The entire world (including the self-driving vehicle industry and the media) recognizes that we still have a long and thorny road ahead for Level 4 and 5 self-driving vehicles to become a reality.

Delays in the release of self-driving cars by numerous leading automakers and tech companies are proof enough of this claim. If that's not enough, then an even stronger signal is dialogue between tech companies and automakers. The topic of these discussions is the impossibility of developing a full-fledged unmanned vehicle without an ecosystem and its widespread support.

While the responsibilities of different companies may differ, automakers and technology firms have begun collaborating to address the safety issue of autonomous vehicles. This approach is very pragmatic, although 5 years ago the situation was much crazier. The developing (at that time) market was saturated with money from car companies and mired in pompous statements and predictions regarding the market for self-driving cars.

Now the inevitable conclusion is in the air: self-driving startups, backed by HYIP and money from automakers, will collapse as investor interest in Level 4 and Level 5 autonomous vehicles wanes (and as the economy weakens due to COVID-19)

There is another obvious conclusion: those players who have already invested heavily and have achieved some success in the development of platforms for unmanned vehicles will not be able to avoid developing a full-fledged technology stack. Investors perceive the development of their own stack as the most difficult technological challenge in their life. It seems to them that this stack will determine the fate of their business in the long term (and even in the near future).

Over the past five years, EE Times contributors have produced a wealth of stories about cars and the collaboration between automakers and tech companies to make self-driving a reality a reality.

Looking back, we ask ourselves - where are all these deals and partnerships now? What progress have you actually made?

The EE Times turned to Egil Juliussen, director of research and chief analyst for automotive technology at IHS Markit, for help in assessing changes in the self-driving vehicle market. The goal of our research is to find the surviving daredevils who have taken on the development of their own technology stack for self-driving cars. We want to know everything about these people and their projects.

