One of the most pernicious mistakes surrounding the TikTok controversy, is that its ban could potentially lead to a split of the Internet. Such an opinion erases the history of the Great Firewall of China, launched 23 years ago, and, in fact, cut China off from most Western services. The fact that the United States will finally be able to give a mirror answer to this is only a reflection of the existing reality, not the creation of a new one.

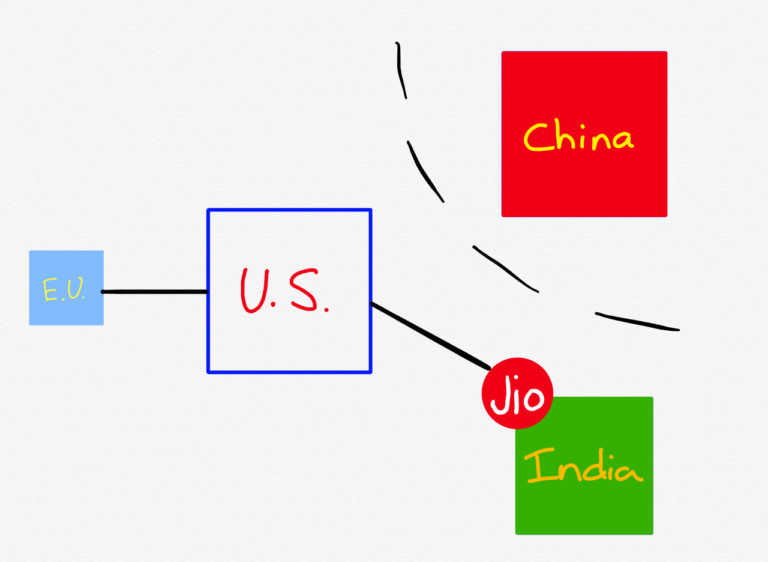

Among the real news, one can note the split in the non-Chinese Internet: for most of the world, the American model serves as the basis, but the European Union and India are increasingly turning on their paths.

American model

The American model of the Internet is built on laissez-faire, and its effectiveness is hard to argue with. The tech sector has been the largest driver of US economic growth for many years, and US Internet companies dominate much of the world, bringing with it US soft power - something like McDonald's with Hollywood on steroids. This approach has obvious drawbacks: the lack of barriers leads to the creation of aggregators that dominate the markets and the emergence of communities, both good and bad.

However, this article mainly discusses economics and politics, and in this sense, the following participants won and lost the most from the American approach:

Winners:

- Major American tech companies that operate freely in the United States, giving them a large and lucrative user base funding expansion abroad.

- New tech companies in the US have relatively low barriers to entry, especially in the areas of regulation and data collection.

- The US government collects most of the taxes from these American companies, including their foreign profits, and also exports its worldview through them, while receiving data on citizens of other countries.

- US citizens enjoy more freedom online, although there are minimal restrictions on the collection of their data by private companies and the US government.

- Companies outside the United States operate freely without restriction in the United States and other countries with an American approach.

Losers:

- : , , .

My bias is obvious: I definitely think the US approach is the best. Many, of course, will argue about how this all affects new companies, given that large aggregators dominate their markets, while others will focus on the issue of collecting data. My concern is that the proposed solutions will turn out to be worse than the problems they have to solve, especially with regard to the benefits users get from using data factories . But, as I noted , I find it compelling to say that the EU's Supreme Court has said that the US government's collection of data on citizens of other countries is a serious privacy issue.

However, this controversy underscores an opinion with which I believe we can all agree: other governments have every reason to complain about the hegemony of American tech companies.

Chinese model

The incentive of the Chinese model is primarily control over information. This is evidenced not only by the fact that China controls access to Western services at the network level, but also by the fact that the Chinese government employs a huge number of censors, and that the government expects Chinese Internet companies like Tencent or ByteDance to have thousands of censors.

At the same time, the economic benefits of the Chinese approach cannot be denied. China is the only country that can compete with the United States in terms of the size and scope of Internet companies due to its huge market and lack of competition. Moreover, this situation leads to the emergence of various innovations, since China immediately switched to the mobile Internet, bypassing the baggage of PC preferences that still burden some American companies.

With all this in mind, it would still not be superfluous to ask the question of how reproducible the Chinese model is. Smaller countries like Iran control American tech companies in a similar way, but in the absence of a comparable Chinese market, it is much more difficult for them to reap the same economic benefits from the Great Firewall. It's also worth noting that the Chinese model has many losers, including Chinese citizens.

European model

Europe, armed with regulations such as the GDPR , the Digital Single Market copyright directive , and a court ruling from last week that overturned the US-European Privacy Shield (and a previous ruling that lifted in 2015 the International Secure Port Privacy "), breaks off and goes to its own Internet.

However, such an Internet seems to be the worst of all possible options. On the one hand, big American tech companies are winning, at least by comparison: yes, all of these regulatory bans increase costs (and reduce targeted advertising revenue), but they have a greater impact on potential competitors. Figuratively speaking, the European Union limits the size of the castle, greatly increasing the width of the moat.

In the meantime, EU citizens will watch their data become increasingly protected from the encroachments of the US government, which is good for them. Other protections are unlikely to prove to be all that effective, or outweigh the general discontent and loss of importance resulting from the endless discussions about permissions and inappropriate content. Moreover, the number of alternatives to established leaders is likely to diminish, especially compared to the United States.

It is also unlikely that European competitors will be able to fill this niche. Any company wishing to achieve large scale must first achieve this in their market and only then go abroad, however, it seems more likely that Europe will rather become the second most important market for companies that have done the dirty work of data processing and integrated markets that are more open to experimentation and less constrained. Increasing value means increasing the drive for success, so a proven model will gain an edge over speculative ones.

Worst of all, at least from an EU perspective, this approach has no benefits for European governments. This is the challenge of managing through standards — without focusing on growth, it's hard to create situations in which everyone can win.

Indian model

The Indian market has always been somewhat unique: while overseas companies were free enough in the digital goods arena, which is why the country has a huge number of users of American companies such as Google and Facebook, and Chinese companies such as TikTok, India has a much stricter approach to issues related to the physical layer of technology. This includes both high tariffs on electronics and a ban on foreign investment in areas such as e-commerce. In addition, India has always been one of the most challenging markets in terms of internet access and logistics.

At the same time, the Indian market is the most attractive in the world for both American and Chinese tech companies, which have already saturated the domestic markets for the most part. This leads to constant clashes between foreign tech companies and Indian regulators - whether it is Facebook's attempts to introduce the Free Basics application [access to social network resources without paying for Internet traffic / approx. transl.] or payments via WhatsApp, or increased restrictions on online trading by Amazon and Flipkart, or, as recently, an outright ban on TikTok for reasons of national security.

However, over the past few months, American tech companies have begun to figure out how to handle this impossible mission, and this heralds the emergence of a fourth internet: invest in Jio Platforms.

Jio Bet

Jio is the dominant telecommunications service provider in India, one of the clearest examples of the avalanche profits generated by betting on a technology-backed market invasion. transl.]. The economics of this stake, made by India's richest man, Mukesh Ambani , I described in one of my April articles :

, , , , , Jio – , 4G.

- 4G, 2G 3G, . , .

- – , 4G , , 2G 3G.

- Jio , , , , .

, Jio – , , , . , , .

This is exactly what Jio did: she spent $ 32 billion on building a network that covered all of India, launched a service offering free data and free calls for the first three months, and after that voice calls remained free, and asked for only data. a couple of bucks a gigabyte. It was a classic Silicon Valley bet: spend money at the start, and then capitalize on scale, thanks to a superior structure built with inexpensive technology.

What makes this story compelling is its contrast with Facebook's justification for Free Basics:

, , , : , , . Free Basics, .I wrote an article about how Facebook bought a 10% stake in Jio Platforms for $ 5.7 billion; it turned out to be the first of many investments in Jio:

, Jio, , Free Basics: , , , stated in all seriousness that it even violated moral standards. In such a world, poor Indians would have little more access to Facebook for poor Indians, since there would be no reason to invest in companies that do not support Free Basics. Instead, they now not only have the entire Internet, but companies from India and China to the United States are competing in their service.

- In May, Silver Lake Partners bought 1.15% of shares for $ 790 million, General Atlantic bought 1.34% of shares for $ 930 million, KKR - 2.32% of shares for $ 1.6 billion.

- In June, the UAE independent funds Mubadala and Adia and the Saudi Arabian independent fund bought 1.85% shares for $ 1.3 billion, 1.16% shares for $ 800 million and 2.32% for $ 1.6 billion, respectively. Silver Lake Partners poured another $ 640 million for a 2.08% stake, TPG invested $ 640 million for a 0.93% stake, and Catterton invested $ 270 million for a 0.39% stake. In addition, Intel invested $ 253 million, gaining 0.39%.

