Most expensive place in the USA

In the last article, we analyzed in detail the structure of the average salaries of programmers in Silicon Valley, and now it would be nice to understand how much will have to be spent on paying bills, and how much money will remain in the end, because the San Francisco Bay area is traditionally considered the most expensive place in the United States. yielding in cost of living only to the center of Manhattan (and according to some sources, it has long overtaken New York).

If it is easier for you to perceive information by ear or in the video clip mode, then an 18-minute video with time codes in the comments is especially for you .

Composition of expenses in Silicon Valley

We will consider four cases that are most often encountered in the case of IT immigration to the Valley:

Residence

As elsewhere, the lion's share of expenses includes rent expenses - be it renting an apartment, house or monthly mortgage payments in case of real estate purchase. This is how a typical residential complex for rent in the city of San Jose looks like:

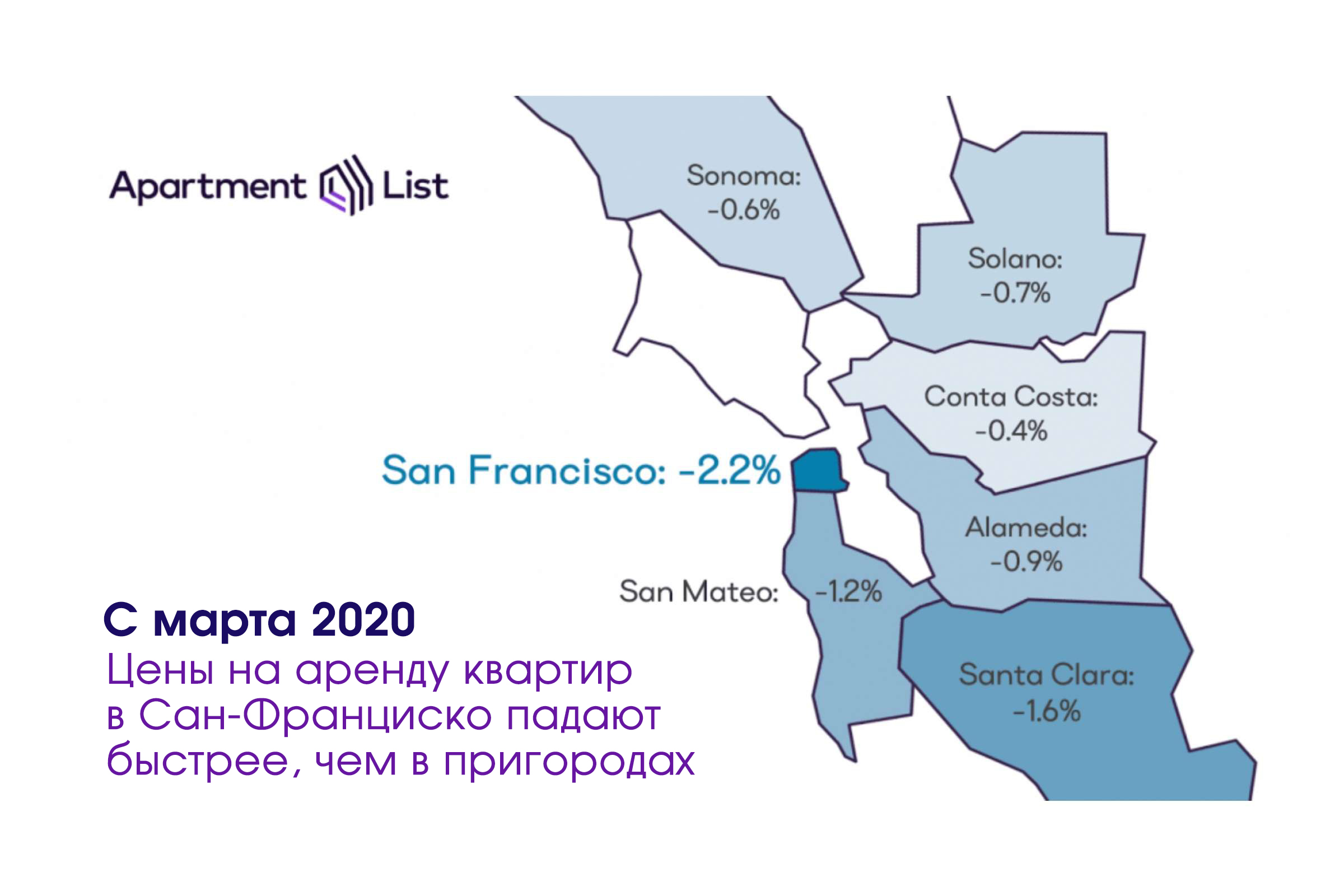

Prices for rental housing in connection with the coronavirus pandemic have fallen by 8-10%, but let's start from the dock era, because sooner or later the economy will catch up and return to its former course.

