dashed off a telegram: "Send money -

I'll work it out, I laughed at them all."

/ V. Vysotsky /

Anyone who first enters the stock market as a private investor immediately thinks about two assets: stocks and currency. These tools seem simple and transparent. But if it were that simple, this article would be written by a dollar millionaire for dollar millionaires. Promotions are an insidious and extremely difficult instrument; it requires a professional approach and does not forgive mistakes. These are far from the cases that are shown in exciting films about stockbrokers of the 20th century - this is the stock market 2020. Even the first step should be very serious.

Source

Previous articles in the series:

1. Stock market beginners: honest conversations about trading

Important Disclaimer

-, , . i.

- — , , . .

- — . . , . .

- , , RUVDS , METATRADER 5 ( ). .

- , . , .

?

A share is a security issued by a legal entity. By purchasing shares in a company, you become its owner in that proportional share, which is the number of shares in your hands. Companies can have from several pieces to millions of shares, depending on the legal status of a joint-stock company, shares can only belong to employees or a certain circle of persons (CJSC), and can be distributed among an unlimited circle of persons (OJSC, or more precisely PJSC - public joint-stock company ).

Today and in the future, we will be interested in companies that not only issued shares, but also entered an IPO - made the first public sale of shares of a joint-stock company to an unlimited number of persons.

There are common and preferred shares. Ordinary shares give their owner the right to vote. If you or your family owns some shares, then for sure every year you receive puffy envelopes with a bunch of papers with a proposal to vote on the life of the company, including for the composition of the board of directors (I wonder if at least someone sent the papers with check marks back ?).

Preferred shares do not give investors the right to vote, but guarantee dividends (including above ordinary ones). In addition, in the event of bankruptcy, the owners of the privates will be the first to receive payments. Preferred shares, along with ordinary ones, can be available for purchase on stock exchanges (it is worth looking for the AO and AP marks), but their presence on the stock market is not required.

Companies issue stocks to attract investor money. As soon as an IPO (Initial Public Offering) takes place on the exchange, the company becomes open for external investment. And of course, market trading begins around the stocks of companies (speculative purchases and sales, etc.), that is, while the company uses investors' money, investors use stocks to obtain speculative income (well, or dividend income).

Everything seems to be unambiguous: the value of the company was divided by the number of shares, and the value of one share appeared. The investor buys a share (thereby providing his money) and expects dividends (a share of the company's profit). Ideally! But everything that enters the market (including the stock market) enters the speculative process (speculation is a good business word, which means that securities are bought and sold in many cycles in order to make a profit (gain)). So, the speculative process arises due to the fact that numerous market traders have different views on the development of companies, make different forecasts, and may also have their own speculative goals - someone buys stocks, someone sells them based on analysis and goals ... As a result of all market processes, the market price of company shares is formed.

And, no matter how surprising it may be, the fair market price of a stock is described by the simplest schedule that we have touched on even at school or on a sleepy course of economic theory at a university - the supply and demand curve: if everyone wants to buy a stock, the price goes up, if the stock is sold, the price drops. At the point where the buyer is ready to buy at the seller’s price, a fair price comes for a point in time.

How to choose stocks to buy?

Definitely not on hype, not on rumors, etc. We were supposed to publish this article in mid-May, but we deliberately refused it, because in May there were terrible fluctuations in the stock market and we were afraid that the newcomers inspired by the publication would rush to start mobile brokers and spend their money on falling and junk papers. This is the most illogical, irrational and dangerous path of a novice investor.

The real story of the author. Back in 2008, I saved up 80,000 rubles and kept them in a bank. Even then, I, a graduate of the financial department, dreamed of becoming a financial tycoon, so I followed the entire market and traded in educational programs for demo money. And so I saw how, against the backdrop of the crisis, Gazprom shares went down. Inspired by the insight, I took time off from the office right at lunchtime and rushed to the bank to buy shares with my only (!) Savings. To my credit, the bank had 160 people with the same symptoms - a thirst to buy / sell a piece of Gazprom, stuffiness, stampede, fainting. Two lunches later, I bought some stock (exchanged my real and long-suffering money for account entries) and was happy. Warren Buffett and Jordan Belfort have never felt like this! Exactly until the moment the stock turned into a pumpkin ... By the way, my salary was 19,700.Smart, huh ?! By the way, I still have those shares. As a monument to my dolbo ... well, you understand.

