The first connected cars have been around in the United States over 20 years ago, and there are more ways to connect cars and user data than you might imagine.

It's hard to believe that plug-in cars appeared in the US over 20 years ago. General Motors was considered a pioneer when it introduced its first telematics system in late 1996. Ford was in the game too, but quickly abandoned its development. GM's OnStar system has been at the forefront and retains that title to this day, with total sales of 50 million OnStar in the United States. OnStar was the most important telematics system of its time, and it pushed many of GM's competitors into the connected car market.

However, Tesla is currently the technology leader. Their vehicles actively use networking systems that are far ahead of other OEMs. Tesla can update its software, collect and analyze massive amounts of user data, and process it with powerful analytics systems, allowing the company to release over the air (OTA) updates on a regular basis — all of which are powered by advanced system architecture. Most OEMs develop their own versions of these products, but they are far from Tesla technology.

Telematics systems have been developed to meet the needs of car manufacturers and vehicle owners. There are other technologies and industries that can take advantage of vehicle data and make money by transferring various data and content to vehicles. These sides of the market have already made significant changes in the connected vehicle market and will continue to change over time.

In order to more clearly describe the current state of affairs in the networked transport market and show its trends, I will answer the questions below.

- Who and what can participate in networking? The short answer is software, hardware, data, content, events, people.

- What can be the methods of networking? Short answer: built-in modems, smartphones, Wi-Fi, Bluetooth.

- ?

- , ?

- ?

- ?

- , ?

- -? ?

- ?

- ?

