But this is just the beginning, and in the future we can expect many innovative products that will provide even more flexible options for trading in derivatives.

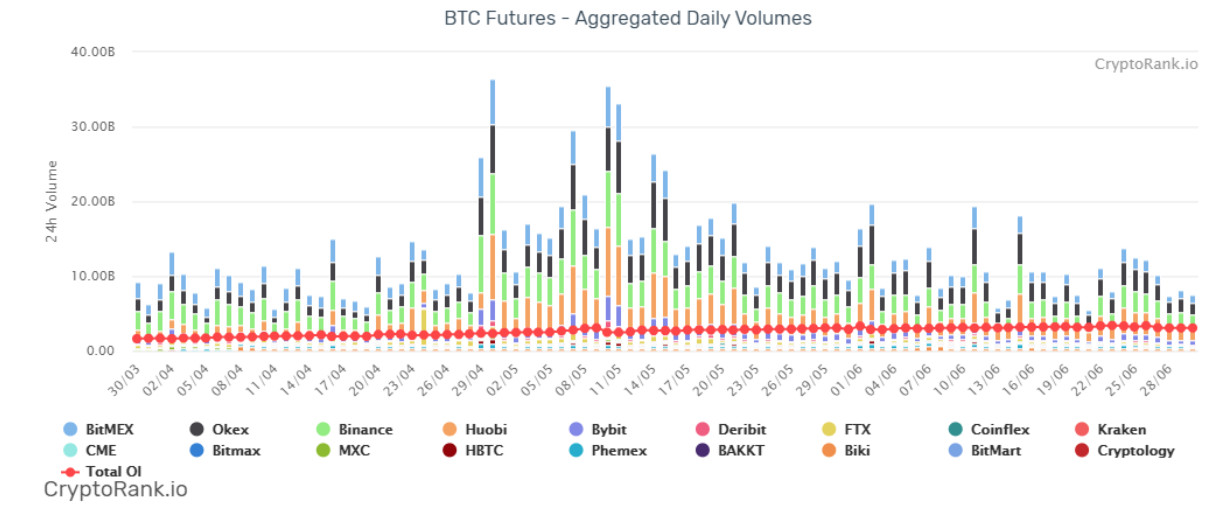

According to the analytic service CryptoRank.io , the total daily volume of bitcoin futures on top crypto exchanges regularly exceeds the $ 35 billion mark.

Since 2019, the daily volume of bitcoin spot trading has been many times lower than the volume of futures contracts traded. Can this be considered the maturation of the crypto market, or do traders just lack volatility?

