If I ranked stock market instruments and other investments according to the degree of their conservatism, then bonds would take a confident second place after a bank deposit. This is a popular conservative instrument aimed at saving funds and obtaining a small profitability (+ -value of inflation, if there is no crisis). However, if everything were so simple, it would not be worthwhile to devote a whole long article to bonds, everything would be limited to the instruction: Russian Railways and OFZ bonds are good, but the bonds of microloan companies are bad, choose good ones, expect income. I propose to distract from all matters for 20-30 minutes and plunge into the topic of bonds, especially since the issue of saving money is faced by many of our readers.

Previous articles in the series:

1. Stock market beginners: honest talk about trading

2. Stock market newbies: honest talk about stocks

Important Disclaimer

After the first article in the series, we received extensive feedback and even a response article where we were accused of stupidly promoting work on the stock exchange as an easy way to make money. Therefore, let's dot all the i.

- Our article series is for newbies of all specialties, not just programmers, analysts and mathematicians. That is why we do not immerse our readers in the development of our algorithms and complex analytics.

- — . . , . .

- , , RUVDS , METATRADER 5 ( ). .

- , . , .

What are bonds and what are they like?

A bit boring theory. A bond is an issue-grade debt security, the owner of which has the right to receive from the issuer the par value of the security in cash or property within the agreed period. Also, the bond can provide the right to receive coupon income from its par value (interest).

Investor's return on bonds = coupon yield (recurring payments) + (redemption price - the purchase price of the security).

Bonds are considered a defensive part of any investor's investment portfolio - they are not as risky as stocks, relatively stable and have low volatility. They are often compared with deposits in terms of reliability and profitability, but this comparison is very conditional, since bonds have a completely different legal basis and can either significantly exceed the average deposit rate or be lower.

There are many types of bonds, but private investors, and even more so beginner conquerors of the stock market, should be interested in four main types.

▍1. Corporate bonds

Corporate bonds are securities that are issued (emitted) by commercial companies for any of their purposes. They use bonds to raise borrowed funds from private and institutional investors. In principle, bonds can be issued by any company - from a small fraudulent microloan office to such giants as Sberbank, Russian Railways, MTS, etc. Moreover, with due diligence, any bonds may appear on the stock exchange and become available for purchase by private investors (public offering), so at this point we remember that not all bonds are equally useful.

▍2. Federal loan bonds

Federal loan bonds OFZ are the most interesting, stable and indestructible type of bonds (well, if the state that issued them is indestructible). By purchasing OFZs, you lend to a large and reliable borrower - the state. For the entire circulation period, you receive a coupon yield, and at the end of the term you extinguish the bond at par (if you hold it until that time). OFZs have low yields, but also the lowest risk of losing funds, which is why they are always popular with investors of all categories. OFZs are issued by the Ministry of Finance of the Russian Federation and they can be nominated both in national and foreign currencies. OFZ, like other bonds, have a number of types: by maturity, by fixed rate, by par indexation (when the par is revised based on inflation data), etc.

Separately, it should be said about people's bonds (OFZ-N) - government bonds for a period of six months to 3 years and a standard par value of 1000 rubles. This type of securities was issued specifically for the population - to acquaint a significant segment of citizens with financial instruments, to increase the level of financial literacy, and to borrow a little from the population, as without it. OFZ-N can be purchased at branches of Sberbank, VTB, Promsvyazbank and Post Bank (these are the so-called agent banks and their list may expand), as well as in the online brokers of these banks. The purchase is possible from 10 pieces (at the start it was from 30, which made the bonds not particularly popular), the limit "from above" - 15,000 shares. On July 16, 2020, the Ministry of Finance of Russia began the sale of OFZ-n of a new issue in the amount of 15 billion rubles. The rate of the first half-year coupon is set at 4.1% per annum, the second - 4,4% per annum, the third - 4.7% per annum, the fourth - 5% per annum, the fifth - 5.3% per annum, the sixth - 5.73% per annum. By the way, the rate on a 1097-day deposit in one of the "expensive" Gazprombank is 3.9%, in Sberbank - 3.65%. So with the same reliability and the ability to withdraw without losing interest, bonds will clearly be more profitable.

In the USSR, bonds were very popular and were reflected in the poster genre

▍3. Municipal bonds

Municipal bonds are bonds issued by a region, region, district, etc. to attract money for some purpose. For example, in the city of N. they are going to build a new bridge or avenue, and the municipal authorities decide to issue bonds to attract investment in construction. In principle, municipal bonds are no different from OFZs, except that the yield is usually 1-2% higher. Well, and, probably, I will note that if you feel that the power in the city is so-so, capital construction is ruined, contractors are unreliable, and the budget is chronically leaky, then you should think three times before investing in a municipal loan, although the risk is still minimal, because the obligation is guaranteed by the municipal property.