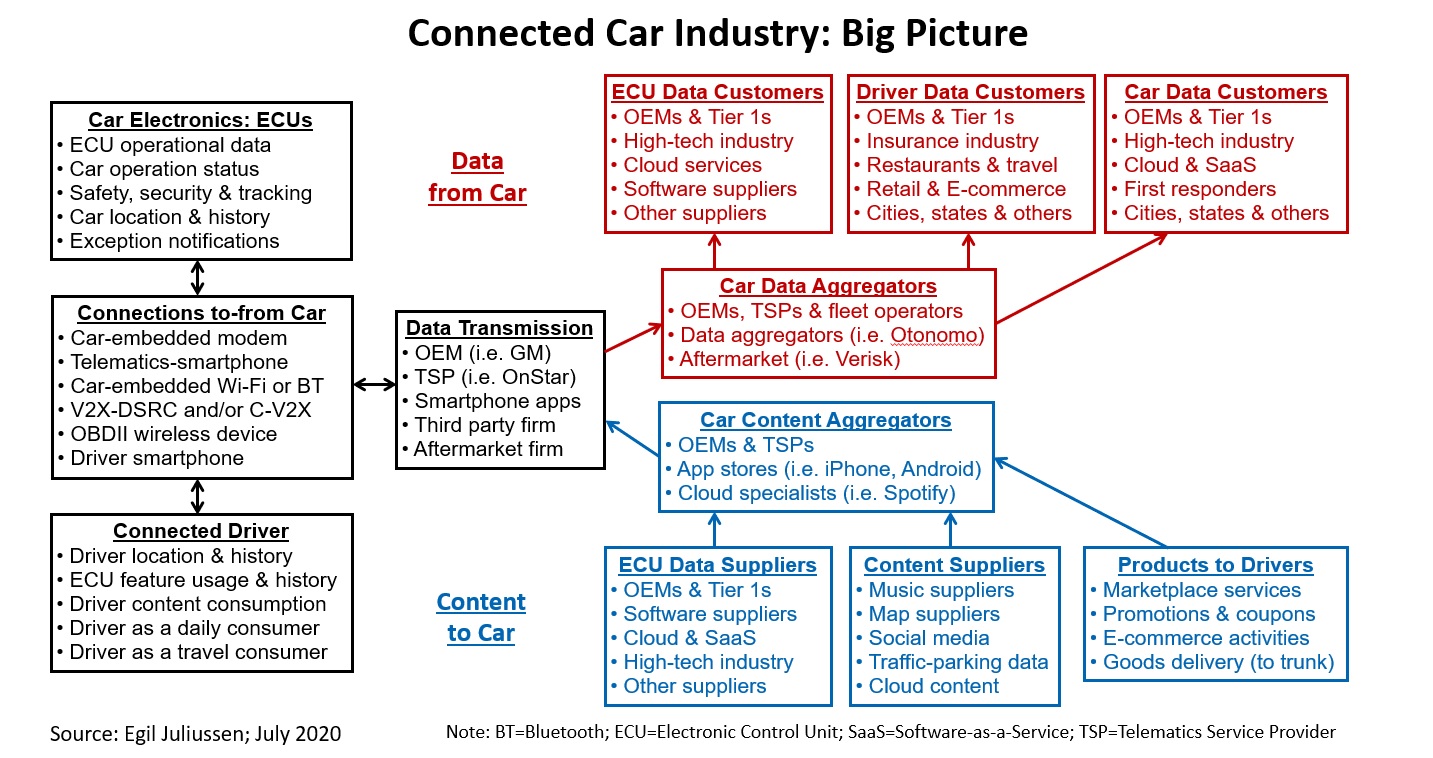

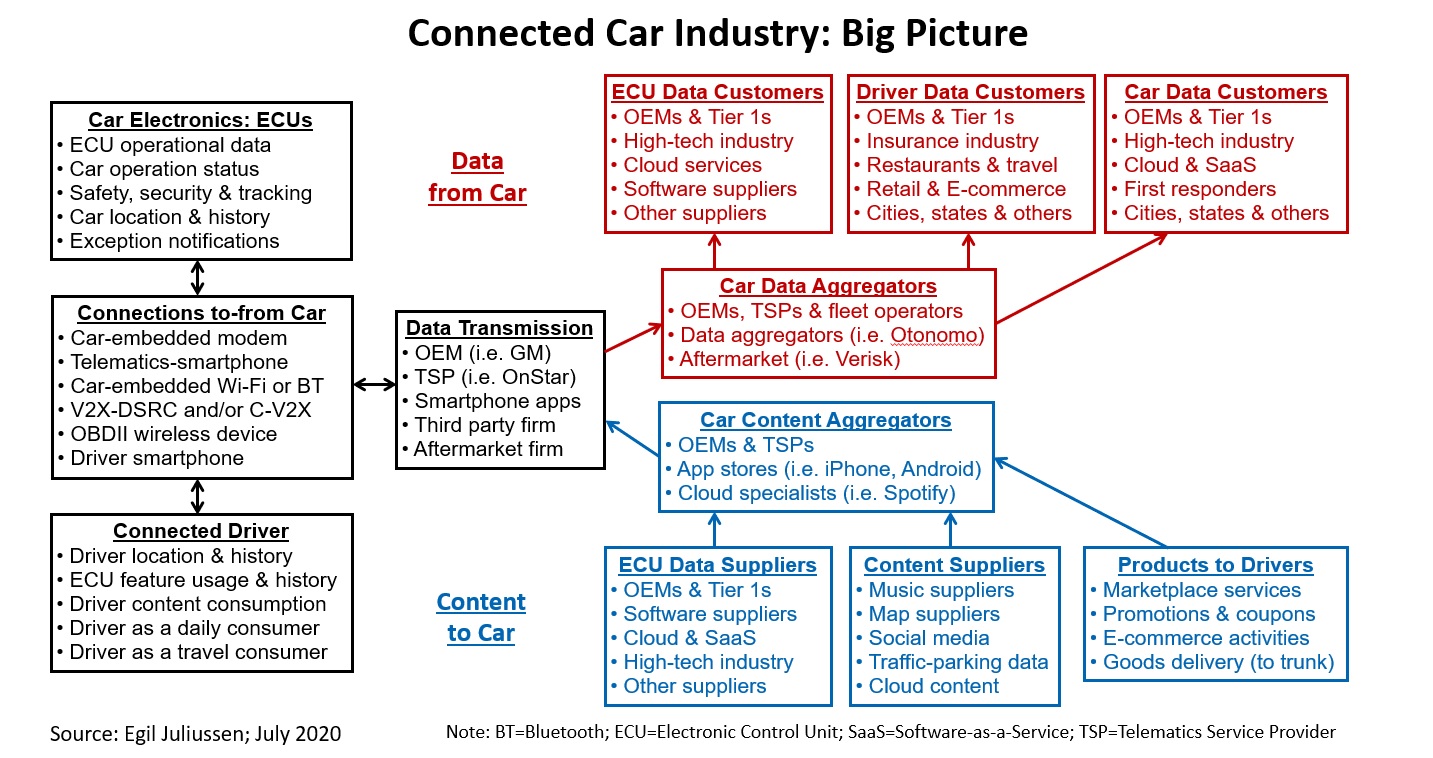

The networked vehicle industry is evolving in different directions. New market segments are emerging, which leads to an increase in the complexity of its structure. I really enjoy putting together a big picture of complex industrial areas. To paraphrase a proverb - in our computer age, one picture is worth 1,024 words.

Connected vehicles: the big picture

The following figure is a simplified diagram of the networked car industry. Today, there are many more methods of interaction and communication, and their number is constantly growing.

The left side of the diagram contains the components located in the car. It presents two main components: various electronics assembled into an ECU (electronic control unit) and the actions performed by a vehicle connected to the network. The ECU generates most of the vehicle data popular with customers. The control units also receive all the data intended for the vehicle. as many newer models have support for over-the-air updates.

The connected vehicle driver is important to the industry because not only does he produce data that is relevant to different market areas, but he is also a consumer of music and various content, and a user of e-commerce systems. The passengers of such cars are equally important, since they can connect their mobile devices to the electronic system of the car, but for simplicity of the scheme, they are combined with the driver.

The segments described above communicate with the outside world through the wireless devices located on the lower left in the diagram.

