It is appropriate here to separate the development of blockchain technologies and the status of bitcoin as a tool for alternative investments.

Blockchain technology

According to a survey by Deloitte, today the blockchain industry has cleared itself of a large number of projects created in the wake of the 2017 hype, the industry is developing more calmly, but there is a steady interest in both the technology itself and new options for its use.

Big companies like Amazon, IBM and Walmart are looking for use cases for blockchain in supply chain, data management and project administration. According to TechCrunch, hiring blockchain technology specialists came in second in terms of growth.

An interesting trend is observed in the development of so-called Baas projects (Blockchain as a service), when users can build their blockchain networks based on existing solutions. For example, Amazon and Microsoft already offer Baas solutions to their users.

Banks are also looking towards the integration of blockchain technology for the implementation of transaction transparency: in this case, they will not need to radically change existing processes. If “compliance” and KYC (Customer Reliability Assessment) procedures are unlikely to be fully automated, then transparency of payments using distributed technologies could become the norm in the industry.

The main obstacle to the development of the industry remains regulation by the state: the circulation of cryptocurrencies is still associated with a lack of a legal framework and a lack of control. The case with the TON blockchain from Telegram is widely known in the industry: Pavel Durov's company itself was fined by the US Securities Commission for $ 18.5 million, and the funds collected from investors in the amount of $ 1.2 billion were ordered to be returned to investors. The “Meta 1 Coin” project was also frozen by the SEC in March 2020. Also, the market still remembers the history of the Libra project, which was launched by Facebook in collaboration with other companies such as Visa, Spotify and Shopify. Due to criticism from the authorities, Facebook and Visa were forced to distance themselves from the project.

Bitcoin as an asset

Observing the behavior of bitcoin during the market crash in March 2020, it can be noted that despite the fall in BTCUSD quotes to the level of 4500, bitcoin recovered quite quickly, and this happened faster than the recovery of the US stock market, but it has not yet been overcome the level of 10000 smog. One way or another, market players have gained confidence that there is a demand for bitcoin, and the equilibrium price of 10,000 is still quite stable.

If we compare the behavior of bitcoin in relation to major exchange-traded assets during the market crash in March 2020, then we can see that all assets fell simultaneously during the exchange panic. Further, Bitcoin showed a good recovery rate, outstripping oil futures, but lost to gold and significantly yielded to the Nasdaq technology index, which became the fastest growing crisis asset. Therefore, despite the fact that bitcoin is not an outsider in the market, it has not yet taken a leading position, although it has confidently taken the role of a reserve asset.

Some big players in the investment market have declared their belief in the investment potential of bitcoin: Paul Tudor Jones, the well-known manager of the hedge fund Tudor Investments, said that he considers bitcoin to be "excellent speculation" and holds about 1% of his investments in it. As he noted, Bitcoin is a hedging asset against inflation, as traditional fiat currencies will depreciate relative to other assets.

Since February, the emission of the US dollar has been about $ 4 trillion: this is how the Fed supported the slumping consumer demand in the United States during the Covid-19 crisis. Interest rates on the US dollar also dropped to near zero, which fueled interest in both traditional and alternative investments.

Another well-known investor, Warren Buffett, on the contrary, is pessimistic about bitcoin and its prospects: according to him, bitcoin does not have any value and nothing else can be done with it except to sell it to someone. At the same time, it is known that Warren Buffett met with representatives of the crypto industry in February 2020: for example, with the main Tron Justin Sun and other “crypto bosses”.