An investor can purchase bonds during the initial placement through a broker or from an issuer - for this, you need to leave an application and wait for the auction and the announcement of the coupon yield value and the final price of the bond, or simply buy available bonds, for example, in a bank. But since we are not just paper holders under the mattress for 30 years, we are interested in the secondary market. It is worth mentioning here that in most cases the face value of a bond on the Russian market is 1,000 rubles. So, after the placement of bonds on the secondary market (speculative), with the par value, or, more precisely, with the bond price, metamorphoses take place: some securities are sold at a premium, some - with a huge discount (up to 500 rubles and below). And then you can make money not only on the coupon yield, but also on the difference between the purchase and sale prices of your bonds.

▍4. Eurobonds

Eurobonds (Eurobonds) - a type of long-term securities. The prefix "euro" is the case when it happened so historically (these bonds originated in Europe, namely in Italy), in fact, practically all economically strong countries of the world issue Eurobonds. The main thing is that Eurobonds are bonds issued in the currency of any country other than the main currency of the state. In addition, Eurobonds are placed on any financial markets (1, 2 or several countries), except for the market of the issuing country. Eurobonds are the "longest" bonds, some issues have a term of up to 40 years (minimum - 1 year, average - from 10 years). In Russia, Eurobonds are issued by the largest corporations and the state itself. A private investor, that is, you and me, can buy Eurobonds through a broker (as always).

Eurobonds are an instrument of exceptional reliability, since all securities of this class are underwriting (a special syndicate of underwriting guarantors with participants from different countries acts as a guarantor of payments on financial instruments) and exceptional liquidity (actively traded on the stock market and always in demand). As for the yield, it is approximately at the level of OFZ, but it can be higher and lower for corporate bonds.

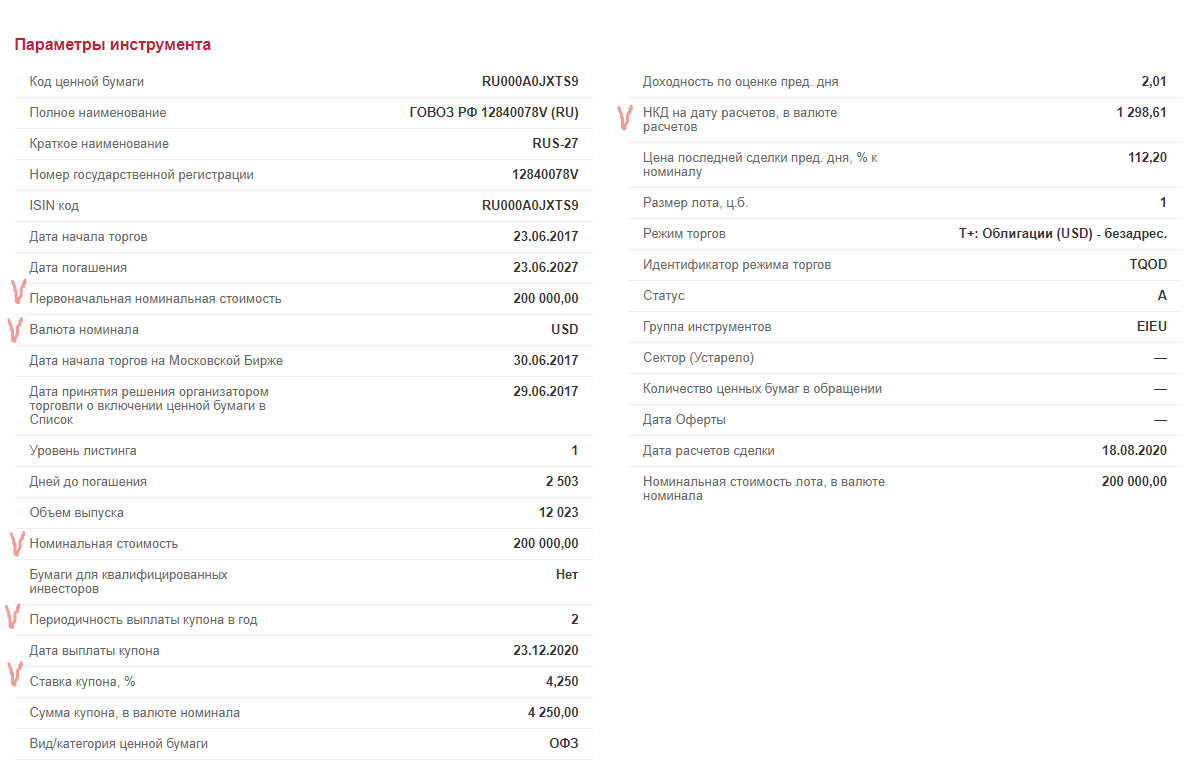

Example of RF Eurobonds . The checkboxes are the parameters that need to be looked at first.

By the way, there are actually many more bonds, but some of them are completely inaccessible to a private investor.

The boring part of the article dragged on, so I'll tell you a couple more important points and drove on.

So, before buying a bond, it is important to study the following information:

- — ; , , , — ;

- — , , , ( );

- — ;

- — ; , , , , ;

- — , , , (, - - 1-1,5%, ).