A brief overview of the bitcoin futures trading market CryptoRank.io

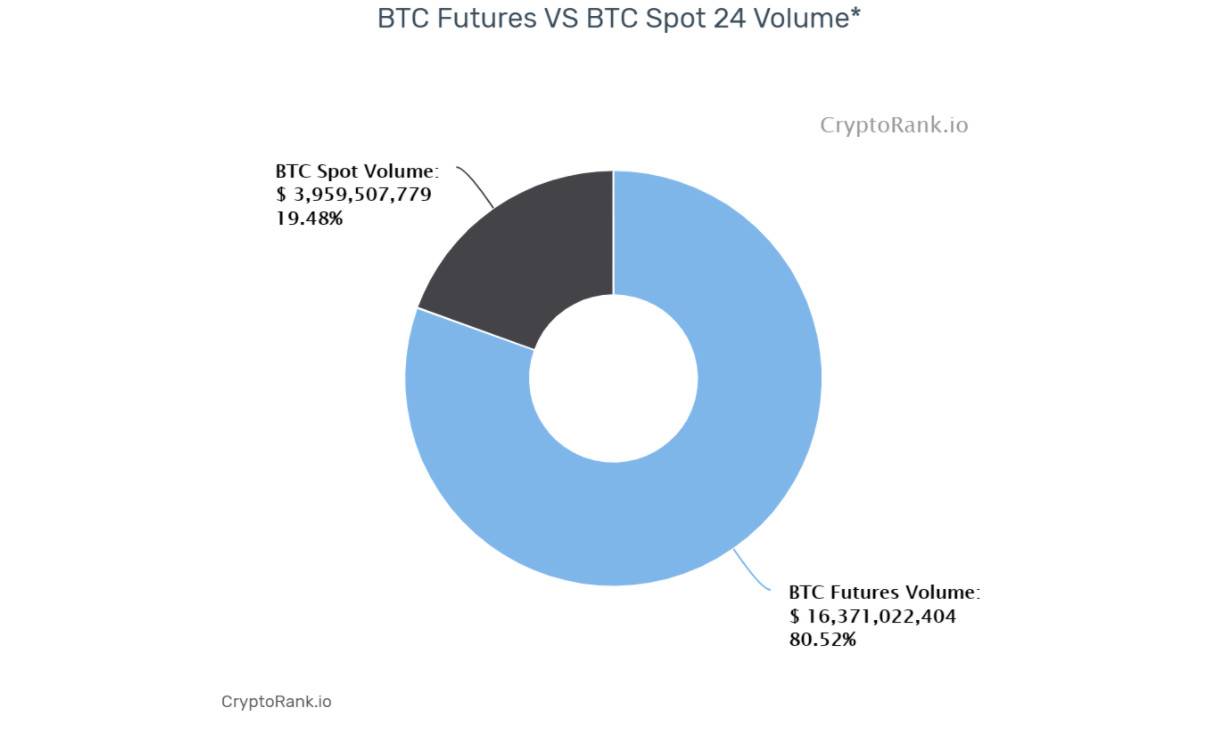

monitoring and analytics service shows that the daily trading volume of bitcoin futures is more than 4 times the volume of the spot market.

The chart above shows that the daily volume of futures trading is more than $ 16 billion, while the volume of spot transactions is less than $ 4 billion (the calculation is based on the adjusted real volume on the top 100 crypto exchanges).

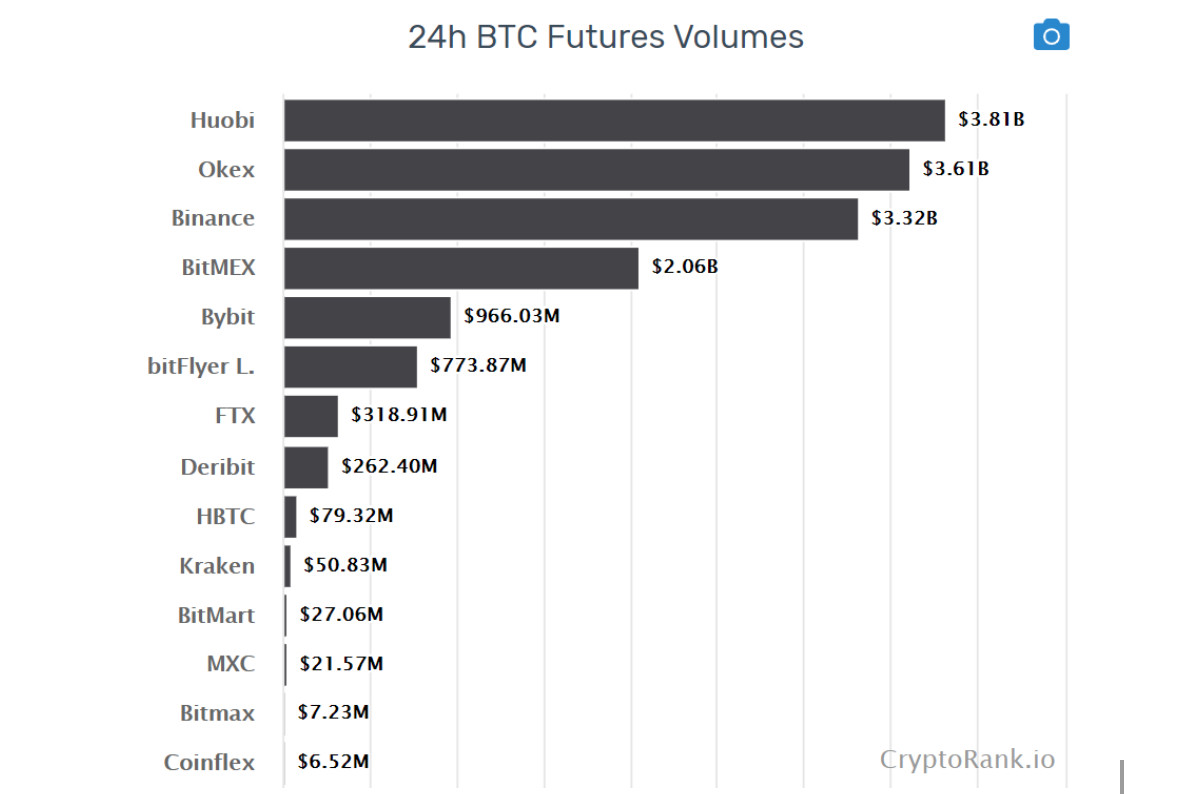

Exchanges such as Huobi, OKEx, Binance and BitMEX account for almost 80% of the daily volume of Bitcoin futures.

The ratio of the volumes of futures and spot markets on the top crypto exchanges, which both types of transactions offer, can be seen in the chart below.

As can be seen from the diagrams, the volumes of futures transactions on all exchanges many times prevail over spot ones.