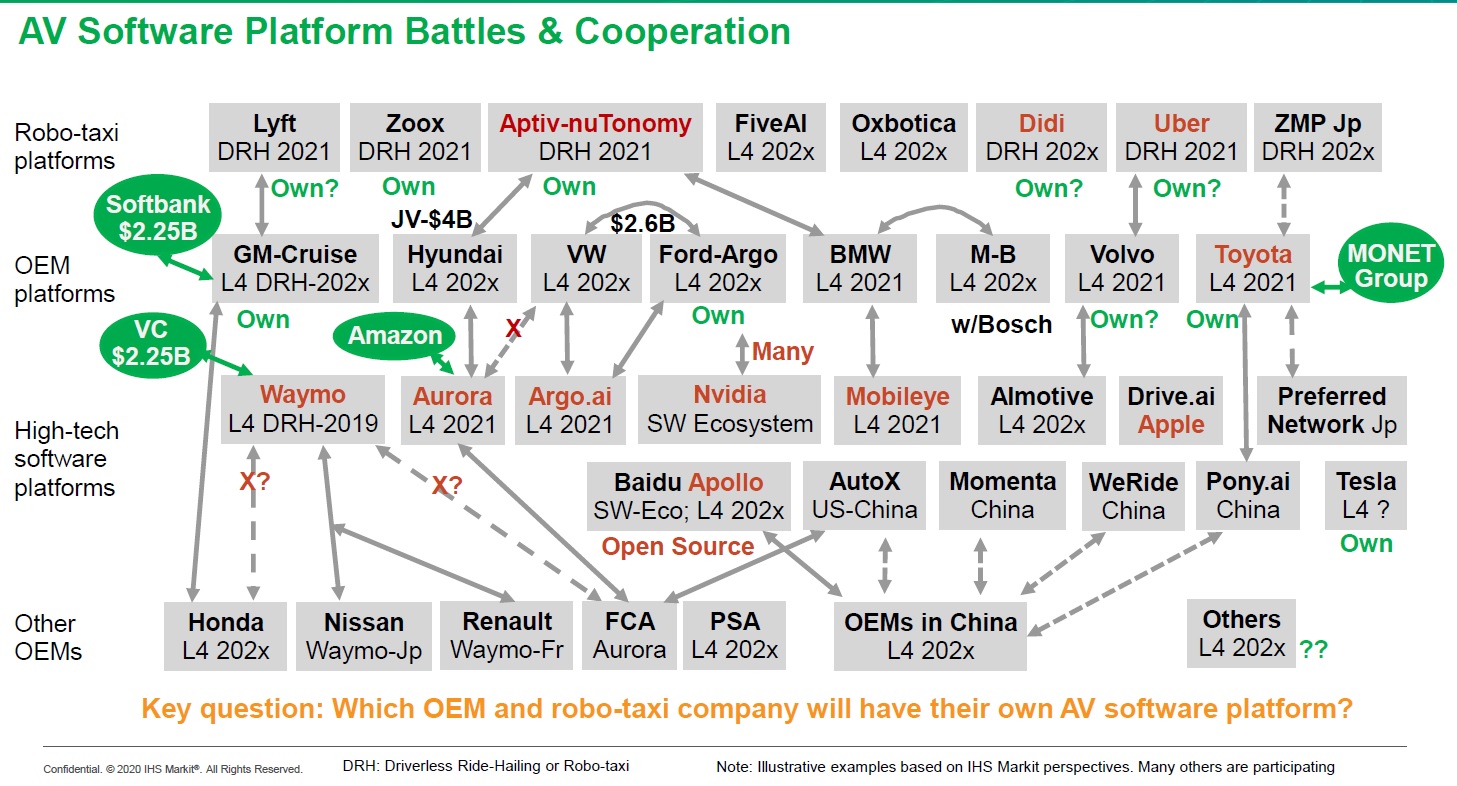

Our main task is to unravel the web of “announced” partnerships between the leading players in the market. The current picture of this relationship is very confusing. While trying to make sense of all this chaos, Juliussen identified three main themes: robo-taxis, OEMs, and high-tech software platforms.

Robo-taxi platforms

When talking about the robo-taxi, Juliussen listed eight major players, including companies that sell rides (such as Uber, Lyft, and Didi), as well as companies such as Aptiv-nuTonomy, FiveAI, Oxbotica, and ZMP Jp.

From the above list, Juliussen singled out three companies at the forefront: Aptiv-nuTonomy, Didi and Uber. It should also be noted that Zoox and Aptiv-nuTonomy have their own technology stacks.

Founded in 2014, Zoox is developing a fundamentally new unmanned vehicle designed to work in a robotic taxi fleet. Zoox is currently in the process of modifying the Toyota Higlander and installing self-driving systems in these vehicles. Self-driving cars are being tested in the Financial District and North Beach area of San Francisco.

Another player, Aptiv (formerly Delphi), three years ago bought NuTonomy, an MIT subsidiary that specializes in software development for self-driving cars and autonomous mobile robots.

Last September, Aptiv announced a $ 4 billion 50/50 joint venture with Hyundai. The deal, completed in March, is a very good deal for Aptiv-nuTonomy.

However, when OEMs begin to enter into deals for the development of technology stacks for autonomous vehicles with various suppliers of platforms for robotic taxis and developers and high-tech software, the relationship in the market becomes very confusing.

For example, Hyundai's position regarding full-fledged technology packages is unknown. It's possible that the Korean automaker is working with both Aptiv-nuTonomy and Aurora at the same time.

Aurora (a startup launched in January 2017) is developing a full technology stack called Aurora Driver. Hyundai is one of the early investors in Aurora. Aurora previously announced plans to expand its research and development program with Hyundai to develop a platform for self-driving vehicles. Torn between the partners, Hyundai said its new joint venture with Aptiv-nuTonomy would not affect its relationship with Aurora. Not wanting to give away its secrets, Hyundai has released a number of meager materials about its projects being developed in conjunction with Aurora.

OEM platforms

Moving on to an OEM platform developer, Juliussen highlighted GM-Cruise, Hyundai, VW, Ford-Argo, BMW, Mercedes-Benz, Bosch, Volvo and Toyota. They all tested their own self-driving cars.