So, at the beginning of August 2008, I bought 300 shares for 75,000 rubles (250 each, on the stock exchange they cost 242), then it was a gorgeous decline from a peak of 360 rubles per share. Since then, the shares have reached 260 only a couple of times, and at the moment, with a price of 193 rubles per share, I have 57,900 out of my 75,000. Plus 28,800 dividends for the entire time. Total 86,700 rubles. Inflation is a consolation.

If I put all 80,000 for this time on a deposit (the average rate over these years is about 5.5%), then today I would have almost 137,000 rubles. Agree, a vivid picture of a beginner's mistake.

Let's pause and learn important lessons for beginners from this real-world example.

- Do not trade on emotions and on the fall - your expertise is definitely not enough for such risks.

- (, ).

- , — . , .

- : , , ..

- -, - . — , , . .

So, we agreed that no one is running anywhere and the 28 kopeck shares are not enough. While we will learn how to think about how to choose stocks.

You should not buy shares of only one company - a diversified portfolio with various assets is almost always safer and more profitable than the shares of an individual company. By collecting a portfolio or portfolios of shares, you protect yourself from industry risks, reputational risks of companies and from the country problems of each individual issuer.

Analyze each issuer. The so-called blue chips are always attractive - companies with first-tier stocks with high liquidity, stable growth and profitability.I have heard that blue chips are called such because the gas burns in blue - this is a rather funny and somewhat sad version that has a right to exist in Russia. In fact, the name of the blue chips came to us from poker, where the blue chips are the most expensive. Gas has nothing to do with it.

So, blue-chip stocks in the portfolio are always good, but the most interesting movements and the most profitable positions, as a rule, show the stocks of the technological sector, the financial sector, and non-blue-chip retail.

It is not worth building a portfolio of stocks at random, but based on strategy and analysis.

▍Stock selection methods

So, clearly there are stock selection strategies for your portfolio. There are a lot of them , I can easily name a dozen, but in the framework of the article I prefer to reveal the three most understandable and useful at the initial stage.

The Foolish Four stock purchase method

The stupid four is not because it is stupid, but because the strategy is simple, understandable and not laborious. Two experts, O'Higgins and John Downs, once found that if you invest in 10 companies from the Dow Jones index that have the highest income shares (estimated by the size of dividends), or in the shares of 5 high-income companies, but with the low cost of the securities themselves, you can get a plus much faster than if you invest in the index itself (yes, it is also a financial instrument, and we will definitely talk about indexes and other interesting investment tools - to get extorted, so to complete). They also noticed that among the shares of this same five the highest yield had securities located in the list in second place. Finds were confirmed by numerous observations.

This is how a stupidly simple strategy appeared.

- We look at stocks of companies from the Dow Jones index (this is for you on the St. Petersburg Exchange ) and select 10 with the highest dividends (this information is always open).

- We select the top five shares with the lowest price.

- We invest in shares from the second to the fifth, and 40% of the money goes to the company with the cheapest share, and the remaining 3 parts, 20% each, into the remaining three.

It is believed that such a strategy brings up to 30% per annum, but in fact, firstly, this is a “ceiling” figure and the real income can be significantly lower, and secondly, this strategy is not an absolute (everything would be so simple), thirdly, it loses its relevance against the background of more promising strategies. However, it is interesting and instructive for beginners to work with it: it is transparent, obvious and simple, without deep diversification.

Buying stocks for a specific idea

This strategy is more suitable for the pros-skilled professionals than for beginners, however it is also understandable and, if you know a certain industry well or even have your own insiders, then it shows itself perfectly. You can buy shares in a company, anticipating the success of some important event: the release of financial statements, new products, successful resolution of the problem, etc.

I will give two striking examples from the last two years.

The first is Apple. Recently, the company's shares, although they continued to grow along the trend, sagged in certain periods, including against the backdrop of economic wars and is especially noticeable against the backdrop of the COVID-19 pandemic, when it was necessary to close factories in China, and then take restrictive measures for retail stores. sales. However, on April 15, 2020, the company, in strict accordance with rumors, presented the world with a successful sequel to the legend - the second generation iPhone SE. This is a decent device that is good in itself, but the image of an older brother will clearly play into the hands of sales volume. After this event, slight growth began, which continued to be more confident after dividend payments exceeding last year. It’s easy to see these events on the chart (D is dividends):

With Gazprom, the situation was much more fun. For a long time he staggered in a certain corridor and from the outside it seemed that one should not expect anything from these shares, especially in the context of world events around the gas industry. However, curious investors could find that on March 31, 2019, the consolidated interim condensed financial statements came out, from which one could learn about significantly higher dividends and successful results of the corporation. If you look at the reporting on the current period, it no longer causes such euphoria. So, knowing that predictably good reporting would come out, it was possible to use the giant's shares in the portfolio.

