Attempts by regulators to gain control over cryptocurrency transactions are not always effective. The situation has not changed after the entry into force of the Fifth EC Directive on the fight against money laundering ( 5AMLD ). According to a report by analyst firm Peckshield , over the past two quarters,147,000 BTC ($ 1.3 billion) received from suspicious addresses. The top ten crypto exchanges accepting these funds included Huobi, Binance, OKEx, ZB, Gate.io, Bitmex, Luno, Huobtc, Bithumb, and Coinbase . The study notes that the top three trading platforms account for over 60% of the total (88,200 BTC).

Criminal transactions

In early April, the FBI arrested a Russian rapper for money laundering using cryptocurrency. The investigation into Maxim Boyko began with the photos he posted with bundles of banknotes in his Instagram account. Investigation bureau agents analyzed his iCloud account and identified a relationship with the account of one of the most disgraced cryptocurrency exchanges - BTC-e * . Further, using tools such as Chainalysis and CipherTrace , it was possible to study in detail the cryptocurrency transactions made by the rapper since 2017.

* Russian cryptocurrency exchange BTC-e ceased to exist in July 2017 due to involvement in money laundering stolen from the Mt.Gox exchange... In the autumn of the same year, the exchange resumed operations under the new WEX brand , but after a while it closed again. Users of Mt.Gox, BTC-e, WEX are still trying to get their funds back.

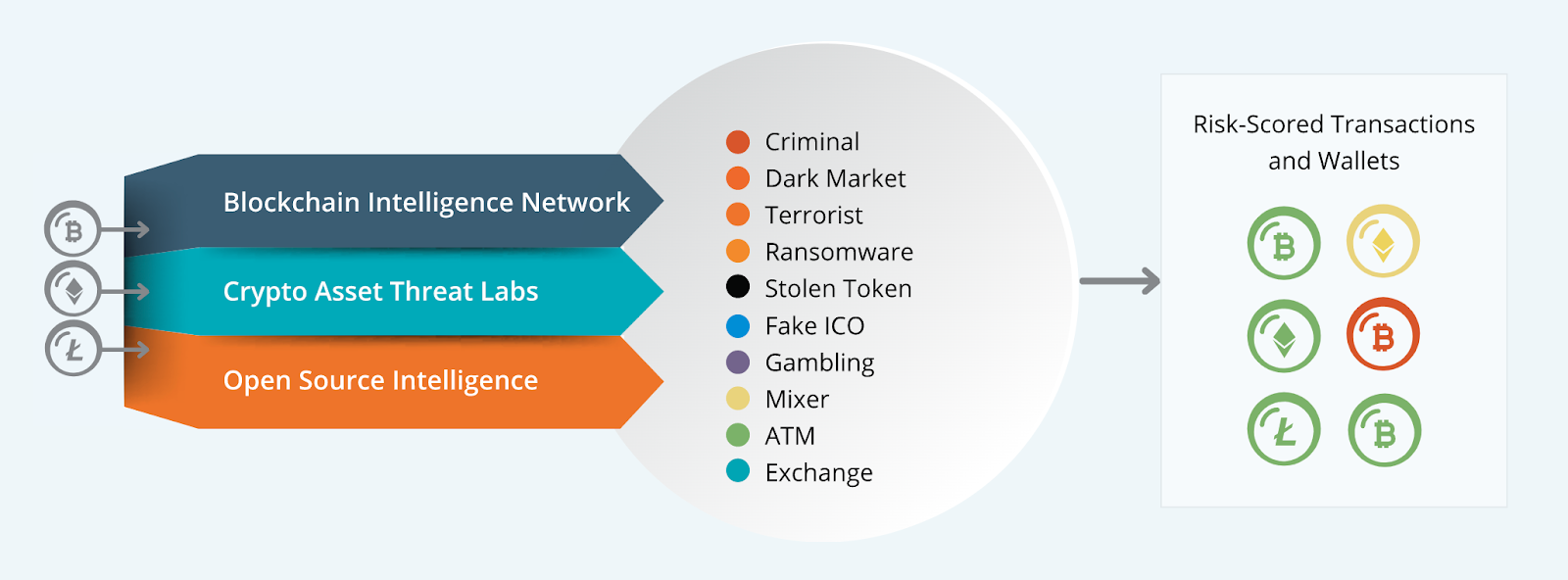

Most of the "dirty" cryptocurrency transactions are ignored as long as no one tries to withdraw funds through cryptocurrency exchanges. Trading platforms can interfere with such transactions and for this they are introducing new tools that allow to identify the origin of funds and check them for intersections with criminal activity. Cryptocurrency

exchange Huobi uses its own program called Star Atlas, which is responsible for the automatic blocking of suspicious accounts. Like CipherTrace, it checks to see if the user's wallets are blacklisted, terrorism-related, fraudulent, etc. The collected information Huobi makes available for money laundering investigations and for regulatory compliance. Another exchange, EXMO , in collaboration with CipherTrace, has launched a real-time risk assessment function for transactions with the addition of forecasting functions.