The listed companies have different market positions. The list of automotive OEMs with their own self-driving software platforms includes the alliances GM-Cruise (which made Cruise, a complete stack for self-driving vehicles) and Ford-Argo (which made Argo.ai), and Toyota itself. Perhaps Volvo also has its own product, earlier the Swedish company announced a partnership with Almotive (formerly AdawWorks), a Hungarian company from Budapest that develops software platforms.

BMW uses Intel / Mobileye software platform. As previously mentioned, Hyundai's collaboration with Aurora and Aptiv-nuTonomy remains highly unclear.

Volkswagen, lacking its own self-driving software platform, ditched Aurora last summer and switched to Ford's Argo.ai.

High-tech software platforms

Juliussen's hi-tech list includes Waymo, Aurora, Argo.ai, AImotive, Drive.ai (all of which operate in the American market). Juliussen also singled out companies such as Baidu (Apollo project), AutoX, Momenta, WeRide and Pony.ai (companies operating in the Asian market, covering Japanese demand).

Nvidia and Mobileye, leading suppliers of chips for self-driving vehicles, are also developing their own software platforms. And, of course, there is Tesla developing its technology platform for self-driving cars.

Speaking of high-tech developments, I would like to highlight the products of Waymo, Aurora, Argo.ai, Intel / Mobileye, Nvidia and Drive.ai.

Last June, Apple acquired Drive.ai, a startup founded in 2015 in Mountain View, California. Drive.ai deals with AI-based systems for self-driving cars.

Apollo by Baidu is an open source self-driving software platform powered by a large number of players in the ecosystem.

Scant public data

The most difficult question in the self-driving car market is: Which player has a reliable and ready-to-release software platform that outperforms the competition?