What is the fundamental difference between bitcoin futures transactions?

A futures contract is an agreement to buy or sell an asset at a later time at a predetermined price. It is a derivative instrument because its value depends on the underlying asset - bitcoin. Every futures trade needs a buyer and seller with the same volume and maturity.

When selling a futures contract, the seller postpones settlement on it. In spot trading, settlement occurs at the same time as the trade.

It is important to note that futures trading does not take place in the same order book as spot trading.

What made traders switch to the futures market?

There are 4 probable reasons behind the prevalence of futures trading volume - the ability to hedge and play short, using a smaller deposit size, the desire to trade increased volatility and the market maturing.

The ability to hedge

For example, miners use futures to hedge future earnings and reduce uncertainty in cash flows. Institutional traders also often use this method: Bitcoin buyer's positions are hedged with a futures contract and vice versa - Bitcoin shorts are hedged with futures longs.

Opportunity to play for a fall

During the rapid fall in the price of bitcoin , participants in spot trading tend to quickly enter stablecoins, while missing out on the opportunity to capitalize on the fall. At the same time, futures trading provides an elegant solution for making a profit - playing for a fall by opening short positions or using the stock slang "short" (from the English. Short).

Using a smaller deposit

Many traders feel uncomfortable when they have to keep large amounts of their own funds on the exchange wallet. In this case, leveraged futures transactions help to reduce the actual volume of entry into the transaction, thereby eliminating the possibility of theft of funds when the exchange is hacked.

Increased volatility

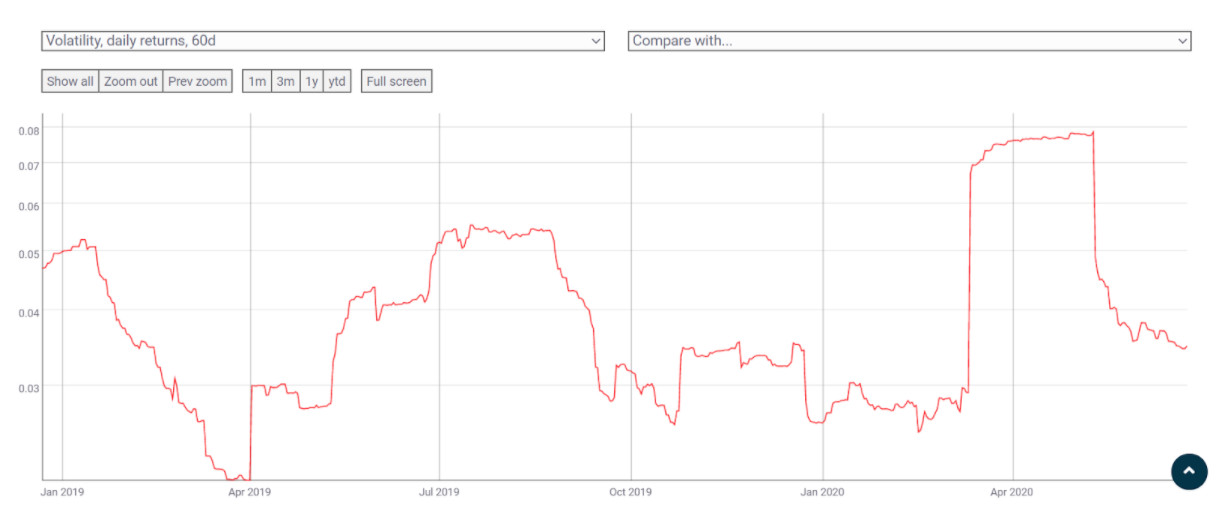

Despite the crashes and surges of bitcoin , such as March 12-13 (the price of the first cryptocurrency fell from $ 8,000 to $ 3,800), special categories of traders note the lack of daily volatility.

A similar circumstance clearly pushed bored traders to trade futures with huge leverage, up to 125X on Huobi and 100x on BitMEX.

Market maturation

As the crypto market matures, it becomes more and more similar to the traditional stock market, where derivatives trading volumes prevail.

The active development of bitcoin futures trading occurred thanks to the launch of derivative platforms. So, in 2019, we saw the start of futures trading on existing spot exchanges, including Huobi Globak, OKEx, Binance, BitMax, and BiKi. In addition, in 2019-2020, new players entered the crypto derivatives market - FTX, Deribit, Bybit, Phemex and others.

As for traders, of course, institutionalists have long known about the additional benefits of futures trading. However, retail crypto traders have just begun to grasp the art of futures trading. Most likely, adaptation to liquidation risks and the use of optimal strategies in this regard is the key to the further development of the crypto derivatives market.