By the way, working “for an idea” is especially relevant for IT, telecom and technology securities, since they are quite predictable and sometimes deliberate or accidental leaks of insider information occur in them. It is only important to be able to see the signs and information first, and not when it gets into the news on the Russian RBC. Therefore, learn English and find a collection of personal sources of operational information on your issuers - a very important skill for any trader.

The method of buying heavily undervalued stocks

Another favorite professional method. Your task: to find stocks at a price below resale value. To evaluate stocks, a system of multipliers and benchmarks is used, the most popular of which is the Graham coefficient.

K graham = (company assets - company debts) / number of company shares

However, this method is not applicable to all companies: more than half of the stock market companies have debts exceeding the value of assets (this does not mean that they are bankrupt, by the way). If so, we will start looking for companies whose assets exceed debt obligations. For them, we calculate the Graham coefficient using the above formula. We write the coefficients in a separate column, and the current price per share in a separate column. For the purchase in your portfolio are suitable stocks whose price does not exceed ⅔ of the Graham coefficient.

There are a few additional points to consider.

- You do not need to rush to buy such stocks right away - first find out the reason for the decline in the value of the stock and the length of time during which the fall occurred.

- — , .

- 0,8.

- , , 10% .

- ( ).

- 0,3.

- 10 000 — , , . , , , . , , .

I brought you three strategies here - and it seems that the first two are very simple, but in all cases I recommend conducting a financial analysis of the companies. Immersing yourself in this is quite simple: you can simply study the topic on the Internet or (for me, the ideal option) buy a good textbook on financial analysis and enterprise economics. The formulas there are far from advanced mathematics, but understanding all the parameters of financial reporting will be useful to you (by the way, you will also have to learn how to “read” IFRS (International Financial Reporting Standards) statements. This, of course, you will need over time and will get used to it pretty quickly.

Important tip when choosing stocks: choose stocks of companies that you understand, whose activities you understand. So you can easily evaluate the news and their possible consequences for the market with which you yourself interact in one form or another. Here the readers of Habr were just lucky: the shares of technology companies today are an interesting, diverse, vibrant and promising segment of the stock market.

By the way, you can purchase ready-made package strategies from your broker taking into account the free amount, investment period, acceptable risk and expected profitability. As my experience shows, ready-made portfolio strategies have annual returns slightly higher than bank deposits and rarely “fly away” to zero. But this is not your job or your development within the stock market. This is just a way to save and slightly increase money (remember inflation and the need to pay 13% personal income tax).

▍ Where to start analyzing stocks?

The gold standard in the stock market is technical and fundamental analysis.

Fundamental analysis is an analysis of stock movements based on a combination of economic factors: accounting and financial reporting of issuing companies, country financial events, the international economy, the situation in the industry, etc. This is a serious, thoughtful work with numbers and facts, based on the results and conclusions of which you can choose stocks and make deals (buy and sell assets).

Technical analysisIs an analysis based on the historical movement of the asset price, presented in the form of charts. In short, it proceeds from the paradigm of extrapolating market behavior in the past to similar modern conditions. Technical analysis believes that similar behavior patterns will lead to similar price movements.

Additionally, the technical analysis is based on the thesis that the asset price chart takes into account everything. This is true: all the necessary information is already reflected in the price dynamics. Both objective factors and the psychological mood of traders are taken into account (for example, now you can see how every COVID-19 microflash message thoroughly pessimizes the market).

Sometimes technical analysis looks like this :) You

cannot choose one type of analysis, because fundamental analysis helps a trader to choose assets to buy, and technical analysis suggests at what time interval it is better to make a particular deal.

Let's take a look at the interfaces of analytical sites.

