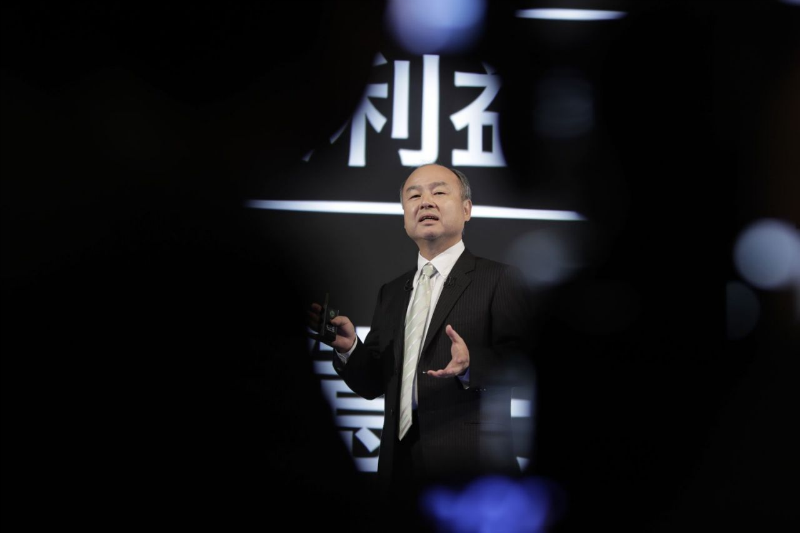

According to media reports, the Japanese conglomerate SoftBank plans to sell 198 million shares of the American telecom giant T-Mobile for about $ 21 billion. This is roughly equal to 65% of SoftBank's total stake in the company, whose shares have been growing steadily over the past months. In our new article, we understand the reasons for this transaction.

Why SoftBank Sell Shares

The past few months have been extremely unfortunate for SoftBank's investments. Poor management decisions of portfolio companies, as well as the global coronavirus pandemic, have seriously affected the conglomerate's earnings.

For example, the $ 100 billion Vision Fund, part of SoftBank, invested in WeWork - this company was unable to go public after the scandal in the center of which was its founder Adam Neumann - he built an opaque corporate structure and did not come close to going into profit. The quarantine measures also hit the business of Uber, another Vision Fund portfolio company. As a result, SoftBank reported losses of $ 17.7 billion.

Now Japanese investors have to sell other assets in order to free up finance to continue working.

Plans

As previously reported, SoftBank plans to sell assets worth $ 41 billion. The money will be used to buy back shares and reduce the debt burden.

T-Mobile also plans to issue part of the shares sold by SoftBank to circulation on the stock exchange. In Russia, T-Mobile shares can be bought on the St. Petersburg Stock Exchange - you do not need to open an account with a foreign broker, a Russian account will be enough. You can open it online .

Read reviews, market analytics and investment ideas in the ITI Capital Telegram channel