The most common means of connection is the built-in modem, which has been a key component of telematics systems for nearly 25 years. It is also worth noting the increase in the prevalence and performance of smartphones, which have become the core of the functionality of modern telematics systems. Many telematics systems can connect to both a modem and a smartphone. Apple and Google provide software for smartphone integration, and many OEMs use the software as part of their telematics and infotainment systems. The driver's smartphone can also be used as a networking element outside the telematics system. Such use of it can be much more distracting for the driver, even if the smartphone can be used without hands.

Short-range wireless technologies (such as Wi-Fi and Bluetooth) are also used for car connections - mainly for communication between a telematics system and a smartphone / tablet. Over the air software updates are often carried out over the drivers' home wireless network.

V2X (communication between cars and all other objects) includes communication between vehicles (V2V), communication between vehicles and transport infrastructure (V2I) and communication between vehicles and pedestrians (V2P). Unfortunately, there is a struggle between the automotive and cellular industries. The automotive industry has developed the V2X protocol, which uses DSRC technology based on IEEE 802.11p standards. The cellular industry has developed the C-V2X standard, which somewhat duplicates DSRC, but is based on 4G and 5G technologies. The war is fought both on the technological and on the political field, and the arguments of the parties sometimes upset. It is likely that the C-V2X will win this battle as some automakers have switched to this protocol. In particular,Chinese companies have decided to use C-V2X and are testing its deployment with 5G.

Data transmission to and from the vehicle is carried out primarily over the cellular network using multiple segments. The Telematics Service Provider (TSP) segment is likely to be the main segment and is typically associated with one or more specific OEMs.