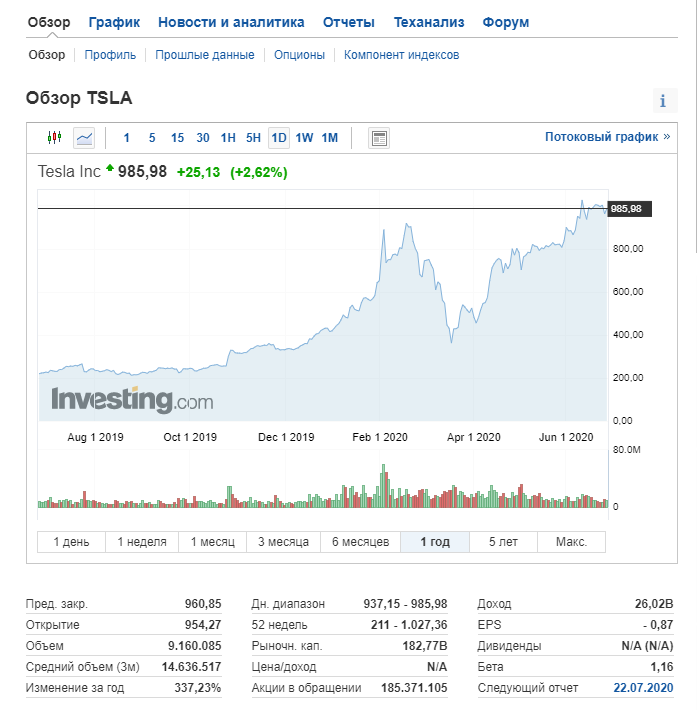

We go to the cool site investing.com (you can choose any other).

I'm tired of talking about Gazprom, let's look at Tesla shares

You can see tabs with news by issuer, technical analysis (real), forum, etc. If you study the historical data and see how events affected growth, you can already understand whether it is worth doing business with a company. For example, Musk’s statements and Tesla’s road accidents affect the movement of stock price trends much more tangibly than the Tesla Cybertruck presentation (the reaction of investors was rather restrained).

Now let's take a look at some Russian company. For example, Norilsk Nickel... These recessions can be found without analysis on practically any chart of price changes for Russian companies. All of them fall in the summer-fall of 2008. The Russian market is extremely sensitive to crises, stagnation and economic downturns. Few who hold their positions - everyone creeps down along with the market. You can see how the trading volume has grown rapidly during the crisis interval.

Almost everything is getting cheaper. But I want to warn you against buying shares during such periods - the economic recovery may be long, and companies may have their own internal problems due to the economic collapse. In fairness, it is worth noting that there is always a rebound, but it is tangible only by investors on large volumes of assets.

It is the charts of different types that underlie technical analysis. A detailed example with technical analysis done without a program and algorithm can be viewed here (great chewed, it makes no sense for us to analyze the example here in the same way).

But if you and I raised the documents, analyzed the financial and production performance of the company, assessed dividends, profit and cost dynamics, etc., we would conduct a fundamental analysis. He is usually loved less because he is similar to accounting.

If you want to delve into and be an independent investor or work as a trader in a broker company, you need both types of analysis: alas, without them our intuition is worth absolutely nothing (and brings losses).

There are such recommendations for shares based on technical analysis:

Exactly such you can see on Quote and other resources for market analysis. You can listen to them, but it is best to study these recommendations in conjunction with the study of markets and specific companies - this way you will understand in which direction to move in studying the assets of your portfolio (future portfolio) and see how far your conclusions are from the expert ones.

To study financial analysis, I recommend you these books:

- Alexey Gerasimenko “Financial reporting for managers and novice specialists”

- Benjamin Graham "The Intelligent Investor"

For technical analysis:

- Jack Schwager “Technical Analysis. Full course »

- John Murphy "Technical Analysis of Futures Markets: Theory and Practice"

▍How to buy shares and start bidding with them?

Easy way

You can buy shares from the issuer (conditionally, come to Sberbank and buy Sberbank shares). Let's talk briefly about this method, since such investment behavior takes place. Remember my story with Gazprom? Well, many then bought shares at a price as high as 111-115 rubles and just kept it - from that very 2008 to 2019. And they won a little, and these are not some traders there, but pensioners, state employees and clerks are simple, in whom the memory of vouchers was alive (I was also alive, I didn’t have enough brains). They, of course, did not think too much about the strategy, they were just lucky. But the professionals earned very good capital on these steep slides ( from real ordinary physicists who have been on QUIK since time immemorial, there is a result - three rubles in St. Petersburg on a combination of painstaking work with shares of Gazprom, Sberbank and with currency).

