How much can an IT specialist earn on an individual entrepreneur? FTS has its own opinion

When one person earns a lot and pays taxes honestly, tax officials look from the outside and think: “How is this possible? Surely he has a lot of assistants! Let him pay taxes for them too! "

We will tell you how to forget about such tax claims in a couple of clicks if you have an electronic signature.

Can an IT specialist earn 400k per month?

Why not? The median salary in the IT industry is now 108 thousand, and the "senior" mobile - developer or architect - even the official salary may be close to this figure. Plus, there is almost always a side job. Many generally go to freelance and work only for orders: they register an individual entrepreneur, write out invoices - an independent unit in the world of Western business. There, the salary ceiling is limited only by your courage and the level of customers. From Krasnogorsk or from Mezhdurechensk, it doesn't matter anymore.

And here you are an individual entrepreneur with customers from Europe and the United States, you are running several projects in parallel: one in active development, one at the stage of approval of technical specifications and a couple in passive support ... You earn the notorious 400k per month. Everything's under control.

But the tax authorities think differently ...

A sudden demand comes from the Federal Tax Service: “Please provide an explanation of how the individual entrepreneur received such income without the presence of employees? Or URGENTLY submit a calculation of insurance premiums for 2019, indicating individuals who received income from individual entrepreneurs and the amount of income received! Come to the Federal Tax Service from ... to ... ”

And what awaits in the tax office ? A lot of serious people in uniform who will argue that one person cannot earn so much. And they will not look at invoices, chats, or signed scans in the dropbox, even a contract in Diadoca is not a decree for them! This is a purely psychological event, which is better not to attend at all.

What then is to be done?

There is a simple solution: write a motivated answer to such a request and send it via TKS. If you have an electronic signature and a program for sending, it's a matter of a couple of clicks.

How to answer?

What does the requirement look like?