Many smartphone apps from various companies (and there are more and more of these companies) exchange large amounts of data and content with cars. Third-party companies and aftermarket firms also connect to vehicle systems and / or interact with the driver. The pioneers in the use of aftermarket devices were insurance companies - they used OBD2 scanners to obtain information that would help assess the risks of driving their customers. This segment of the insurance market is User Based Insurance (UBI).

Red color shows the scheme of transferring data about the car to the client through the aggregator company. Content transferred to the vehicle is highlighted in blue on the diagram. Both of these segments have been greatly simplified in terms of data flow and the number of companies working on them - just a few of them are shown in the diagram. In the following paragraphs, we will look at the structure of these monetization segments (including discussing the prospects of the leading companies in the market)

Car data

The data coming from the car is primarily intended to help car OEMs. Monthly Remote Diagnostics (or Remote Diagnostics On Demand) has been the primary source of telematics data for OEMs and Tier 1 suppliers for nearly two decades. The main benefit of these processes is, first of all, the cost reduction, due to which the warranty service becomes cheaper. Manufacturers also have the ability to quickly find problems and fix them early in the production cycle, which increases the reliability of vehicles and the manufacturer's reputation.

These same reasons make remote diagnostics the most valuable service for car owners. Remote diagnostics allows you to identify problems with the technical condition of the car before they become serious and require expensive repairs (provided the car owner understands these problems early). In the aftermarket, a connected vehicle with a good history of remote diagnostics will generally cost more.

Cars can produce other data as well, potentially useful for various industries and companies. Automotive OEMs did not have the experience in the market to work on such projects long term. It took automotive data companies like Otonomo a significant amount of time to build the business models and cloud platforms that allowed them to enter this market. Aftermarket aggregators (such as Verisk) have also expanded the range of opportunities offered by automotive data (this includes the insurance market).

Automotive data processing companies are changing their business model and moving into mutually beneficial partnerships with automotive OEMs. Now OEMs provide vehicle data to aggregator companies, and in return receive a share of the revenues generated by the data. This approach enhances customer engagement potential and vehicle data availability. Next, I will expand on the topic of the automotive data and technology market in this market in more detail.

Automotive content

The possibilities of delivering content to the car are not covered in the same detail as the data generated by the cars. However, this market is actively developing, opening up new opportunities. The most promising technology for OEMs is over the air software update technology. This business model can significantly reduce the cost of car maintenance, since remote software updates are much cheaper than flashing at a dealer. Statistics show that most car owners update their vehicle software at home and not in dealerships.

Functional software updates that add new capabilities to the control unit can also be a new revenue stream for the automotive industry. Tesla was a pioneer in this area, and now many OEMs are working hard on their own systems for functional software updates. Modern automotive electronic systems architectures using CAN buses do not have the flexibility to upgrade functionality. Widely deployed network-based system architectures are much easier to update.

Many other options for delivering content to vehicles are emerging today (especially for driver-oriented content). Music has always been a leading component of in-car infotainment systems and is now being streamed via smartphones. Map updates, traffic information and parking data - all of this data is also growing in importance.

A new market segment for drivers is also emerging - it is called the market for services (by analogy with GM's innovative Marketplace Service product). Essentially, this service is an advertising and e-commerce platform that connects to a telematics system and minimizes driver distractions. In order to work with this platform, retailers will need to register and partner with GM. This business model gives the driver the ability to easily order a variety of goods during their daily commutes, and GM will receive a commission on these purchases. Promotions and various coupons will also be part of this system.

Delivery of goods is a growing business and connected cars are also entering this market. The trunks of many networked vehicles can be opened via the telematics system using one-time codes. and this opportunity can be used to deliver goods directly to the car. In this way, the delivery of online orders or various products from retail stores can be organized.

Subscribe to the channels:

@TeslaHackers - a community of Russian Tesla hackers, rental and drift training on Tesla

@AutomotiveRu - auto industry news, hardware and driving psychology

About ITELMA

Read more helpful articles: