What will be discussed

As part of Friday's madness, let's imagine that you magically have a work permit in the United States, and you are ready to teleport to the very center of Mountain View after breakfast to instantly find a job in a large IT company and start earning your first contribution to house in Silicon Valley. But first, let's try to figure out what the salary of a software developer consists of, what is usually included in the social package of an IT specialist, and what additional benefits are received by employees of large technology companies in the United States. All this knowledge will be useful to you in order to sell yourself more expensive, live more comfortably and make money faster on a shed in the suburbs of San Francisco.

If it is easier for you to perceive information by ear or in the mode of a video clip, then especially for you is ready28 minute video with timecodes in the comments .

Three main components

So, a software engineer in the United States is a rather

prestigious profession . Of course, these are not anesthesiologists, not surgeons, not orthodontists, not dentists, not therapists, not pediatricians, or even pilots, who, according to official statistics from the US Department of Labor, earn much more than developers. But the area of responsibility and the risks of the latter are much higher.

So, first of all, you need to understand that the amount that the employer pays you

is formed from three components:

- Cash is money that you receive directly to the card twice a

month (or they are sent to you by paper check, which can then either be cashed or deposited into your bank account. - Non-cash are promotions in different variations: RSA, RSU, PSU, PSA or ESPP.

- Benefits - all indirect costs incurred by the employer, from which you also

benefit.

When it comes to salary, it is customary to talk about the amount one year before taxes. This amount is called Total Compensation (TC) and includes Cash and Non-cash components.

Total Compensation + Benefits are referred to herein as Compensation Package.

What is Cash?

This is the main salary component, which in turn is divided into three parts:

- Base salary is your base salary for the year without tax deduction. This amount is indexed annually by 4-5% in accordance with the market, which has been growing for the last 15 years, for sure.

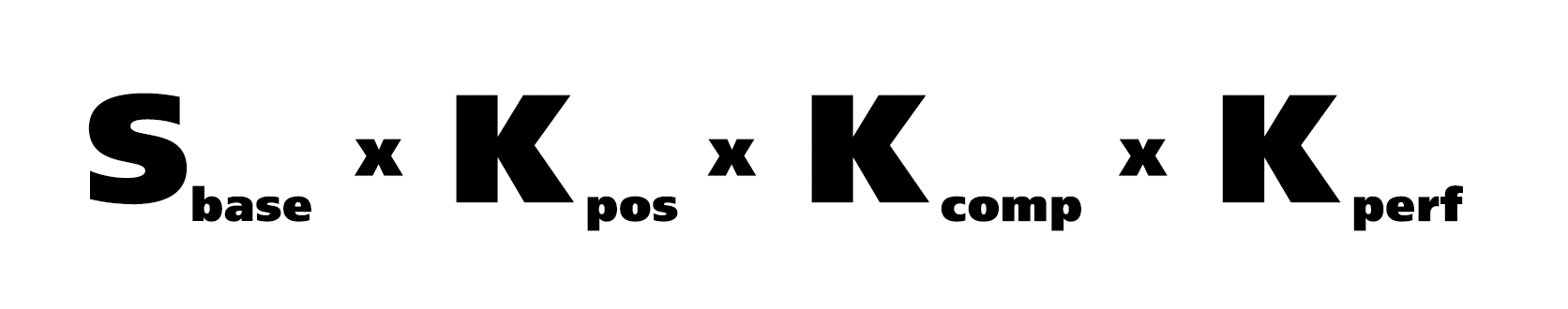

- Performance bonuses — , - , . , :

Sbase — , Kpos — (, , , , , ), Kcomp — , Kperf — , ( )

, $100,000 20% . . - Sign-up bonuses — , .

-, , , . , , , . , , , !

-, , RSU, , sign-up bonus .

«non-cash»

This is a very important and extremely interesting way of paying for labor, when public corporations (and private companies too) pay employees not only in money, but also in their own shares.

These can be payment options through RSA, RSU, PSU, PSA, or ESPP. What is this anyway

?

RSU (Restricted Stock Units)

These are stocks that promise to be issued in your favor if certain conditions are met. RSU can be obtained in several ways:

- as a sign-up stock bonus when you apply for a job and have previously discussed the number of shares that you will receive (with the terms of their issue in your name)

- and as bonuses along with a six-month bonus

Moreover, these promotions can be of two types:

- already released in your favor

- limited

You can sell the former immediately after receiving (or leave it while waiting for dividends), while the latter will be issued to you after some time.

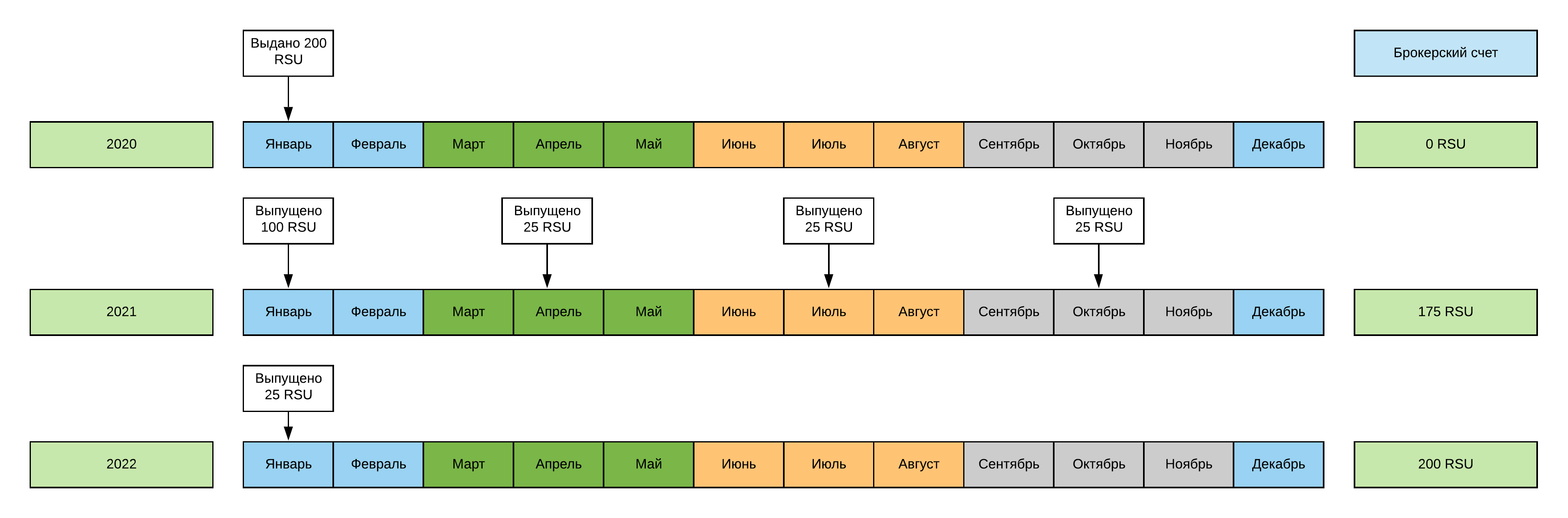

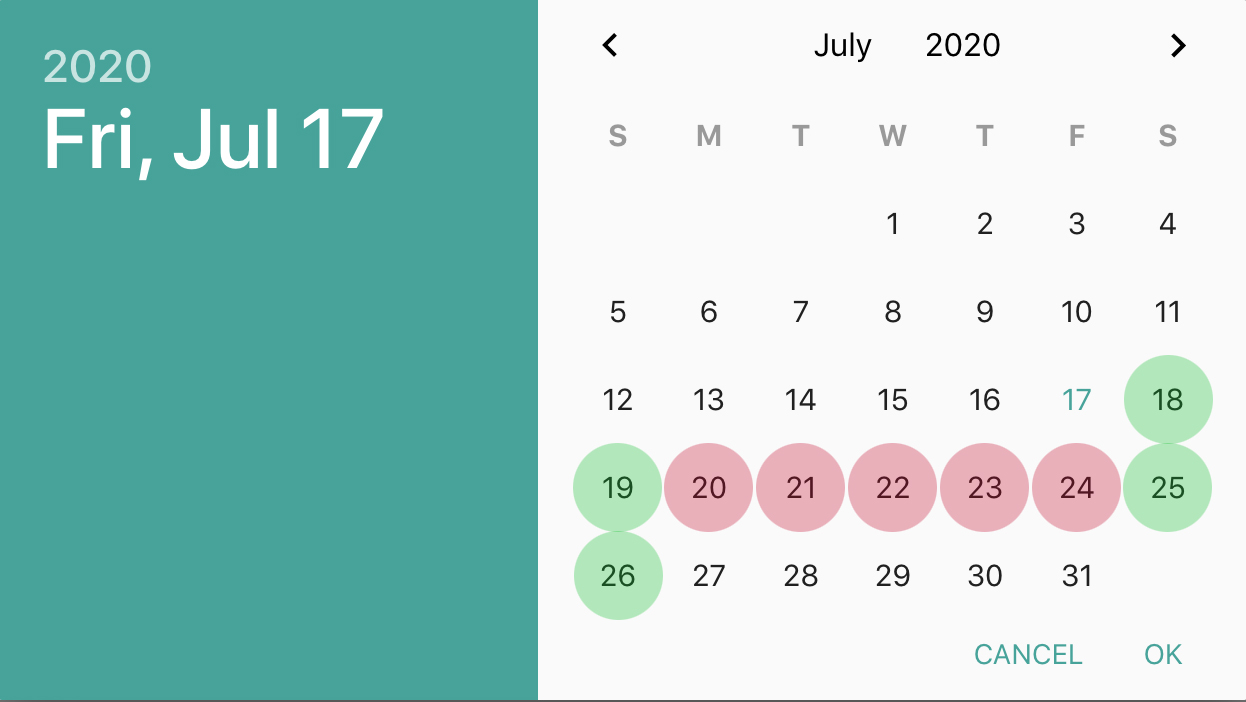

Difficult, give an example of RSU

Let's take a simple example: let's say that you got a job in a company in January 2020 and you were given 200 RSU, provided that the vesting period of the first hundred shares (the time you need to work in the company to get them) is one year. That is, you will be able to sell this hundred only after you have worked in the company for a year. And the remaining one hundred shares will be issued to you according to the vesting schedule (the schedule for issuing the rest of the shareholding) - 25 shares every quarter. As a result, you will receive all 200 shares only after working for two years in the company.

Thus, corporations solve several problems at once:

- you can have less cash for wages;

- by releasing RSU to employees - staff turnover decreases;

- the involvement of employees in the company's financial affairs increases;

- unobtrusive binding of employees to the company is carried out, since no one wants to lose potential shares that are almost in their pocket;

- motivation increases and employees are interested in working more efficiently in order to raise the value of stocks and increase their capital with their own labor.

That is why this part of the compensation is often called Equity , which in English means "capital".

The same spherical employee in a vacuum with a base salary of $ 100,000 on average earns about $ 30,000 in RSU per year.

ESPP (Employee Stock Purchase Program)

This is another share payment option, using which employees can buy company shares twice a year at a discount of up to 15% using the money allocated from their pay checks .

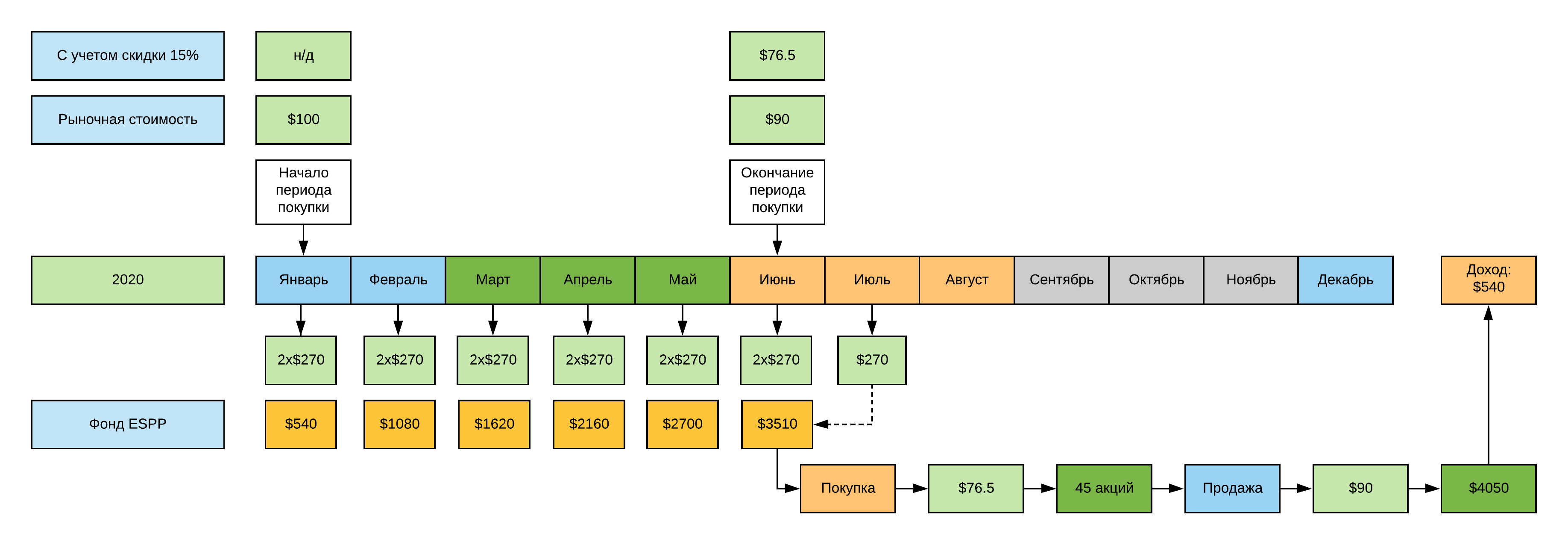

Let's take a quick look at how it works. Let's say an employee receives a check twice a month for $ 2,700 after tax . And then he decides that it would be nice to join the ESPP program and buy the company's shares at a discount. Then he decides that he will spend ten percent of the amount of his check on buying shares through ESPP. That is, now the employer withholds $ 270 in favor of the ESPP program, and the employee writes a check for $ 2,430.

Let's say the company's shares for the period of the beginning of the purchase are equal to $ 100, and on the day when the period for the purchase ends, they fell to $ 90. In this case, the employer chooses the minimum price, that is, $ 90 and discounts another 15%.

Thus, the employee's share price will be $ 76.5. For six months, about $ 3,510 should have been withheld from the employee's checks, that is, he can buy 45 shares, and immediately sell at the current price of $ 90, receiving $ 4,050, that is, earn $ 540 from scratch, despite the fact that the company's shares fell in price.

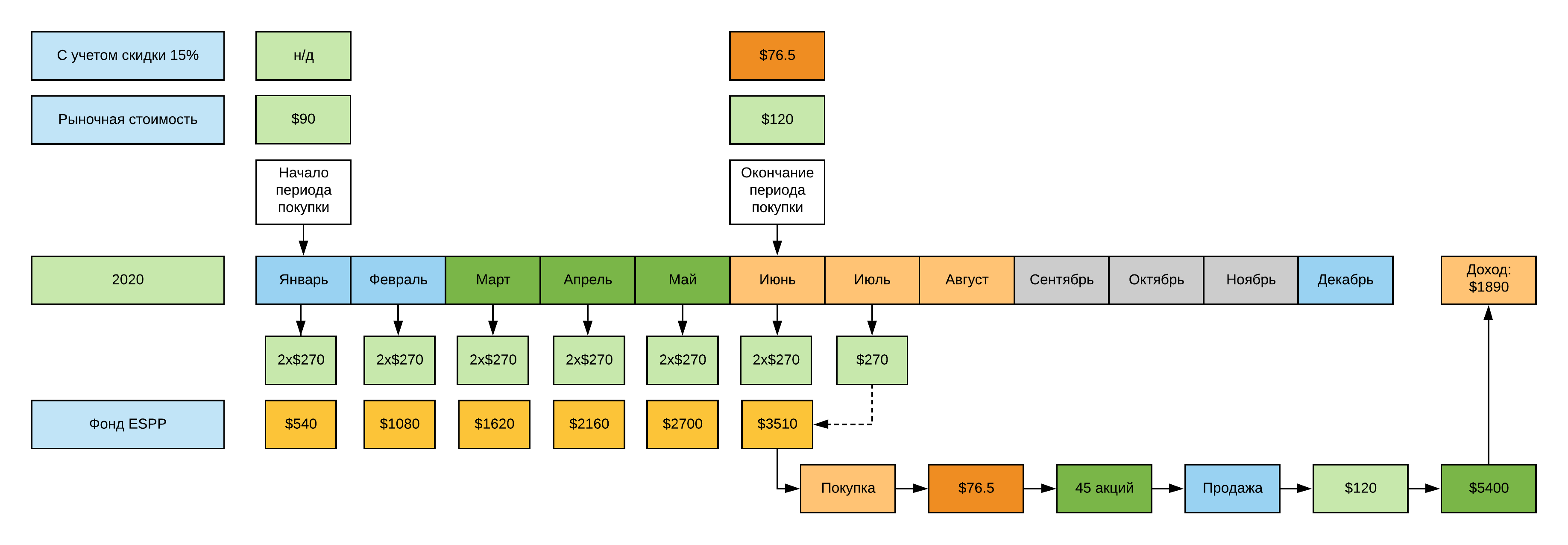

It is better, of course, if the company's shares go up strongly, then, for example, at the end of the buying period, the price of shares has risen from $ 90 to $ 120, then by buying 31 shares for $ 76.5 you can sell them for $ 120 and get $ 5,400, that is, earn $ 1,890!

In general, there is nothing to even think about - this is free money, which you should not refuse if your employer offers the ESPP program.

But what about RSA, PSA, PSU?

The Restricted Stock Award (RSA) is usually given out almost for free by startups at the initial stage, when they still do not have much cash and it is easier for them to pay employees with stocks, which in the future may greatly increase in price (or not at all). But RSA can also have restrictions in the form of vesting period and vesting schedule .

The Performance Stock Award (PSA) and Performance Stock Unit (PSU) are the same eggs, only in profile, except that the number of shares can be changed in accordance with the performance of the employee.

Benefits or "bonuses and benefits"

We go further - all indirect costs of the employer for you, from which you also benefit are called Benefits . You can list them endlessly, but let's try to concentrate on the main ones:

- medical insurance

- paid holiday

- sick days

- contributions to the pension fund

- Holiday to care for the child

- training at the expense of the company

- compensation for public transport costs

- daily hot meals

Medical insurance

What does medical insurance include? Each company has its own

insurance plans, and the companies work with completely different medical institutions.

Basic Plan . If you are young and do not have special health problems, you can choose a plan that will cost only $ 30 per month ($ 360 per year). It will cover the basic needs from the series - an annual routine examination by a therapist (they will listen to you, knock on your knees, poke your stomach, check your throat, measure blood pressure, pulse, height and weight), advise you to take tests (already paid) and prescribe medications, prescribing you have a prescription at the pharmacy. All other hospital visits will have to be paid out-of-pocket, that is, out of your pocket. In this case, you will be limited only to those doctors who work in the medical center on the company's campus (if there is one, of course) or medical personnel in the institution with which your employer cooperates.

Health Maintenance Organization (HMO) . These plans have higher monthly premiums that allow for $ 1,500 - $ 2,000 per year for a family of two to attend state-of-the-art clinics such as Kaiser Permanente or Stanford Healthcare. At the same time, the company pays up to 88% of your insurance plan costs. And that's about $ 15,000 - $ 20,000 every year.

Usually these are large multidisciplinary medical centers that provide the

entire range of medical services in one place. This system is very similar to what we

used to know under the name "polyclinic". To get to a specialist of this or

that profile, you first have to make an appointment with a therapist who will already refer you to the right doctor.

Preferred Provider Organization (PPO) . The third and most expensive type of insurance is when you are connected to a network of medical providers such as United Healthcare or Cigna and you are free to visit any doctors and clinics that work in these networks, without prior agreement with the attending physician. These insurance plans are usually chosen by those who have health problems.

By the way, employer insurance often includes dental and vision medical insurance.(ophthalmology), some plans include up to 2 free visits to the dentist and ophthalmologist per year, while you can order new glasses, brushing or whitening your teeth for free.

Many companies also offer life insurance (up to 5-6 annual salaries) and such a thing as the Health Care Flexible Spending Account , where you can save up to $ 2,500 dollars annually before taxes, and use these funds to pay for medical services ( and even to buy medicines in pharmacies).

Paid holiday

But enough about doctors, let's talk about vacations. After all, all around them they say that the

USA has insanely short vacations, that Americans are terrible workaholics and that it is

simply impossible for Russian people to live in the States after their New Year and May holidays.

Of course, this is not the case when it comes to Silicon Valley IT companies. Many companies, such as WorkDay, DropBox and GitHub, provide unlimited PTO, that is, an unlimited number of vacation days. How do you ask? It's very simple: the company shifts responsibility to employees and, hoping for their decency, allows them to rest as much as they need, of course, all this should not affect productivity and work results. Plus, a psychological fact is triggered here, when each employee understands that while he is on vacation, his duties fall on his colleagues, who, by the way, are also people.