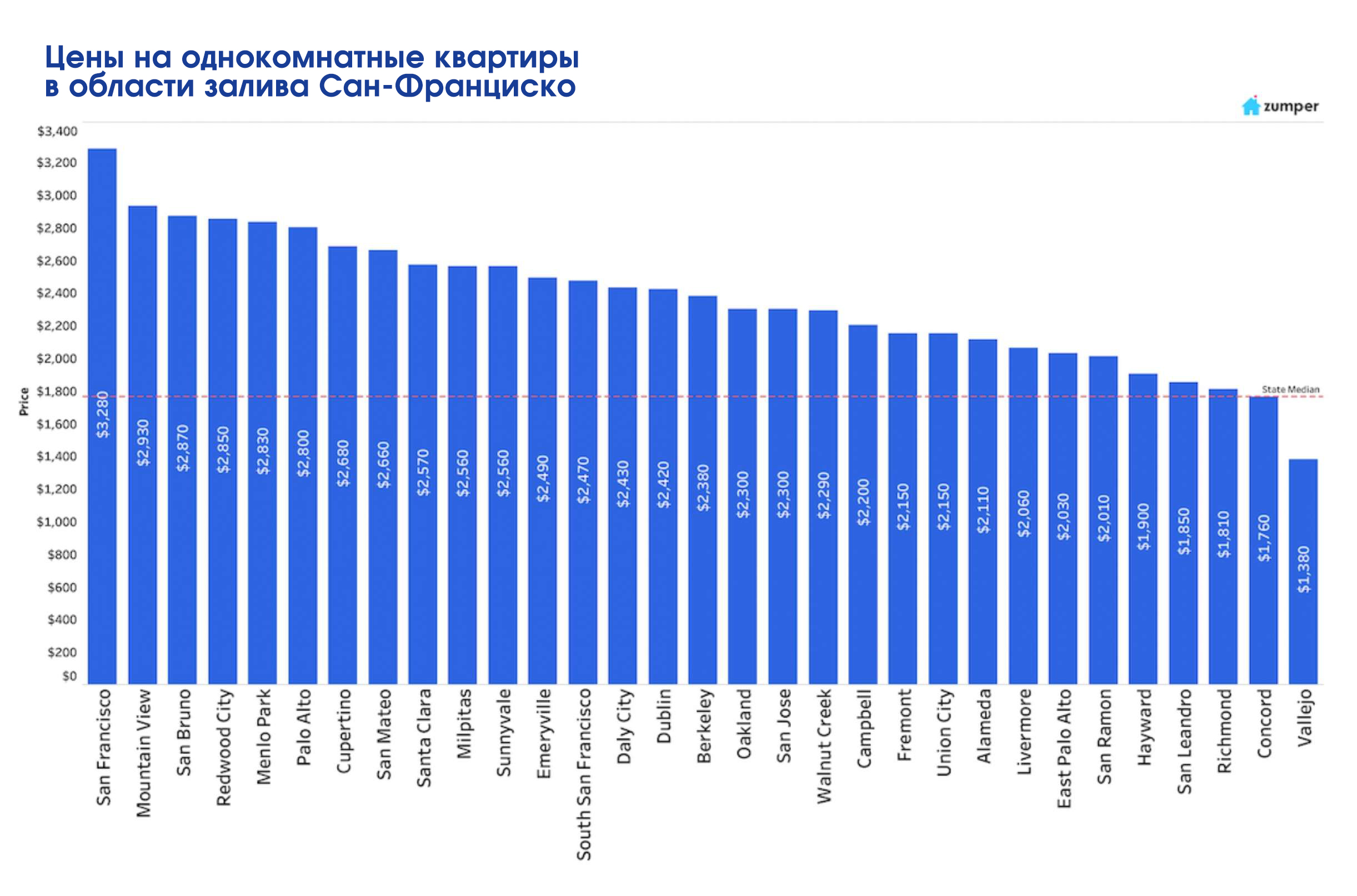

Price range per apartmentis very wide and starts anywhere from $ 2,000 and goes up to $ 10,000 per month depending on the location, the modernity of the complex, the number of bedrooms, bathrooms and the availability of additional amenities (amenities) such as: gyms, saunas, lounges with grills and pools, and the general condition of the residential complex - this is a new building or a building of 1962:

In fact, in the East Bay, you can find a one-bedroom apartment for $ 1,500, but as you get closer to the campuses of technology companies, the price can easily rise to $ 4,000. For a "kopeck piece", on average, you will have to pay $ 3,300. A 2 bedroom apartment means an apartment with two bedrooms and one living room. But, if you suddenly want to live overlooking the Bay Bridge in the financial district of San Francisco on the 34th floor in a three-room apartment, then you have to pay almost $ 10,000 a month.

If you are a loner, then a studio apartment is suitable for you, where there is only one room combined with a kitchen, and such housing will cost on average $ 2,400 in a new complex or about $ 1,700 in old one-story barracks without air conditioning.

Subtotal: Housing

- $2,400 —

- $2,750 —

- $3,300 —

- $3,300 — -

Communal payments

Do not forget that utilities are often not included in the rental price, so you will have to pay an average of about $ 150 per month for cold water, sewage, gas, electricity and garbage collection. Add to this gigabit Internet access for $ 70 and unlimited mobile communications for $ 45 per handset. Utilities payments can also include a voluntary-compulsory service for taking out garbage right from the threshold of your apartment (valet trash), it cannot be canceled and it is difficult to understand its convenience, but under the terms of the contract, you have to pay $ 25 a month for such a miracle service.