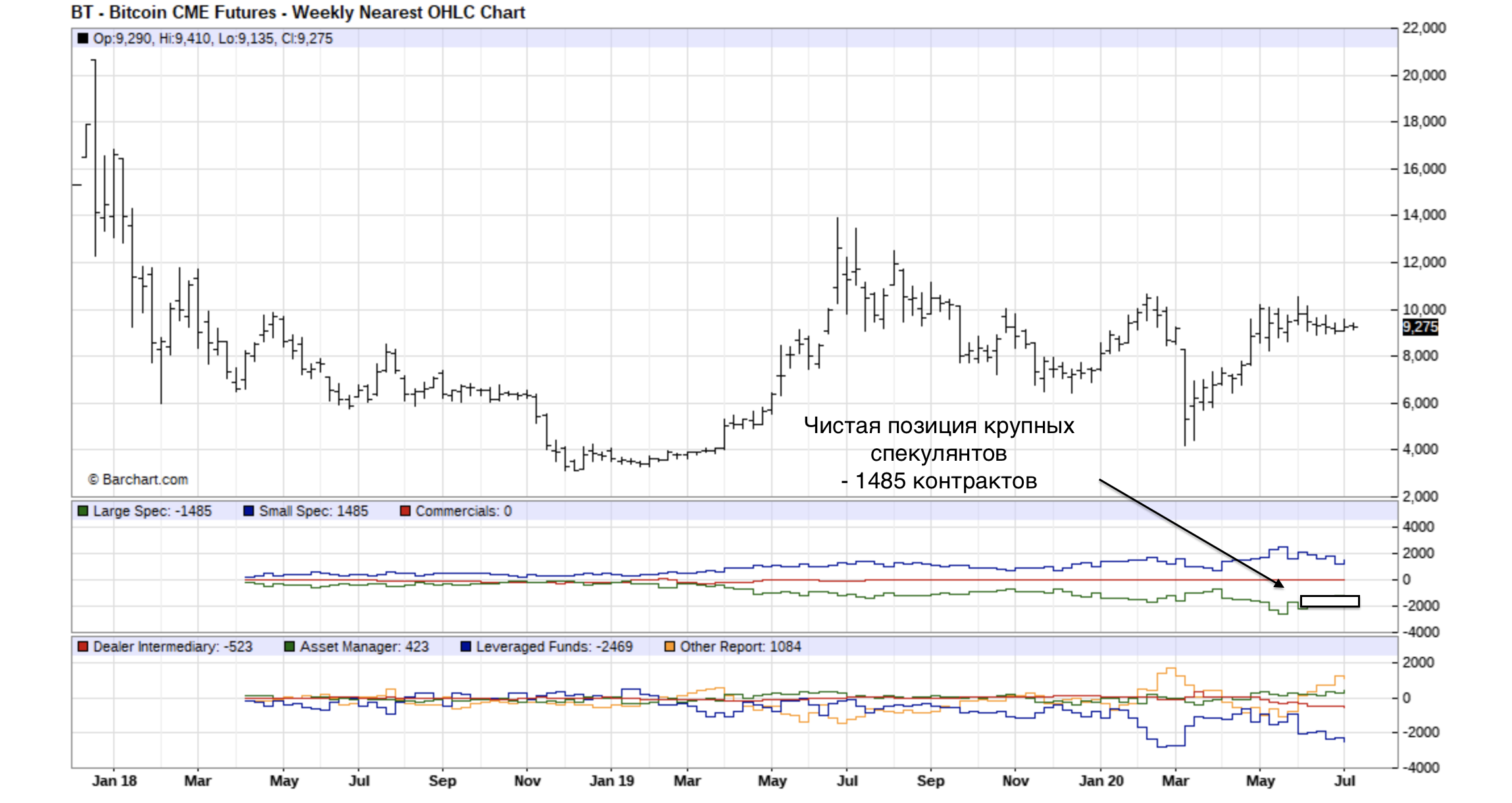

In general, if we look at the dynamics of Bitcoin futures as of July 2020, we can see so far that large institutional players are holding a net short position (playing short), not expecting a bull market for cryptocurrency. Of course, they may not be right in all cases, but from observing the history of an asset, we know that large price jumps in an asset are usually preceded by a reduction in short positions in its futures on the part of professionals.

Development of derivatives

If bitcoin as an investment asset is still ambiguously perceived by large market players, then we can note the rapid development of the speculative direction in the industry: bitcoin futures and options are gaining momentum and becoming popular among professional traders.

So, according to information from the Tokeninsight report, in the first quarter of 2020 alone, the turnover of trading in Bitcoin futures reached $ 2.1048 trillion, which is an increase of more than 300% compared to the average value for 4 quarters of 2019.

The interest in this class of products is understandable: the volatility of cryptocurrencies in 2017-2018 was quite high (twice as much as the volatility of traditional markets). Further, the volatility of BTCUSD dropped to 2-3% per day, which is comparable to oil and gold futures. That is why traders become interested in leveraged trading: the appearance of relative stability of an asset gives rise to the development of derivatives around this asset.

For those who do not plan to engage in speculation, but would like to hedge their cryptocurrency portfolios, the development of the futures market is also useful, since previously there was only one reliable hedging tool - bitcoin futures on the CME exchange. However, it is a rather expensive solution: the contract size of 5 bitcoins and the guarantee collateral of 50% of the contract amount (about $ 25,000 as of July 2020) does not allow many market players to work with it.

Therefore, the development of projects such as Deribit (crypto derivatives exchange) was received with enthusiasm by the market. Overall, this is a good signal that the industry is developing. If this does not allow Bitcoin to rise in price several times (as many crypto enthusiasts expect), then this increases its stability as a settlement tool. Risks-ready speculators reduce risks for systemic market players.

Other cryptocurrencies

What Happens to Other Cryptocurrencies in Summer 2020?