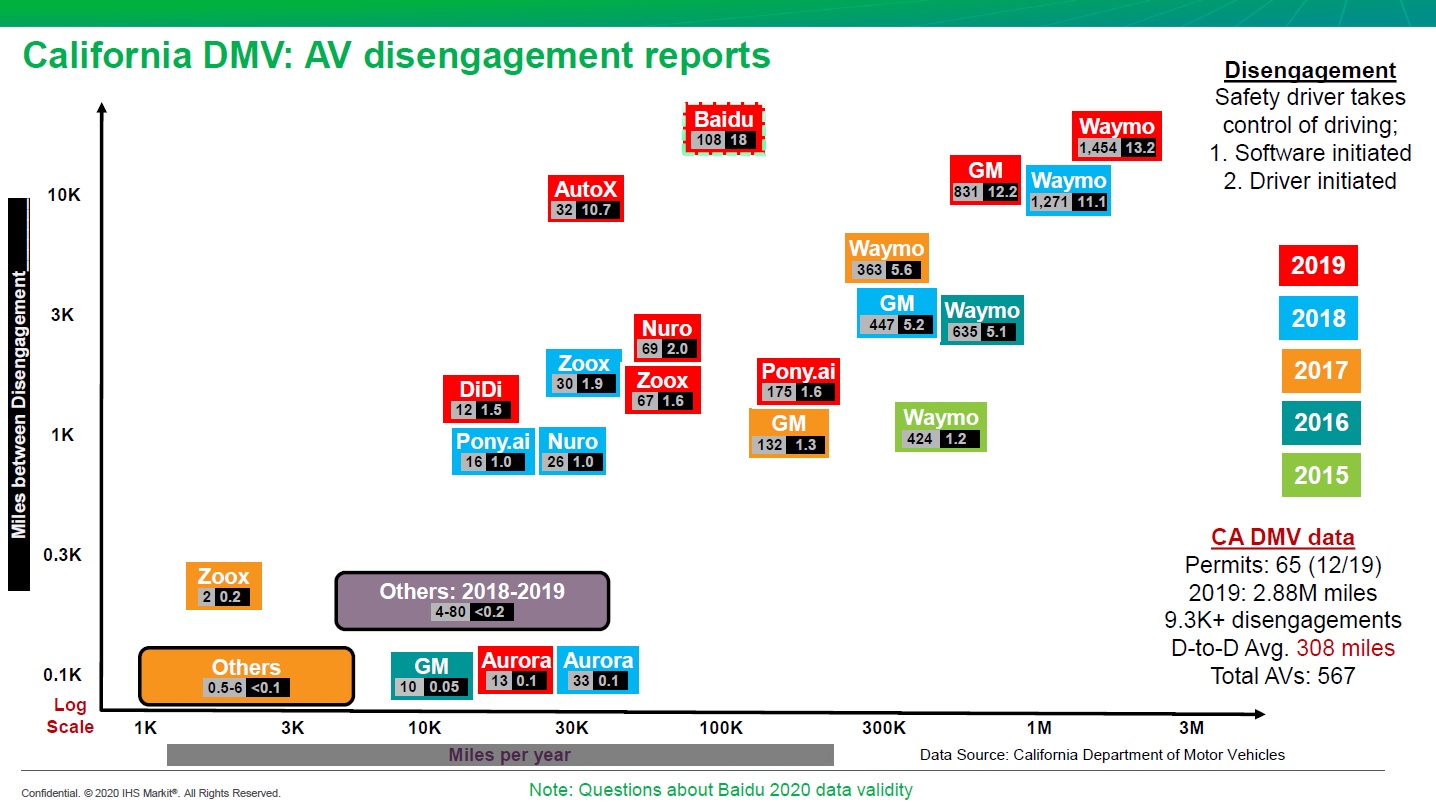

The developers of software platforms publish little information about their work. Data that can tell something about the state of affairs in the market for self-driving cars can be found only in the reports of the California Department of Transportation.

By law, all companies actively testing self-driving cars on California roads are required to publish data on the mileage and frequency of interception of control by a human driver (such emergencies are called rollbacks)

The California Department of Transportation defines a rollback as "disabling autonomous mode when a technical failure is detected, or when safe vehicle operation requires the test driver to disable autonomous autonomous mode and immediately take control of the vehicle."

Safety experts believe that this approach encourages test operators to intervene as little as possible, which could make the tests unsafe. One of the experts, Phil Koopman, made a categorical statement on this point: "Counting control returns is the wrong metric for testing security."

Nonetheless, Juliussen believes that take-back reports help the industry gauge the readiness of self-driving cars (even if they don't talk about safety as such).

As of the end of last year, 65 companies had test drive permits from the California Department of Transportation. Juliussen notes that despite the fact that 567 vehicles were licensed, only 420

were allowed on the roads. ...

According to Baidu reports, their test rides totaled 108,300 miles. The California Department of Transportation received a report from the company that said it had 18,000 miles between returns. Many industry experts (including Juliussen) are skeptical as Baidu claims their software platform performs much safer than similar products from Waymo (13,200 miles between control returns) and GM (12,200 miles)