A little about taxes. Unlike a deposit, some bond income is taxable. Thus, the tax is imposed on the coupon income of corporate bonds issued before January 1, 2017. Also, a tax of 35% is imposed on the excess of profitability equal to the key rate + 5%, that is, as of the beginning of August 2020, 4.25% + 5% = 9.25%. Coupon income from OFZs, municipal bonds and from corporate bonds issued after January 1, 2017 if the value does not exceed 9.25%, is not taxed. You can read more about taxation of bonds here .

So why are bonds better than a deposit?

Due to the reliability, the reduced level of risk and the profitability of the same order, bonds are most often compared with bank deposits and often the comparison goes in favor of the deposit: they say, you don’t bother at all - you put your money in the bank, signed an agreement and forgot for the time being, the money will drip by itself ... However, this motivation is for limitless lazy people. In our age of electronic accessibility of everything in the world and high-speed Internet, it is not so difficult and time-consuming to acquire bonds, but, by the way, they have advantages.

- You can select bonds with different levels of risk and return and combine them in your investment portfolio.

- If you decide to sell or redeem bonds before the expiration date (expiration date), you do not lose interest, that is, coupon yield. In case of early withdrawal of the deposit (except on demand), interest is lost.

, , . , , , (, 1000 , 870 , 2022 1330, - ). — , , .

- . - , , , , . ( ). , 10 10 .

- , . , ( , ()).

- , . , 10 11% 4,3%, - , , 5%. , , . , 2010-2020 5,1%. , , . , , , , .

- — ( ): ( ) 400 000 , 8% ( ). : , 13% ( ). , , , , .

But, unfortunately, unlike a deposit, bonds do not have deposit insurance, so the risks for them are slightly higher (if we are talking about small amounts of funds). Although, to be honest, in the context of constant bank readjustments, liquidation of individual financial and credit institutions and constant rumors about the withdrawal or freezing of any deposits in favor of the state, the existence of insurance "for a million four hundred" looks somehow faded.

What's the point of investing in this boring tool?

So, I'm sure that after the exciting world of stocks and currencies, bonds look pretty boring. However, there are several important nuances, understanding of which will help you not only choose a tool, but also earn a little more than the possible coupon income on it.

By the way, the "Bonds" section is perfectly implemented in trading platforms such as QUIK and Metatrader (which, by the way, works safer and faster on special VPS from RUVDS with METATRADER 5 on board- again, we are not shy and say that we have the best solution for beginners and advanced traders, even though the largest brokers in the country trust us). There you can view the entire set of information on these securities, make orders to the broker, and make transactions. And it is there that the understanding comes that a bond is the same subject of speculative trading as other securities, and not just an instrument for balancing an investment portfolio.

So, about the nuances that you should know from the very beginning.

- The price of a bond always moves in the opposite direction to interest rates: if interest rates rise, bonds fall in price. This is a fact you must consider when looking to sell bonds before maturity. If you hold your bonds to maturity (at par), these fluctuations do not affect you.

- — . . , , , 0,5% , — , , .

, , — . , .

, , . , . , .

- , , , , . ( — ) ( ). , . — , .

- . — , . — , ( , ). . , . , - , , .

- , , , , . , , , , , . , , .

- Finally, bonds are the best way to ride out bad times in the economy and save cash in times of crisis. To save money during such periods, short-term instruments are suitable, because the yield closer to the end of the bond term is higher, besides, during the stock market crisis, bonds lose much less than stocks. But again, I will repeat the thesis from previous articles: the stock market is a risky story and this is not your pocket and wallet, so you should invest in it money that you will not need in the near future.

Bond risks

As you may have noticed during the course of the article, bonds are not so simple in terms of risk: on the one hand, they are more secure than even deposits, on the other hand, as a security and a stock market instrument, they carry specific risks.

- — , ( ), . , . ( ).

. ,

- . . — . — .

- . , - , .

- , .

- , , : , . ( , ).

- .

▍ ?

- — . , , , (), . — , .

- —

,. , , , . . . - (BBB- — , , — ). , , Standard & Poor’s, Moody’s Fitch, .

- . , : , , ( 2020 4,25%, , 8-8,5% ).

- , 5-10 - . , , .

Oh yeah, I almost forgot! If you are too lazy to move, analyze and navigate the sites, you can buy portfolio, structural instruments from mutual funds (mutual investment funds), which, among other things, allow you to purchase package strategies even on the IMS. In this case, everything is done for you and you will not need any platforms and analytical calculations.However, you should still think about risks and commissions. And then, it is much more fun to grope for your strategy, study QUIK or METATRADER along and across, and get better at the stock market. The case when curiosity and perfectionism can earn a little (or a lot).

Useful links related to bonds

- Select bonds

- Top bonds

- The main bond site

- RF Central Bank website

- Moscow Exchange website

- Saint Petersburg Exchange website

- Deutsche Bank articles on Habré for advanced