Subtotal: Utility bills

- $2,665 —

- $3,060 —

- $3,655 —

- $3,610 — -

Kindergarten and school

If you have a small child, you will have to pay $ 1,500 - $ 2,000 for a kindergarten, while schoolchildren will cost free if they attend a regular school, in the case of a private one, you will have to pay about $ 3,000 monthly. By the way, public schools live not only at the expense of the state budget, but also gladly accept donations, so you can donate any amount per month, if religion does not forbid you and finances allow.

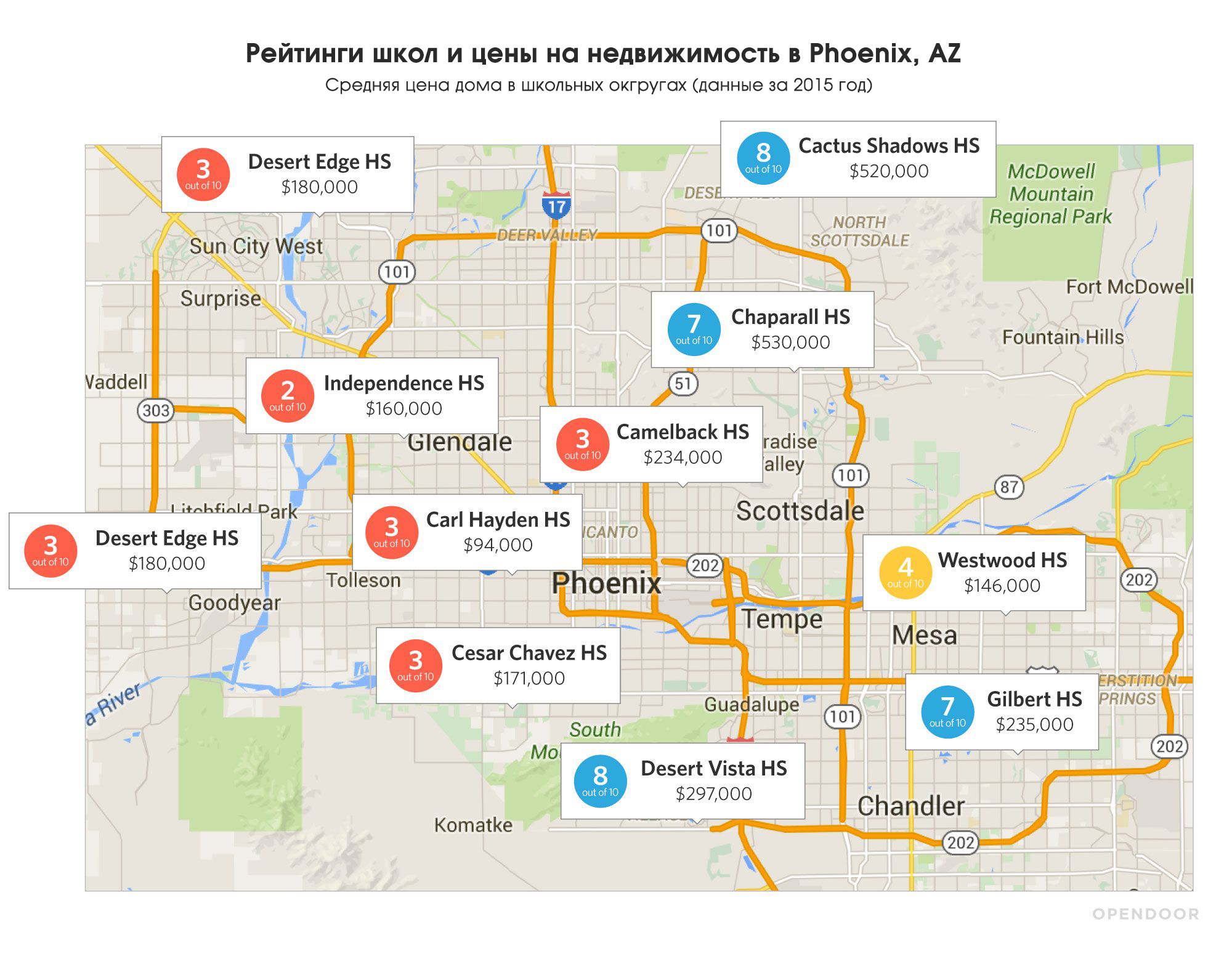

Returning to the topic of housing choice: those who have a school-age child should pay special attention to the rating of schools in the area where you intend to settle, since often good schools can only be found in areas with expensive housing. There is a linear relationship - the higher the school's rating (school performance), the more expensive real estate in the district.