- In July, Qualcomm invested $ 97 million for a 0.15% stake, and Google invested $ 4.7 billion for a 7.7% stake.

This avalanche of investment in Reliance has fully recouped the billions of dollars it had borrowed to build Jio. And it is becoming clearer that the company's ambitions go far beyond simple telecommunications services.

Jio's plans for the future

Last Wednesday, announcing Google's investment in Jio Platforms at Reliance Industries' annual meeting, Ambani said:

First, I would like to share with you the philosophy that motivates Jio's current and future initiatives. The digital revolution was the largest transformation in human history, comparable only to the emergence of intelligent human beings, which took place about 50,000 years ago. They can be compared because today people are beginning to introduce almost limitless intelligence into the world around them.

. , , . XXI , 20 . , . , . , . . Jio. Jio.

, Jio , , , , . Jio . – , – .

Simply put, Jio is determined to achieve a dream that has long eluded telecom providers in other countries: moving from fixed-cost infrastructure to high-margin services. Ambani's plans look all-encompassing:

Media, finance, commerce, education, health care, agriculture, smart cities, smart manufacturing and mobility

Jio has three important differences from telecoms in other markets to achieve them:

- Jio has created a huge slice of the market in which it can operate. If Verizon in the US or NTT DoCoMo in Japan offer services in a competitive telecom market, Jio is the only option for a huge number of Indians (and for those with options, Jio is much cheaper due to the IP network that can afford the additional load).

- Rather than kick companies like Facebook or Google that have a large market share in India, Jio is partnering with them.

- Jio positions itself as the Indian champion and as the company that drives the entire Indian model.

Take a look at how Ambani presented Jio's 5G plans:

4G- Jio , , . - Jio : 5G.

, , , Jio 5G- . 5G 100% . , , 5G, – . Jio IP-, 4G 5G.

Jio , 5G- - . Jio 5G - "Atmanirbhar Bharat" [ , / ..].

, Jio Platform , , , .

Don't assume that the Jio network and its work on 5G, which took years to complete, was really motivated by Prime Minister Modi's statement two months ago. Ambani's sense of purpose provides insight into the role Jio will play in the eyes of investors like Facebook and Google:

- Jio is using this investment to become the monopoly telecom provider in India.

- Jio is the only leverage the government can use to control the Internet and collect its share of the profits.

- Jio becomes a reliable intermediary for foreign investments in the Indian market; yes, they will have to share the profits with Jio, but in return the company will smooth out all the regulatory and infrastructure hurdles that many have already stumbled upon.

What's interesting about this approach is that the lists of winners and losers are very quickly blurred. On the one hand, Jio has brought the internet to hundreds of millions of Indians who would not otherwise have access to it, and the benefits of this investment will only increase as Jio's services and partnerships are implemented. On the other hand, the disadvantage is the presence of a monopolist, especially in the context of a government that has expressed a desire to increase control over the flow of information.

The economic bottom line is also blurry. Monopolies have always been ineffective in the economy. On the other hand, if market efficiency means that all profits will flow to Silicon Valley, why should India be concerned about efficiency? In a market driven by Jio, American tech companies will make less money than they could, and in doing so India will not only collect more taxes, but it could also reap huge benefits from the long-term expansion of national champion Jio.

Indian counterweight

It is becoming less and less realistic - or, at least, irresponsible - to assess the tech industry, especially its largest players, without considering the existing geopolitical problems. With them in mind, I applaud Jio's plans. It would be unreasonable and disrespectful for the United States to treat India as a technologically subordinate country. Moreover, the states will well have a counterbalance to China, both geographically and in general among all developing countries. Jio looks at goals that are often overlooked by American tech companies, and that matters not only to India, but to much of the rest of the world.

But Facebook, Google, Intel, Qualcomm, and others must proceed with caution. For a company and country that has its own path, they are just a means to an end. I am not suggesting that this investment is a bad idea (I think it is a good one) - however, the Indian path seems more populist and nationalist than Americans might like. However, it is still not as antagonistic to Western liberalism as the Chinese Communist Party, and is an important counterweight.

The only question that remains is where Europe will go - and the overall picture of the situation turns out to be rather unattractive:

The European Internet, unlike the American, Chinese or Indian, lacks plans for the future. If you do nothing and just say no, you will end up with a pathetic copy of the status quo, in which money matters more than innovation.

See also:

- " Instagram enters Indian market with TikTok clone after Chinese app banned "

- « TikTok can lock in the US and Australia because of the threat to national security "

- " Facebook is shutting down its TikTok counterpart, the Lasso app "