If the company does not have an unlimited weekend policy, then in most cases

for every two weeks worked, the employee receives a little over 6 hours of paid leave. That is, if we assume that there are 52 weeks in a year, then in 12 months an employee can accumulate 160 hours or exactly 20 vacation days. These days can be used as you like - you can take

one day in the middle of the week, you can take 5 days at once and go on a 9-day trip

(that is, two days off before and two days after the working week are stitched together).

Typically, people take vacations in the immediate vicinity of holidays, which are often celebrated on Mondays in the United States. Thus, taking a vacation on Friday, you can go somewhere for four days, spending just one day of your vacation (and a lot of money, because prices in these holiday periods double up, and people in popular places triple).

By the way, if you are not a big fan of recreation, you can save up vacation days up to 240 hours (if you have worked in the company for less than 5 years) and up to 280 hours if you have given the company more than 5 years of your life. And this is seven whole weeks of unbridled fun!

Many corporations give an extra day off for their birthday, which can be rescheduled within two weeks of the date of birth. There is also a so-called floating holiday , which can be attached to any vacation or taken on any day of the year.

And if you are tired of work, and there is no vacation left, but you really want to change the type of activity, employees are given the opportunity to spend up to seven days, working in some volunteer organization.

Sick days

Sick days in the usual sense of the word does not exist here: either you will have to use your vacation days as sick days, and / or you will have a limited number of sick days that you can use during the year. The lucky ones who work on Facebook can enjoy unlimited sick days and be sick for a whole year.

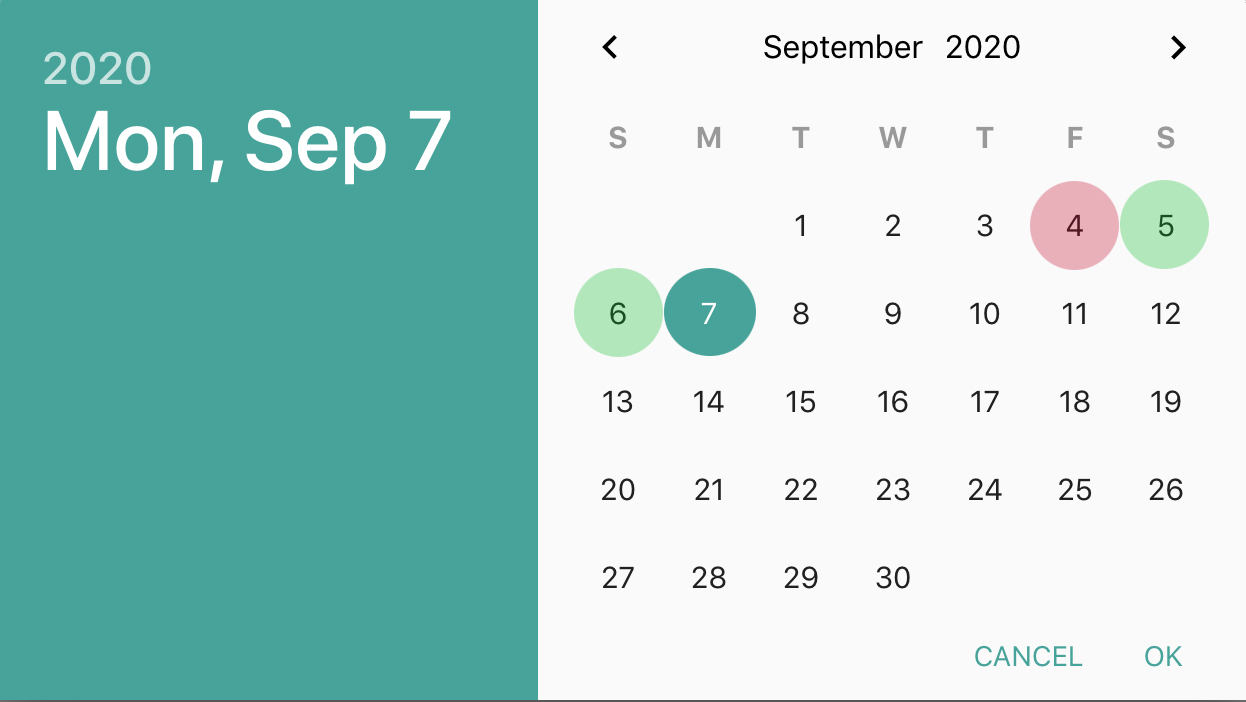

Maternity leave

Perhaps it is worth mentioning also the parental leave. There is no decree for 166 weeks, as

in Ukraine, or 165 weeks, as in Russia. America in this regard is closer to Kyrgyzstan (18) and Turkmenistan (16). Of course, each company has a different decree, but the general trend is no more than 13 weeks. And it doesn't matter whether you are a man or a woman. Parental leave (parental leave) is given to the main care giver (parent who takes care of the newborn), that is, the new father can easily go on vacation for 13 weeks and take care of the child, and the mother can return to work in a week. Of course, it is possible to extend the vacation at your own expense, if circumstances so require.