Subtotal: Kindergarten and school

- $2,665 —

- $3,060 —

- $5,360 —

- $3,805 — -

Nutrition

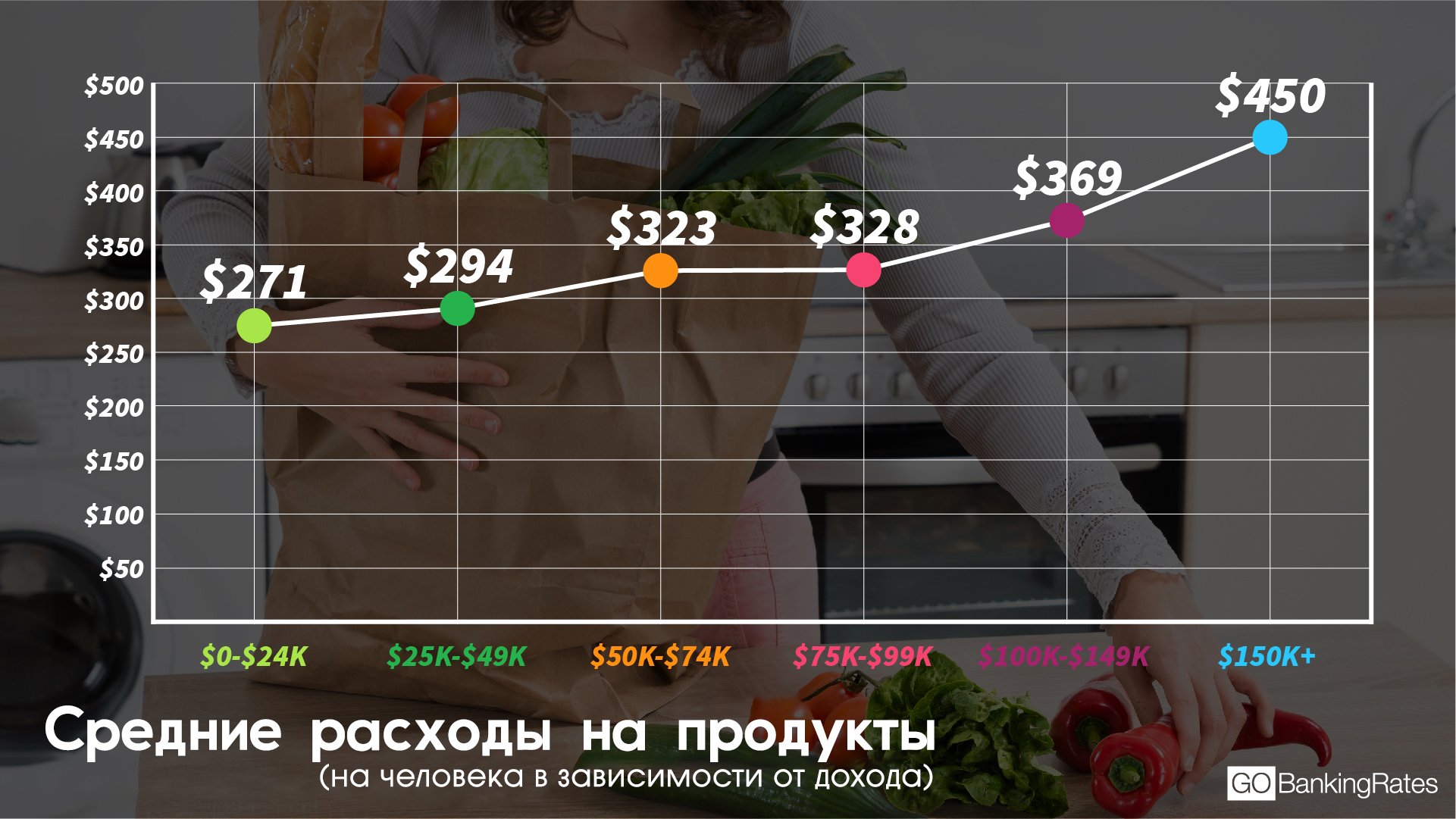

Not everything is so simple here, because everyone eats differently: some love fast food, others prefer to cook at home, still others are vegan, still others order ready-made meals home, and still others eat only in restaurants. But on average, you should be looking at $ 450 - $ 500 per month per adult, and that will include grocery shopping, ordering food at home, and going out to restaurants (no tips). If you eat only at home, then this amount can be safely lowered one and a half times to $ 350 per person.

Subtotal: Nutrition

- $3,140 —

- $4,010 —

- $6,550 —

- $5,230 — -

Public transport

It's real to live without a car, and everyone who says that there is a problem with public transport in America has simply never used it in Silicon Valley. I lived 3 years without a car at the dawn of my immigration. Not convenient? Perhaps, but when you live alone it is quite acceptable, and also magically helps to keep fit.

In general, the Valley is distinguished by the fact that public transport is much more developed here than is commonly believed. You can travel by buses, trams, trains, trains and, of course, by bike. For lovers of two-wheeled friends, all conditions have been created here - a bicycle path runs along almost every road, bicycle and pedestrian overpasses are laid above and below major highways, and all public transport is equipped with special places for fixing and transporting bicycles.

