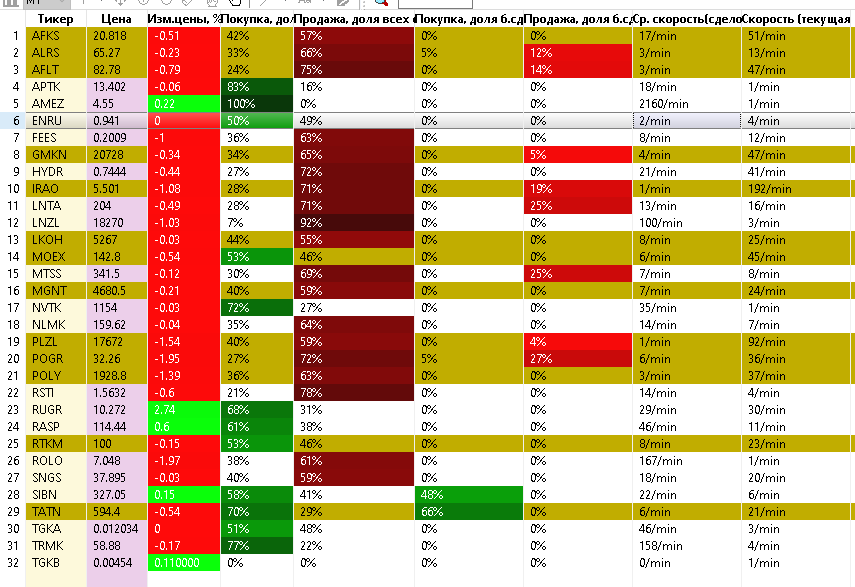

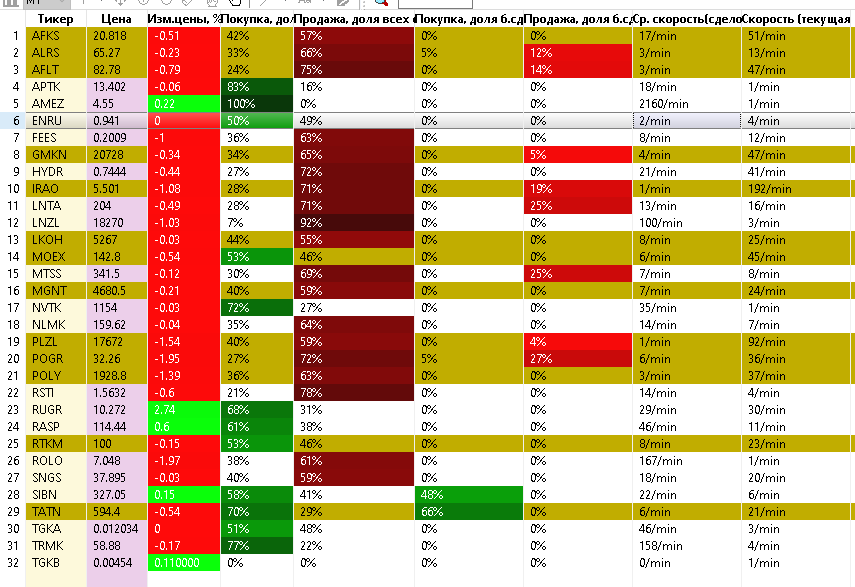

After the publication of the first article, I received a fairly large number of messages with a request to implement "Prilipala" (a table in Excel for analyzing information about anonymous transactions) for the Quik trading terminal. Implemented, but this is not the main thing.

Sources here: Download

Personally, this turned out to be not enough for me, I also implemented it in graphic form.

And this was not enough. I made a telegram bot that sends fresh data to this telegram channel kbs.online every 10 minutes (the channel is public, no advertising, subscribe to your health, I only recommend turning off notifications, I am personally distracted by the "clap" every 10 minutes).

And of course, over time, an insight came (otherwise there would be no point in writing this article).

What makes a speculator (specifically a speculator, not an investor)? Correctly "bought cheaper, sold more expensive", or vice versa, "I sold more expensive, bought cheaper" (yes, this is also possible). The main question is: what instrument (stock) to trade? Liquid (for which there is always supply and demand)? Not only, it is rather a necessary, but not a sufficient condition. Imagine a metaphor: a person stands on the platform of a railway station and watches which train goes faster in the desired direction. And jumps into the fastest train. Also in the markets - for a speculator "hardened by financial crises", liquidity and high volatility of the instrument are important.

But, not everything is so simple: there are practically no liquid shares on the Russian market, which for a long period of time (for example, within a year) jump by more than ± 1% every day. With different stocks, volatility occurs periodically for a variety of reasons. Expanding the previous metaphor, the “ideal speculator” is a passenger who, in pursuit of his goal - changes trains at each station - if the train speed suddenly slows down, he jumps out at the station and jumps into another train, which rushes faster. What happens if the speculator does not have time to jump out of the slowing train? Yeah, he will either turn into a "long-term investor" or take a loss.

So I came up with the idea of monitoring.

Quoting from the wiki:

Monitoring is a system of constant monitoring of phenomena and processes taking place in the environment and society, the results of which serve to substantiate management decisions to ensure the safety of people and economic objects.What will be monitored? The entire Russian market. Well, what parameter are we going to monitor? That's right - changing the speed of transactions. We calculate the average speed per minute for each instrument (the number of deals since the beginning of the trading day is divided by the number of minutes that have passed since the beginning of the day). If the current speed (the number of deals in the current minute) is twice the average speed, this position is highlighted in dark yellow, which will be a signal for a speculator that a movement has begun on this stock.

Sources here: Download

What's next:

- Then I plan to upload all large anonymous transactions to the database and carry out analysis for large transactions within a specific campaign, and not during the day, but for example a month. If there are a lot of people willing, I will "fasten" the database to the telegram bot, or make a web interface.

- With the help of the community, I come to the conclusion that large transactions in the market are still just the tip of the iceberg, and the bottom is in the derivatives market. Therefore, further efforts will be directed at analyzing and monitoring the derivatives market.