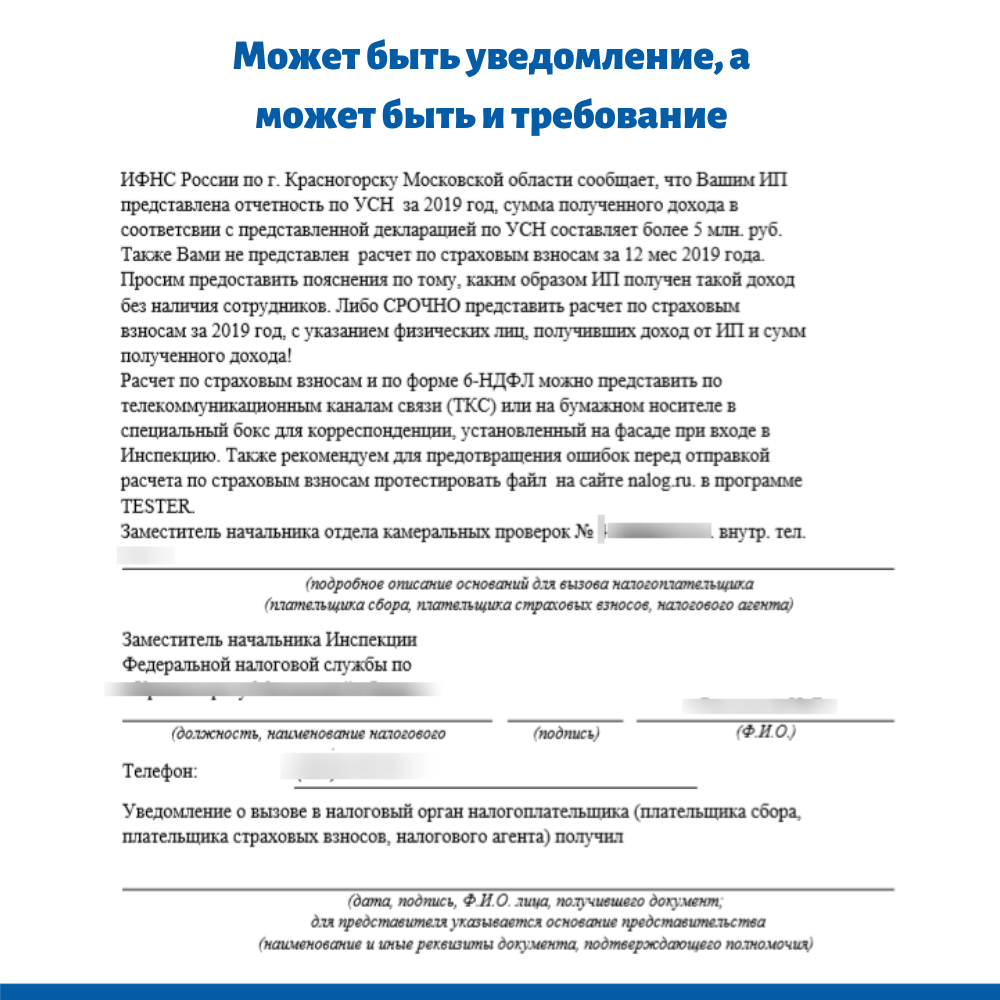

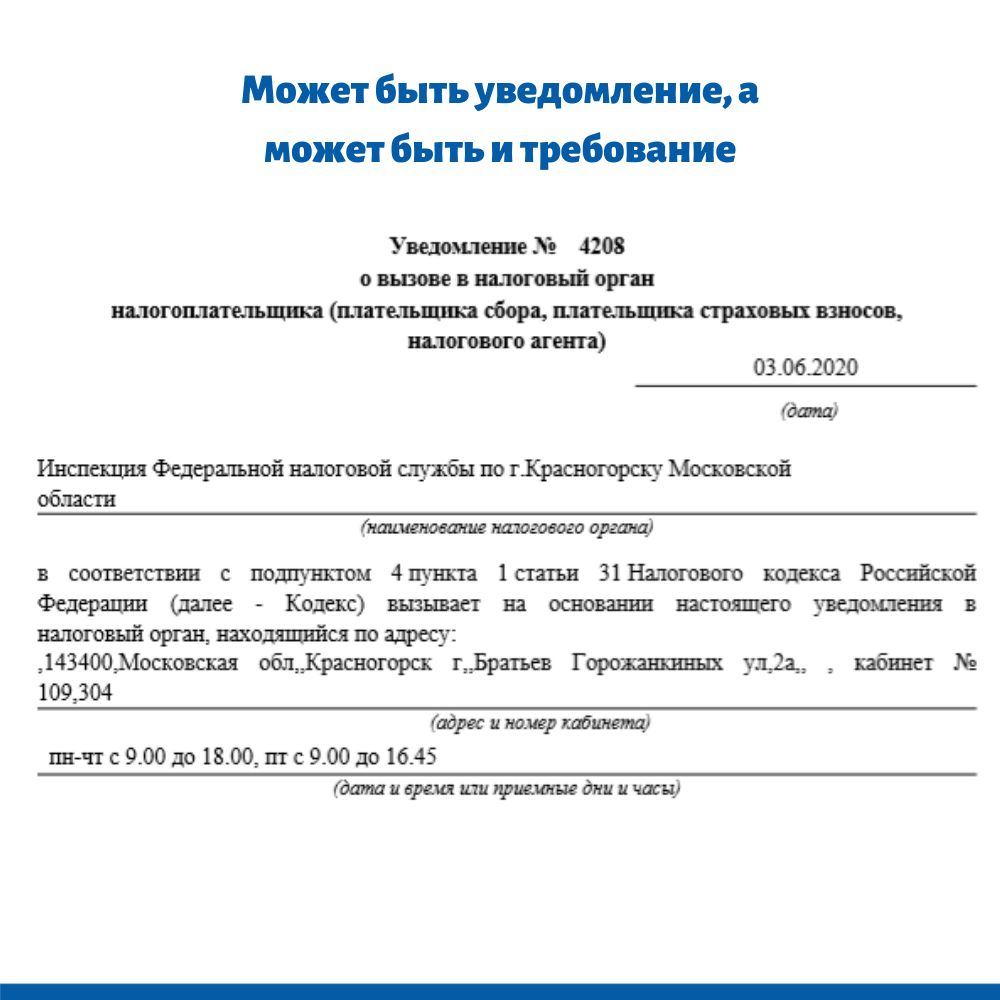

This can be a request or a call notification. It looks like this:

What amounts of income of individual entrepreneurs are acceptable for the FTS?

There are no uniform criteria. They change over time and depend on the region. The income habitual for Moscow may seem prohibitive to an inspector from Mezhdurechensk. But if we are talking about autorequest, then the amount here is usually from 200k and above, which is why IT specialists fall under the gun.

Bug or feature?

Having received such a request, it makes no sense to argue about the legality of the request. If it is expressed in the form of a requirement, then you still have to answer. Otherwise, it may come to the blocking of the current account.

What else can we expect from the Federal Tax Service?

So far, one thing is clear: there will be more and more auto demands. The FTS automates manual labor and comes up with more and more inspections designed to increase tax collection. The development backlog of the Federal Tax Service is huge: the service is making great strides in digitalization, and when their software finally starts to work consistently well, the work of accountants will increase. Maybe this is the demand they send at the request of their HR-s, the tax "senior" in the development is also needed, not all the same at the expense of "June" to leave.