For example, a bus can easily transport two bicycles on the outside and two on the inside, VTA trams are equipped with four bike racks in each carriage, and CalTrain trains attach a separate bicycle carriage for public transport enthusiasts. Therefore, there is life without a car in Silicon Valley! The price for a monthly bus-trolley-bus-tram pass in the same VTA network is $ 90 per month or $ 990 if paid for a year. A monthly CalTrain train pass from San Jose to San Francisco costs nearly $ 300 . But you can save about the same amount every month in a parking lot in the city center.

True, there are also disadvantages - getting to the Pacific coast in Santa Cruz or going to Yosemite National Park for the weekend becomes an interesting quest with the search for friends who want to go on adventures with you. But, here you can be helped by any company that provides car rental services or the same Turo service, where you can rent a car for the weekend from private traders.

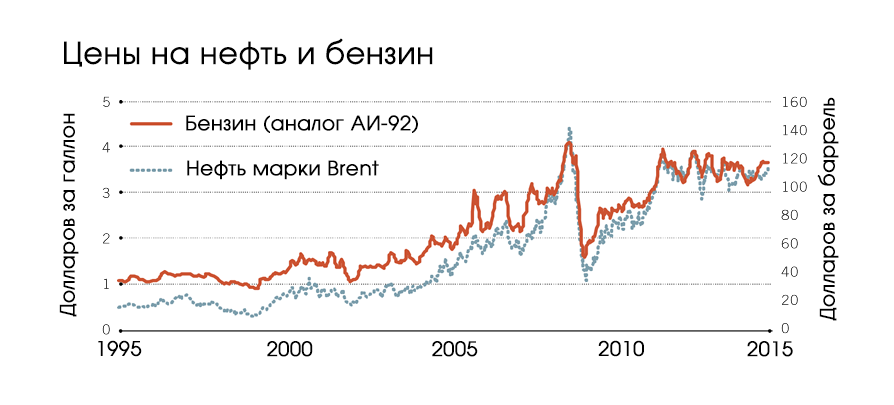

Car

Gasoline prices in the USA are volatile and tied to oil prices, that is, if black gold goes down, then in the morning a gallon of gasoline costs $ 2.50, if oil rises, then the price may rise to $ 4.50, but on average over the past two years the cost of regular gasoline (it is analogous to the AI-92) was $ 3.70 per gallon, that is, about 70 rubles per liter. Therefore, with a combined consumption of 22 mpg (10.5 liters per 100 km) and an average mileage of 15,000 miles per year (24,140 km), you will have to pay $ 190 per month for gas. If you have two cars - boldly multiply by two!

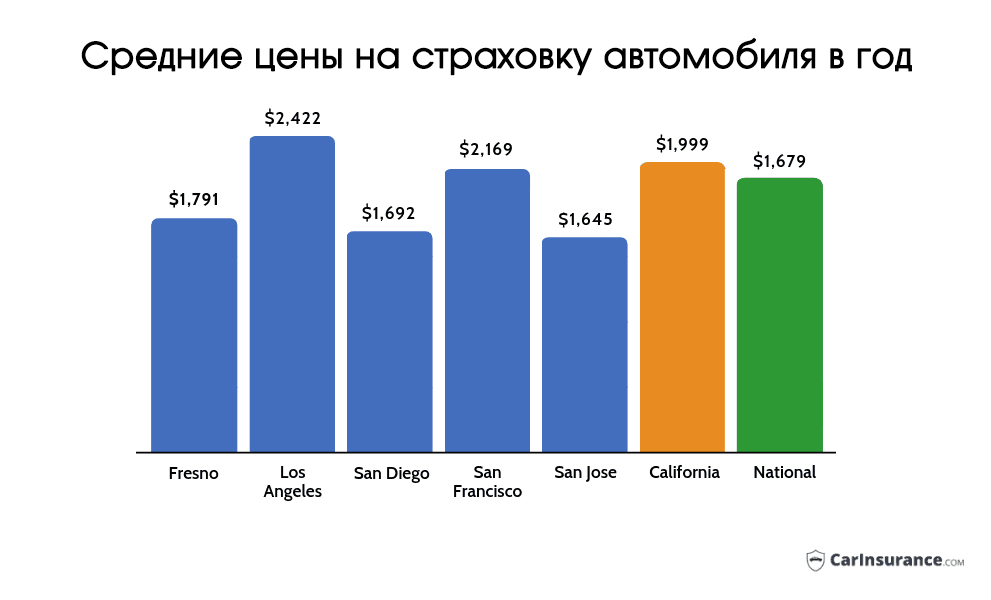

Continuing the automotive theme - monthly expenses for a car, including insurance and maintenance, of course, can vary greatly depending on many factors: this is the class of the car, and the maintenance plan at the dealership, and the type of transaction - purchase or lease (when the car is rented on a long-term basis, usually from 2 to 3.5 years). In the latter case, the pricing is also influenced by the number of miles per year that are allowed to roll back on this car. As a personal example, I can say that leasing an Infiniti Q50 LUXE 3.0t with a 15,000 miles limit costs $ 460 per month plus $ 160 insurance, the cost of which depends on the coverage and crime rate in the area where you live. Therefore, the price for insurance in Mountain View or Palo Alto will be much lower than in San Francisco.