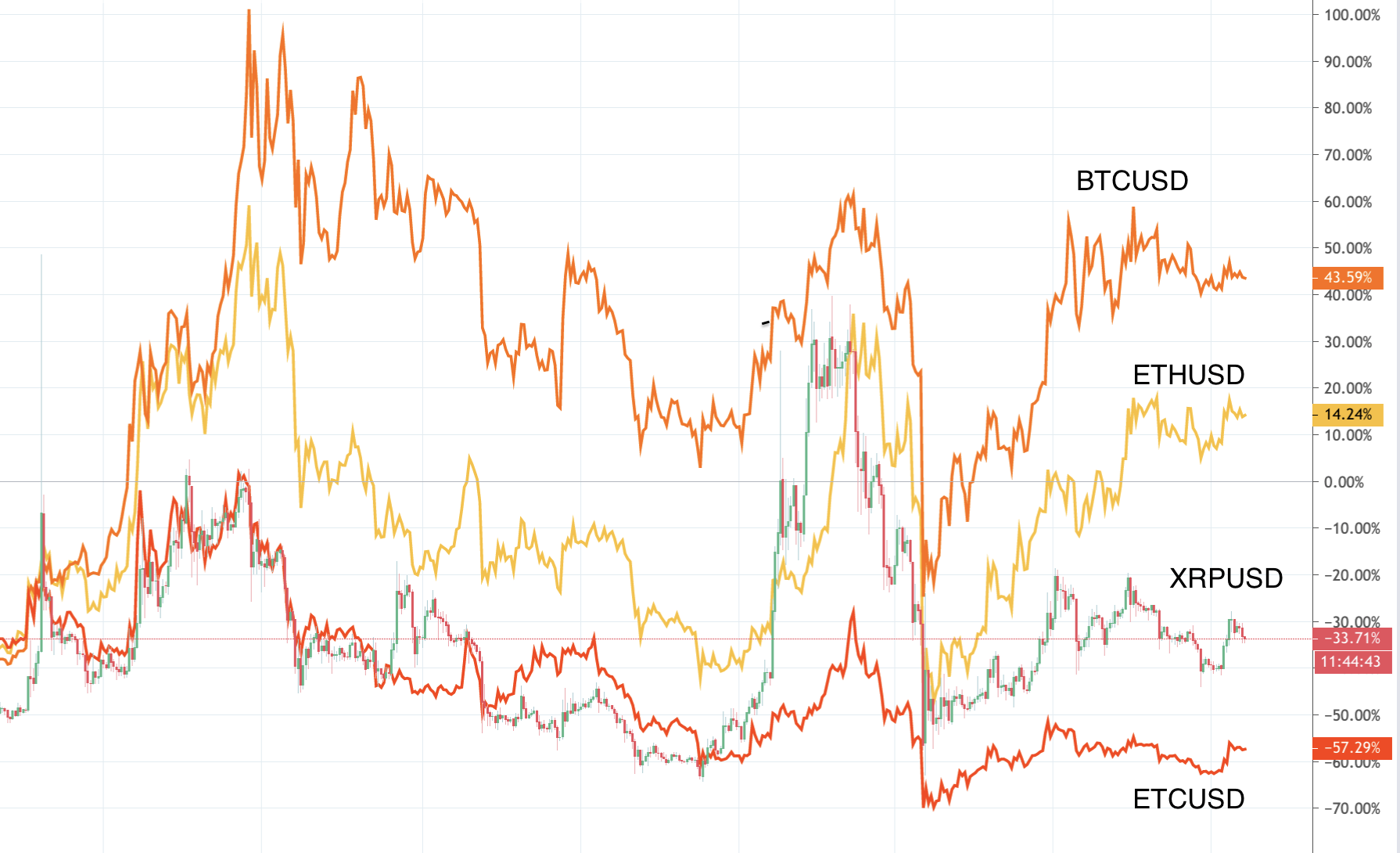

Many altcoins never recovered from the 2018 hard landing triggered by the Bitcoin crash. The chart below shows the comparative dynamics of BTC, ETC, ETH and XRP. So far, we see that the only alternative cryptocurrency to bitcoin is Etherium. That is why some cryptocurrency exchanges provide the ability to trade futures on it.

Therefore, from an investment and speculative point of view, it is likely that these two flagships will continue to attract most of the capital of investors and speculators.

The volatility of cryptocurrency prices is also increasing interest in “stablecoins” - cryptocurrencies backed by certain assets. The most famous and largest of these is Tether, although there are many currencies tied to various “real world” assets.

conclusions

In July 2020, bitcoin confidently takes the position of an alternative investment asset, derivatives on it are actively developing, which reduces the risks for market players using it.

So far, we have not seen any hype around cryptocurrency assets. Rather, we can say that blockchain technologies are on the rails of smooth and strategic development and will be adapted in the foreseeable future by various major market players. Bitcoin, on the other hand, is gradually taking a place in the investment portfolios of hedge funds (so far an insignificant part), and if this trend continues, it is quite possible to see a breakthrough of the psychological mark of $ 10,000 and further growth of the cryptocurrency. But we must not forget that the volatility of bitcoin can be quite high. This is good news for you if you are a trader: in this case, you can work on both the rise and fall of the BTCUSD price.