Major software platforms for unmanned vehicles in the USA

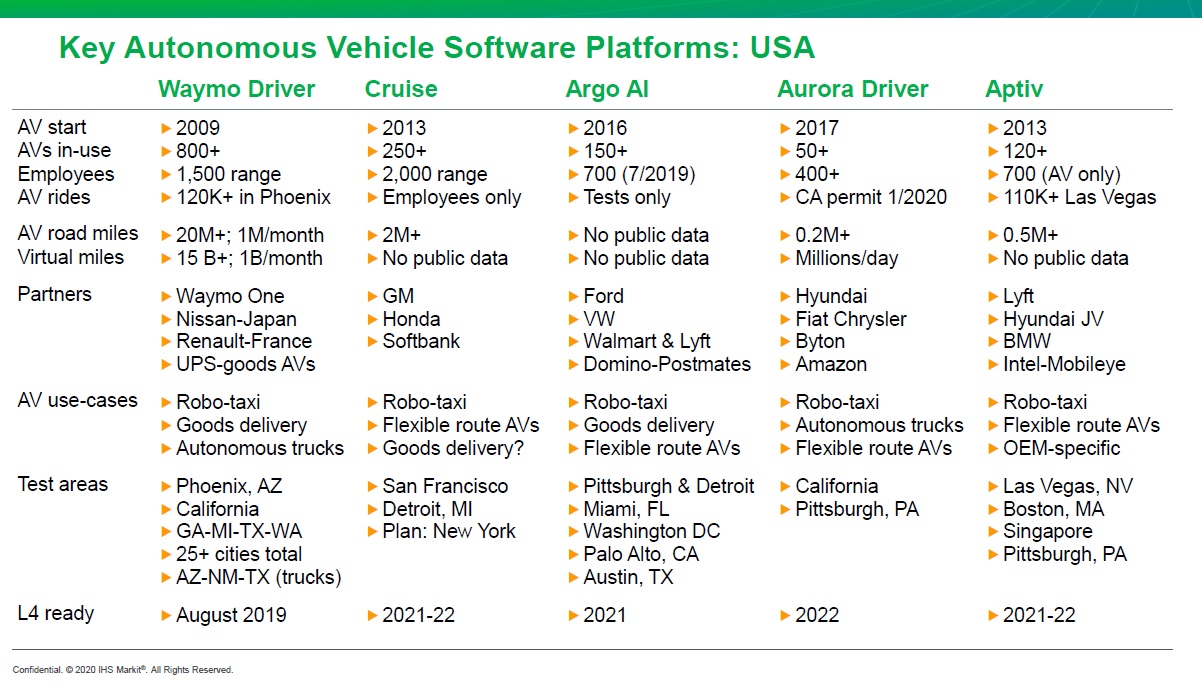

Juliussen compiled the following table listing five key software platforms for self-driving cars in the United States. This table provides information on scopes, target use cases, and test zones.

Most companies claim that their Level 4 driverless vehicle software platforms will be ready between 2021 and 2022. The exception is Waymo - they announced the launch of fully self-driving cars in parts of Arizona last fall.

Companies also vary in the number of self-driving cars they use. So, in the Waymo fleet there are the most cars (more than 800 are actively used), Aptiv has more than 120 and 50+ in Aurora.

However, in the era of Covid-19, test trips on American streets are not carried out.

The following announcement is posted on the Waymo website: “The Waymo One Arizona service is currently suspended. At the moment, we do not provide both rides with a trained driver, and services for driving self-driving cars as part of the early access program. "

Waymo also added: “Despite the fact that our services are suspended, from May 11th we will bring some of our vehicles onto the roads of Arizona. This program will be the first part of our project to restore secure service delivery. As part of the first phase, we will resume test rides, and then we will start working responsibly with Waymo One passengers. "

Of course, the pandemic will affect the progress in the development of software platforms for unmanned vehicles (it is not known how).

Recently, the self-driving vehicle industry came out with statements that "the pandemic has made it clear to us that the demand for self-driving vehicles is much greater than previously thought."

Juliussen, partially agreeing with this point of view, gave the following comment to the EE Times: “I think that self-driving cars are more necessary now than ever, but many players in the market do not have sufficient financial resources to continue their activities at the level of previous investments. ... Leading technology companies such as Google, Intel and a number of Chinese companies can continue to operate at the same level. Most OEMs will have to choose whether to invest in electric or self-driving cars, and funding may have to be cut in some segment to bring sales back to their previous level. "

Juliussen also added: "From a strategic point of view, electric vehicles can be more important than self-driving cars, because if they are not engaged, Tesla will capture too much market share."

In the future, the EE Times plans to develop a separate material that will look in more detail on the use cases for autonomous vehicles. We want to know: who needs self-driving cars?

Subscribe to the channels:

@TeslaHackers - a community of Russian Tesla hackers, rental and drift training on Tesla

@AutomotiveRu - auto industry news, hardware and driving psychology

About ITELMA

- automotive . 2500 , 650 .

, , . ( 30, ), -, -, - (DSP-) .

, . , , , . , automotive. , , .

, , . ( 30, ), -, -, - (DSP-) .

, . , , , . , automotive. , , .

Read more helpful articles:

- Free Online Courses in Automotive, Aerospace, Robotics and Engineering (50+)

- [] (, , )

- DEF CON 2018-2019

- [] Motornet —

- 16 , 8

- open source

- McKinsey: automotive

- …