Maintenance comes out somewhere in the $ 65 a month, if you add up all visits to service centers for the lease period and divide them by a lease period of 36 months. Service includes changing tires and brake pads before returning the vehicle back to the dealer, regularly changing the oil, air and oil filters (every 10,000 miles), and rotating the wheels every 5,000 miles. With cars of a class simpler instead of $ 680 per month, you can easily give no more than $ 350 - $ 400.

Subtotal: Transport

- $3,523 — ( )

- $4,885 —

- $7,425 —

- $6,105 — -

In the case of a purchase on credit, the monthly payment will be twice the lease payment. Many expats buy a car for cash upon arrival in America and thus do not overpay for a loan. Plus, here you can save on the cost of insurance, since you will have to take full insurance coverage for a leased car, which is obligatory for you by the contract, and your car can get by with a minimum wage. The right step would be to pay part of the cost of the car right away, and borrow the other part in order to start building your credit history in the United States.

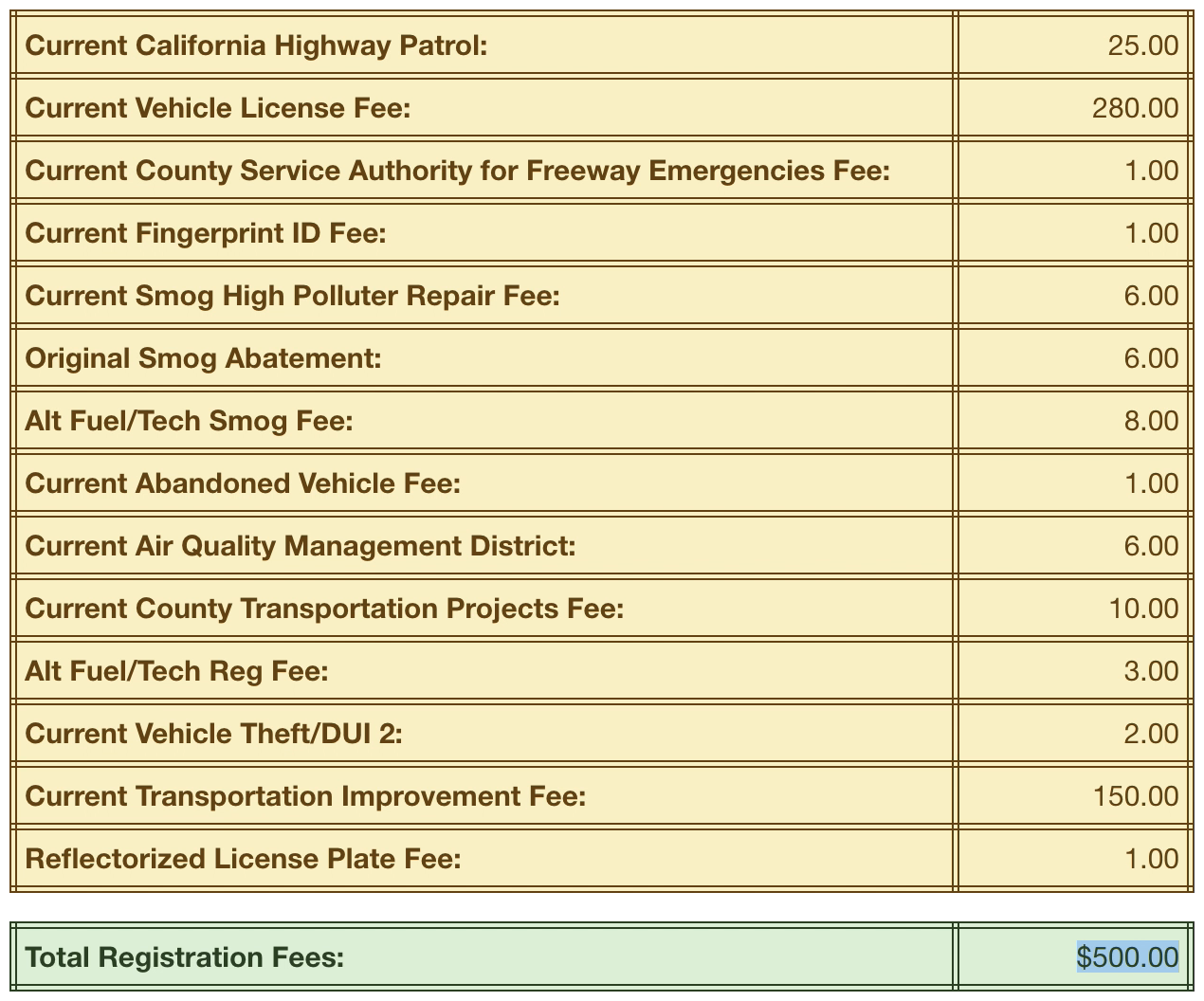

I have to pay in the region of $ 500 a year in car tax, because 300 horses will not pay for itself. And most of this tax goes to the so-called License Fee ($ 280), $ 150 goes to the municipal budget for the construction and repair of roads (Transportation Improvement), $ 25 goes to the Highway Patrol budget, and the rest is distributed on trifles between categories like Air Quality Management, Freeway. Emergency Services and Abandoned Vehicle Fees.

