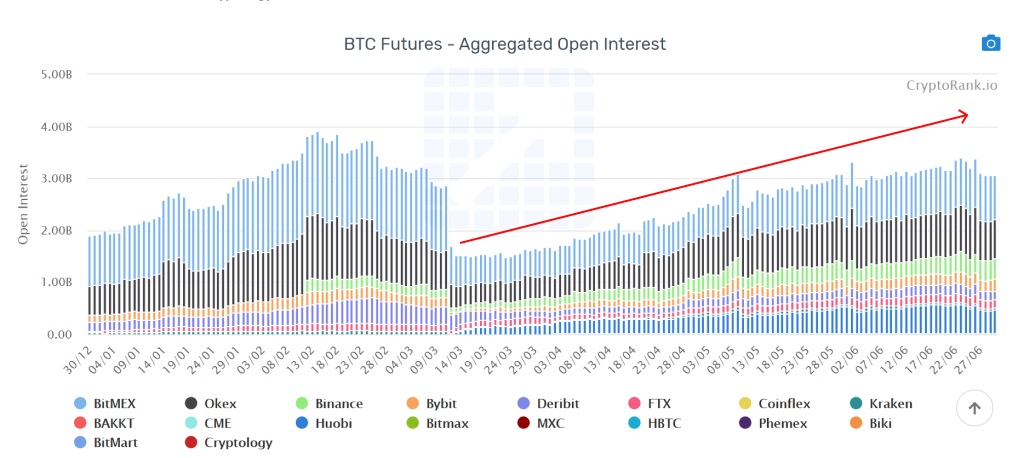

A collapse on Black Thursday March 12 led to the liquidation of positions worth hundreds of millions of dollars. Nevertheless, after 3 months, open interest (hereinafter - OI) in bitcoin futures almost completely recovered to the volumes preceding the collapse. In this regard, it is important to understand what the restoration of OI means for the main cryptocurrency and the entire market.

Why did the March collapse occur?

In retrospect, it is clear that the sharp drop in OI for bitcoin futures was caused by the selling of institutions that should have offloaded risk to their portfolios. So, on CME in one day, OI fell from $ 210 million to $ 113 million, on BitMEX - from $ 1253 million to $ 565 million. This sale took place after the same drop in the stock market. The simultaneous collapse of bitcoin contributed to the correlation between the two markets, bringing it to a new level.

However, unlike the stock market, Bitcoin recovered quite quickly. And although the price rose from $ 3,820 to $ 7,000 in less than a week, open interest lagged and only recently, when futures trading on the CME began to gain traction again, has fully recovered.

In particular, an influx of traders was observed at CME, who in just two months were able to disperse OI from $ 113 to $ 379 million. A similar sharp increase in OI occurred on the Bakkt exchange. The Grayscale platform also did not stand aside, since in 3 months it bought 33% of all mined BTC. All this together leads to an increase in the price of bitcoin and an increase in OI on all platforms. From the above chart, it can be seen that BitMEX, OKEx, Binance, Huobi and CME contributed the most to the recovery in open interest.

What does recovery of OI mean?

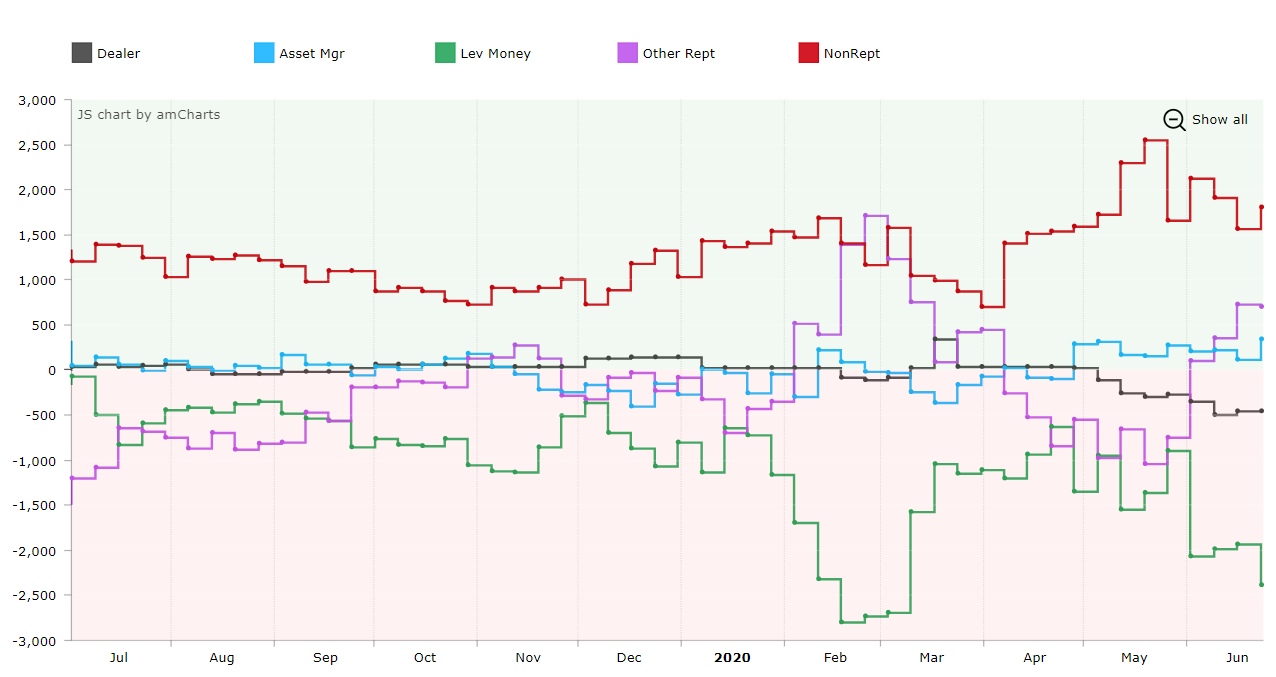

Without a doubt, an increase in OI signals an increase in market liquidity, but this does not necessarily mean a bullish trend. By definition, OI is the number of open positions, regardless of whether they are long or short.

The published change in open positions from June 16 to June 23 showed that hedge funds increased short positions from 9.7 thousand BTC to 11.9 thousand BTC, while private traders increased long positions from 7.8 thousand BTC to 9 , 0 thousand BTC. It is not the first time that these players are on opposite sides of the market.

A set of short positions by institutions and the inability of Bitcoin to gain a foothold above 10,000 USD can further contribute to the development of the correction of the first cryptocurrency.