Know your Customer (KYC) and Anti-Money Laundering (AML)

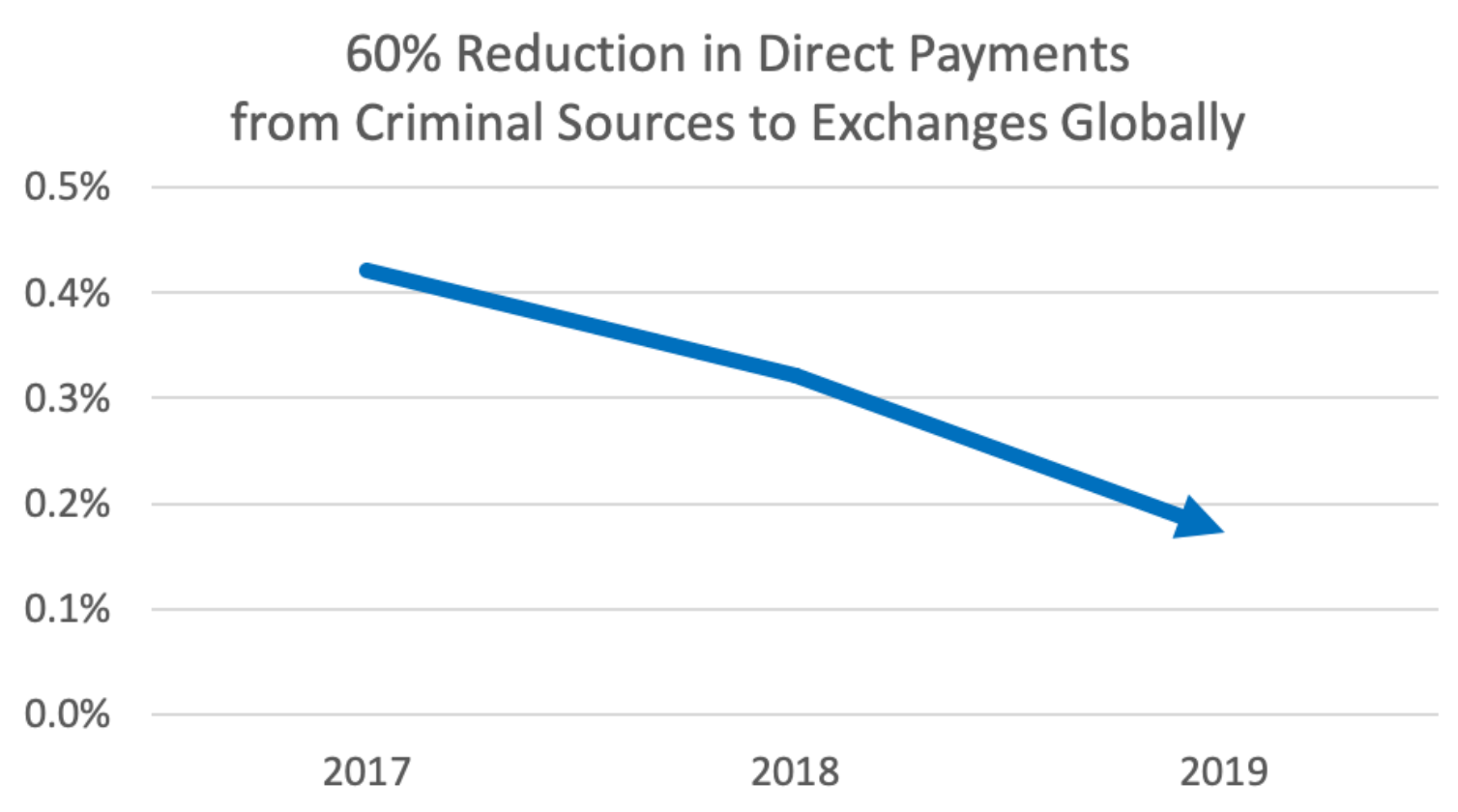

Compliance with KYC and AML procedures are two key principles of a transparent cryptocurrency exchange. Initially, the community was ambivalent about these conditions, but in the end, many recognized their effectiveness and direct necessity. As the AML rules for cryptocurrencies are implemented around the world (including 5AMLD), it becomes more difficult for many criminals to transfer cryptocurrencies to exchanges for further exchange.

According to AAX CEO Tor Chan, the challenge is to keep the market safe from intruders who may engage in illegal activities and / or reside in high-risk jurisdictions:

The tricky part is that individuals may be subject to sanctions, but wallet addresses may not. Thus, in addition to obtaining identity documents, all virtual asset service providers (VASPs), such as exchanges, must receive and transmit customer data associated with wallet addresses when making any transaction.

In 2019, AAX partnered with Refinitiv to validate customer histories and Elliptic to detect and investigate cybercrime using proven forensic solutions like Elliptic Navigator . AAX has also integrated solutions from Kroll , the world leader in cybersecurity, working with financial institutions and intelligence agencies such as the FBI, MI6 and Interpol.

Cryptocurrency exchanges are actively looking for solutions that will allow them to continue their activities in different jurisdictions. In the face of regulatory uncertainty, you have to worry about transparency and fight against money laundering without waiting for laws to be passed. This seems to be the right thing to do and the only way to avoid situations like Epayments , where customers of the service have become hostages of imperfect regulation.

Therefore, AAX, Huobi and other exchanges are introducing new tools to analyze and verify users and their transactions. Hopefully, they will allow a correct response to the increased attention to suspicious transactions both from the community and from regulators around the world, and not turn into a "witch hunt" from which law-abiding citizens of different countries will suffer.