Leisure and travel

It is quite difficult to average the cost of vacation and travel in terms of a month, but if you take all our travels for a year and divide the amount received by 12 months, then on average you get $ 380 per person. This amount includes plane tickets, car rentals, fuel, toll roads, parking lots, hotel or rental services such as Airbnb / VRBO , meals, taxis, excursions and souvenirs.

You can estimate how often we travel on Instagram . There, I often share interesting places near the Valley, which are definitely worth a visit as soon as you set foot on Californian land.

Subtotal: Vacation and travel

- $3,903 —

- $5,645 —

- $8,375 —

- $7,055 — -

Entertainment

Any trips to the cinema, to museums, to concerts, to theaters, to musicals, to amusement parks and other entertainment events (again, depending on the frequency of visits) will cost an average of $ 250 per person. If you are small amateurs of entertainment, you can safely delete this item, and even in the COVID-19 pandemic, which it is not yet known how long will last, this is not very relevant.

Subtotal: Entertainment

- $4,153 —

- $6,145 —

- $9,000 —

- $7,680 — -

The medicine

Life and medical insurance for one person - $ 30, for a family of two - $ 80, for parents with one child - $ 120. Such prices for medicine, provided that the main part is paid by your employer. If the company where you work does not provide insurance, or you have not yet found a job, but you may need medical services, you will have to pay $ 350per month for one person for the most HMO plan. The full Platinum plan will cost $ 560. Plus, do not forget about the mandatory ten percent surcharge for all medical services, and this is a visit to the doctor, tests, X-rays, MRI and so on. On average, with medications for colds, analgin, fillings and crowns, another $ 45 per month per person will be released. The main thing is not to get sick without insurance, because, as everyone knows perfectly well, in America it can cost a pretty penny.

Subtotal: Medicine

- $4,228 —

- $6,315 —

- $9,255 —

- $7,935 — -

Household goods

Household supplies, household chemicals, apartment decor, tools, consumables and stationery will cost an average of $ 200 per adult. Do not be surprised at this amount, because this includes the average monthly expenses for the purchase of furniture, and it is very expensive here, even a trip to IKEA can pull a decent amount out of your pocket. Therefore, those who have recently arrived will not be superfluous to find out about the craigslist site , which is an analogue of Avito. Also, there are groups on Facebook, where Russian-speaking (and not only) people sell used furniture or even give it away for free in good condition.

Subtotal: Household goods

- $4,428 —

- $6,715 —

- $9,655 —

- $8,335 — -

Electronics

Next, let's take the average spending on electronics from the series: update / buy a TV, quadcopter, camera, game computer, phone, monitor, toys for a child, etc. $ 150 - $ 200 per month per family member - it's easy!

Subtotal: Electronics

- $4,603 —

- $7,065 —

- $10,180 —

- $8,860 — -

Personal belongings

Do not forget about personal items, such as clothes, accessories to it, personal hygiene products, cosmetics, gifts, and this item of expenditure will be in the region of $ 200 per person.