There are many disadvantages of this method, including the need to hold shares for more than 3 years in order to receive a personal income tax deduction (well, or you will have to pay it), low speed of purchase and sale transactions (you just go to the bank with your feet and spend about an hour with this story ), a bank commission, and even a conversation with the bank’s security service, if something suddenly seems suspicious to them.

The advice is simple: if you want to invest for a long time like this, receive dividends and then just sell the shares, then it is better to do this through the IIS (individual investment account). I will not write here what it is and why it is convenient and profitable, I will leave a link to a good post (spoiler: IIS is a thing).

Way of the Samurai

But our path is to buy shares from a broker (individuals are not allowed to trade on the stock exchange). You can consult a personal broker and choose your portfolio, or you can connect to the platform or application and start choosing instruments yourself. In any case, your actions will be an instruction to the broker to make transactions on your behalf and at your expense.

In the first article, we already talked about how to choose a broker, how to learn. Therefore, let's move on to the start of practice. You will need an automated terminal to work with the stock market.

Trading terminals (QUIK, Metatrader, etc.) in the modern world are an important thing, a real trading platform, where you have the opportunity to conduct technical analysis, work with quotes, open and close positions, write your own algorithms (here Metatrader is especially good). Usually, all these terminals are launched from a desktop (well, they look, by the way, like harsh informative and analytical desktop software). However, in 2020, for trading, it is better to use platforms hosted on VPS - this is the truth written by nerves.

RUVDS has special images with trader software (for handshakes) that allow you to run hellish cars to flush the family budget even on servercore (so, you remember that until the middle of a professional trader's path, you cannot trade in panic, in the negative and use the last money for trading or money set aside for important purchases?).

It is worth stopping here and saying that we have every reason to say that we are the best in VPS for traders (without even being afraid of the Federal Law "On Advertising"): 1. we have 10 data centers around the world; 2. reasonable prices for VPS, which already include OS Windows licenses (all platforms work only on it; 3. we used to trade robots ourselves and know a lot about all these pings, latency, etc., which are extremely important for automated trading, 4. brokers choose us (you can look at the list of clients, we promised not to advertise them - we do not advertise.)

So, okay, let's stop bragging.

- VPS, : , , , . , ( , - — ).

- 24/7 , , , . , , , .

- , VPS , — - ( ), «, , » . , 100 000 , ( , ).

In short, write down the formula:

trading robot (platform, terminal) + VPS = speed, security, availability

If you haven’t come across a trading terminal (robot), then in short, this is a special platform on which a trader keeps in touch with a broker, giving him orders buy and sell assets at one time or another. In the terminal you can track indexes, news, carry out technical and fundamental analysis, monitor indicators, test strategies (testing takes place on historical data).

Your trading strategy at first will be more like copying the steps of other traders, but gradually you will have your own strategy. The main thing is to follow a number of important rules (and it is better to always remember them).

- : ( ).

- , .

- .

- «» .

- -.

- .

- — ( ).

- , , , . , , .

- «» .

- ! , , — .

The main reason for the loss of money in the process of working with the stock market is a lack of knowledge. Now I am writing this article with some feeling of annoyance, because I understand that preparing for working with the stock market is almost 2 years of university and this is a dreary, difficult process. It is much more pleasant to be inspired by the dashing story of an experienced investor and start "picking" the terminal. And rightly so: start, but at the same time, you simply have to master the fundamentals of fundamental and technical analysis, financial reporting and so on. Continuous self-learning is the way of a serious trader. If you immediately break into the terminal “hey hei, I have 100,000, I bet on everything”, then there is a tip for you from the joke “if you can't fly - don't show off”. Do not be offended.

Your second ally is patience. Good deals often require several weeks or months, and this time is worth waiting methodically without stopping the analysis for even a second.

Your third ally is cold reason and calculation. Do not get fooled by obvious trends and appeals on traders' forums, be strong with your mind. Working in the stock market is analytical work and a thorough analysis of a huge number of indicators, and not a game of chance.

When starting to work with stocks in particular with the stock market in general, remember that this is not a one-time toy or a computer game. This activity easily becomes your second job and is time consuming. I am convinced that in our time it is extremely useful and necessary to try yourself in investing, to master the basics of trading, because this is an important part of the economy and even the IT sphere. But, when starting, always compare the risks: perhaps adding 2-3 hours of workload to your main job or taking a side project in your main specialty, you will make money easier and more.

It is up to you to decide.

PS: there will be bonds in the next series, everything is much simpler there. Or not.