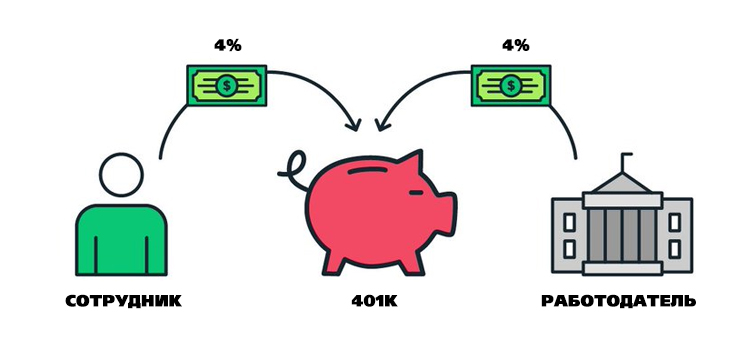

Pension fund contributions

The next major benefit is 401k retirement fund contributions. This is a US private pension plan that allows employees to deposit a portion of their pre-income tax salary into their personal savings accounts and distribute it among index and ETF funds as they wish. Thus, employees save on taxes, gradually increase their capital and save up for their happy old age.

In addition, employers often deposit their funds into employees' accounts, and the share of their contributions ranges from 10% to 100%. Google, for example, makes a match (equal contribution to a retirement account) 100% until the amount of contributions for the year exceeds $ 3000, after which it continues to make a match 50% up to the limit of $ 20,000.

Whatmatch ? This is when 4% of your salary ($ 2,700 every two weeks), you put aside in the pension fund (you can choose the percentage yourself to the point that you can completely abandon these contributions). But in case of refusal, you will lose the same match from your employer. After all, 4% of $ 2,700 is $ 121.5, which you put into your retirement account and exactly the same amount your employer will put there, that is, in a year, those who do not save in 401k will lose $ 3,159.

Tuition payment

Trainings and payment for conferences you are interested in is also a very important benefit! The usual course lasts three to five working days. You can take up to four such classes per year (one training per quarter). The average price for companies is $ 1,500 per unit, which means that you can save up to $ 6,000 per year.

Some companies that do not always feel financially independent are not wasting money right and left, but simply buying their employees a Pluralsight, Lynda or Code School subscription. In total, it comes out about $ 150 per year, versus $ 6,000 per employee. The benefits are clear. Other companies do both together.

By the way, such giants as Google, Apple, Facebook help their employees with obtaining an MBA, conduct regular consultations and can compensate up to $ 10,000 a year for training.

A typical campus of a large IT company in the Valley

If we are talking about large companies, then a campus is a huge territory and a bunch of buildings that include not only offices, but also kindergartens, fitness centers (with an excellent park of simulators and a set of sports programs for cycling, cross-fit, boxing or Pilates), pharmacies with discounts for employees, a medical center (with offices of a therapist, dentist, ophthalmologist and its own laboratory). That is, it is absolutely not necessary to waste time on the road to the doctor, because you can solve all the issues with excellent specialists right at work!

Fare

Owners of electric cars can charge for free at ChargePoint stations, however, as soon as the car is 100% charged, it needs to be parked and space for the next person who wants to recharge with free electricity.

If you do not have a car or your road to work by car brings only mental suffering - you can use the shuttle buses that take employees home every day from 7 am to 6 pm. An hour and a half and you got from San Jose to San Francisco or vice versa.

And if you need to get from one campus building to another (after all, it can take up to 45 minutes on foot), then you can use the internal taxi system, which is ordered as Uber, and will take you from the entrance to the entrance in 5 minutes. But it only works within the campus.

And for lovers of public transport, companies pay for travel tickets. In the southwestern area of the San Francisco Bay, there are branches of the transport company VTA. The annual pass here costs about $ 1,000.