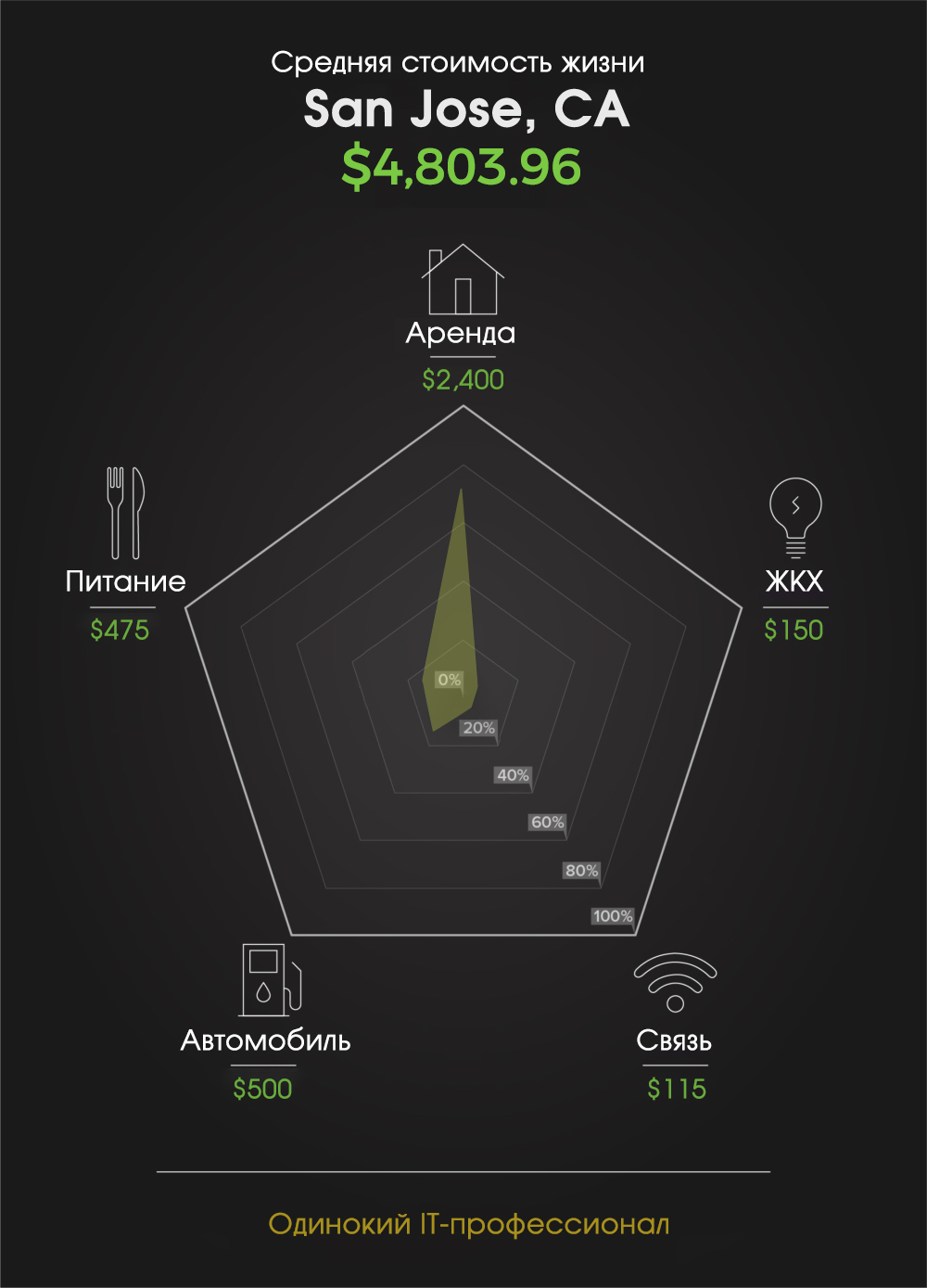

Subtotal: Personal belongings

- $4,803 —

- $7,465 —

- $10,780 —

- $9,460 — -

Important note

Please note that the first couple of months after the move, you will have to invest in the last three categories much more than the monthly average, because you will need to buy furniture, appliances, tools, household chemicals, kitchen utensils and, most importantly, a normal shower with a hose, because Americans love watering cans that stick out of the wall at a height of two meters. By the way, it would be a great idea to take as many things as possible with you - pots, towels, hangers, knives, your favorite vase, bed linen, and so on.

Let's sum up

What do we get in the end? With a salary of $ 185,000.00, after taxes, say 30%, there remains $ 129,500, which is $ 10,790 net each month. With this level of expenses, a family of two adults with a preschool child will have $ 10 left, the parents of the student will have a balance of $ 1,330, well, and a couple without children can start saving as much as $ 3,325 for training their future spinoggling! The lucky one (or the lucky one) will be able to party for almost $ 6,000 ($ 5,987) every month

Note that all of these calculations are approximate, and your expenses may differ from those shown in this video, especially when it comes to spending on personal items, clothing, household items and travel. By the way, do not forget that only one person in the family works in the calculations, and $ 185,000 is the base salary, to which the employees have bonuses with cash and shares on top.

As you can see, a family of three can live quite well, almost denying themselves nothing, for $ 11,000 a month. At the same time, there is a huge springboard for savings at the beginning of the move. A couple without children can easily live in a studio, a young family for the first year of their immigration can live in a complex without frills such as a pool and chill-out zones (but in California), a Honda Civic for $ 190 per month will be more profitable and more practical than Infiniti, and you can travel and with tents in campsites for $ 15 per night.

Statistics show that the median household income in the San Francisco Bay Area, that is, in the area of such cities as San Bruno, San Mateo, Redwood City, Palo Alto, Sunnyvale, San Jose, Fremont and Hayward, is $ 117,000 after payment of taxes, which means that if we cut the budget of our spherical programmer in a vacuum by exactly $ 12,000, he can still live in the Valley (others somehow live)!

Of course, over the past five years, there has been more than one wave of migration along the Valley towards technology hubs in Austin, Denver, Seattle, Boston, Chicago and Portland, but people still go to the Golden State, despite its exorbitant cost of living and insane property prices. Let's see how the face of Silicon Valley will change in a year, when IT specialists continue to work remotely, and companies will finally understand the benefits of such a scheme.

Otherwise, if everything returns to normal, you will already have numbers, armed with which, you can safely start planning your budget for the first months of adaptation in California and start accumulating the coveted amount for moving to the States (if you move without guaranteed employment ). Well, for those who travel to America on a work visa, this information was supposed to give an understanding of how much money would need to bargain with an employer in order to live comfortably for the first couple of years in the IT capital of the world.