Nutrition

I won't talk about free snacks and drinks, you won't see anyone with that now. But many companies provide daily hot meals. Someone feeds their employees three times a week, others have a daily meal. Food is brought to order from restaurants or the company employs a whole army of chefs, as it is arranged in Google. That is, for a year in which 261 working days, you can save $ 3,915, given that the average check for lunch here is $ 15.

Sudden contraction

If they suddenly decide to cut you down due to reorganization or optimization, you will be paid wages for another 4 months, all unpaid vacations will be paid, medical insurance will be paid for another 4 months, you will receive a six-month bonus, and in special cases the kindergarten where your the child, and even your mortgage, will be paid within the same four months.

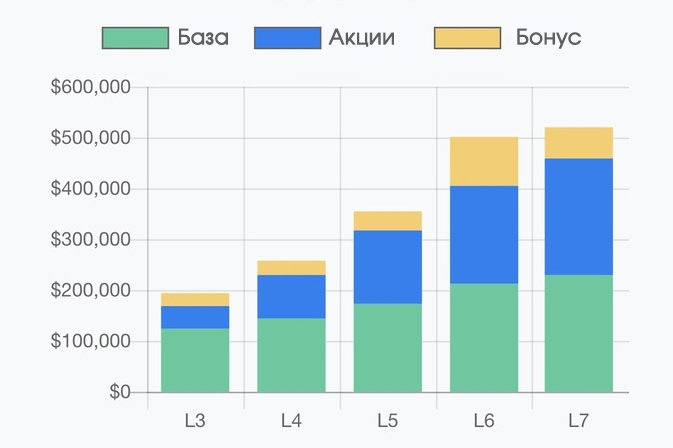

Let's sum up

It turns out that with a base salary of $ 100,000, the total compensation package practically

exceeds $ 200,000. Often, the higher the position, the correspondingly higher the base

salary, as well as cash and stock bonuses. The rest of the goodies remain unchanged. That is, with a base salary of $ 100,000, you receive $ 50,000 in bonuses / shares, and the cost of your social package costs your employer another $ 50,000.

It is important to understand that the size of your salary will depend not only on your experience and interviewing skills, but also on your status in the United States. If you suddenly come to work in the USA through a bodyshop(an outstaffer company) such as Luxoft or EPAM, then most likely you will be issued an L-visa, according to which you will have to work in this company until a green card is issued to you. According to the law, the process should begin no earlier than in 1.5 years, but in practice it can take several years.

What does it mean? And the fact that working for such a company on an L-visa, you will have to forget about the average market salary until you get a green card and change your employer. Therefore, when planning your future budget in the States with a move through a badishop,

focus on the average salary in the state, and not according to your specialty in this region. That is, going to California, expect $ 75,000 - $ 90,000 thousand per year before taxes.

But, if you already have five years of development experience, a green card or an H1B visa, then you can safely claim $ 180,000 - $ 200,000 per year. But, in order to better understand trends and not lose money on your salary, I strongly advise you to study the site www.levels.fyi , which contains financial insights on all large companies in Silicon Valley, broken down by position.

Also, it will not be superfluous to look at the average temperature in the hospital using the good old www.glassdoor.com - the information there is a little less visual, but more complete and detailed.

The top 10 average salaries for 2019 for the software engineer position with

more than 5 years of experience correlates well with the profitability and capitalization of companies on the market.

After all, everyone has probably heard the acronym FAANG? Now let's go through the top salary:

- Netflix pays well above the market by hiring only strong seniors, so the average salary there is $ 227,264 per year

- Airbnb - $ 177,168

- Facebook - $ 176,672

- Google - $ 175,885

- Uber - $ 174,857

- Lyft - $ 173,161

- Twitter - $ 166,972

- Apple - $ 165,106

- LinkedIn - $ 164,514

- Amazon - $ 163,347

- Dropbox - $ 154,091

- Salesforce - $ 146,758

Yandex, Kaspersky Lab, JetBrains, Mail.ru Group and Vkontakte also spoil their employees, or is Silicon Valley lagging behind the leading Russian IT companies?

Tell us about your perks, bonuses, goodies and gadgets that the employer pleases you with!

UPD : The minimum TC with which EPAM is currently transporting seniors to the Valley is $ 115,000 (the $ 75,000 - $ 90,000 fork was 4 years ago). Thanks to everyone who noticed this inaccuracy!